Answered step by step

Verified Expert Solution

Question

1 Approved Answer

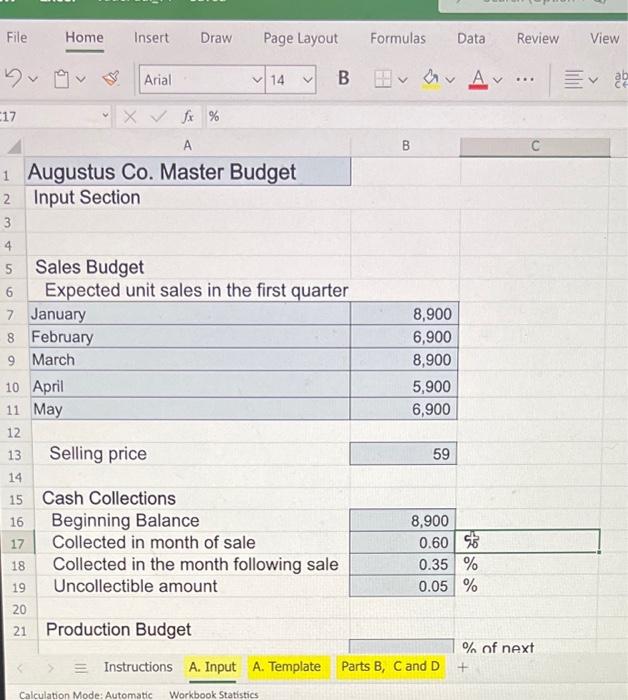

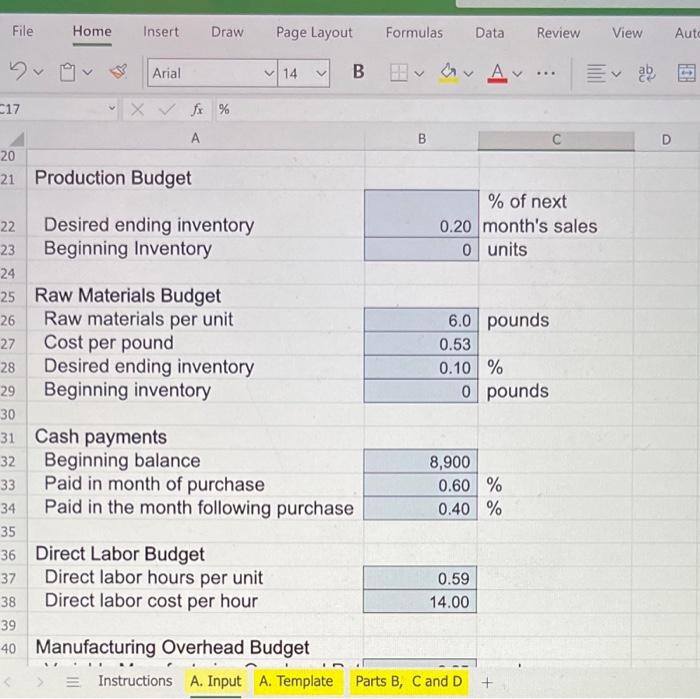

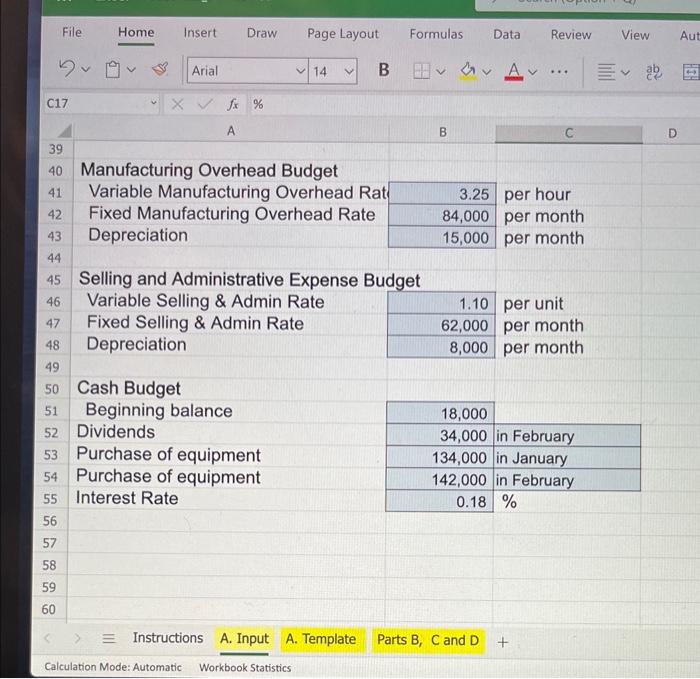

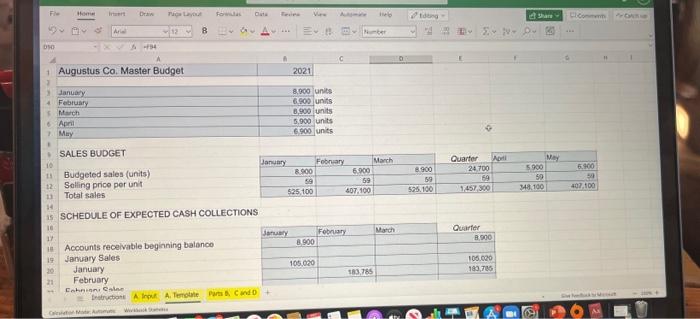

need help with requiremnt c & d please! Sales Budget Expected unit sales in the first quarter Augustus Co. Master Budget Input Section begin{tabular}{|l|r|} hline

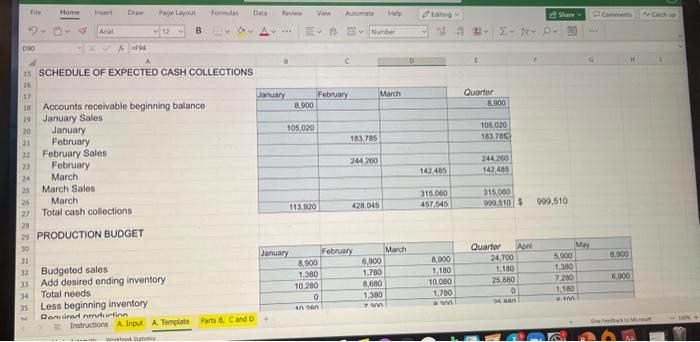

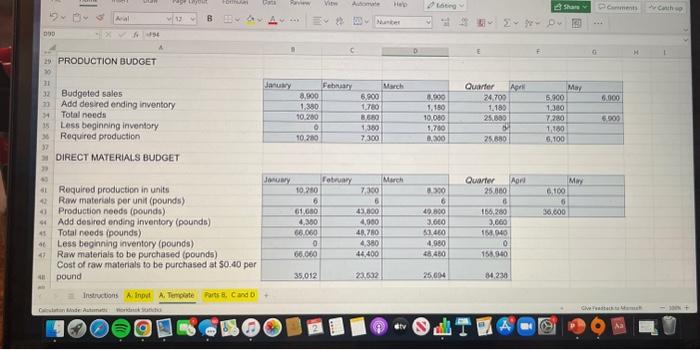

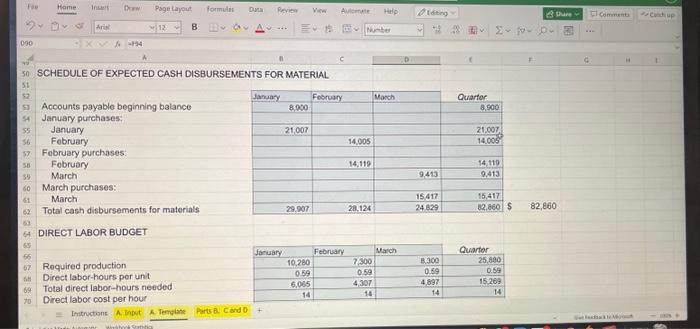

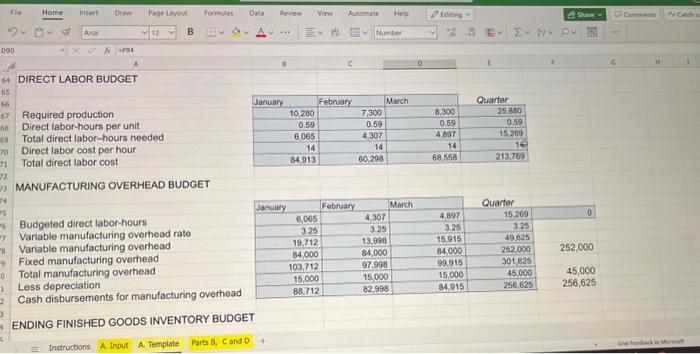

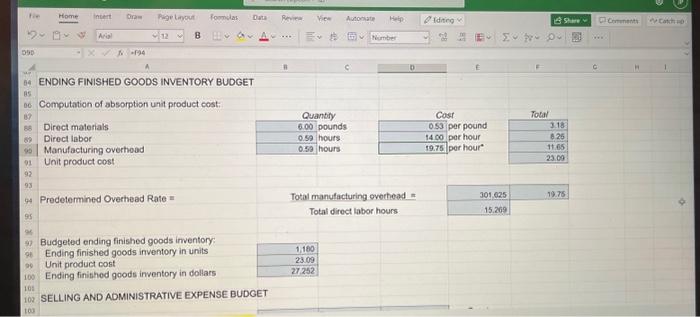

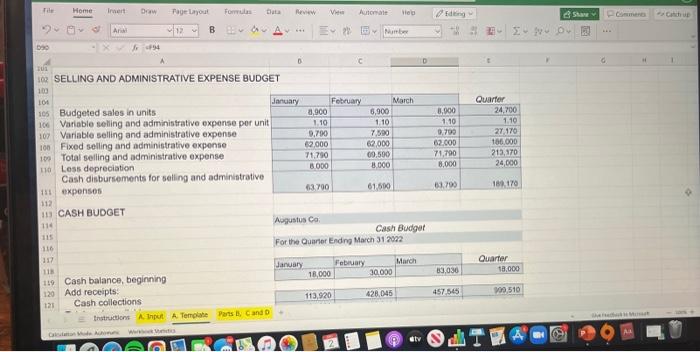

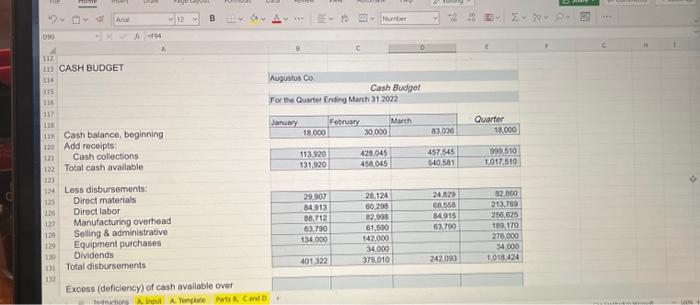

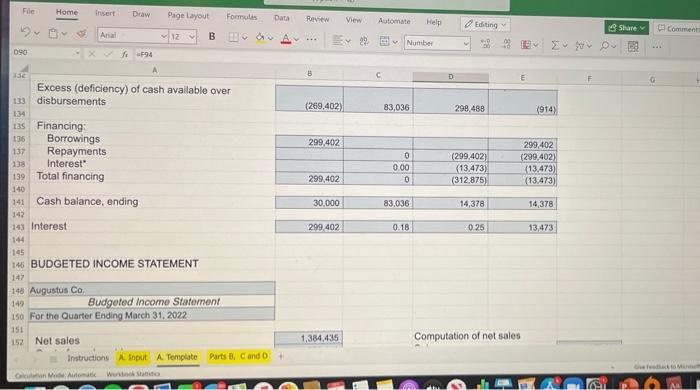

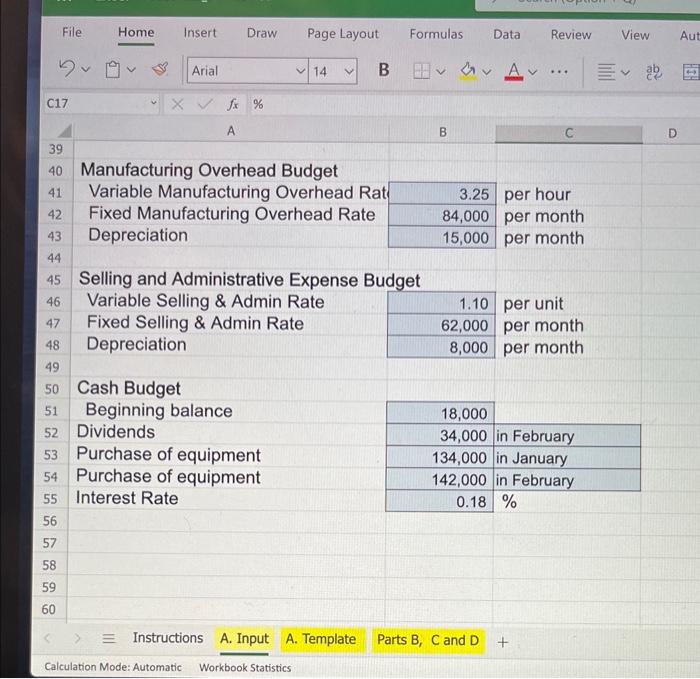

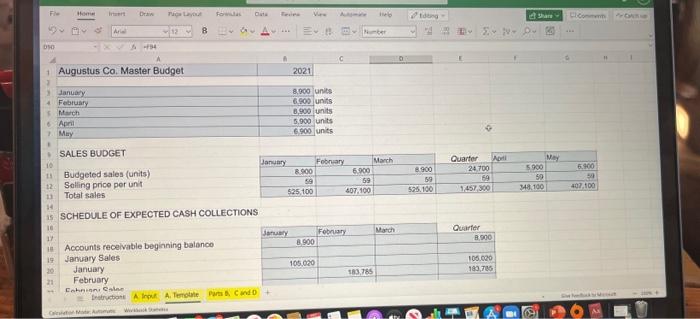

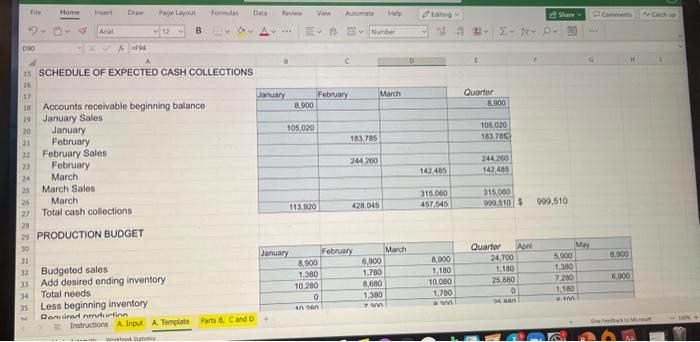

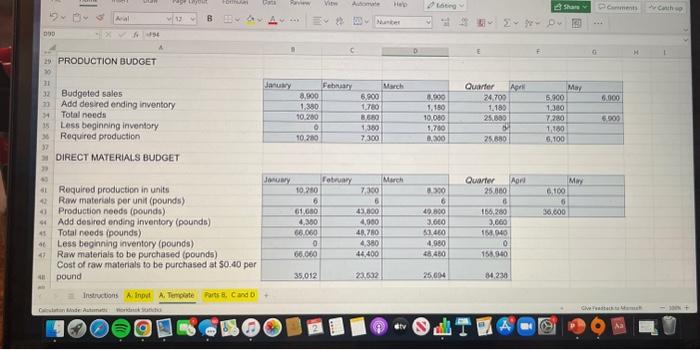

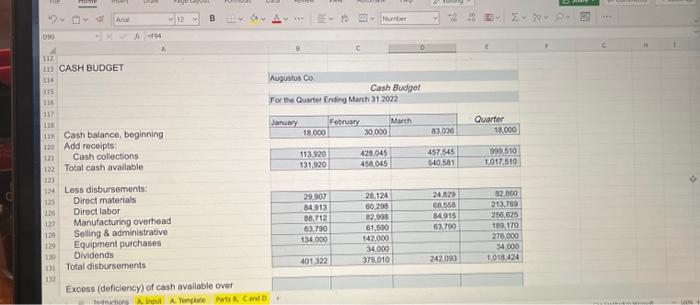

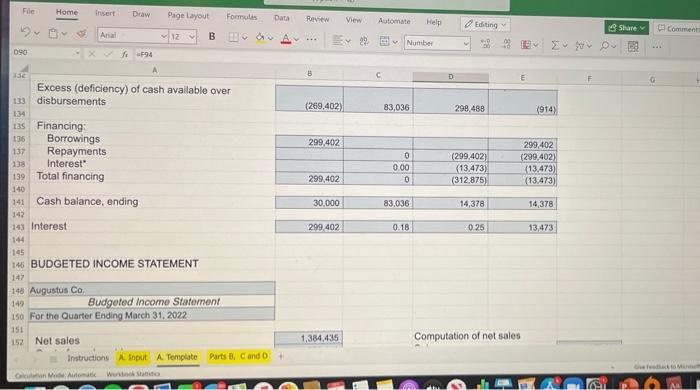

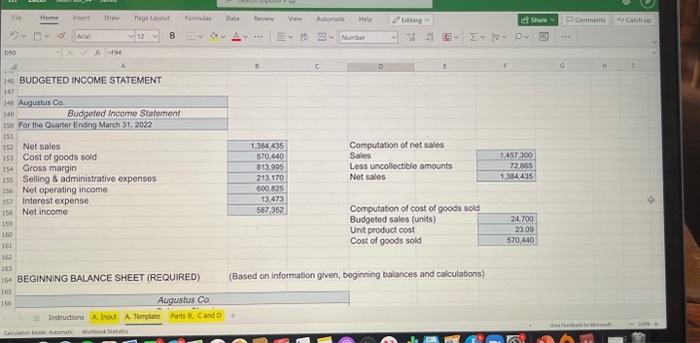

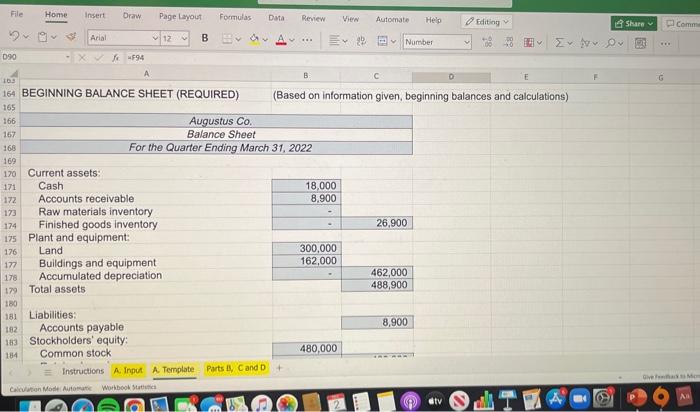

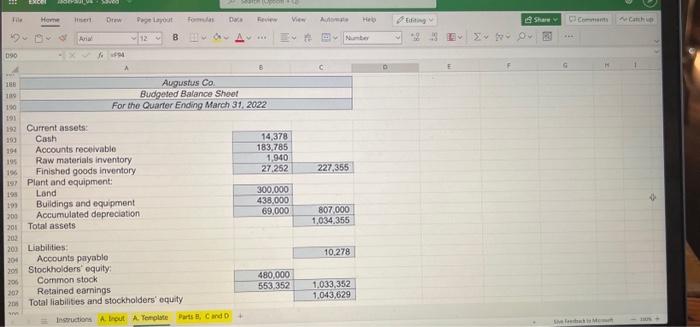

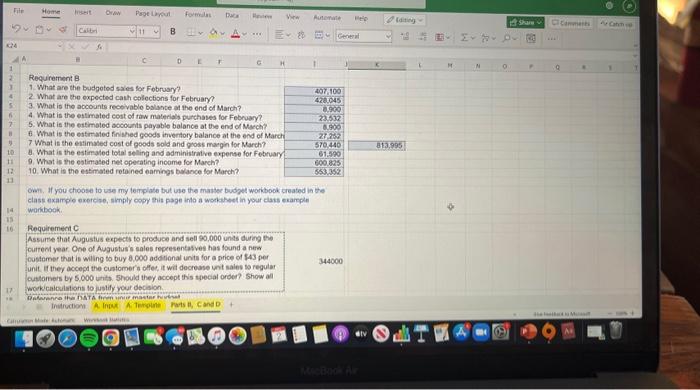

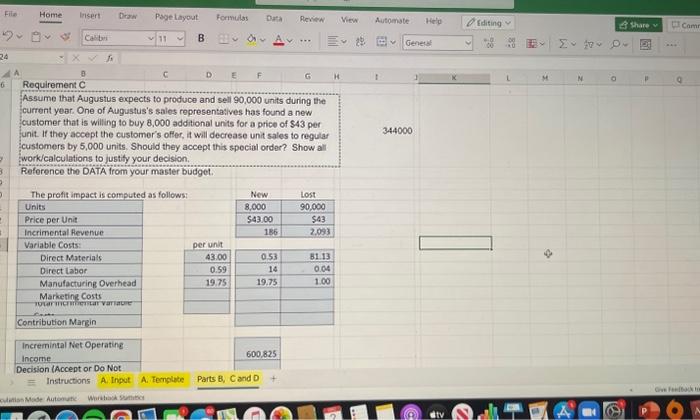

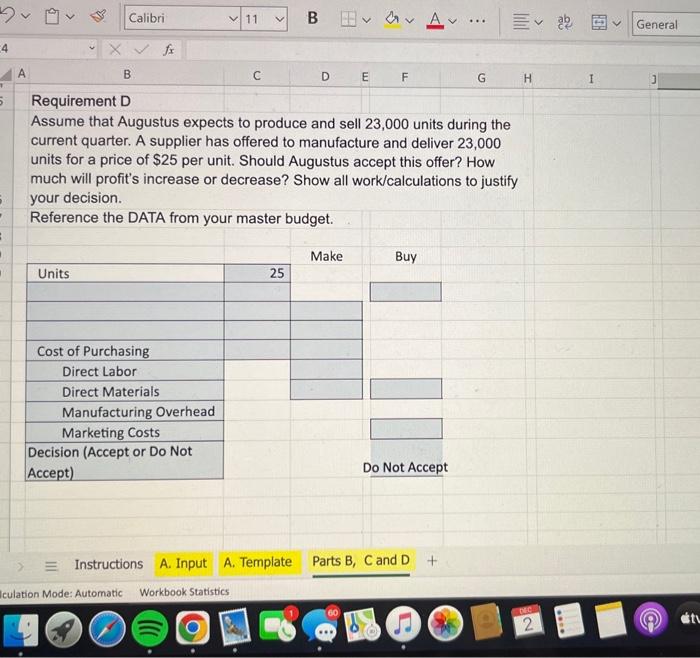

need help with requiremnt c & d please!

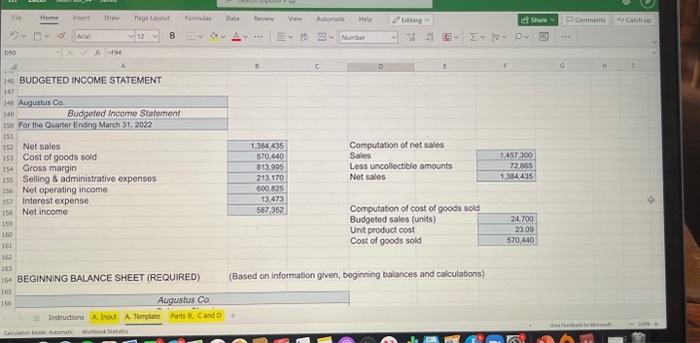

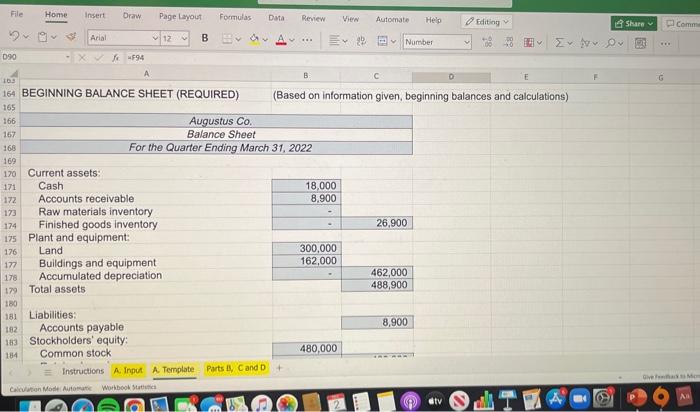

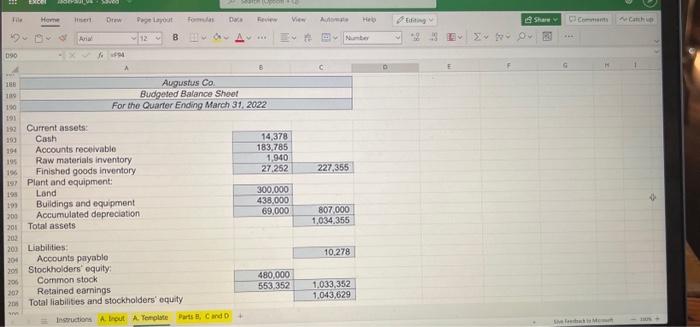

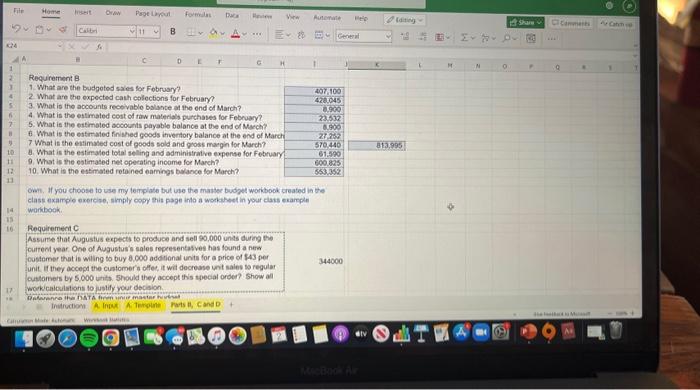

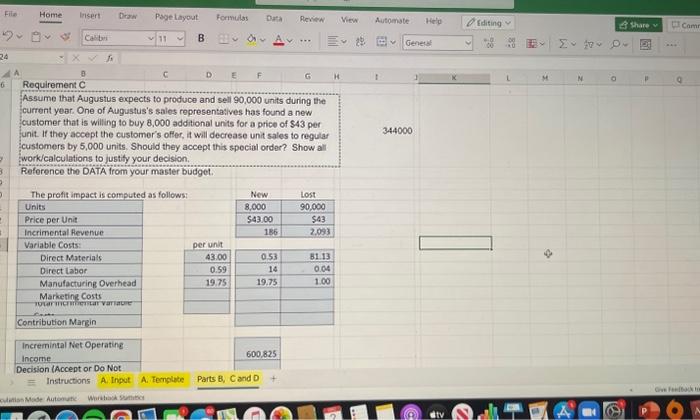

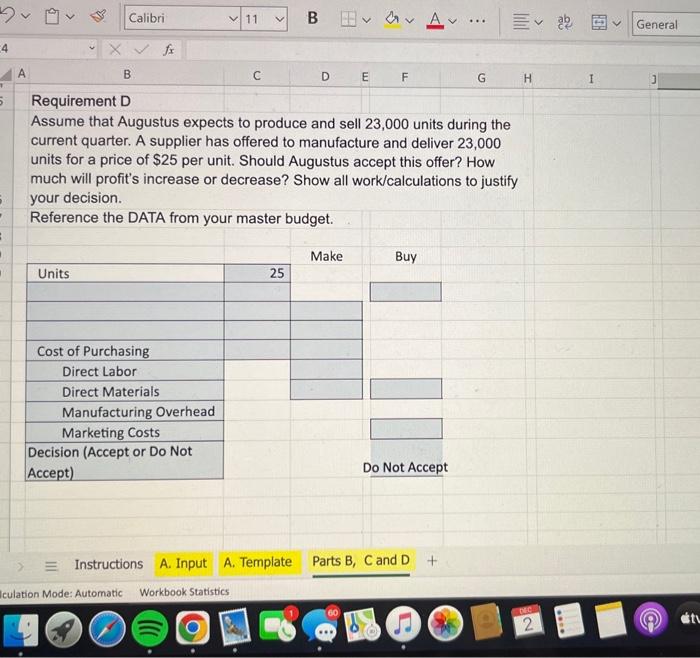

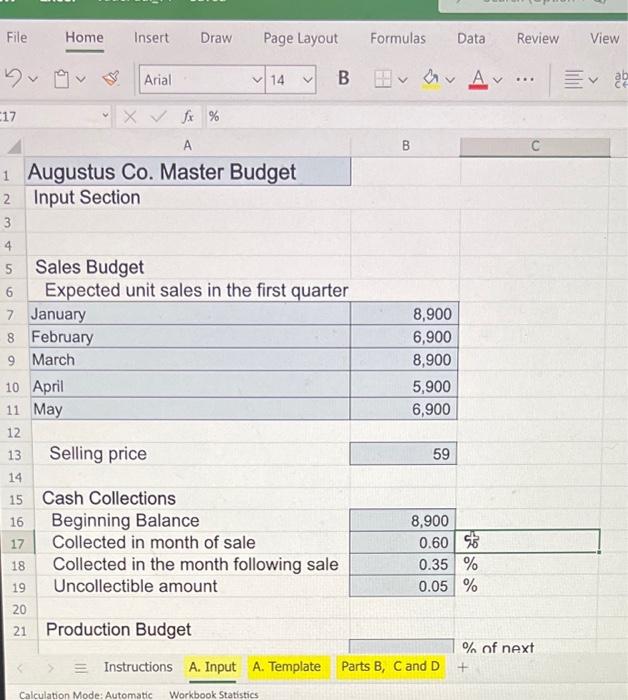

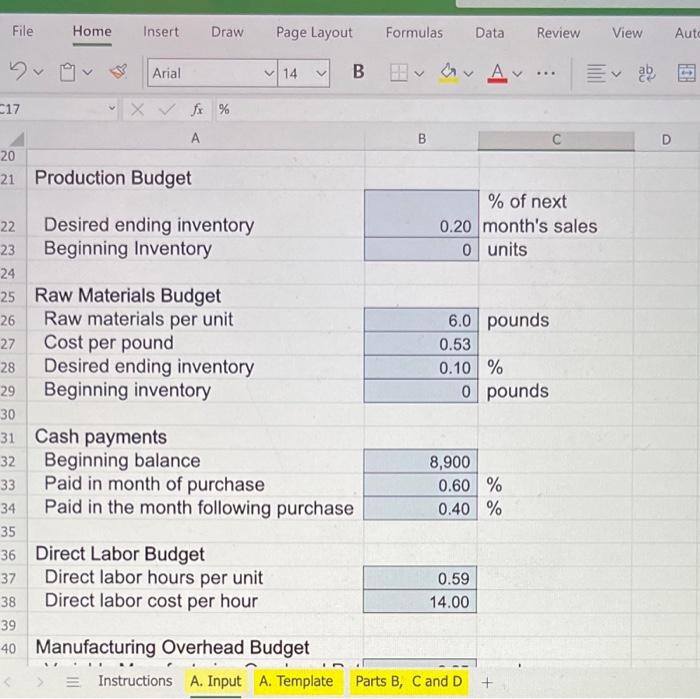

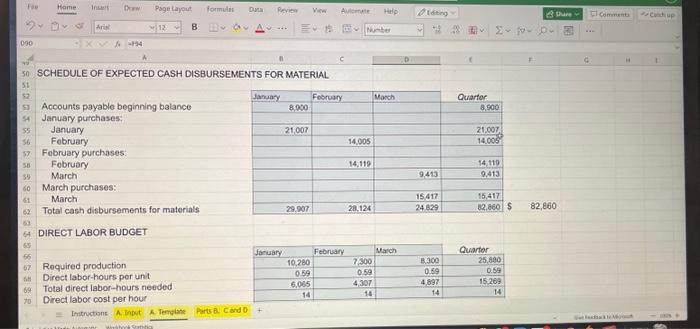

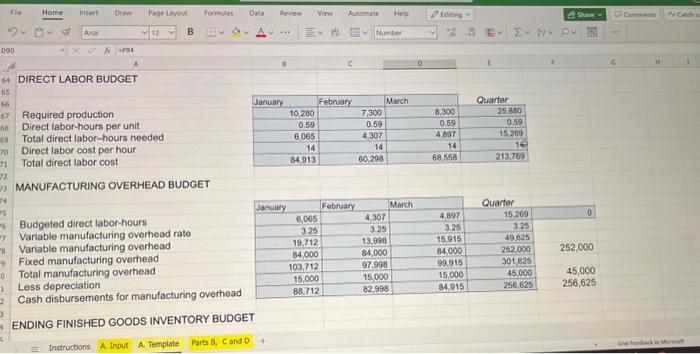

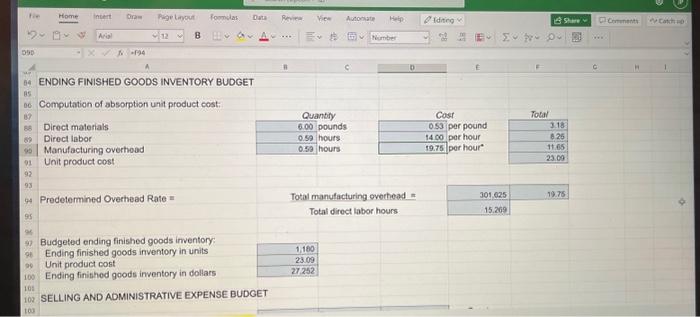

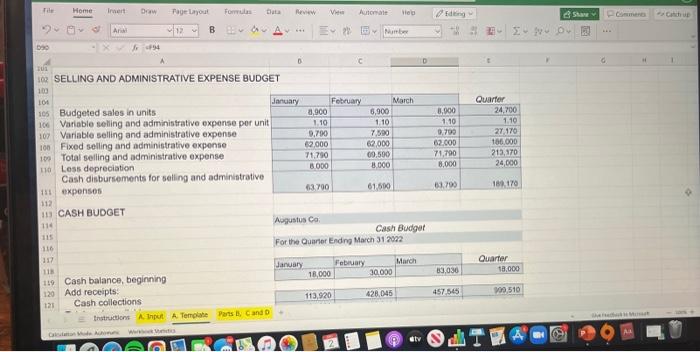

Sales Budget Expected unit sales in the first quarter Augustus Co. Master Budget Input Section \begin{tabular}{|l|r|} \hline January & 8,900 \\ \hline February & 6,900 \\ \hline March & 8,900 \\ \hline April & 5,900 \\ \hline May & 6,900 \\ \hline \end{tabular} Selling price \begin{tabular}{|l|} \hline 59 \\ \hline \end{tabular} Cash Collections Beginning Balance Collected in month of sale Collected in the month following sale Uncollectible amount \begin{tabular}{|r|r|} \hline 8,900 & \\ \hline 0.60 & \\ \hline 0.35 & % \\ \hline 0.05 & % \\ \hline \end{tabular} Production Budget % nf next Instructions A. Input A. Template Parts B, C and D + Calculation Mode: Automatic Workbook Statistics Production Budget \begin{tabular}{|r|l|} \hline & % of next \\ \hline 0.20 & month's sales \\ \hline 0 & units \\ \hline \end{tabular} Raw Materials Budget Raw materials per unit Cost per pound Desired ending inventory Beginning inventory \begin{tabular}{|r|l} \hline 6.0 & pounds \\ \cline { 1 - 2 } 0.53 & \\ \hline 0.10 & % \\ \hline 0 & pounds \\ \hline \end{tabular} Cash payments Beginning balance Paid in month of purchase Paid in the month following purchase \begin{tabular}{|r|r|} \hline 8,900 & \\ \hline 0.60 & % \\ \hline 0.40 & % \\ \hline \end{tabular} Direct Labor Budget Direct labor hours per unit Direct labor cost per hour \begin{tabular}{|r|} \hline 0.59 \\ \hline 14.00 \\ \hline \end{tabular} Manufacturing Overhead Budget Instructions A. Input A. Template Parts B, C and D + Selling and Administrative Expense Budget Variable Selling \& Admin Rate Fixed Selling \& Admin Rate Depreciation \begin{tabular}{|r|l|} \hline 1.10 & per unit \\ \cline { 1 - 2 } 62,000 & per month \\ \cline { 1 - 2 } 8,000 & per month \\ \hline \end{tabular} Cash Budget Beginning balance Dividends Purchase of equipment Purchase of equipment Interest Rate \begin{tabular}{|r|l|} \hline 18,000 & \\ \hline 34,000 & in February \\ \hline 134,000 & in January \\ \hline 142,000 & in February \\ \hline 0.18 & % \\ \hline \end{tabular} InstructionsA.InputA.TemplatePartsB,CandDP Calculation Mode: Automatic Workbook Statistics SCHEDULE OF EXPECTED CASH COLLECTIONS Budgeted sales Add desired ending inventory Total needs Less beginning inventory Ronu inarl nmaluetinn Rarts B. Cand D PRODUCTION BUDGET Budgeted sales Add desired ending inventory Total needs Less beginning inventory Required production DIRECT MATERIALS BUDGET Required production in units Raw materials per unit (pounds) Production needs (pounds). Add desired ending inventory (pounds) Total needs (pounds) Less beginning inventory (pounds) Raw materials to be purchased (pounds) Cost of raw materials to be purchased at $0.40 per pound Instuctions A inget A. Terwate Farse, CandD + SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL ENDING FINISHED GOODS INVENTORY BUDGET SELLING AND ADMINISTRATIVE EXPENSE BUDGET Cash balance, beginning Augusius Co Cash Budget For the Quaver Ending Mach 312002. Add receipts: Cash collections Total cash available Less disbursements: Direct materials Direct labor Manufacturing overthead Seling 8 administrative Equipment purchases Dividends Total disbursements \begin{tabular}{|r|r|r|r|} \hline 20.907 & 22.124 & 24.820 & 62.800 \\ \hline 34.913 & 60.209 & 69.558 & 213.769 \\ \hline 88.712 & 82.935 & 84.915 & 256.625 \\ \hline 69.790 & 61.570 & 63.790 & 189.170 \\ \hline 134.000 & 142.000 & & 276.000 \\ \hline & 34.000 & & 4,000 \\ \hline 401.322 & 375.010 & 242.090 & 1.018.424 \\ \hline \end{tabular} Excess (deficiency) of cash available over BUDGETED INCOME STATEMENT Augustus Co. Budgeted income Statement For the Quarter Ending March 31, 2022. Net 5ales 1,384,435 Computation of net sales instructions A inpoit A Template Parts B,C and 0 BEGINNING BALANCE SHEET (REQUIRED) (Based on information given, boginning balances and calculations) BEGINNING BALANCE SHEET (REQUIRED) (Based on information given, beginning balances and calculations) Current assets: Total liabilites and stockholders' equity com. If you choose to use my terflale but use the master budget workbock created in the class example exereise, simply copy this page inde a wodkeneet in your elats exareple workbock. Roquirement C Assurte that Aupustus expects to produce and sell 90,000 unas dureg the cutrem year, One of Augustus's sales representasves has found a nex custemer that is wiling to buy 8.000 additional unte for a price of f43 per. unit if they accept the cuntomer's oflec it wit decrease unit sales so regular custameis by 5.000 unith. Fhould they accept this thecial order? Show all workicaibulstiont to ystify your decision. Assume that Augustus expects to produce and sell 90,000 units during the current year. One of Augustus's sales representatives has found a new customer that is willing to buy 8,000 additional units for a price of $43 per funit. If they accept the customer's offer, it will decrease unit sales to regular customers by 5,000 units. Should they accept this special order? Show all fwork/calculations to justify your decision. Reference the DATA from your master budget. Assume that Augustus expects to produce and sell 23,000 units during the current quarter. A supplier has offered to manufacture and deliver 23,000 units for a price of $25 per unit. Should Augustus accept this offer? How much will profit's increase or decrease? Show all work/calculations to justify your decision. Sales Budget Expected unit sales in the first quarter Augustus Co. Master Budget Input Section \begin{tabular}{|l|r|} \hline January & 8,900 \\ \hline February & 6,900 \\ \hline March & 8,900 \\ \hline April & 5,900 \\ \hline May & 6,900 \\ \hline \end{tabular} Selling price \begin{tabular}{|l|} \hline 59 \\ \hline \end{tabular} Cash Collections Beginning Balance Collected in month of sale Collected in the month following sale Uncollectible amount \begin{tabular}{|r|r|} \hline 8,900 & \\ \hline 0.60 & \\ \hline 0.35 & % \\ \hline 0.05 & % \\ \hline \end{tabular} Production Budget % nf next Instructions A. Input A. Template Parts B, C and D + Calculation Mode: Automatic Workbook Statistics Production Budget \begin{tabular}{|r|l|} \hline & % of next \\ \hline 0.20 & month's sales \\ \hline 0 & units \\ \hline \end{tabular} Raw Materials Budget Raw materials per unit Cost per pound Desired ending inventory Beginning inventory \begin{tabular}{|r|l} \hline 6.0 & pounds \\ \cline { 1 - 2 } 0.53 & \\ \hline 0.10 & % \\ \hline 0 & pounds \\ \hline \end{tabular} Cash payments Beginning balance Paid in month of purchase Paid in the month following purchase \begin{tabular}{|r|r|} \hline 8,900 & \\ \hline 0.60 & % \\ \hline 0.40 & % \\ \hline \end{tabular} Direct Labor Budget Direct labor hours per unit Direct labor cost per hour \begin{tabular}{|r|} \hline 0.59 \\ \hline 14.00 \\ \hline \end{tabular} Manufacturing Overhead Budget Instructions A. Input A. Template Parts B, C and D + Selling and Administrative Expense Budget Variable Selling \& Admin Rate Fixed Selling \& Admin Rate Depreciation \begin{tabular}{|r|l|} \hline 1.10 & per unit \\ \cline { 1 - 2 } 62,000 & per month \\ \cline { 1 - 2 } 8,000 & per month \\ \hline \end{tabular} Cash Budget Beginning balance Dividends Purchase of equipment Purchase of equipment Interest Rate \begin{tabular}{|r|l|} \hline 18,000 & \\ \hline 34,000 & in February \\ \hline 134,000 & in January \\ \hline 142,000 & in February \\ \hline 0.18 & % \\ \hline \end{tabular} InstructionsA.InputA.TemplatePartsB,CandDP Calculation Mode: Automatic Workbook Statistics SCHEDULE OF EXPECTED CASH COLLECTIONS Budgeted sales Add desired ending inventory Total needs Less beginning inventory Ronu inarl nmaluetinn Rarts B. Cand D PRODUCTION BUDGET Budgeted sales Add desired ending inventory Total needs Less beginning inventory Required production DIRECT MATERIALS BUDGET Required production in units Raw materials per unit (pounds) Production needs (pounds). Add desired ending inventory (pounds) Total needs (pounds) Less beginning inventory (pounds) Raw materials to be purchased (pounds) Cost of raw materials to be purchased at $0.40 per pound Instuctions A inget A. Terwate Farse, CandD + SCHEDULE OF EXPECTED CASH DISBURSEMENTS FOR MATERIAL ENDING FINISHED GOODS INVENTORY BUDGET SELLING AND ADMINISTRATIVE EXPENSE BUDGET Cash balance, beginning Augusius Co Cash Budget For the Quaver Ending Mach 312002. Add receipts: Cash collections Total cash available Less disbursements: Direct materials Direct labor Manufacturing overthead Seling 8 administrative Equipment purchases Dividends Total disbursements \begin{tabular}{|r|r|r|r|} \hline 20.907 & 22.124 & 24.820 & 62.800 \\ \hline 34.913 & 60.209 & 69.558 & 213.769 \\ \hline 88.712 & 82.935 & 84.915 & 256.625 \\ \hline 69.790 & 61.570 & 63.790 & 189.170 \\ \hline 134.000 & 142.000 & & 276.000 \\ \hline & 34.000 & & 4,000 \\ \hline 401.322 & 375.010 & 242.090 & 1.018.424 \\ \hline \end{tabular} Excess (deficiency) of cash available over BUDGETED INCOME STATEMENT Augustus Co. Budgeted income Statement For the Quarter Ending March 31, 2022. Net 5ales 1,384,435 Computation of net sales instructions A inpoit A Template Parts B,C and 0 BEGINNING BALANCE SHEET (REQUIRED) (Based on information given, boginning balances and calculations) BEGINNING BALANCE SHEET (REQUIRED) (Based on information given, beginning balances and calculations) Current assets: Total liabilites and stockholders' equity com. If you choose to use my terflale but use the master budget workbock created in the class example exereise, simply copy this page inde a wodkeneet in your elats exareple workbock. Roquirement C Assurte that Aupustus expects to produce and sell 90,000 unas dureg the cutrem year, One of Augustus's sales representasves has found a nex custemer that is wiling to buy 8.000 additional unte for a price of f43 per. unit if they accept the cuntomer's oflec it wit decrease unit sales so regular custameis by 5.000 unith. Fhould they accept this thecial order? Show all workicaibulstiont to ystify your decision. Assume that Augustus expects to produce and sell 90,000 units during the current year. One of Augustus's sales representatives has found a new customer that is willing to buy 8,000 additional units for a price of $43 per funit. If they accept the customer's offer, it will decrease unit sales to regular customers by 5,000 units. Should they accept this special order? Show all fwork/calculations to justify your decision. Reference the DATA from your master budget. Assume that Augustus expects to produce and sell 23,000 units during the current quarter. A supplier has offered to manufacture and deliver 23,000 units for a price of $25 per unit. Should Augustus accept this offer? How much will profit's increase or decrease? Show all work/calculations to justify your decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started