Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with the excel formula for =Price( and =PV( ? X m. VIEW Sign In XUE 5 Calculating a bond price - Excel FILE

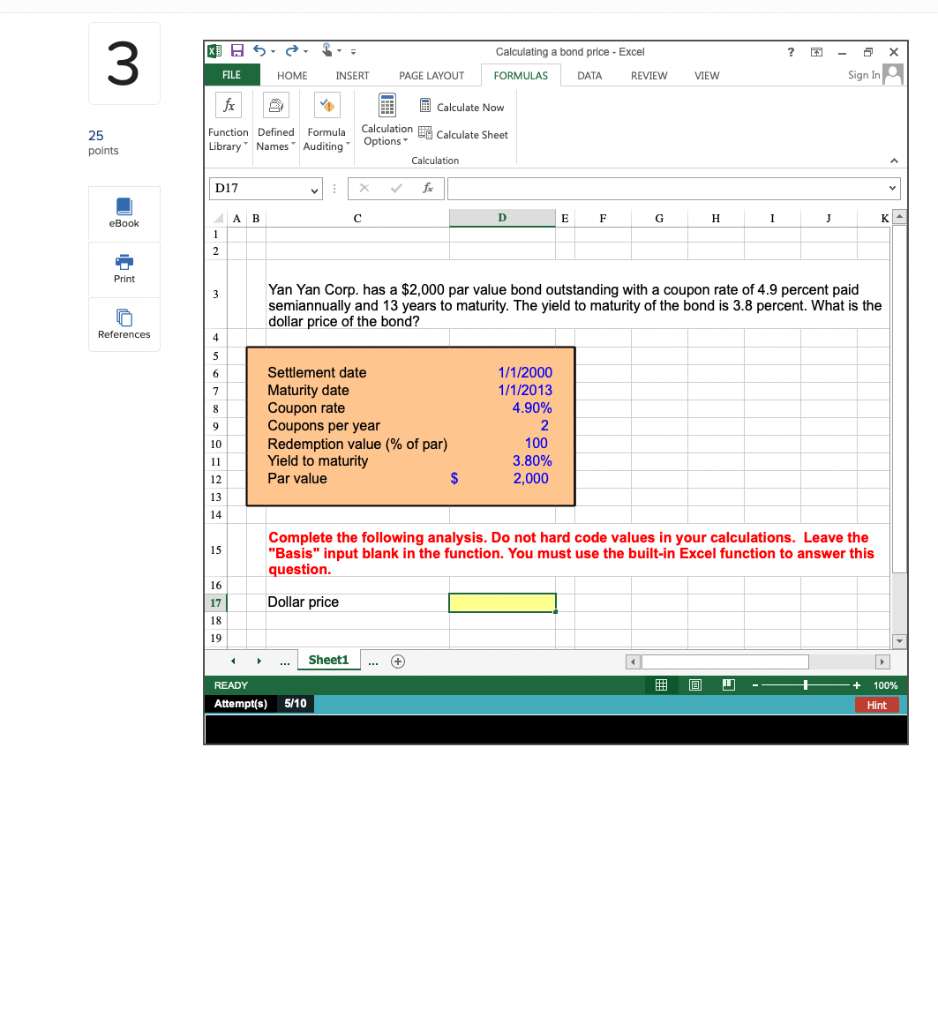

Need help with the excel formula for =Price( and =PV(

? X m. VIEW Sign In XUE 5 Calculating a bond price - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW fx Calculate Now Function Defined Formula Calculation Et Calculate Sheet Options Library Names Auditing Calculation 25 points D17 fo AB D E F G eBook H I J K- 1 2 Print 3 Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.9 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 3.8 percent. What is the dollar price of the bond? References 5 6 7 8 9 10 11 12 13 14 Settlement date Maturity date Coupon rate Coupons per year Redemption value (% of par) Yield to maturity Par value $ 1/1/2000 1/1/2013 4.90% 2 100 3.80% 2,000 15 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. Dollar price 16 17 18 19 Sheet1 + 100% READY Attempt(s) 5/10 HintStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started