Answered step by step

Verified Expert Solution

Question

1 Approved Answer

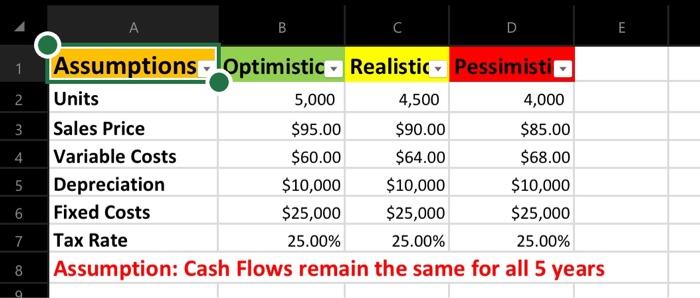

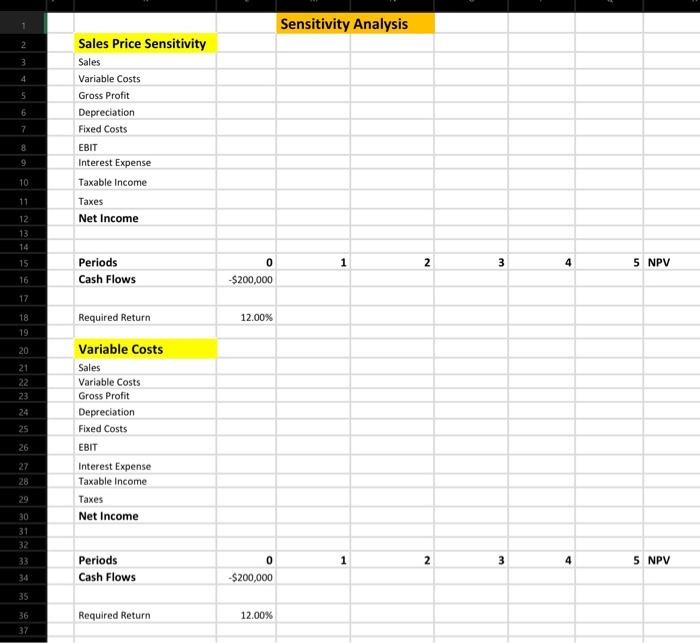

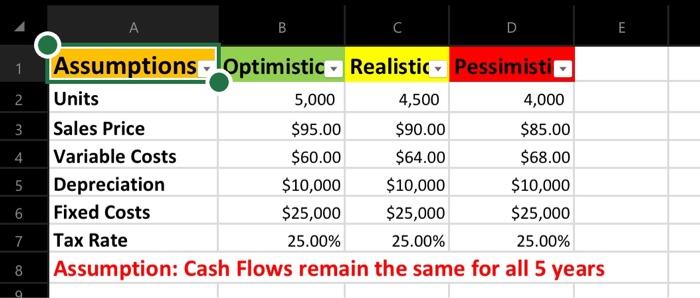

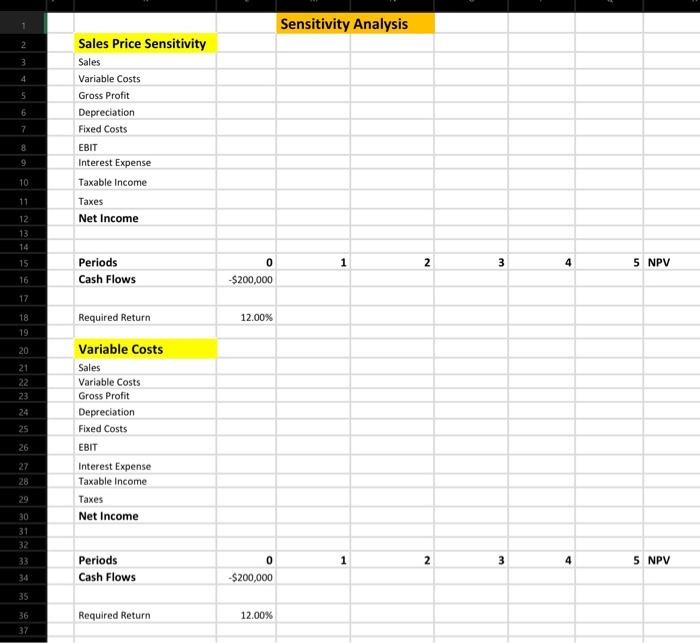

need help with sensitivity analysis for sales price and variable costs E 1 2 3 4 B D Assumptions - Optimistic Realistic Pessimistio Units 5,000

need help with sensitivity analysis for sales price and variable costs

E 1 2 3 4 B D Assumptions - Optimistic Realistic Pessimistio Units 5,000 4,500 4,000 Sales Price $95.00 $90.00 $85.00 Variable Costs $60.00 $64.00 $68.00 Depreciation $10,000 $10,000 $10,000 Fixed Costs $25,000 $25,000 $25,000 Tax Rate 25.00% 25.00% 25.00% Assumption: Cash Flows remain the same for all 5 years 5 6 LO 7 8 a Sensitivity Analysis 2 3 7 Sales Price Sensitivity Sales Variable Costs Gross Profit Depreciation Fixed Costs EBIT Interest Expense Taxable income Taxes Net Income 8 9 10 11 12 13 14 15. 1 2 2 3 4 5 NPV Periods Cash Flows 0 -$200,000 16 17. 18 19 Required Return 12.00% 20 21 22 23 24 25 Variable Costs Sales Variable Costs Gross Profit Depreciation Fixed Costs EBIT Interest Expense Taxable income Taxes Net Income 26 27 28 29 30 31 32 33 1 2 3 3 4 5 NPV Periods Cash Flows 0 $200,000 34 35 36 37 Required Return 12.00% E 1 2 3 4 B D Assumptions - Optimistic Realistic Pessimistio Units 5,000 4,500 4,000 Sales Price $95.00 $90.00 $85.00 Variable Costs $60.00 $64.00 $68.00 Depreciation $10,000 $10,000 $10,000 Fixed Costs $25,000 $25,000 $25,000 Tax Rate 25.00% 25.00% 25.00% Assumption: Cash Flows remain the same for all 5 years 5 6 LO 7 8 a Sensitivity Analysis 2 3 7 Sales Price Sensitivity Sales Variable Costs Gross Profit Depreciation Fixed Costs EBIT Interest Expense Taxable income Taxes Net Income 8 9 10 11 12 13 14 15. 1 2 2 3 4 5 NPV Periods Cash Flows 0 -$200,000 16 17. 18 19 Required Return 12.00% 20 21 22 23 24 25 Variable Costs Sales Variable Costs Gross Profit Depreciation Fixed Costs EBIT Interest Expense Taxable income Taxes Net Income 26 27 28 29 30 31 32 33 1 2 3 3 4 5 NPV Periods Cash Flows 0 $200,000 34 35 36 37 Required Return 12.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started