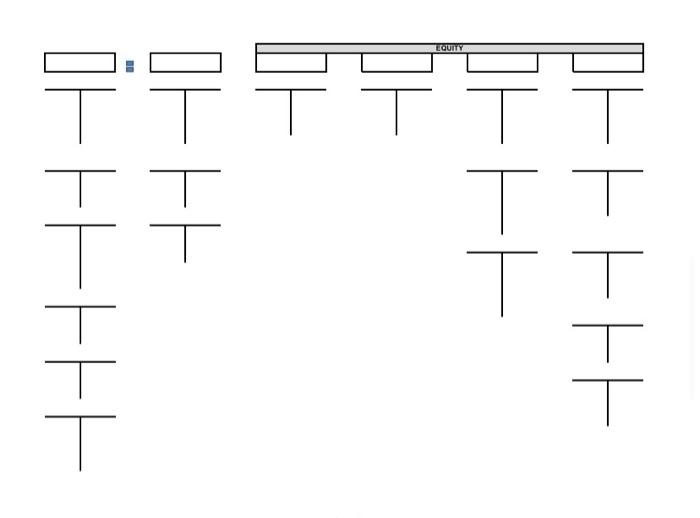

Need help with step 2. Filling out the T accounts.

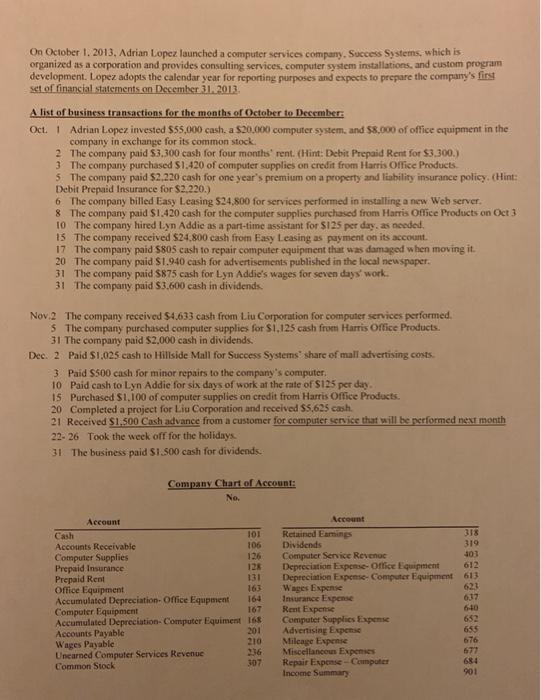

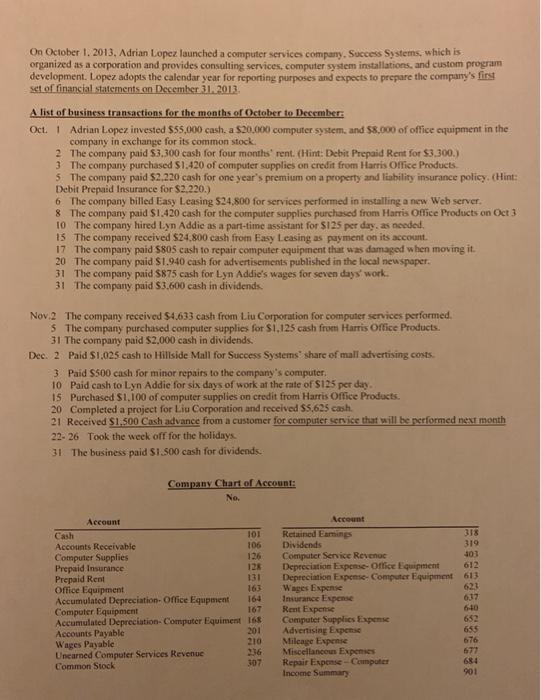

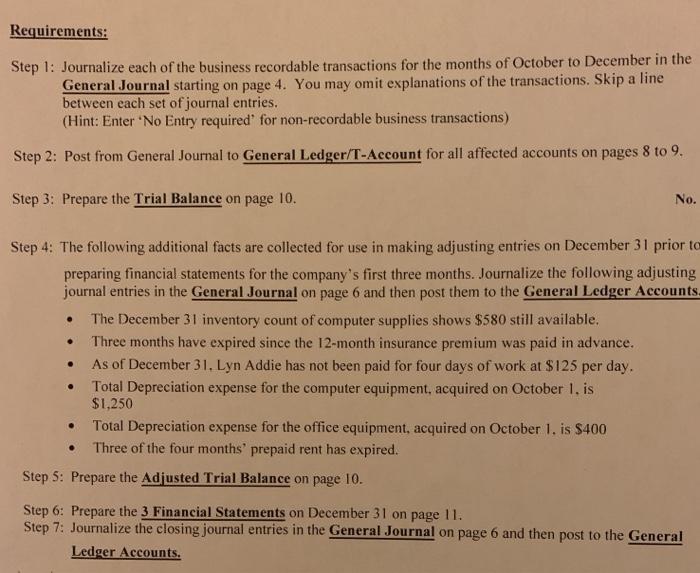

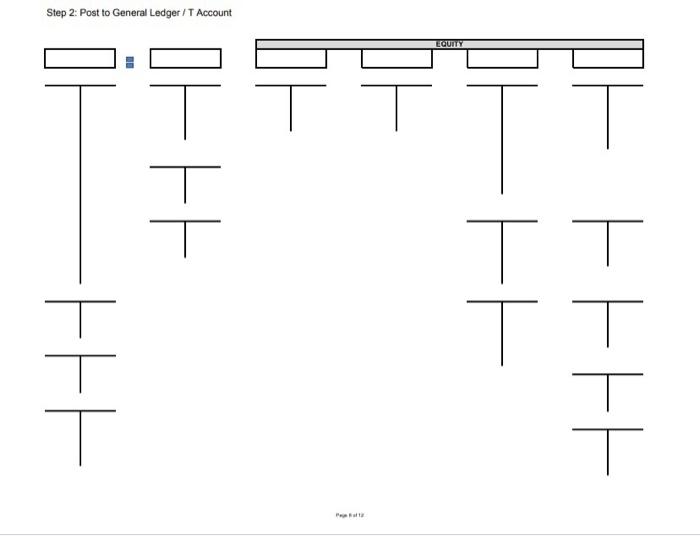

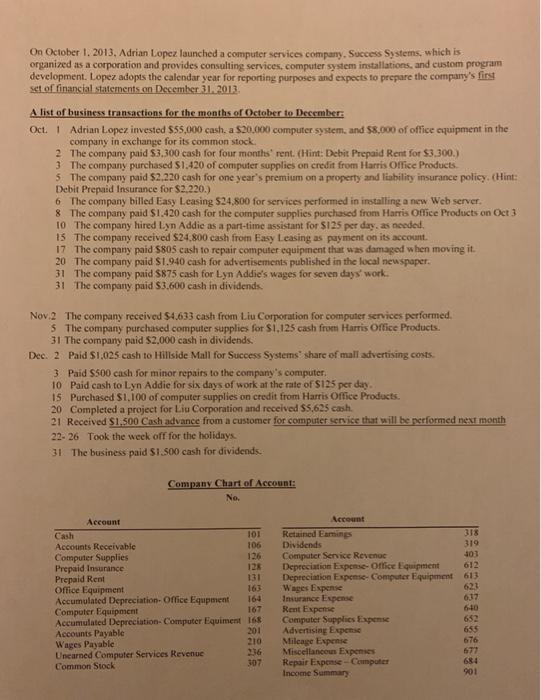

On October 1. 2013. Adrian Lopez launched a computer services company. Success Systems, which is organized as a corporation and provides consulting services, computer system installations, and custom program development. Lopez adopts the calendar year for reporting purposes and expects to prepare the company's first set of financial statements on December 31, 2013 A list of business transactions for the months of October to December Oct. 1 Adrian Lopez invested $55,000 cash. a $20.000 computer system, and $8.000 of office equipment in the company in exchange for its common stock 2 The company paid $3.300 cash for four months' rent. (Hint: Debit Prepaid Rent For $3.300.) 3 The company purchased $1.420 of computer supplies on credit from Harris Office Products 5. The company paid $2,220 cash for one year's premium on a property and liability insurance policy. (Hint: Debit Prepaid Insurance for $2.220.) 6 The company billed Easy Leasing $24.800 for services performed in installing a new Web server. 8 The company paid $1.420 cash for the computer supplies purchased from Harris Office Products on Oct 3 10 The company hired Lyn Addie as a part-time assistant for S125 per day, as needed 15 The company received $24.800 cash from Easy Leasing as payment on its account. 17 The company paid $805 cash to repair computer equipment that was damaged when moving it. 20 The company paid $1.940 cash for advertisements published in the local newspaper. 31 The company paid $875 cash for Lyn Addie's wages for seven days' work. 31 The company paid $3.600 cash in dividends. Nov.2 The company received $4.633 cash from Liu Corporation for computer services performed 5 The company purchased computer supplies for $1.125 cash from Harris Office Products. 31 The company paid $2,000 cash in dividends. Dec. 2 Paid S1.025 cash to Hillside Mall for Success Systems sharc of mall advertising costs. 3 Paid S500 cash for minor repairs to the company's computer. 10 Paid cash to Lyn Addic for six days of work at the rate of $125 per day. 15 Purchased $1,100 of computer supplies on credit from Harris Office Products 20 Completed a project for Liu Corporation and received $5,625 cash. 21 Received S1.500 Cash advance from a customer for computer service that will be performed next month 22-26 Took the week off for the holidays 31 The business paid $1.500 cash for dividends. Company Chart of Account: No. Account Cash 101 Accounts Receivable 106 Computer Supplies Prepaid Insurance 12 Prepaid Rent 131 Office Equipment Accumulated Depreciation Office Equpment 164 Computer Equipment 167 Accumulated Depreciation Computer Equiment 168 Accounts Payable 201 210 Wages Payable Unearned Computer Services Revenue 2:36 Common Stock 307 Account Retained Emin 313 Dividends 319 Computer Service Revenec 101 Depreciation Expense-Office Equipment 612 Depreciation Expense-Computer Equipment 613 Wages Expense 621 Insurance Expense 637 Rent Expense Computer Supplies Expense 652 Advertising Expense 655 Milcage Expense 676 Miscellaneous Experies Repair Expense - Computer 684 Income Summary 901 Requirements: Step 1: Journalize each of the business recordable transactions for the months of October to December in the General Journal starting on page 4. You may omit explanations of the transactions. Skip a line between each set of journal entries. (Hint: Enter 'No Entry required' for non-recordable business transactions) Step 2: Post from General Journal to General Ledger/T-Account for all affected accounts on pages 8 to 9. Step 3: Prepare the Trial Balance on page 10. No. . Step 4: The following additional facts are collected for use in making adjusting entries on December 31 prior to preparing financial statements for the company's first three months. Journalize the following adjusting journal entries in the General Journal on page 6 and then post them to the General Ledger Accounts The December 31 inventory count of computer supplies shows $580 still available. Three months have expired since the 12-month insurance premium was paid in advance. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. Total Depreciation expense for the computer equipment acquired on October 1. is $1,250 Total Depreciation expense for the office equipment, acquired on October 1. is $400 Three of the four months' prepaid rent has expired. Step 5: Prepare the Adjusted Trial Balance on page 10. . . Step 6: Prepare the 3 Financial Statements on December 31 on page 11. Step 7: Journalize the closing journal entries in the General Journal on page 6 and then post to the General Ledger Accounts. Step 2: Post to General Ledger /T Account EQUITY TT FEH --- --- EQUITY HE II- EHE FEE