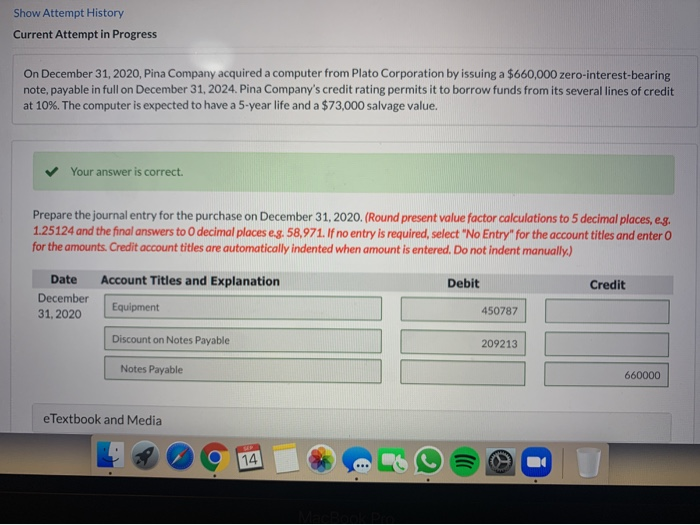

Need help with the boxes highlighted in red. Thanks!

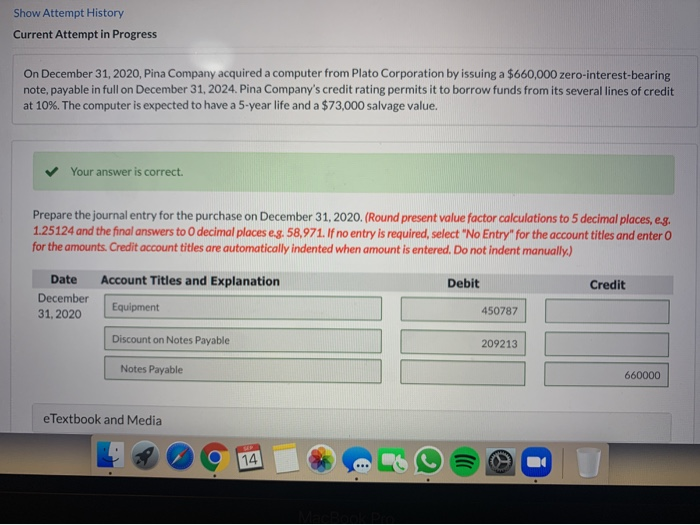

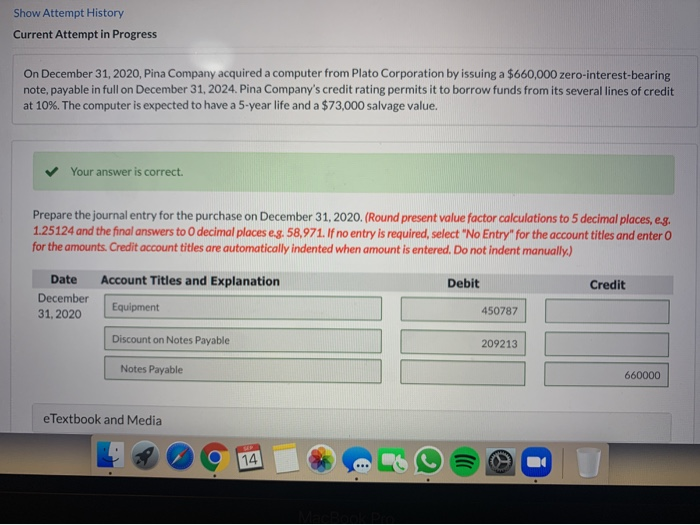

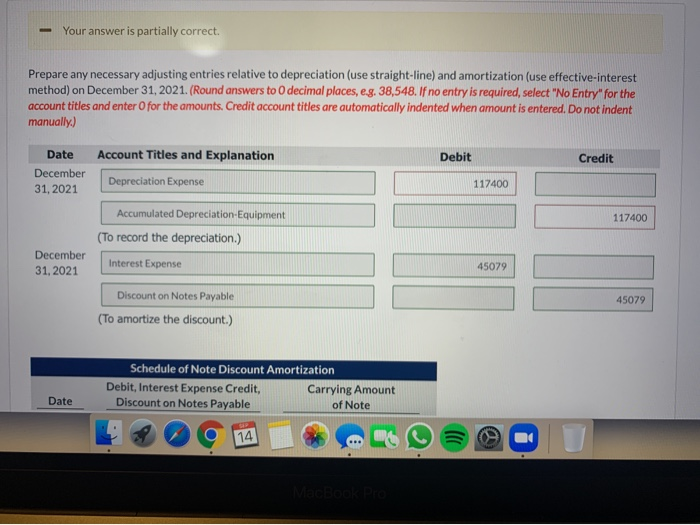

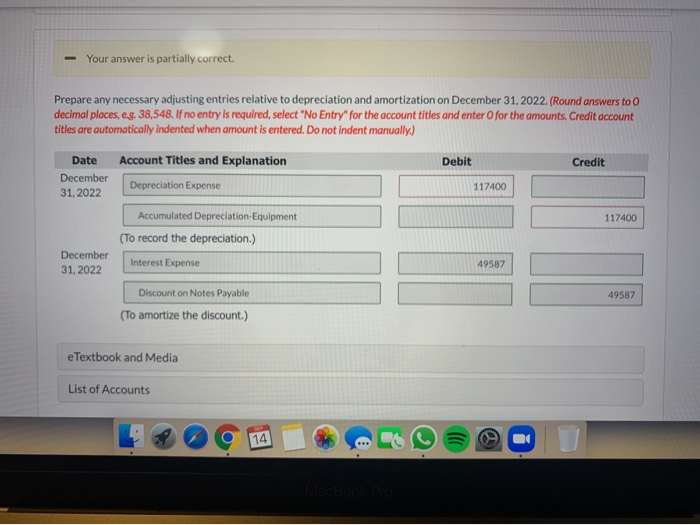

Show Attempt History Current Attempt in Progress On December 31, 2020, Pina Company acquired a computer from Plato Corporation by issuing a $660,000 zero-interest-bearing note, payable in full on December 31, 2024. Pina Company's credit rating permits it to borrow funds from its several lines of credit at 10%. The computer is expected to have a 5-year life and a $73,000 salvage value. Your answer is correct Prepare the journal entry for the purchase on December 31, 2020. (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to decimal places e.g. 58,971. If no entry is required, select "No Entry" for the account titles and entero for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit December Equipment 450787 31, 2020 Discount on Notes Payable 209213 Notes Payable 660000 e Textbook and Media 14 o . Your answer is partially correct. Prepare any necessary adjusting entries relative to depreciation (use straight-line) and amortization (use effective interest method) on December 31, 2021. (Round answers to decimal places, eg. 38,548. If no entry is required, select "No Entry"for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date December 31, 2021 Account Titles and Explanation Depreciation Expense 117400 117400 Accumulated Depreciation Equipment (To record the depreciation.) December 31, 2021 Interest Expense 45079 45079 Discount on Notes Payable (To amortize the discount.) Schedule of Note Discount Amortization Debit, Interest Expense Credit, Carrying Amount Discount on Notes Payable of Note Date 14 Your answer is partially correct. Prepare any necessary adjusting entries relative to depreciation and amortization on December 31, 2022. (Round answers to decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date December 31, 2022 Account Titles and Explanation Depreciation Expense 117400 117400 Accumulated Depreciation Equipment (To record the depreciation.) Interest Expense December 31, 2022 49587 49587 Discount on Notes Payable (To amortize the discount.) eTextbook and Media List of Accounts 14 Maceea