Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help with required 4 and 5 parts of this question, thanks alot!!! Pool Corporation, Inc, is the world's largest wholesale distributor of swimming pool

Need Help with required 4 and 5 parts of this question, thanks alot!!!

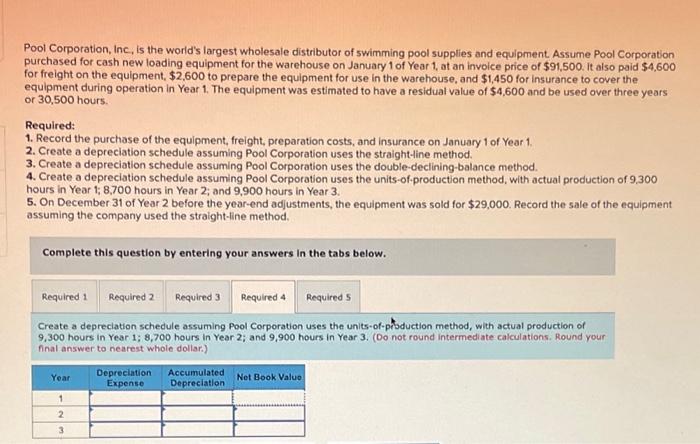

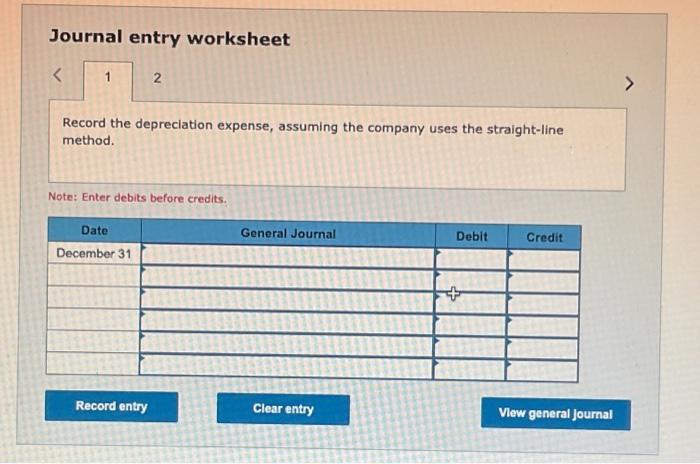

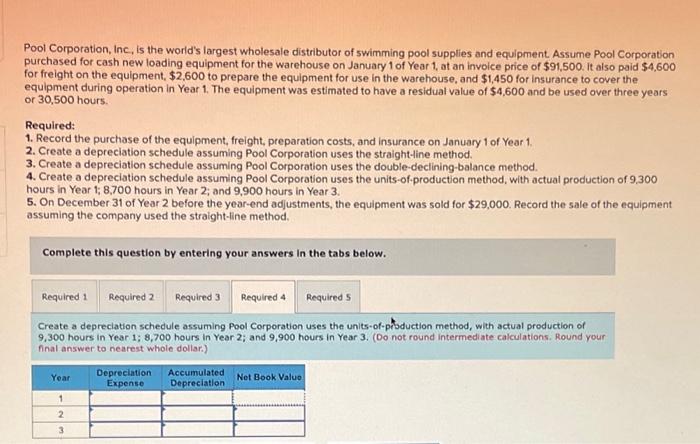

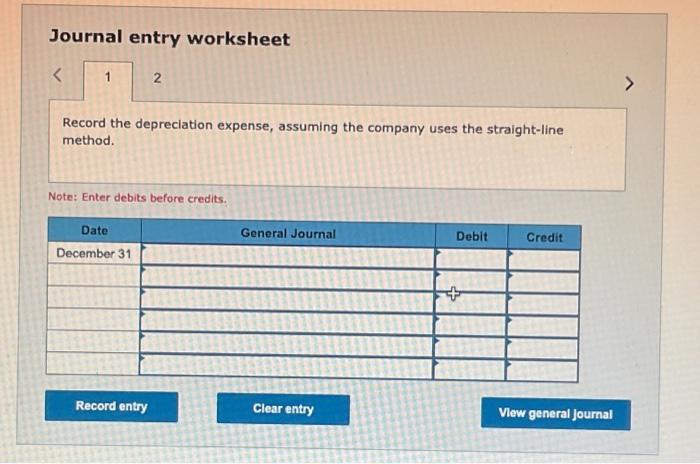

Pool Corporation, Inc, is the world's largest wholesale distributor of swimming pool supplies and equipment. Assume Pool Corporation purchased for cash new loading equipment for the warehouse on January 1 of Year 1 , at an invoice price of $91,500. it also paid $4,600 for freight on the equipment, $2,600 to prepare the equipment for use in the warehouse, and $1,450 for insurance to cover the equipment during operation in Year 1. The equipment was estimated to have a residual value of $4,600 and be used over three years or 30,500 hours. Required: 1. Record the purchase of the equipment, freight, preparation costs, and insurance on January 1 of Year 1. 2. Create a depreciation schedule assuming Pool Corporation uses the straight-line method. 3. Create a depreciation schedule assuming Pool Corporation uses the double-declining-balance method. 4. Create a depreciation schedule assuming Pool Corporation uses the units-of-production method, with actual production of 9,300 hours in Year 1;8,700 hours in Year 2; and 9,900 hours in Year 3. 5. On December 31 of Year 2 before the year-end adjustments, the equipment was sold for $29,000. Record the sale of the equipment assuming the company used the straight-line method. Complete this question by entering your answers in the tabs below. Create a depreciation schedule assuming Pool Corporation uses the units-of-phoduction method, with actual production of 9,300 hours in Year 1; 8,700 hours in Year 2; and 9,900 hours in Year 3. (Do not round intermediate calculations. Round your nal answer to nearest whole dollar.) Journal entry worksheet Record the depreciation expense, assuming the company uses the straight-line method. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started