Need help with the blank questions.

Need help with the blank questions.

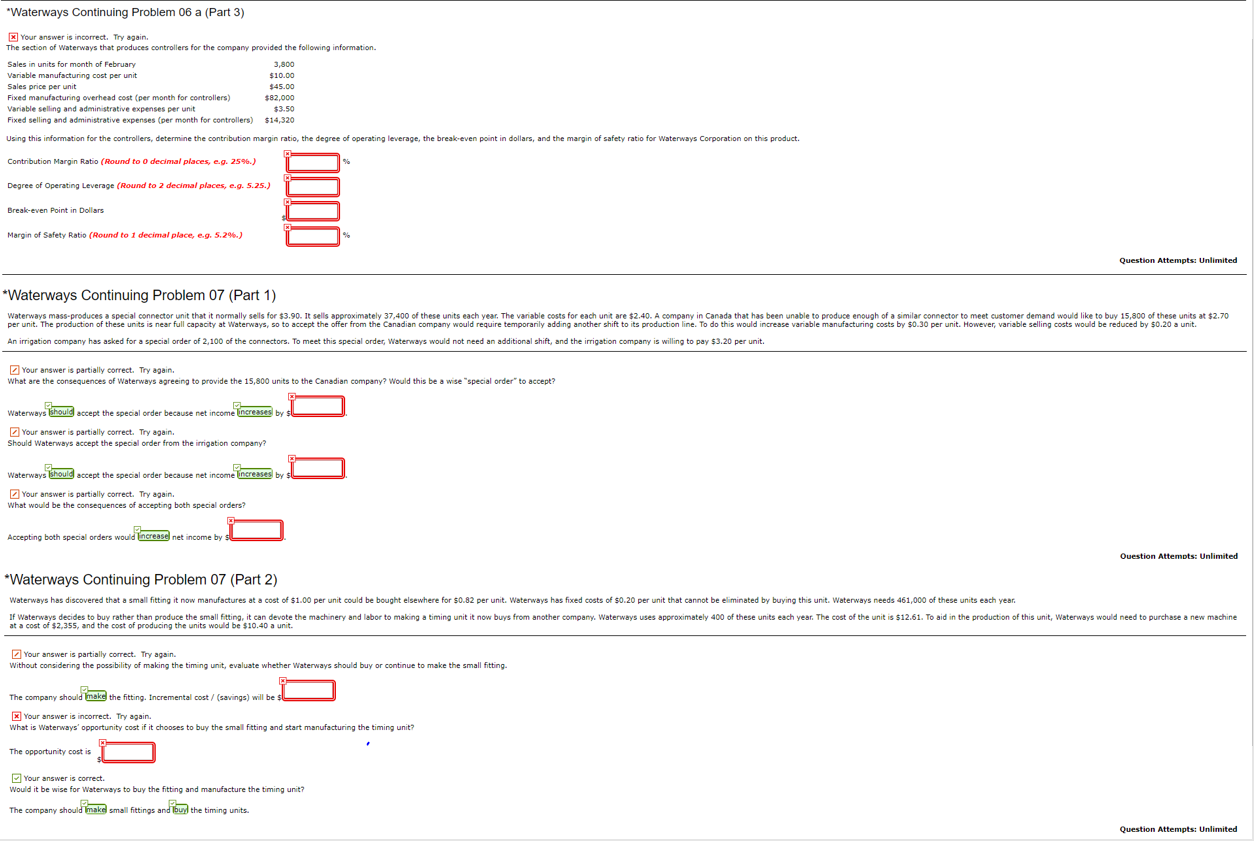

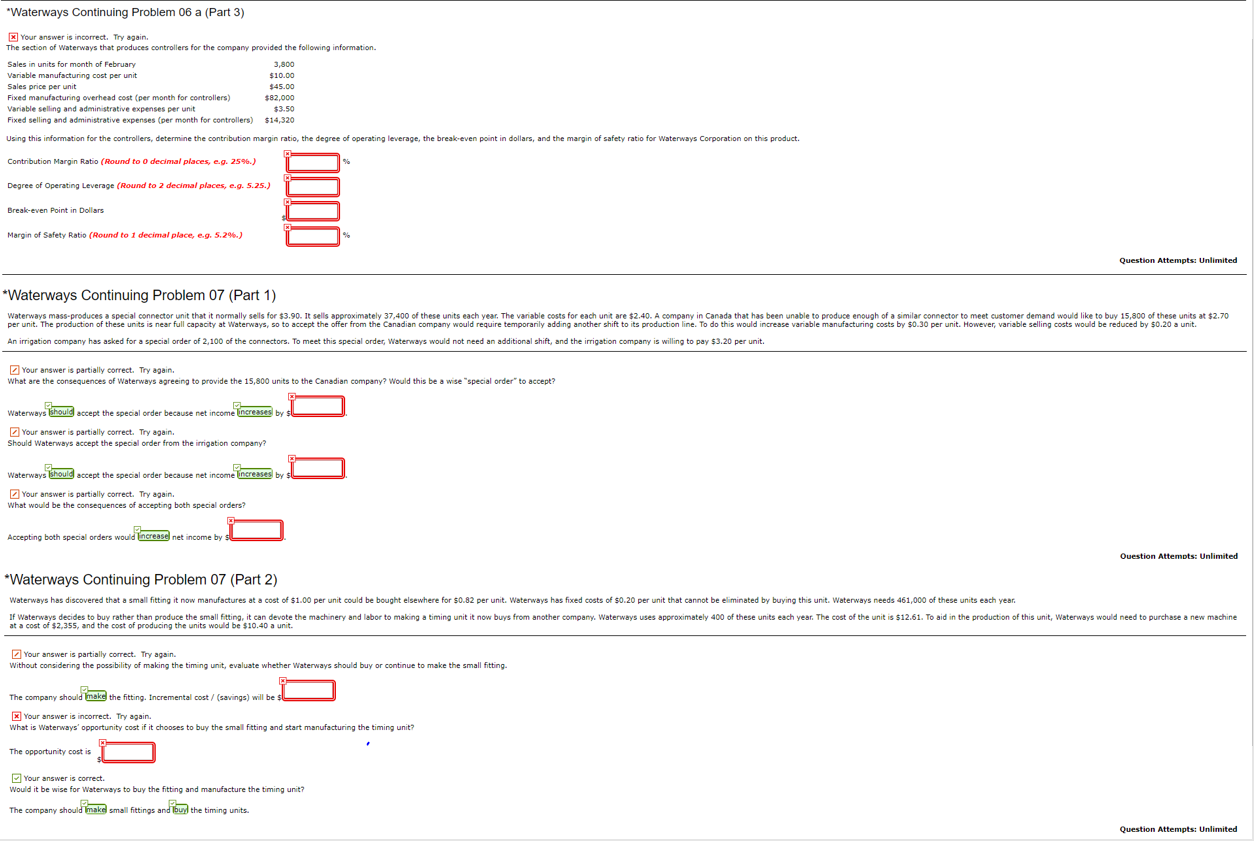

"Waterways Continuing Problem 06 a (Part 3) x Your answer is incorrect. Try again. The section of Waterways that produces controllers for the company provided the following information. Sales in units for month of February Variable manufacturing cost per unit Sales price per unit Fixed manufacturing overhead cost (per month for controllers) Variable selling and administrative expenses per unit Fixed selling and administrative expenses (per month for controllers) 3,800 $10.00 $45.00 $82,000 $3.50 $14,320 Using this information for the controllers, determine the contribution margin ratio, the degree of operating leverage, the break-even point in dollars, and the margin of safety ratio for Waterways Corporation on this product. Contribution Margin Ratio (Round to o decimal places, e.g. 2596.) Degree of Operating Leverage (Round to 2 decimal places, e.g. 5.25.) Break-even Point in Dollars Margin of Safety Ratio (Round to 1 decimal place, e.g. 5.29.) Question Attempts: Unlimited *Waterways Continuing Problem 07 (Part 1) Waterways mass-produces a special connector unit that it normally sells for $3.90. It sells approximately 37,400 of these units each year. The variable costs for each unit are $2.40. A company in Canada that has been unable to produce enough of a similar connector to meet customer demand would like to buy 15,800 of these units at $2.70 per unit. The production of these units is near full capacity at Waterways, so to accept the offer from the Canadian company would require temporarily adding another shift to its production line. To do this would increase variable manufacturing costs by $0.30 per unit. However, variable selling costs would be reduced by $0.20 a unit. An irrigation company has asked for a special order of 2,100 of the connectors. To meet this special order, Waterways would not need an additional shift, and the irrigation company is willing to pay $3.20 per unit. Your answer is partially correct. Try again. What are the consequences of Waterways agreeing to provide the 15,800 units to the Canadian company? Would this be a wise "special order to accept? Waterways should accept the special order because net income increases by Your answer is partially correct. Try again. Should Waterways accept the special order from the irrigation company? Waterways should accept the special order because net income increases by Your answer is partially correct. Try again. What would be the consequences of accepting both special orders? Accepting both special orders would increase net income by s Ouestion Attempts: Unlimited *Waterways Continuing Problem 07 (Part 2) Waterways has discovered that a small fitting it now manufactures at a cost of $1.00 per unit could be bought elsewhere for $0.82 per unit. Waterways has fixed costs of $0.20 per unit that cannot be eliminated by buying this unit. Waterways needs 461,000 of these units each year. If Waterways decides to buy rather than produce the small fitting, it can devote the machinery and labor to making a timing unit it now buys from another company. Waterways uses approximately 400 of these units each year. The cost of the unit is $12.61. To aid in the production of this unit, Waterways would need to purchase a new machine at a cost of $2.355, and the cost of producing the units would be $10.40 a unit. Your answer is partially correct. Try again. Without considering the possibility of making the timing unit, evaluate whether Waterways should buy or continue to make the small fitting The company should make the fitting. Incremental cost / (savings) will be L x Your answer is incorrect. Try again. What is Waterways' opportunity cost if it chooses to buy the small fitting and start manufacturing the timing unit? The opportunity cost is Your answer is correct. Would it be wise for Waterways to buy the fitting and manufacture the timing unit? The company should make small fittings and buy the timing units. Question Attempts: Unlimited

Need help with the blank questions.

Need help with the blank questions.