Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with questions d-f. Thank you. Questions D $ A B E F G H 1 2 3 Chapter 2 Mini Case 4 5

Need help with questions d-f. Thank you.

Questions

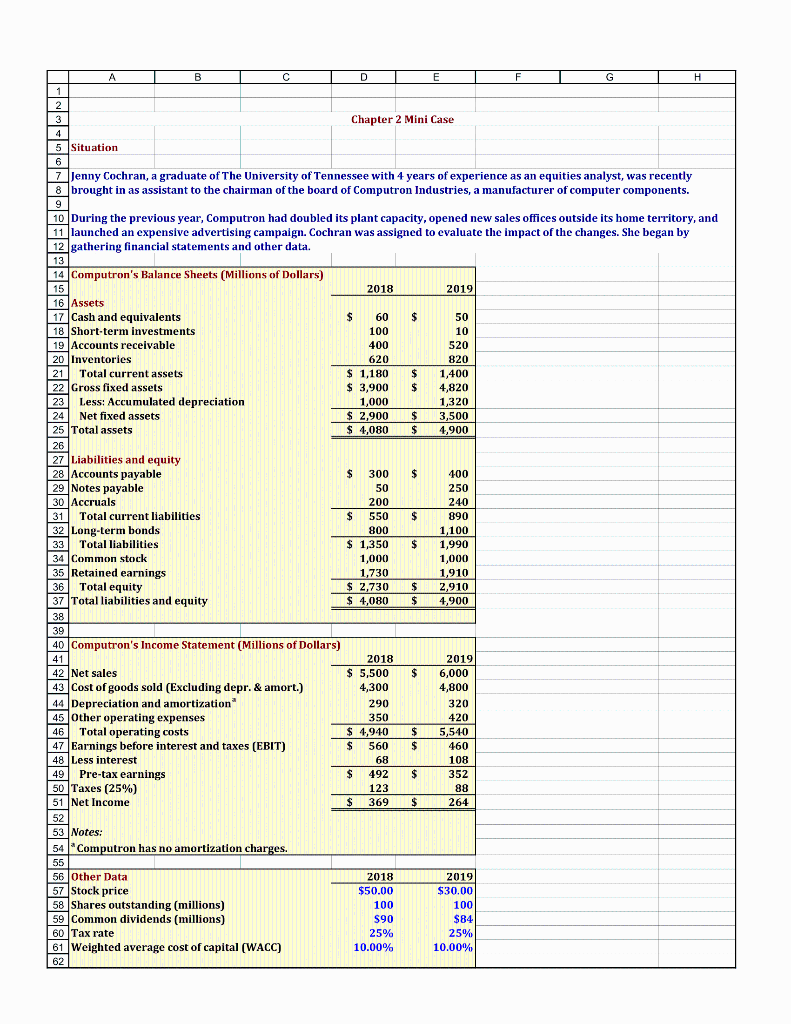

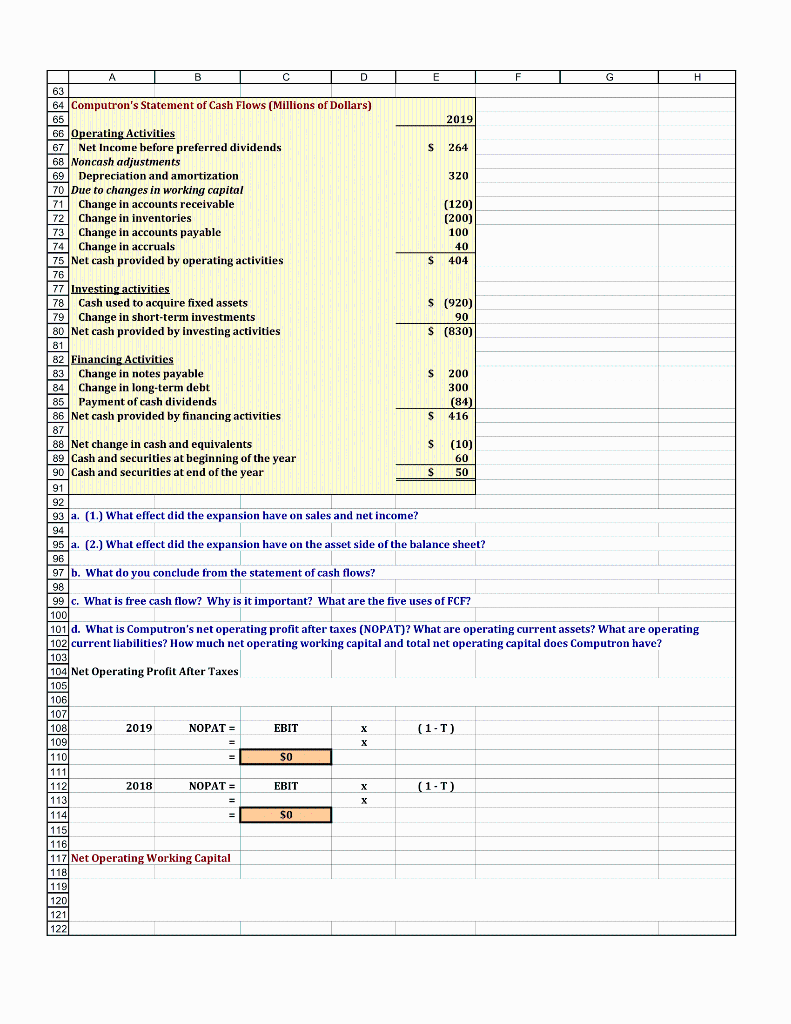

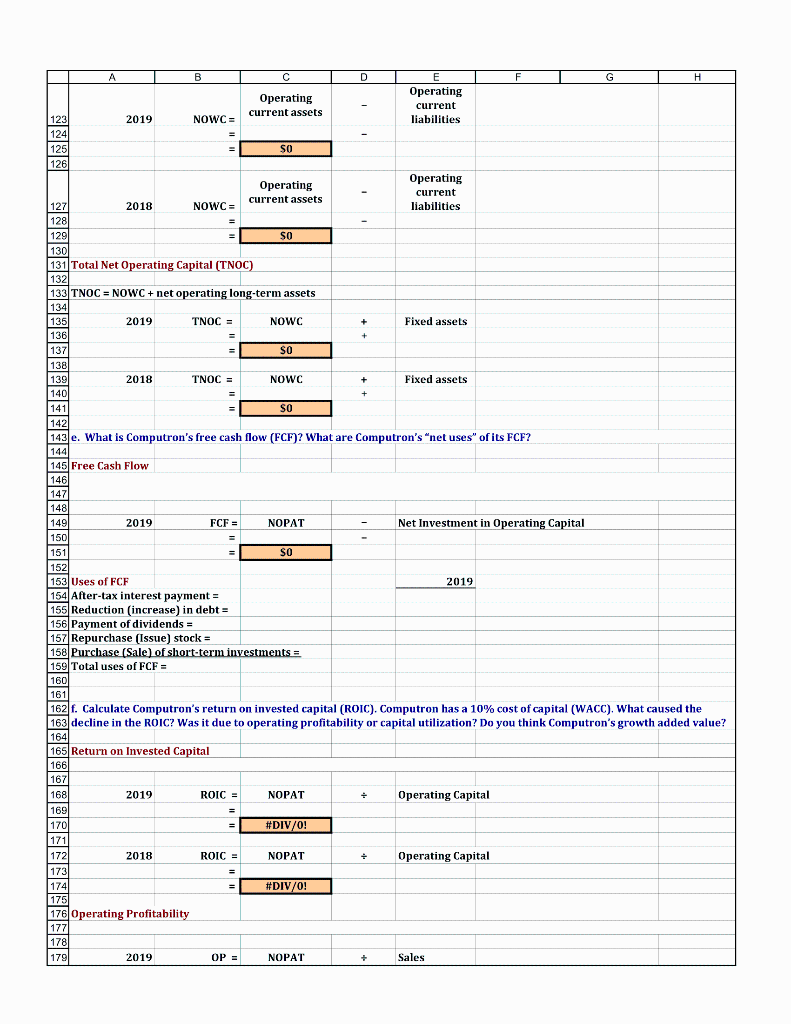

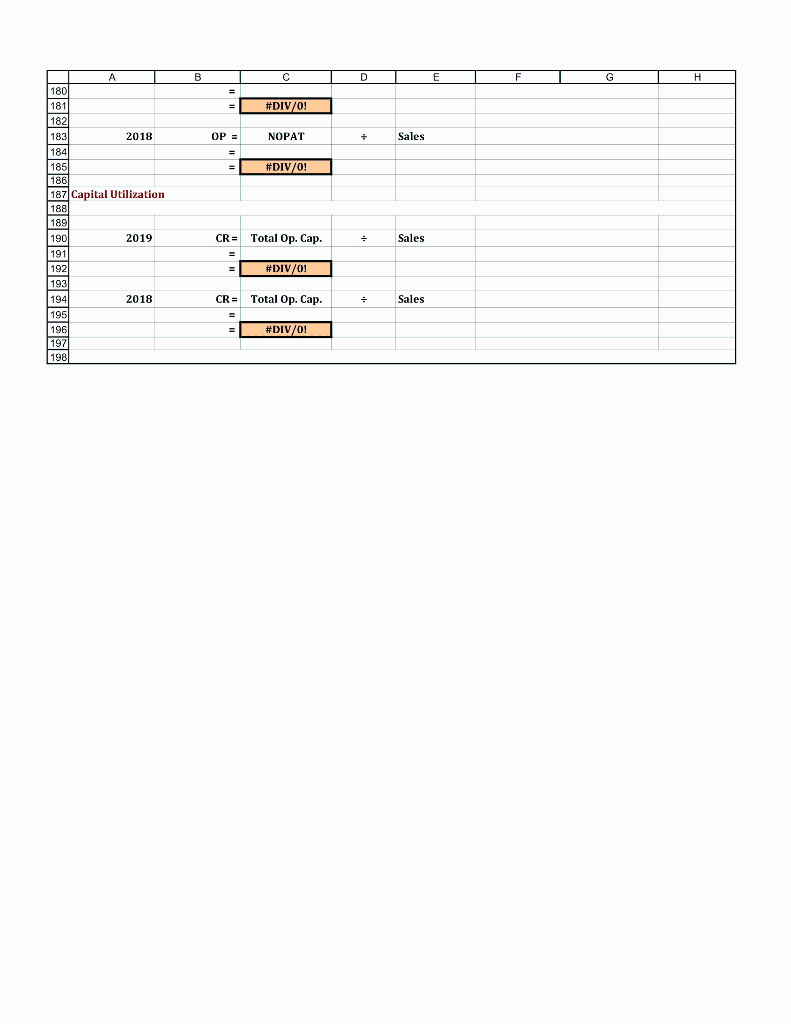

D $ A B E F G H 1 2 3 Chapter 2 Mini Case 4 5 Situation 6 7 Jenny Cochran, a graduate of the University of Tennessee with 4 years of experience as an equities analyst, was recently 8 brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. 9 10 During the previous year, Computron had doubled its plant capacity, opened new sales offices outside its home territory, and 11 launched an expensive advertising campaign. Cochran was assigned to evaluate the impact of the changes. She began by 12 gathering financial statements and other data. 13 14 Computron's Balance Sheets (Millions of Dollars) 15 2018 2019 16 Assets 17 Cash and equivalents $ 60 $ 50 18 Short-term investments 100 10 19 Accounts receivable 400 520 20 Inventories 620 820 21 Total current assets $ 1,180 $ 1,400 22 Gross fixed assets $ 3,900 4,820 23 Less: Accumulated depreciation 1,000 1,320 24 Net fixed assets $ 2,900 $ 3,500 25 Total assets $ 4,080 $ 4,900 26 27 Liabilities and equity 28 Accounts payable $ 300 $ 400 29 Notes payable 50 250 30 Accruals 200 240 31 Total current liabilities $ 550 $ 890 32 Long-term bonds 800 1,100 33 Total liabilities $ 1,350 $ 1,990 34 Common stock 1,000 1,000 35 Retained earnings 1,730 1,910 36 Total equity $ 2,730 $ 2,910 37 Total liabilities and equity $ 4,080 $ 4,900 38 39 40 Computron's Income Statement (Millions of Dollars) 41 2018 2019 42 Net sales $ 5,500 $ 6,000 43 Cost of goods sold (Excluding depr. & amort.) 4,300 4,800 44 Depreciation and amortization 290 320 45 Other operating expenses 350 420 46 Total operating costs $ 4,940 $ 5,540 47 Earnings before interest and taxes (EBIT) $ 560 $ 460 48 Less interest 68 108 49 Pre-tax earnings $ 492 $ 352 50 Taxes (25%) 123 88 51 Net Income $ 369 $ 264 52 53 Notes: 54 Computron has no amortization charges. 55 56 Other Data 2018 2019 57 Stock price $50,00 $30.00 58 Shares outstanding (millions) 100 100 59 Common dividends (millions) $90 $84 60 Tax rate 25% 25% 61 Weighted average cost of capital (WACC) 10.00% 10.00% 62 B F G H A D E 63 64 Computron's Statement of Cash Flows (Millions of Dollars) 65 2019 66 Operating Activities 67 Net Income before preferred dividends S 264 68 Noncash adjustments 69 Depreciation and amortization 320 70 Due to changes in working capital 71 Change in accounts receivable (120) 72 Change in inventories (200) 73 Change in accounts payable 100 74 Change in accruals 40 75 Net cash provided by operating activities S 404 76 77 Investing activities 78 Cash used to acquire fixed assets $ (920) 79 Change in short-term investments 90 80 Net cash provided by investing activities S (830) 81 82 Financing Activities 83 Change in notes payable S 200 84 Change in long-term debt 300 85 Payment of cash dividends (84) 86 Net cash provided by financing activities S 416 87 88 Net change in cash and equivalents S (10) 89 Cash and securities at beginning of the year 60 90 Cash and securities at end of the year S 50 91 92 93 a. (1.) What effect did the expansion have on sales and net income? 94 95 a. (2.) What effect did the expansion have on the asset side of the balance sheet? 96 97 b. What do you conclude from the statement of cash flows? 98 99 c. What is free cash flow? Why is it important? What are the five uses of FCF? 100 101 d. What is Computron's net operating profit after taxes (NOPAT)? What are operating current assets? What are operating 102 current liabilities? How much net operating working capital and total net operating capital does Computron have? 103 104 Net Operating Profit Afer Taxes 105 106 107 108 2019 NOPAT = EBIT (1-1) 109 110 SO 111 112 2018 NOPAT = EBIT (1-1) 113 114 SO 1151 116 117 Net Operating Working Capital 118 119 120 121 122 G H A B D E F Operating Operating current current assets 123 2019 NOWC= liabilities 124 125 SO 126 Operating Operating current assets current 127 2018 NOWC= liabilities 128 129 so 130 131 Total Net Operating Capital (TNOC) 132 133 TNOC = NOWC + net operating long-term assets 134 135 2019 TNOC = NOWC Fixed assets 136 137 SO 138 139 2018 TNOC = NOWC Fixed assets 140 141 SO 1421 143 e. What is Computron's free cash flow (FCF)? What are Computron's "net uses" of its FCF? 144 145 Free Cash Flow 146 + + + 147 148 149 2019 FCF = NOPAT Net Investment in Operating Capital 150 151 SO 152 153 Uses of FCF 2019 154 After-tax interest payment = 155 Reduction (increase) in debt = 156 Payment of dividends = 157 Repurchase (Issue) stock = 158 Purchase (Sale) of short-term investments = 159 Total uses of FCF = 160 161 162 f. Calculate Computron's return on invested capital (ROIC). Computron has a 10% cost of capital (WACC). What caused the 163 decline in the ROIC? Was it due to operating profitability or capital utilization? Do you think Computron's growth added value? 164 165 Return on Invested Capital 166 167 168 2019 ROIC = NOPAT Operating Capital 169 170 #DIV/0! / 171 1721 2018 ROIC = NOPAT . Operating Capital 173 174 #DIV/0! 175 176 Operating Profitability 177 178 179 2019 OP = NOPAT Sales + A C H = #DIV/0! 180 181 182 183 184 185 2018 OP = NOPAT Sales #DIV/0! 185 187 Capital Utilization 199 189 190 2019 CR = Total Op. Cap. Sales 191 192 #DIV/0! 193 194 2018 CR = Total Op. Cap. . Sales 195 #DIV/0! 197Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started