Need help with questions on my Managerial Decisions final, problems 5, 6 & 7.

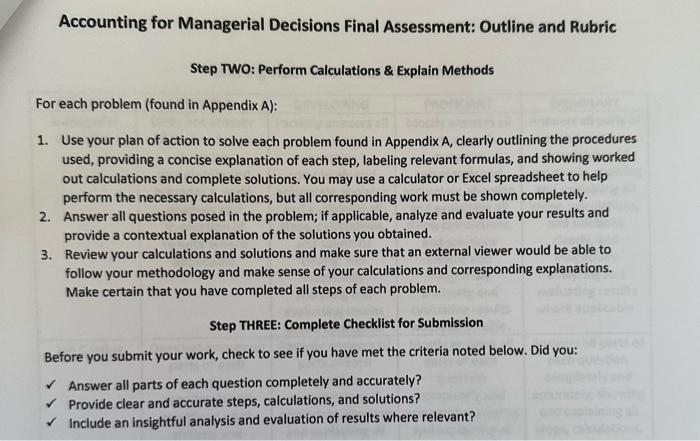

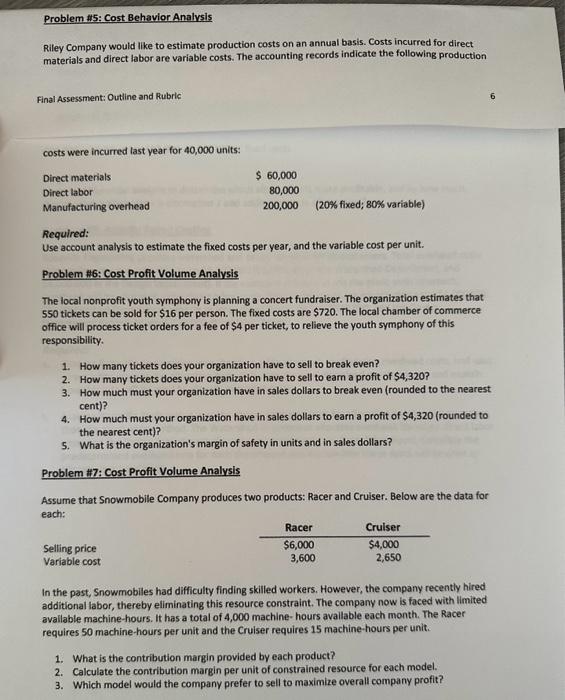

Accounting for Managerial Decisions Final Assessment: Outline and Rubric Step TWO: Perform Calculations \& Explain Methods For each problem (found in Appendix A): 1. Use your plan of action to solve each problem found in Appendix A, clearly outlining the procedures used, providing a concise explanation of each step, labeling relevant formulas, and showing worked out calculations and complete solutions. You may use a calculator or Excel spreadsheet to help perform the necessary calculations, but all corresponding work must be shown completely. 2. Answer all questions posed in the problem; if applicable, analyze and evaluate your results and provide a contextual explanation of the solutions you obtained. 3. Review your calculations and solutions and make sure that an external viewer would be able to follow your methodology and make sense of your calculations and corresponding explanations. Make certain that you have completed all steps of each problem. Step THREE: Complete Checklist for Submission Before you submit your work, check to see if you have met the criteria noted below. Did you: Answer all parts of each question completely and accurately? Provide clear and accurate steps, calculations, and solutions? Include an insightful analysis and evaluation of results where relevant? Problem \#5: Cost Behavior Analysis Riley Company would like to estimate production costs on an annual basis. Costs incurred for direct materials and direct labor are variable costs. The accounting records indicate the following production Final Assessment: Outline and Rubric 6 costs were incurred last year for 40,000 units: Required: Use account analysis to estimate the fixed costs per year, and the variable cost per unit. Problem H: Cost Profit Volume Analysis The local nonprofit youth symphony is planning a concert fundraiser. The organization estimates that 550 tickets can be sold for $16 per person. The fixed costs are $720. The local chamber of commerce office will process ticket orders for a fee of $4 per ticket, to relieve the youth symphony of this responsibility. 1. How many tickets does your organization have to sell to break even? 2. How many tickets does your organization have to sell to eam a profit of $4,320 ? 3. How much must your organization have in sales dollars to break even (rounded to the nearest cent)? 4. How much must your organization have in sales dollars to earn a profit of $4,320 (rounded to the nearest cent)? 5. What is the organization's margin of safety in units and in sales dollars? Problem 117: Cost Profit Volume Analysis Assume that Snowmobile Company produces two products: Racer and Cruiser. Below are the data for each: Selling price Variable cost In the past, Snowmobiles had difficulty finding skilled workers. However, the company recently hired additional labor, thereby eliminating this resource constraint. The company now is faced with limited avallable machine-hours. It has a total of 4,000 machine-hours avallable each month. The Racer requires 50 machine-hours per unit and the Cruiser requires 15 machine-hours per unit. 1. What is the contribution margin provided by each product? 2. Calculate the contribution margin per unit of constrained resource for each model. 3. Which model would the company prefer to sell to maximize overall company profit