Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with some true and false questions 9. What is the stand-alone principle? Why is it important to the analysis of capital projects? True

Need help with some true and false questions

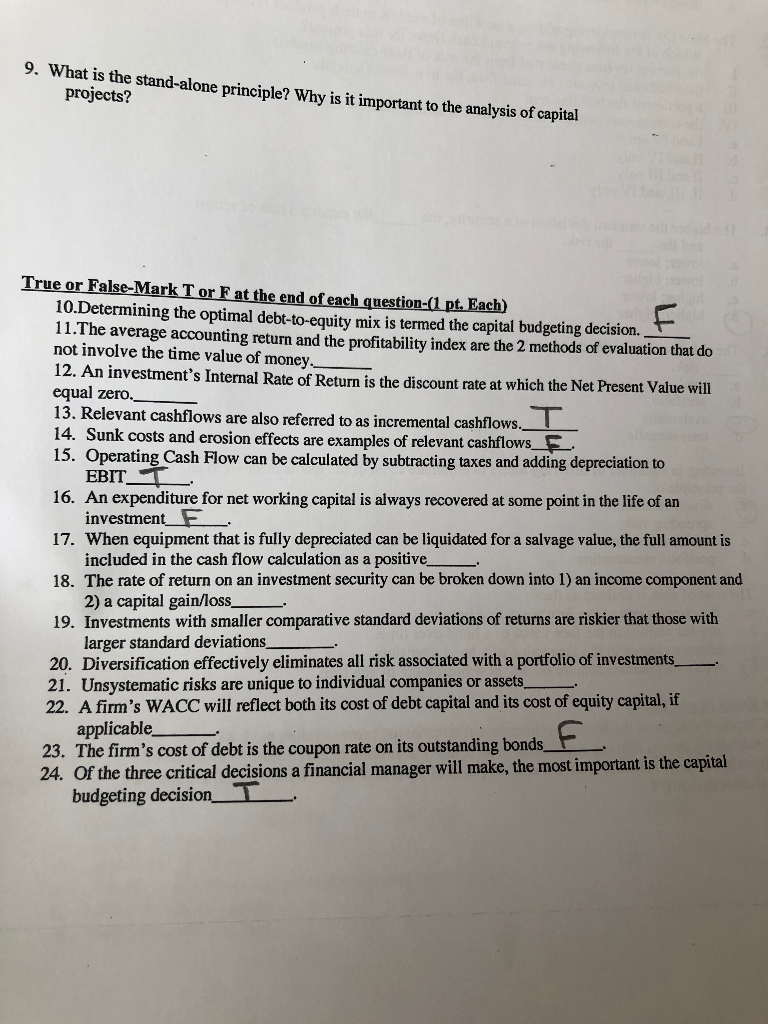

9. What is the stand-alone principle? Why is it important to the analysis of capital projects? True or False-Mark T or F at the end of each question-1 pt. Each) 10.Determining the optimal debt-to-equity mix is termed the capital budgeting decision. 11.The average accounting return and the profitability index are the 2 methods of evaluation that do not involve the time value of money 12. An investment's Internal Rate of Return is the discount rate at which the Net Present Value wil equal zero._ 13. Relevant cashflows are also referred to as incremental cashflows.T 14. Sunk costs and erosion effects are examples of relevant cashflows_F 15. Operating Cash Flow can be calculated by subtracting taxes and adding depreciation to EBIT 16. An expenditure for net working capital is always recovered at some point in the life of an investmen 17. When equipment that is fully depreciated can be liquidated for a salvage value, the full amount is included in the cash flow calculation as a positive_ 18. The rate of return on an investment security can be broken down into 1) an income component and 2) a capital gain/loss_ 19. Investments with smaller comparative standard deviations of returns are riskier that those with larger standard deviations_ 20. Diversification effectively eliminates all risk associated with a portfolio of investments_ 21. Unsystematic risks are unique to individual companies or assets_ 22. A firm's WACC will reflect both its cost of debt capital and its cost of equity capital, if applicable 23. The firm's cost of debt is the coupon rate on its outstanding bonds 24. Of the three critical decisions a financial manager will make, the most important is the capita budgeting decisionT 9. What is the stand-alone principle? Why is it important to the analysis of capital projects? True or False-Mark T or F at the end of each question-1 pt. Each) 10.Determining the optimal debt-to-equity mix is termed the capital budgeting decision. 11.The average accounting return and the profitability index are the 2 methods of evaluation that do not involve the time value of money 12. An investment's Internal Rate of Return is the discount rate at which the Net Present Value wil equal zero._ 13. Relevant cashflows are also referred to as incremental cashflows.T 14. Sunk costs and erosion effects are examples of relevant cashflows_F 15. Operating Cash Flow can be calculated by subtracting taxes and adding depreciation to EBIT 16. An expenditure for net working capital is always recovered at some point in the life of an investmen 17. When equipment that is fully depreciated can be liquidated for a salvage value, the full amount is included in the cash flow calculation as a positive_ 18. The rate of return on an investment security can be broken down into 1) an income component and 2) a capital gain/loss_ 19. Investments with smaller comparative standard deviations of returns are riskier that those with larger standard deviations_ 20. Diversification effectively eliminates all risk associated with a portfolio of investments_ 21. Unsystematic risks are unique to individual companies or assets_ 22. A firm's WACC will reflect both its cost of debt capital and its cost of equity capital, if applicable 23. The firm's cost of debt is the coupon rate on its outstanding bonds 24. Of the three critical decisions a financial manager will make, the most important is the capita budgeting decisionTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started