Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with the 3rd question please Brad Shin is an operations manager for a large manufacturer. He earned $73,500 in 2015 and plans to

need help with the 3rd question please

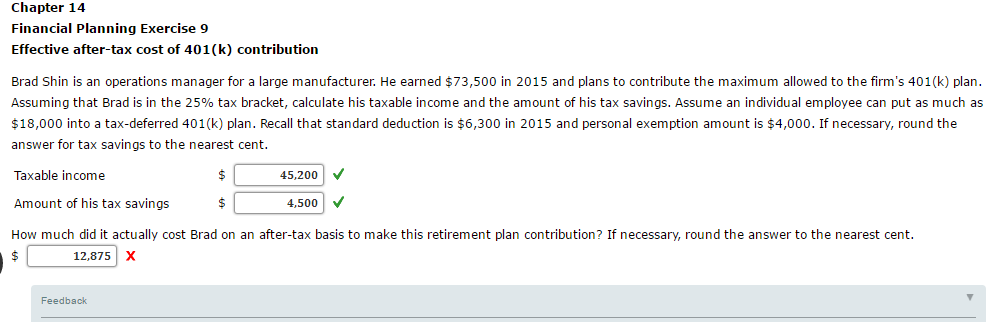

Brad Shin is an operations manager for a large manufacturer. He earned $73,500 in 2015 and plans to contribute the maximum allowed to the firm's 401(k) plan. Assuming that Brad is in the 25% tax bracket, calculate his taxable income and the amount of his tax savings. Assume an individual employee can put as much as $18,000 into a tax-deferred 401(k) plan. Recall that standard deduction is $6,300 in 2015 and personal exemption amount is $4,000. If necessary, round the answer for tax savings to the nearest cent. Taxable income $ 45,200 Amount of his tax savings $ 4,500 How much did it actually cost Brad on an after-tax basis to make this retirement plan contribution? If necessary, round the answer to the nearest cent. $ 12,875Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started