Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with the following: On December 1, 2019, Monty Corp. had the following account balances. Cash Accounts Receivable Inventory Supplies Equipment Debit Credit $7,500

Need help with the following:

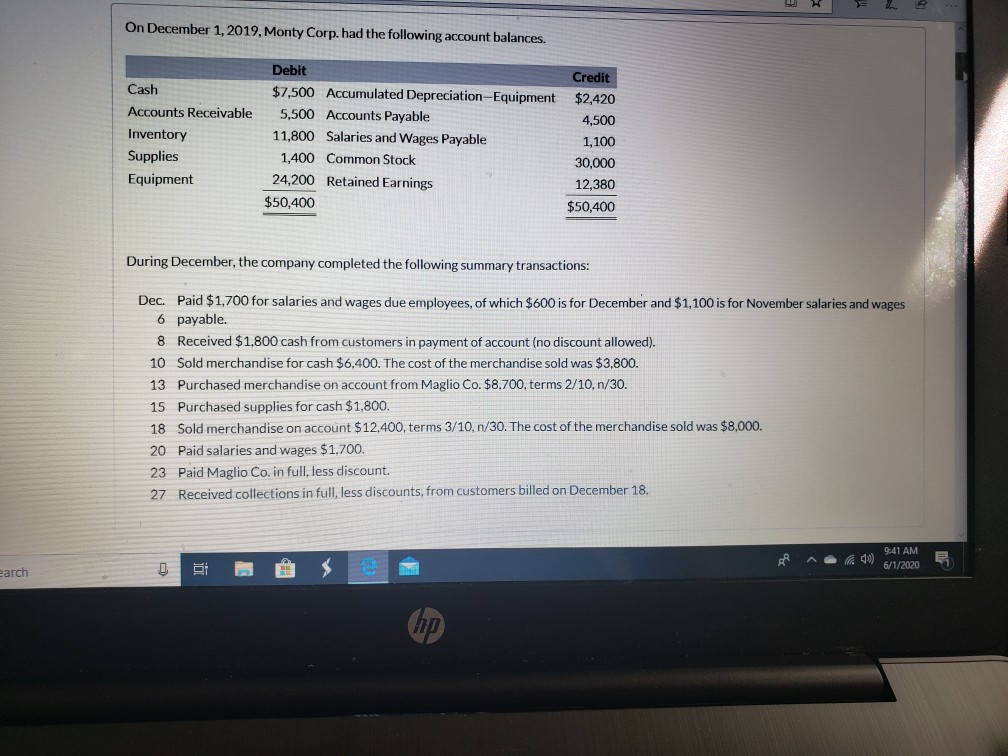

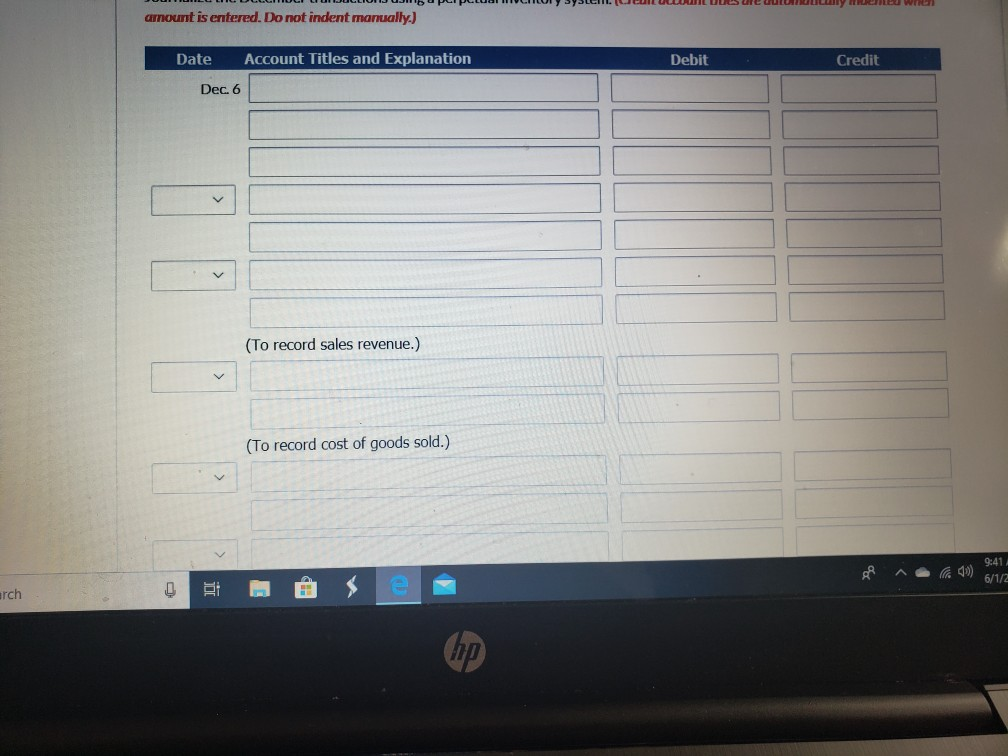

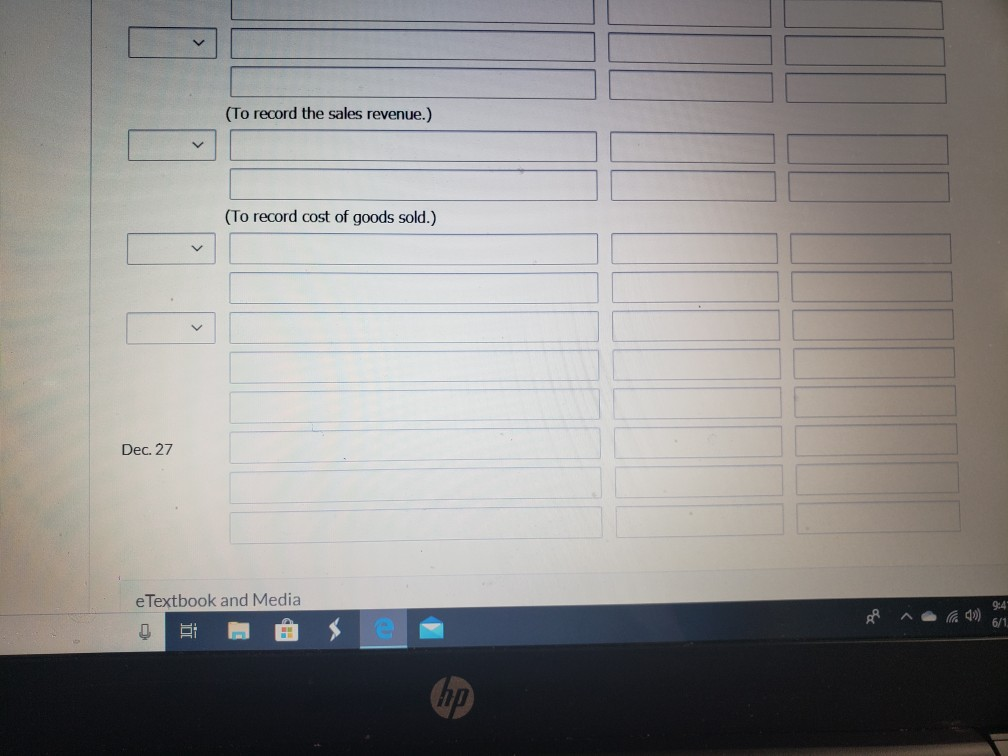

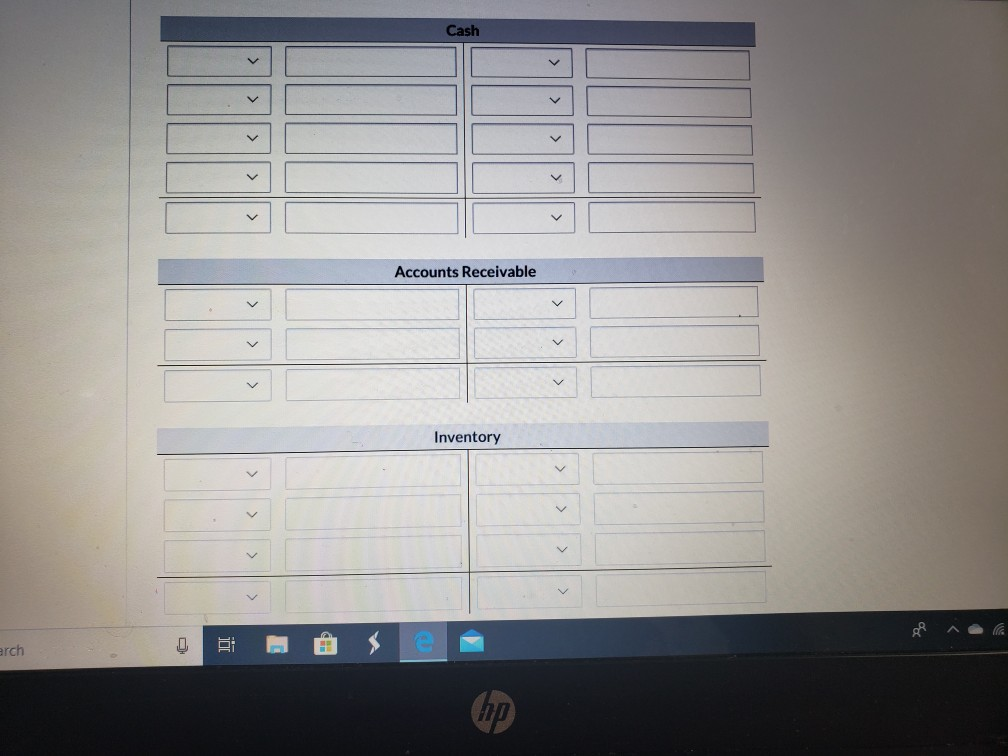

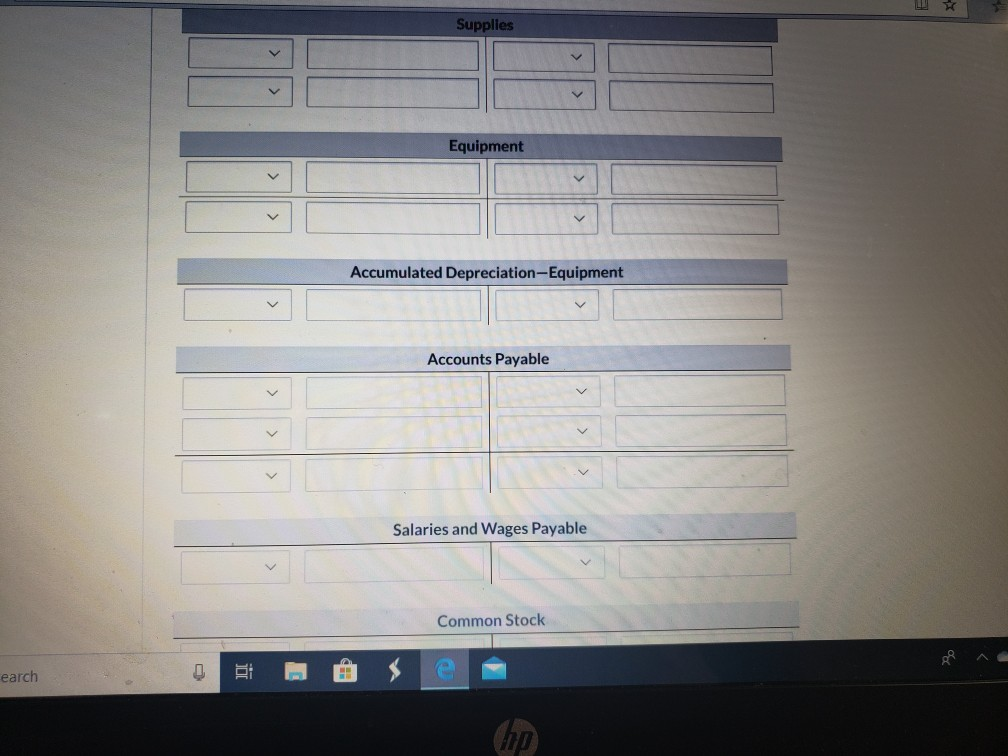

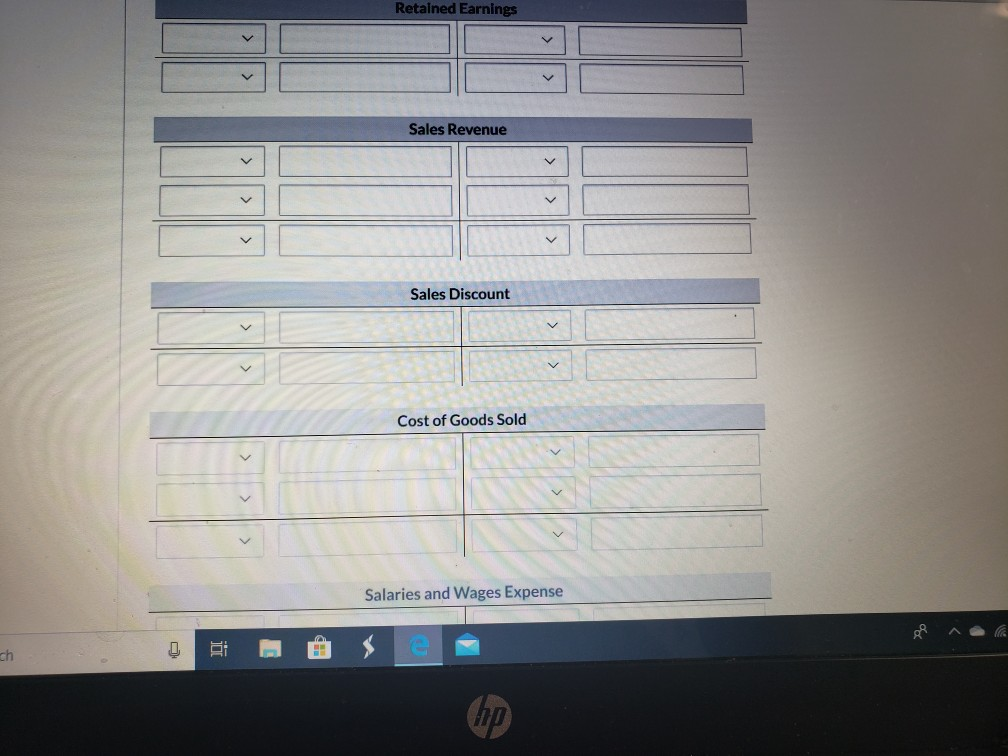

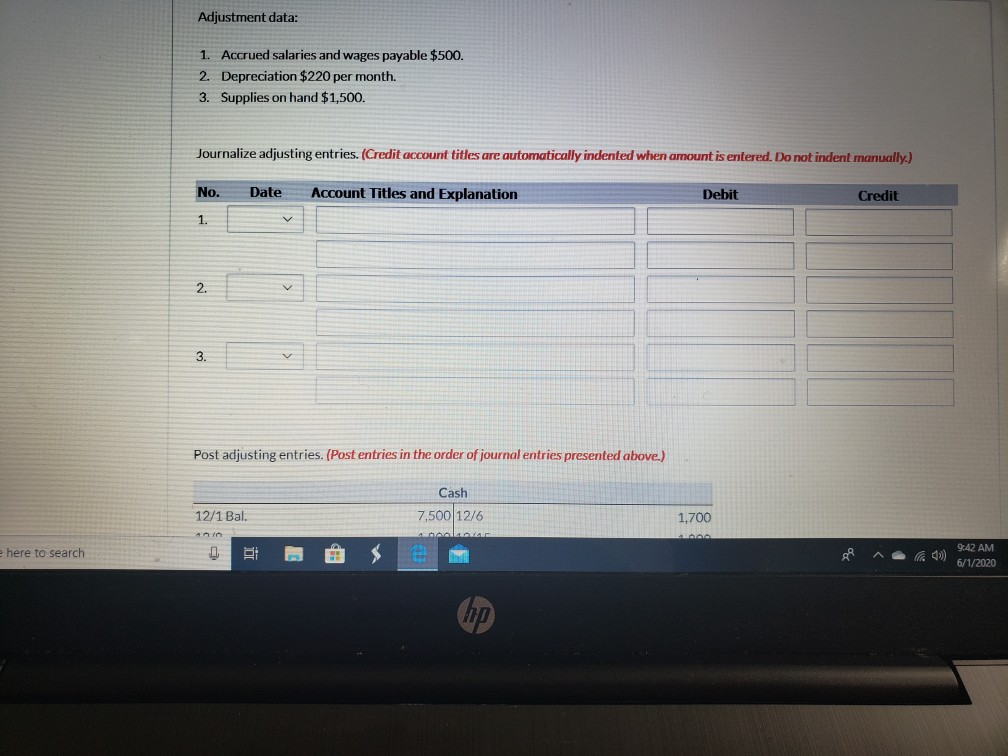

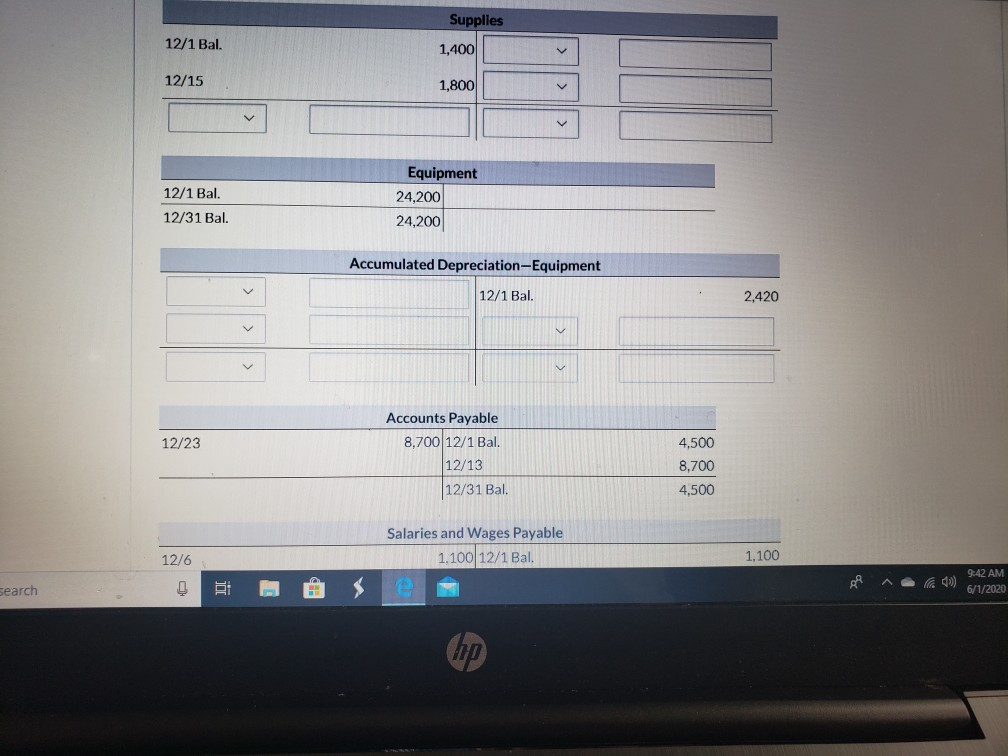

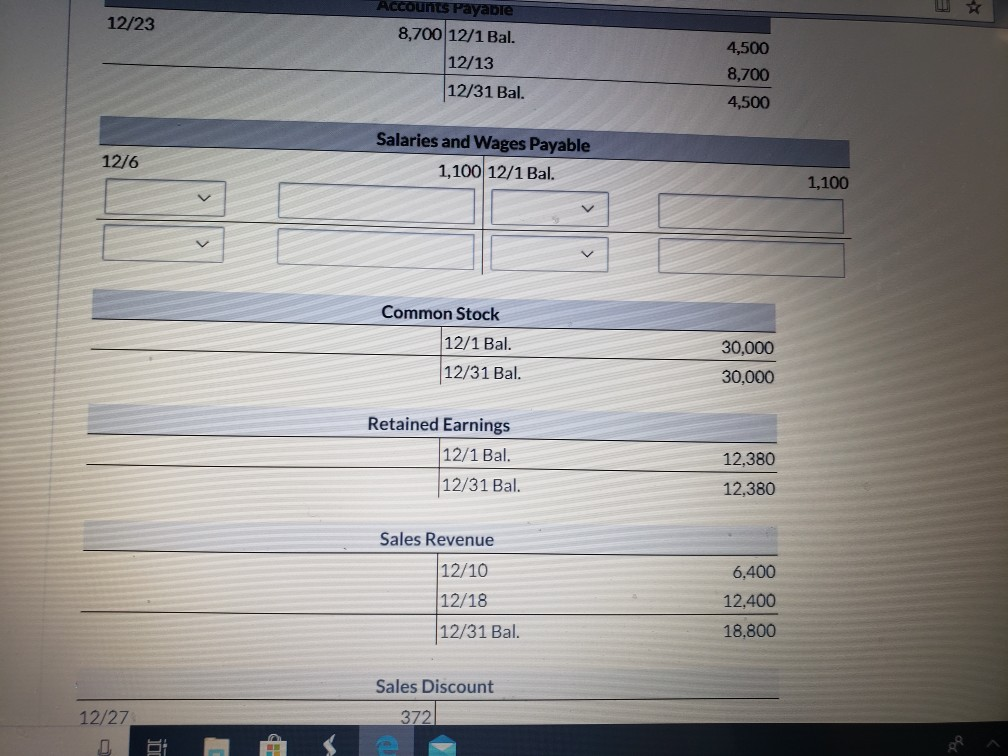

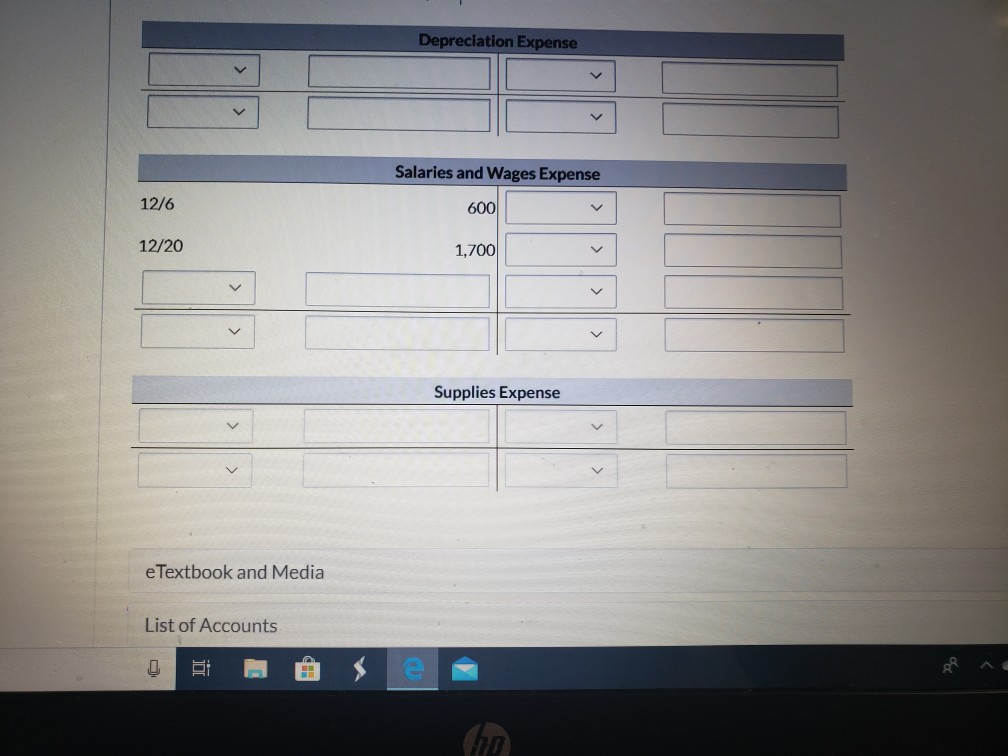

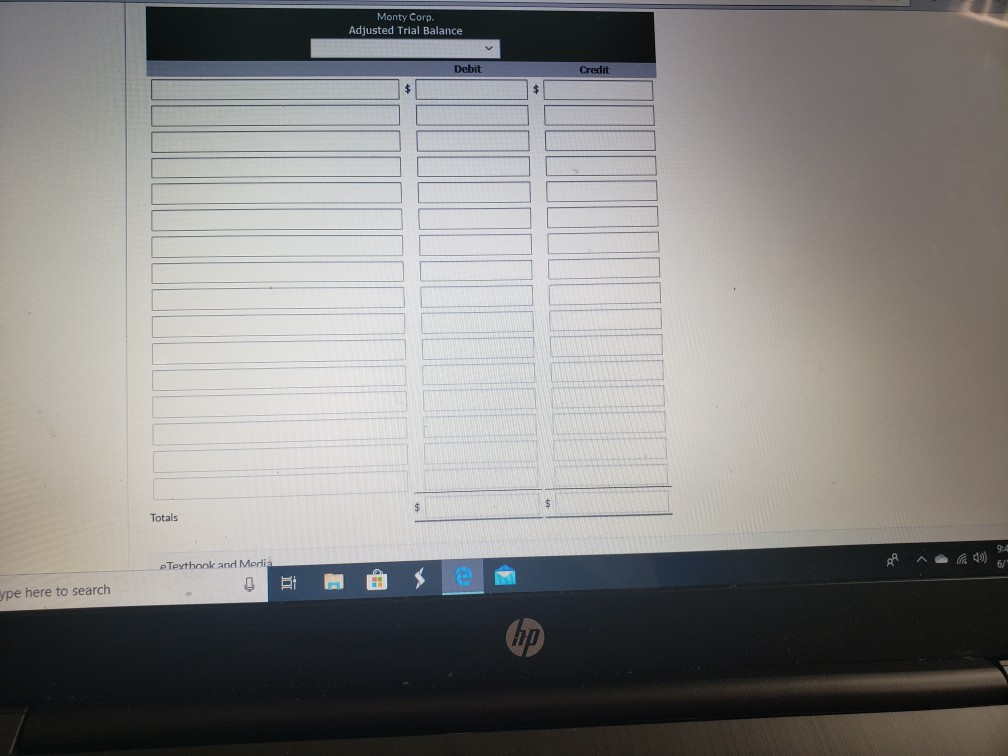

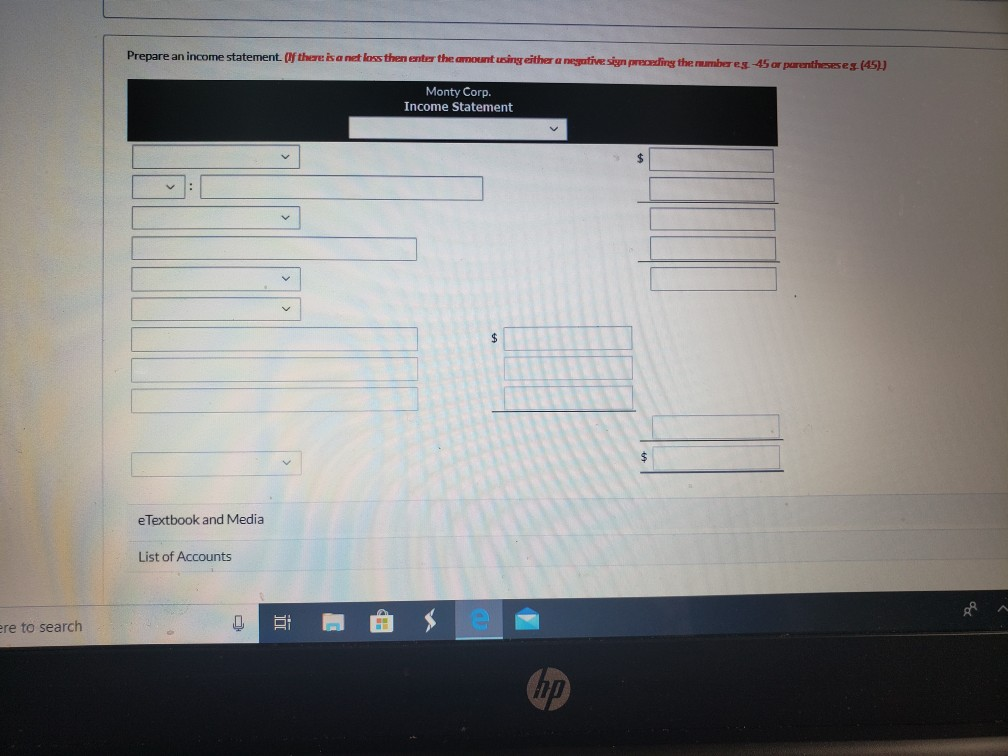

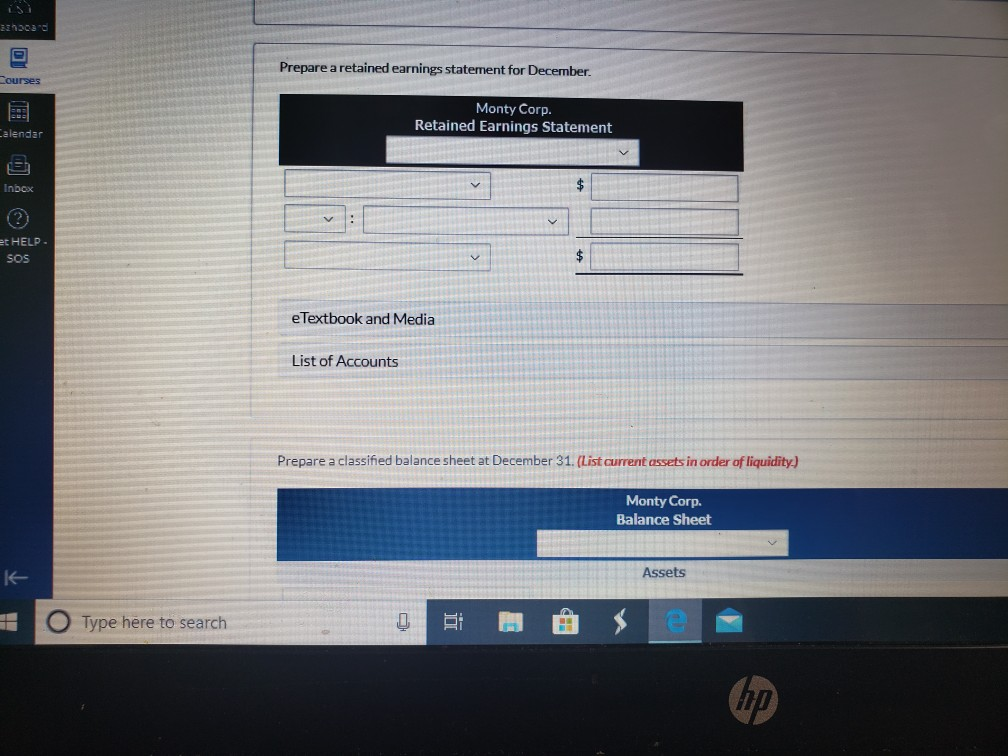

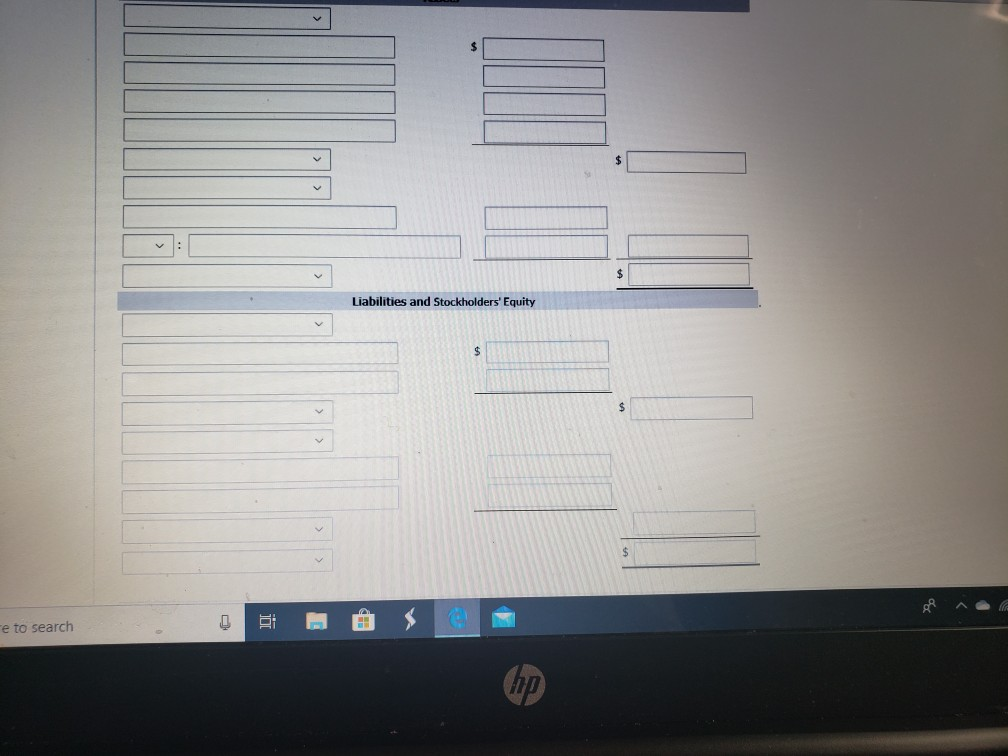

On December 1, 2019, Monty Corp. had the following account balances. Cash Accounts Receivable Inventory Supplies Equipment Debit Credit $7,500 Accumulated Depreciation-Equipment $2,420 5,500 Accounts Payable 4,500 11,800 Salaries and Wages Payable 1,100 1,400 Common Stock 30,000 24,200 Retained Earnings 12,380 $50,400 $50,400 During December, the company completed the following summary transactions: Dec. Paid $1,700 for salaries and wages due employees, of which $600 is for December and $1,100 is for November salaries and wages 6 payable. 8 Received $1,800 cash from customers in payment of account (no discount allowed). 10 Sold merchandise for cash $6,400. The cost of the merchandise sold was $3,800. 13 Purchased merchandise on account from Maglio Co. $8,700, terms 2/10,n/30. 15 Purchased supplies for cash $1,800. 18 Sold merchandise on account $12,400, terms 3/10,n/30. The cost of the merchandise sold was $8,000. 20 Paid salaries and wages $1,700. 23 Paid Maglio Co. in full. less discount. 27 Received collections in full, less discounts, from customers billed on December 18. 9:41 AM 6/1/2020 earch new amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 6 (To record sales revenue.) (To record cost of goods sold.) 9:41 6/1/2 arch E 0 hp (To record the sales revenue.) (To record cost of goods sold.) Dec. 27 e Textbook and Media A 9:4 6/1 HD Cash v Accounts Receivable Inventory arch . Ei ID Supplies v Equipment Accumulated Depreciation-Equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started