Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with the conclusion portion. 2. Assessing Exchange Rate Risk. Washington Co. and Vermont Co. have no domestic business. They have a similar dollar

Need help with the conclusion portion.

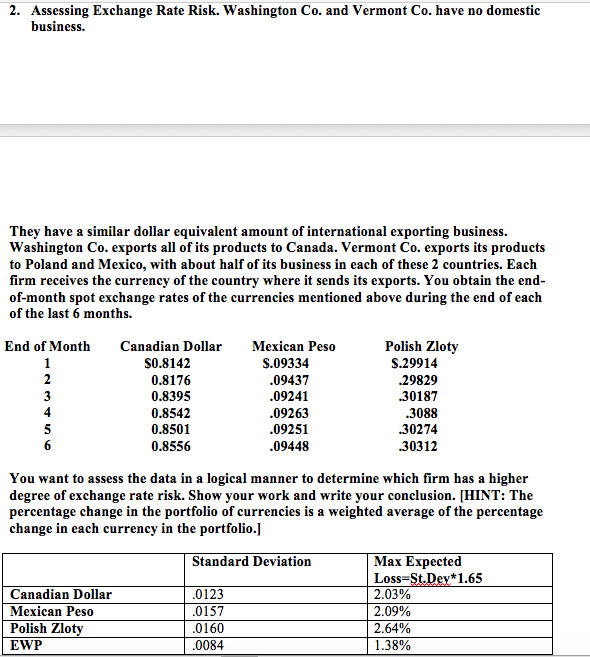

2. Assessing Exchange Rate Risk. Washington Co. and Vermont Co. have no domestic business. They have a similar dollar equivalent amount of international exporting business. Washington Co. exports all of its products to Canada. Vermont Co. exports its products to Poland and Mexico, with about half of its business in each of these 2 countries. Each firm receives the currency of the country where it sends its exports. You obtain the end- of-month spot exchange rates of the currencies mentioned above during the end of each of the last 6 months. Canadian Dollar S0.8142 0.8176 0.8395 0.8542 0.8501 0.8556 Polish Zloty S.29914 29829 30187 3088 30274 30312 End of Month Mexican Peso S.09334 09437 09241 09263 09251 09448 You want to assess the data in a logical manner to determine which firm has a higher degree of exchange rate risk. Show your work and write your conclusion. [HINT: The percentage change in the portfolio of currencies is a weighted average of the percentage change in each currency in the portfolio.] Max Expected Loss- 2.03% 2.09% 2.64% 1 .38% Standard Deviation *1.65 Canadian Dollar Mexican Peso Polish Zlot EWP 0123 0157 0160 0084Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started