Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with req A-C On January 2, 2018, Delightful Corporation paid $67,000 in cash and exchanged a chocolate mixing machine, which had a fair

Need help with req A-C

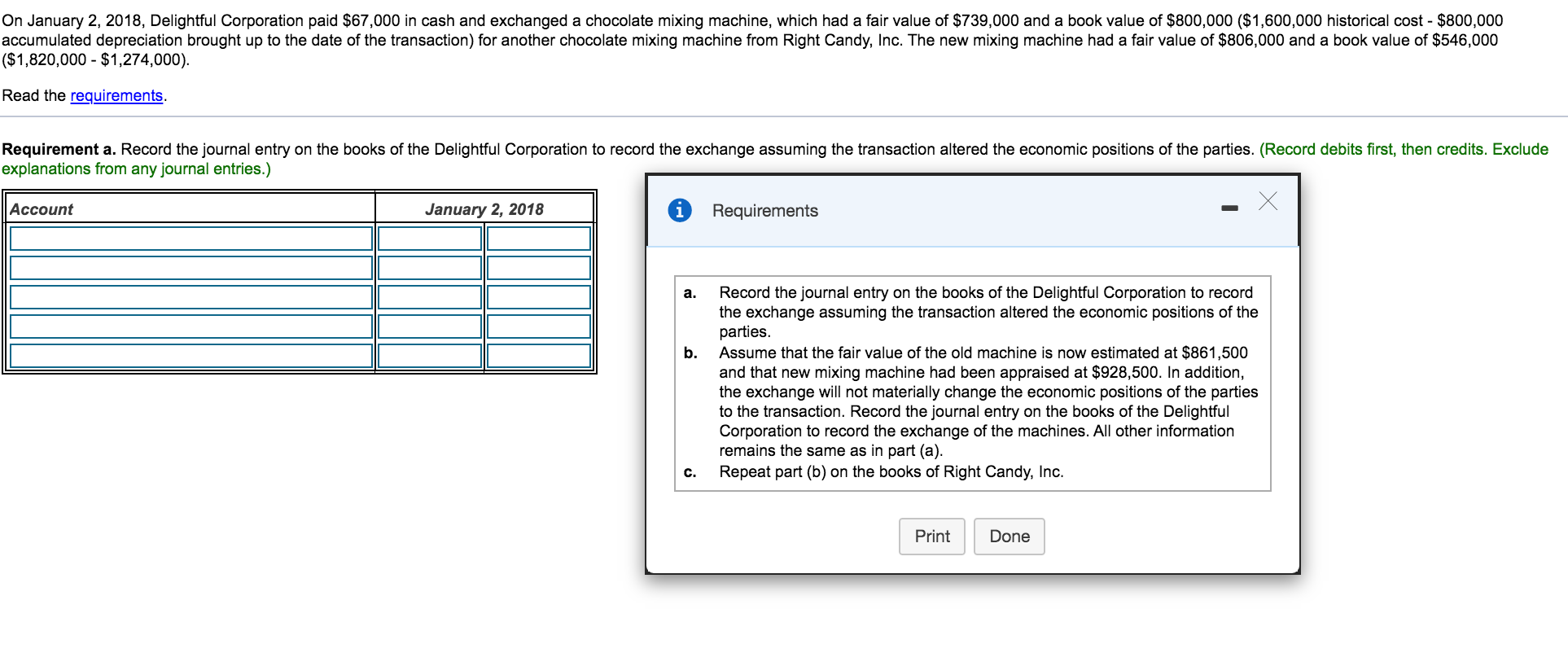

On January 2, 2018, Delightful Corporation paid $67,000 in cash and exchanged a chocolate mixing machine, which had a fair value of $739,000 and a book value of $800,000 $1,600,000 historical cost - $800,000 accumulated depreciation brought up to the date of the transaction) for another chocolate mixing machine from Right Candy, Inc. The new mixing machine had a fair value of $806,000 and a book value of $546,000 ($1,820,000 - $1,274,000). Read the requirements. Requirement a. Record the journal entry on the books of the Delightful Corporation to record the exchange assuming the transaction altered the economic positions of the parties. (Record debits first, then credits. Exclude explanations from any journal entries.) Account January 2, 2018 Requirements Record the journal entry on the books of the Delightful Corporation to record the exchange assuming the transaction altered the economic positions of the parties. Assume that the fair value of the old machine is now estimated at $861,500 and that new mixing machine had been appraised at $928,500. In addition, the exchange will not materially change the economic positions of the parties to the transaction. Record the journal entry on the books of the Delightful Corporation to record the exchange of the machines. All other information remains the same as in part (a). Repeat part (b) on the books of Right Candy, Inc. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started