need help with the final exam study guide

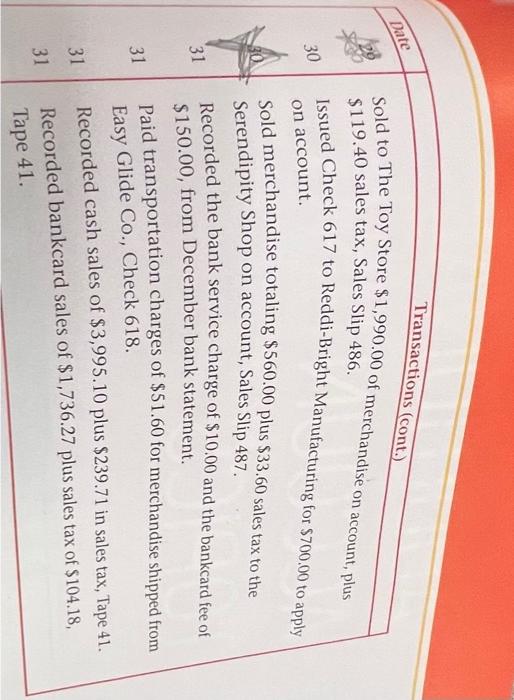

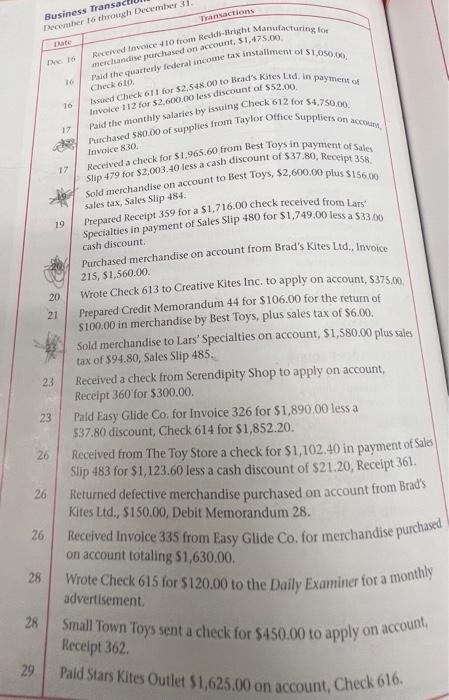

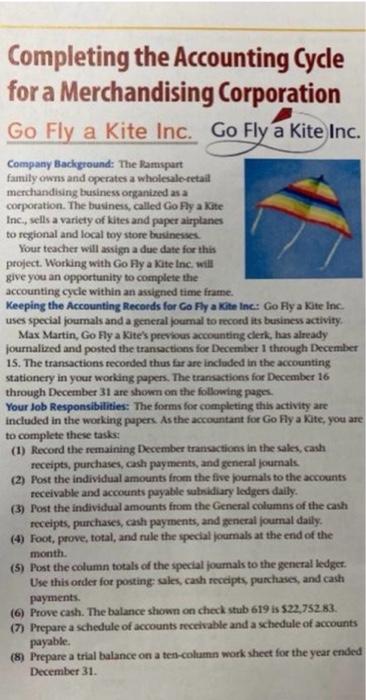

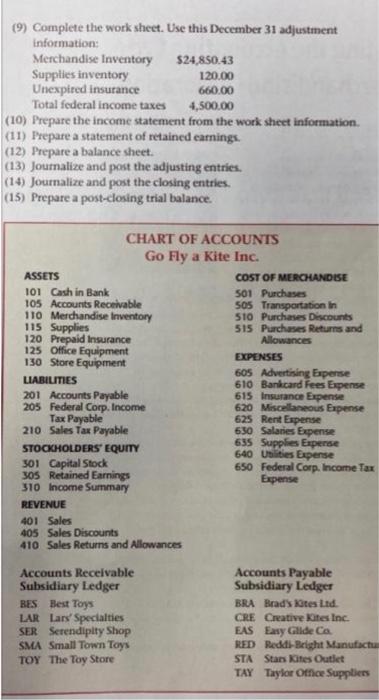

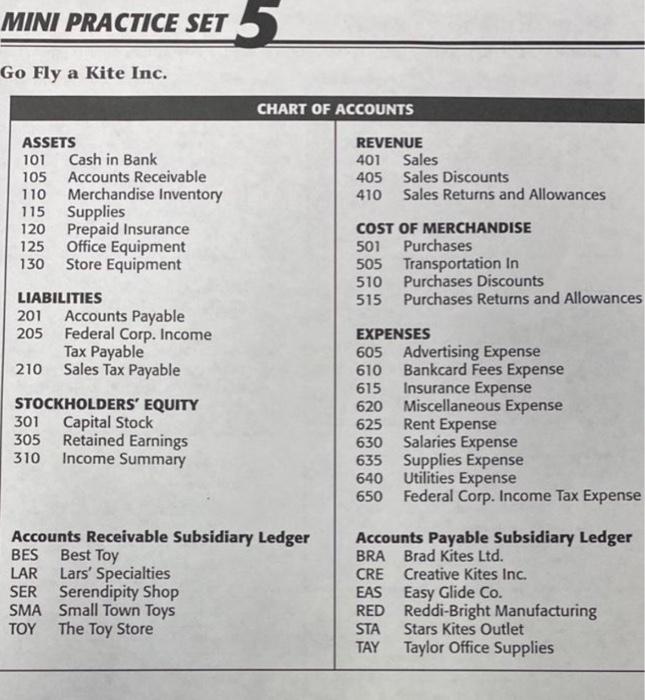

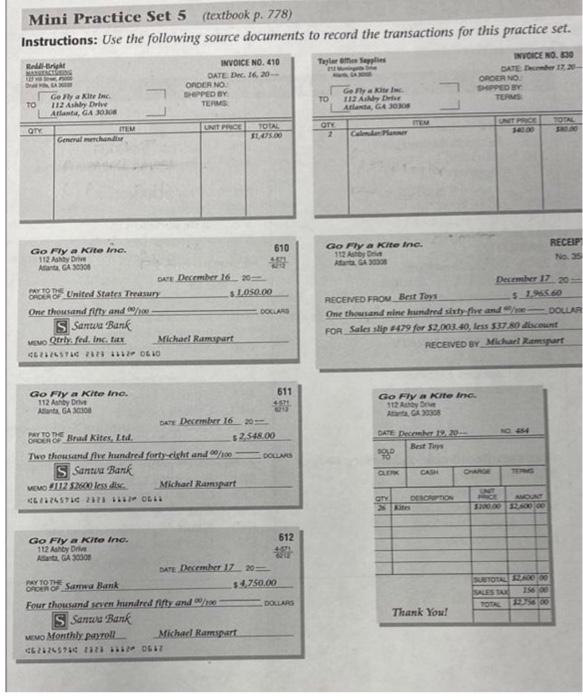

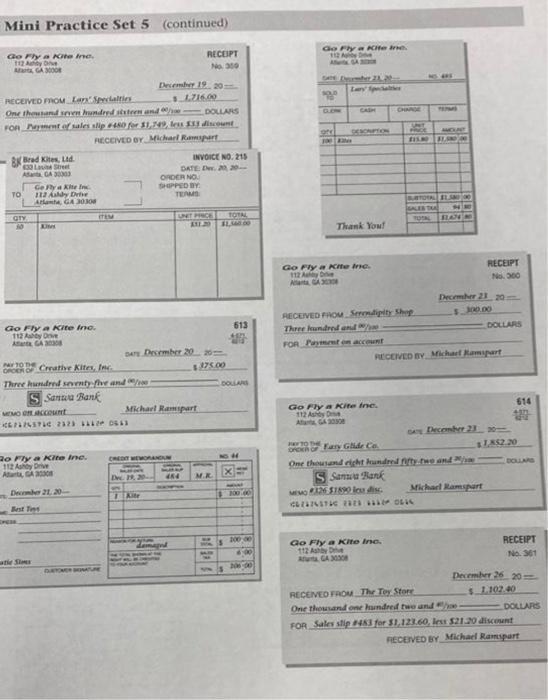

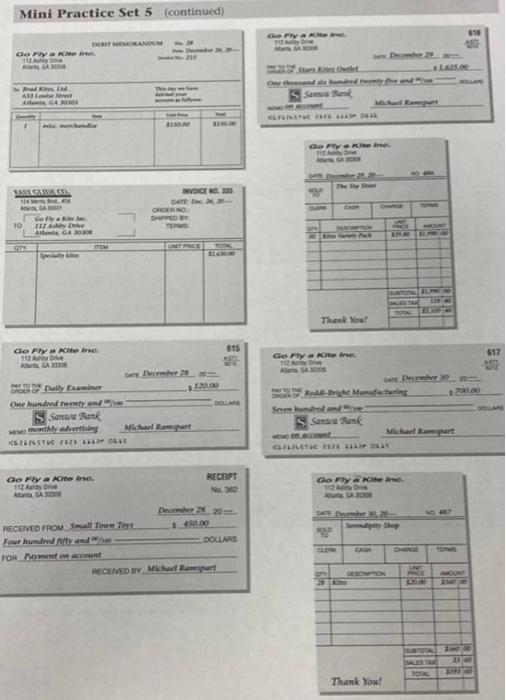

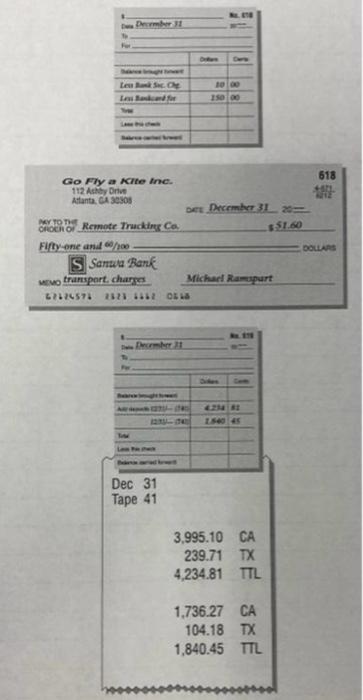

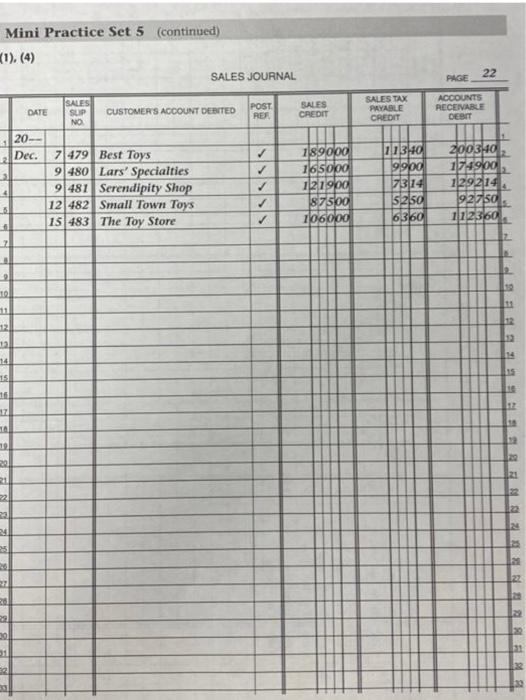

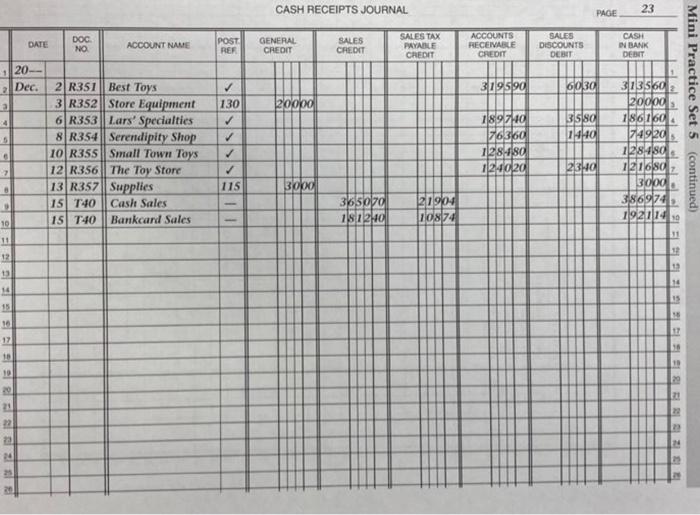

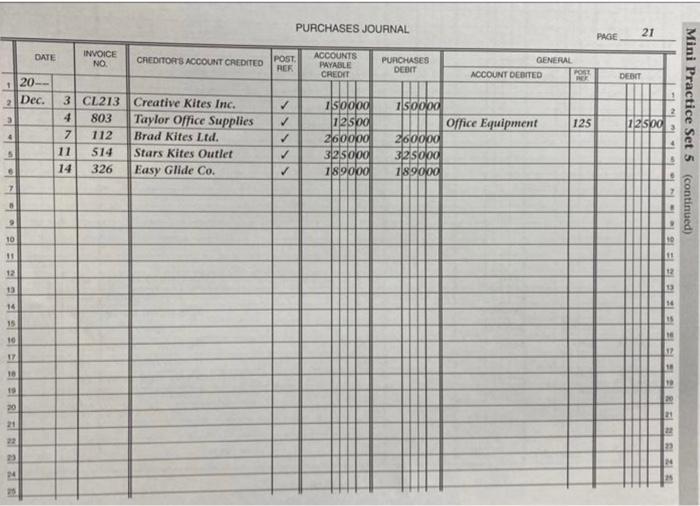

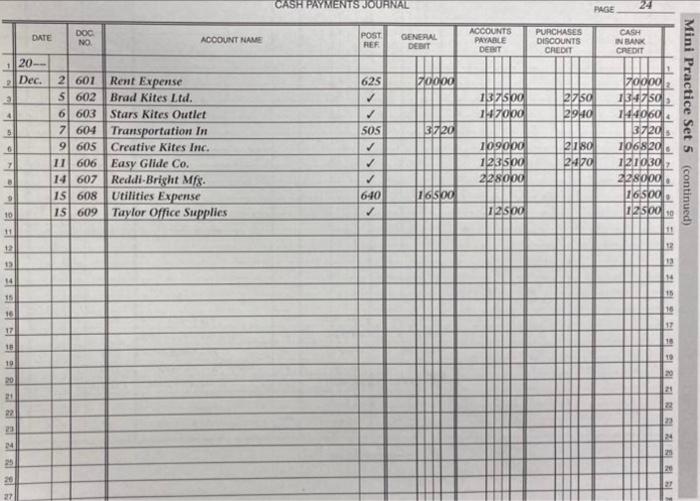

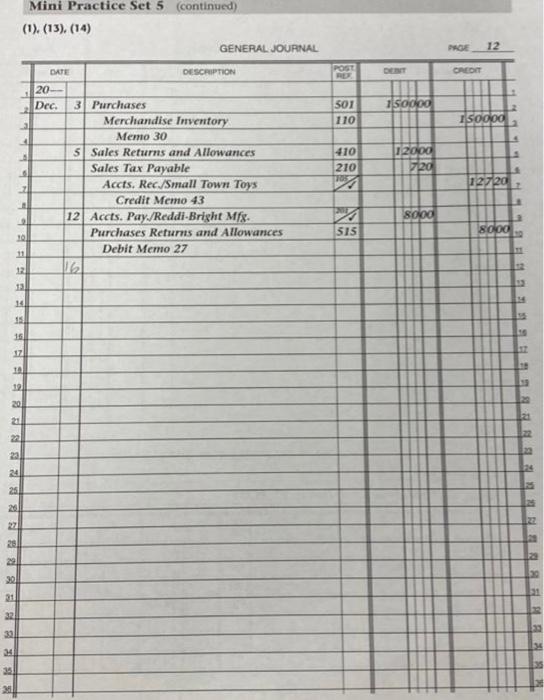

Sold to The Toy Store $1,990.00 of merchandise on account, plus $119.40 sales tax, Sales Slip 486. Issued Check 617 to Reddi-Bright Manufacturing for $700.00 to apply on account. Sold merchandise totaling $560.00 plus $33.60 sales tax to the Serendipity Shop on account, Sales Slip 487. Recorded the bank service charge of $10.00 and the bankcard fee of $150.00, from December bank statement. Paid transportation charges of $51.60 for merchandise shipped from Easy Glide Co., Check 618. Recorded cash sales of $3,995.10 plus $239.71 in sales tax, Tape 41 . Recorded bankcard sales of $1,736.27 plus sales tax of $104.18, Tape 41 Deo 16. Received Involce +10 trom Reddi-Bright Manufacturing for patc merctandise parchased on accote tax installment of $1.050.00. Issued Check 611 for 52.548 .00 to Brad's Kites Ltd. in payment of (reck 610. Involee 112 tor 52,600.00 less discount of $52.00 Paid the monthly salaries by issuing Check 612 for 54,750,00. Purchased 580.00 of supplies from Taylor Office Suppliets on accoum, Receiveda check for $1.965.60 from Best Toys in payment of Sales Invoice 830 Slip 479 for $2,003.40 less a cash discount of $37.80. Receipt 358 . Sold merchandise on account to Best Toys, $2,600.00 plus $156,00 Prepared Receipt 359 for a $1,716.00 check received from Lars' sales tax, Sales Slip 484 Specialties in payment of Sales Slip 480 for $1,749.00 less a $33.00 Purchased merchandise on account from Brad's Kites Lid., Invoice. cash discount. 215,51,560.00. Wrote Check 613 to Creative Kites Inc. to apply on account, $375:00 Prepared Credit Memorandum 44 for $106.00 for the return of $100.00 in merchandise by Best Toys, plus sales tax of $6.00. Sold merchandise to Lars' Specialties on account, $1,580.00 plus sales tax of $94.80, Sales Slip 485 . 23 Received a check from Serendipity Shop to apply on account, Receipt 360 for $300.00. 23 Paid Easy Glide Co, for Invoice 326 for $1,890.00 less a $37.80 discount, Check 614 for $1,852.20. 26 Received from The Toy Store a check for $1,102.40 in payment of Salo Slip 483 for $1,123.60 less a cash discount of $21,20, Receipt 361 . 26 Returned defective merchandise purchased on account from Brad's Kites Ltd., \$150.00, Debit Memorandum 28. 26 Received Invoice 335 from Easy Glide Co, for merchandise purchased on account totaling $1,630.00. 28 Wrote Check 615 for $120.00 to the Daily Examiner for a monthly advertisement, 28 Small Town Toys sent a check for $450.00 to apply on account. Receipt 362. 29 Paid Stars Kites Outlet \$1,625.00 on account, Check 616. Completing the Accounting Cycle for a Merchandising Corporation Go Fly a Kite Inc. Go Fly a Kite Inc. Company Background: The Ramspart family owrs and operates a wholesaletetail merchardising business organired as a corporation. The business, called Cio Fy a kite Inc., sells a varicty of kites and paper airplanes to rogional and local toy store burinesses. Your teacher will ansign a due dafe for this ptoject. Wotking with Go Hy a Jite lne. will give you an opportunity to complete the accounting cycle within an assigned time frame. Keeping the Accounting Records for Co Fly a Kite Inc. Go Fy a Kite Inc. uses special joumals and a kenctal foumal to rocotd its business activity. Max Martin, Go Fly a Kite's pecvious accounting clerk, has already journalized and posted the trancactions foe December 1 thtough Decemaler 15. The tranactions reconded thus far are incloded in the accotanting stationcry in yout working papers. The trandations for December 16 through December 31 are shown on the following pagen. Your Job Responsibilities: The forms foe completing this activity are included in the woeking papers As the accountant for Go Fly a Kate, you are to complete these tasks: (1) Record the romaining December transacticns in the sales, cash roceipts, purchases, cash payments, and general jowarnals (2) Fost the individual amounts from the five journals to the accoumts feceivable and accounts paryable ualidiary ledgen daily. (3) Post the individual amounts from the Gieneral columns of the cash feceipts, purchaves, cash payments, and gencral journal daily. (4) Foot, prove, total, and rale the special jorarnals at the end of the moctith. (5) Post the column totals of the special joumals to the gencral ledget. Wie this order for posting sales, carh rcceipts, peanchases, and cash payments. (6) Prove cash. The balance shown on check stub 619 is 522,752.83. (7) Prepare a schedule of accounts receivable and a schedule of accounts payable. (8) Prcpare a trial balance on a ten-column work ahect for the year cmaled December 31. (9) Complete the work sheet. Use this December 31 adjustment information: (10) Prepare the income statement from the work sheet information. (11) Prepare a statement of retaincd eamings. (12) Prepare a balance sheet. (13) Joumalize and post the adjusting entries. (14) Journalize and post the closing entries. (15) Prepare a post-closing trial balance. Go Fly a Kite Inc. Mini Practice Set 5 (textbook p. 778) Instructions: Use the following source documents to record the transactions for this practice set. Gompa cite ine. ilineraman Pecmive 1720 AECENED FAO Beit Ton recelved er Misturi Zamipurt Mini Practice Set 5 (continued) AECEITI Co ryy a kite tre 112 ke bien Nos. 900 Prarmter 21,29= Cao rry a krite bno. 1ithates one Mini Practice Set 5 (continued) Mini Practice Set 5 (continued) (1), (4) CASH RECEIPTS JOURNAL. PUACHASES JOUANAL. CASH PAYMENTS JOURINAL (1). (13), (14) Sold to The Toy Store $1,990.00 of merchandise on account, plus $119.40 sales tax, Sales Slip 486. Issued Check 617 to Reddi-Bright Manufacturing for $700.00 to apply on account. Sold merchandise totaling $560.00 plus $33.60 sales tax to the Serendipity Shop on account, Sales Slip 487. Recorded the bank service charge of $10.00 and the bankcard fee of $150.00, from December bank statement. Paid transportation charges of $51.60 for merchandise shipped from Easy Glide Co., Check 618. Recorded cash sales of $3,995.10 plus $239.71 in sales tax, Tape 41 . Recorded bankcard sales of $1,736.27 plus sales tax of $104.18, Tape 41 Deo 16. Received Involce +10 trom Reddi-Bright Manufacturing for patc merctandise parchased on accote tax installment of $1.050.00. Issued Check 611 for 52.548 .00 to Brad's Kites Ltd. in payment of (reck 610. Involee 112 tor 52,600.00 less discount of $52.00 Paid the monthly salaries by issuing Check 612 for 54,750,00. Purchased 580.00 of supplies from Taylor Office Suppliets on accoum, Receiveda check for $1.965.60 from Best Toys in payment of Sales Invoice 830 Slip 479 for $2,003.40 less a cash discount of $37.80. Receipt 358 . Sold merchandise on account to Best Toys, $2,600.00 plus $156,00 Prepared Receipt 359 for a $1,716.00 check received from Lars' sales tax, Sales Slip 484 Specialties in payment of Sales Slip 480 for $1,749.00 less a $33.00 Purchased merchandise on account from Brad's Kites Lid., Invoice. cash discount. 215,51,560.00. Wrote Check 613 to Creative Kites Inc. to apply on account, $375:00 Prepared Credit Memorandum 44 for $106.00 for the return of $100.00 in merchandise by Best Toys, plus sales tax of $6.00. Sold merchandise to Lars' Specialties on account, $1,580.00 plus sales tax of $94.80, Sales Slip 485 . 23 Received a check from Serendipity Shop to apply on account, Receipt 360 for $300.00. 23 Paid Easy Glide Co, for Invoice 326 for $1,890.00 less a $37.80 discount, Check 614 for $1,852.20. 26 Received from The Toy Store a check for $1,102.40 in payment of Salo Slip 483 for $1,123.60 less a cash discount of $21,20, Receipt 361 . 26 Returned defective merchandise purchased on account from Brad's Kites Ltd., \$150.00, Debit Memorandum 28. 26 Received Invoice 335 from Easy Glide Co, for merchandise purchased on account totaling $1,630.00. 28 Wrote Check 615 for $120.00 to the Daily Examiner for a monthly advertisement, 28 Small Town Toys sent a check for $450.00 to apply on account. Receipt 362. 29 Paid Stars Kites Outlet \$1,625.00 on account, Check 616. Completing the Accounting Cycle for a Merchandising Corporation Go Fly a Kite Inc. Go Fly a Kite Inc. Company Background: The Ramspart family owrs and operates a wholesaletetail merchardising business organired as a corporation. The business, called Cio Fy a kite Inc., sells a varicty of kites and paper airplanes to rogional and local toy store burinesses. Your teacher will ansign a due dafe for this ptoject. Wotking with Go Hy a Jite lne. will give you an opportunity to complete the accounting cycle within an assigned time frame. Keeping the Accounting Records for Co Fly a Kite Inc. Go Fy a Kite Inc. uses special joumals and a kenctal foumal to rocotd its business activity. Max Martin, Go Fly a Kite's pecvious accounting clerk, has already journalized and posted the trancactions foe December 1 thtough Decemaler 15. The tranactions reconded thus far are incloded in the accotanting stationcry in yout working papers. The trandations for December 16 through December 31 are shown on the following pagen. Your Job Responsibilities: The forms foe completing this activity are included in the woeking papers As the accountant for Go Fly a Kate, you are to complete these tasks: (1) Record the romaining December transacticns in the sales, cash roceipts, purchases, cash payments, and general jowarnals (2) Fost the individual amounts from the five journals to the accoumts feceivable and accounts paryable ualidiary ledgen daily. (3) Post the individual amounts from the Gieneral columns of the cash feceipts, purchaves, cash payments, and gencral journal daily. (4) Foot, prove, total, and rale the special jorarnals at the end of the moctith. (5) Post the column totals of the special joumals to the gencral ledget. Wie this order for posting sales, carh rcceipts, peanchases, and cash payments. (6) Prove cash. The balance shown on check stub 619 is 522,752.83. (7) Prepare a schedule of accounts receivable and a schedule of accounts payable. (8) Prcpare a trial balance on a ten-column work ahect for the year cmaled December 31. (9) Complete the work sheet. Use this December 31 adjustment information: (10) Prepare the income statement from the work sheet information. (11) Prepare a statement of retaincd eamings. (12) Prepare a balance sheet. (13) Joumalize and post the adjusting entries. (14) Journalize and post the closing entries. (15) Prepare a post-closing trial balance. Go Fly a Kite Inc. Mini Practice Set 5 (textbook p. 778) Instructions: Use the following source documents to record the transactions for this practice set. Gompa cite ine. ilineraman Pecmive 1720 AECENED FAO Beit Ton recelved er Misturi Zamipurt Mini Practice Set 5 (continued) AECEITI Co ryy a kite tre 112 ke bien Nos. 900 Prarmter 21,29= Cao rry a krite bno. 1ithates one Mini Practice Set 5 (continued) Mini Practice Set 5 (continued) (1), (4) CASH RECEIPTS JOURNAL. PUACHASES JOUANAL. CASH PAYMENTS JOURINAL (1). (13), (14)