Need help with the items marked in red...

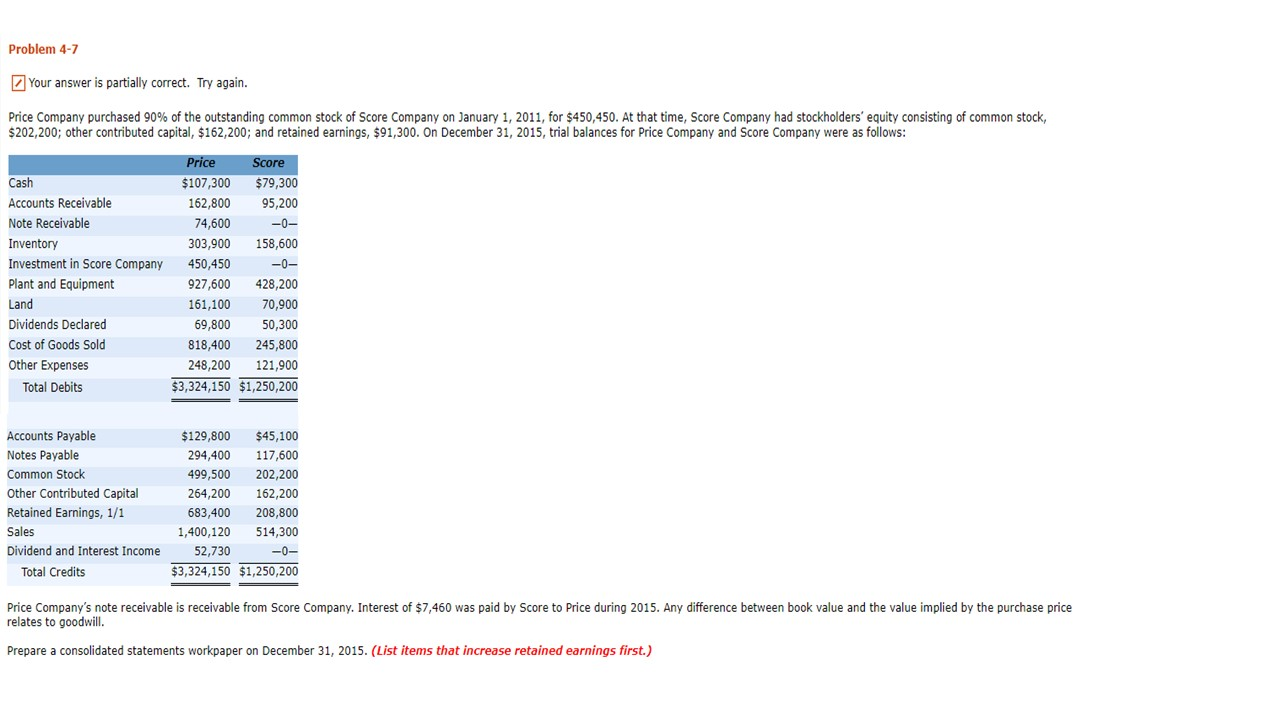

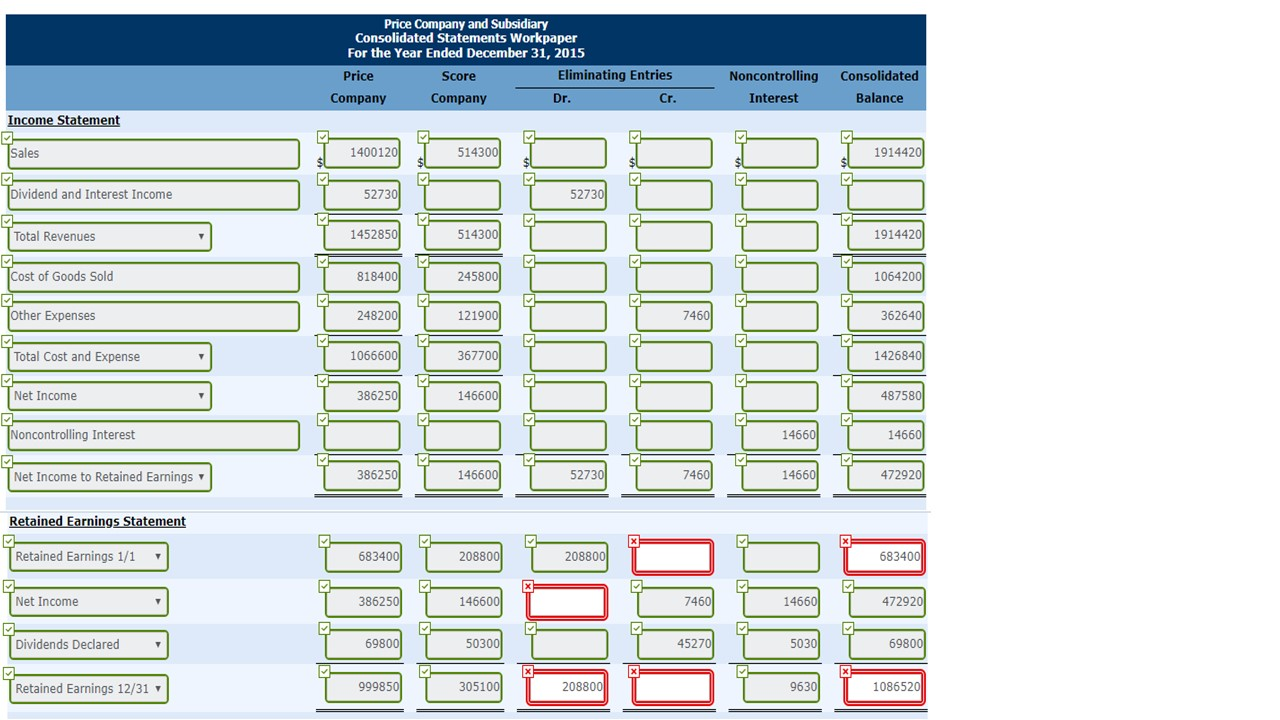

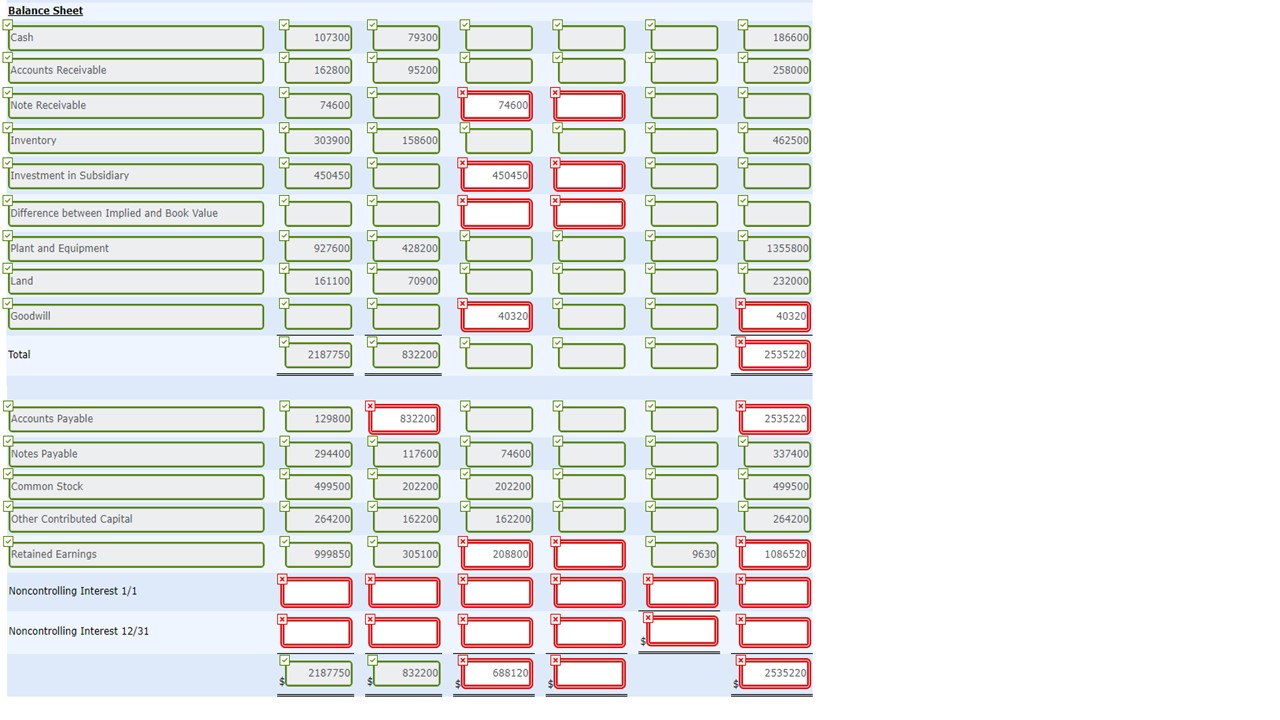

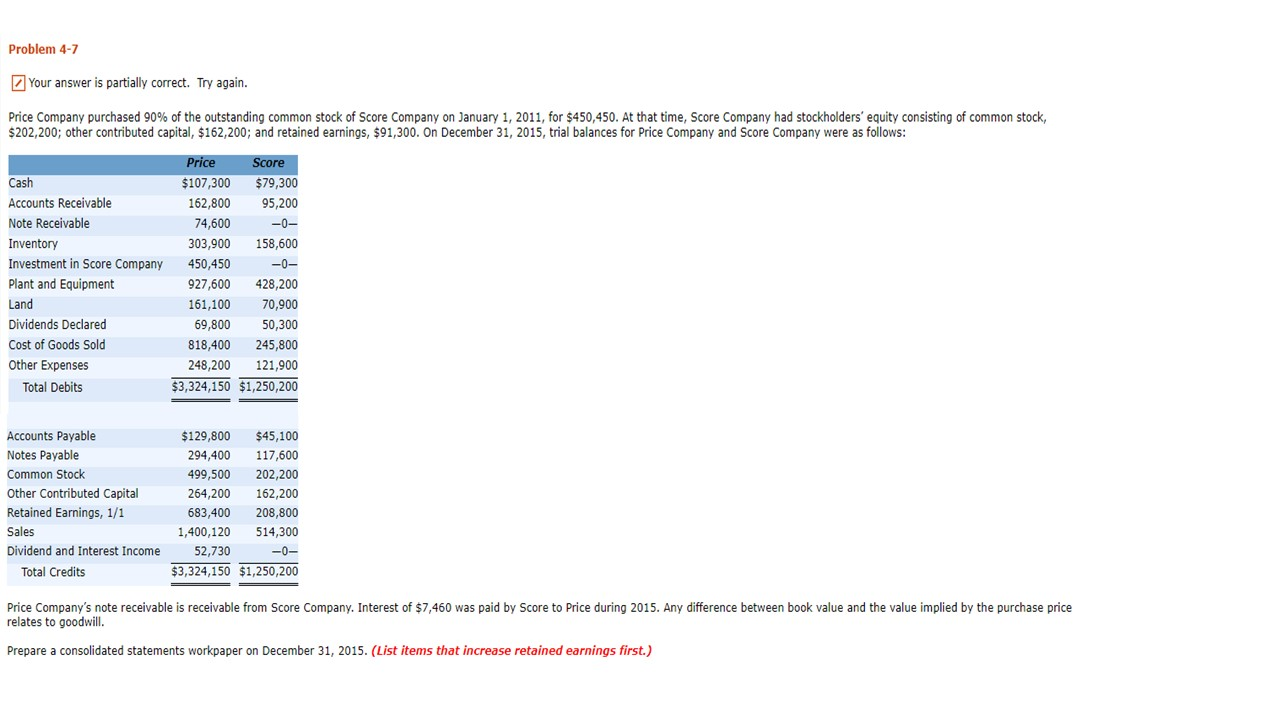

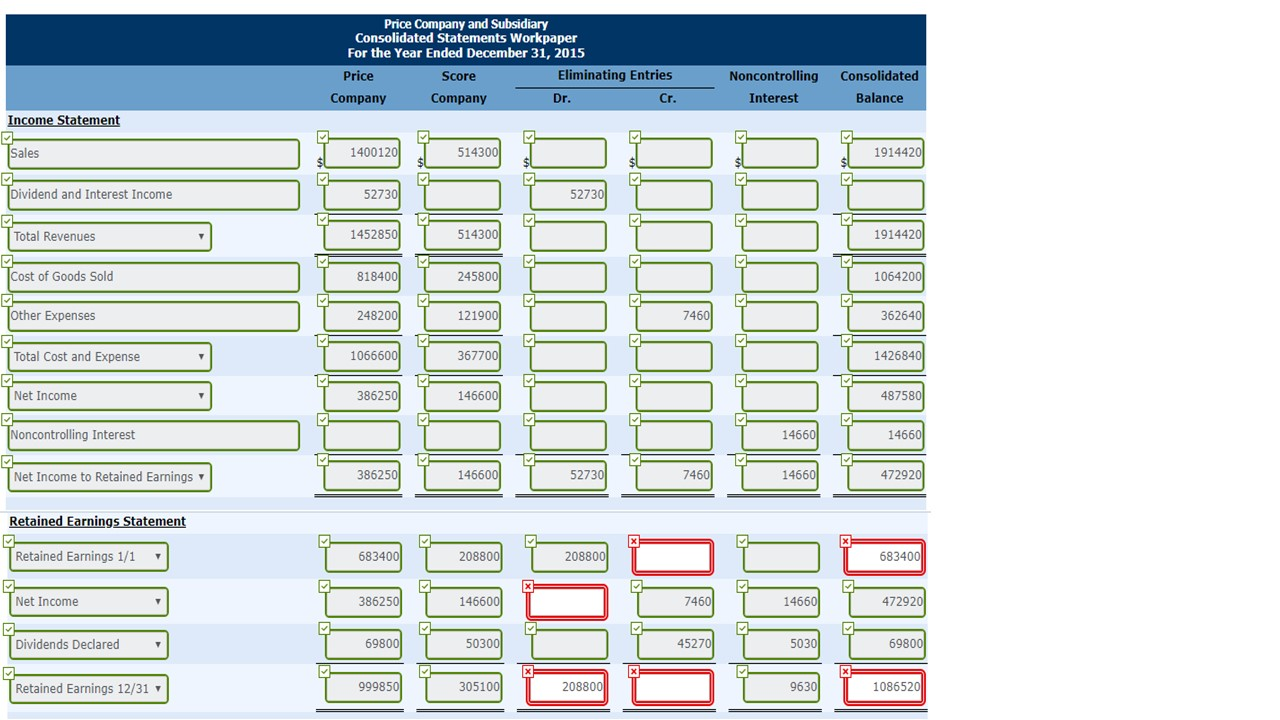

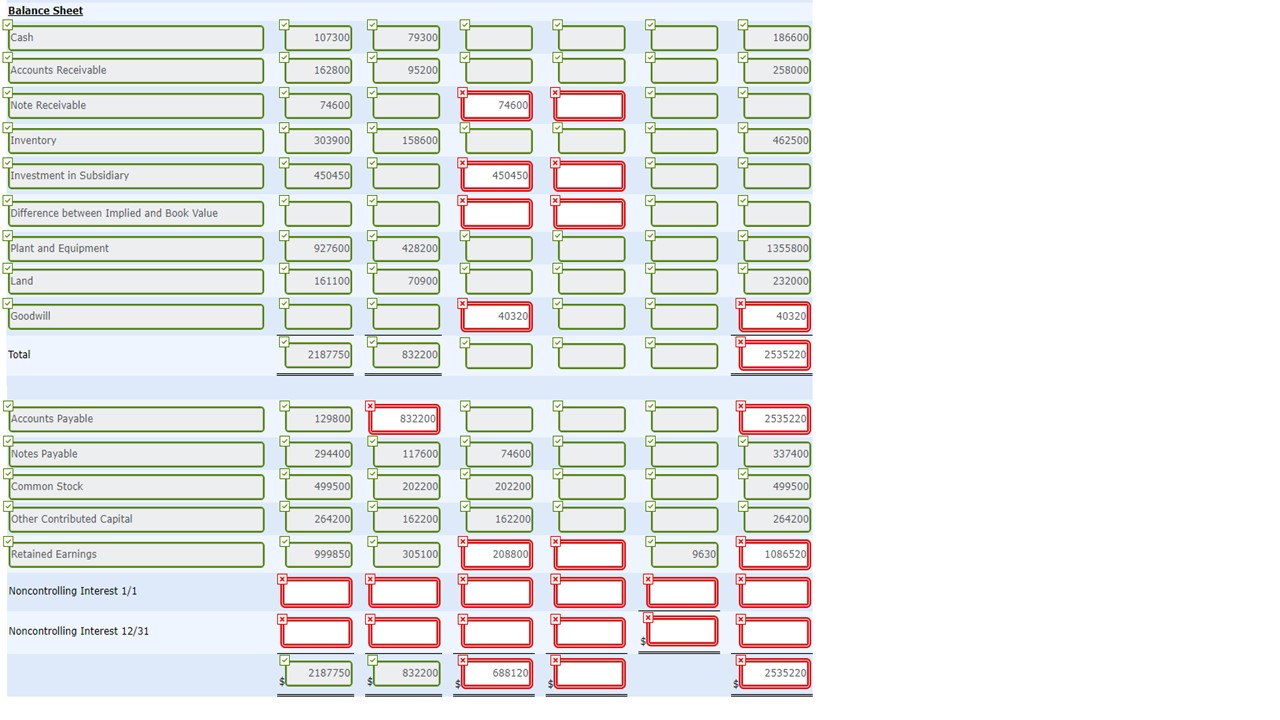

Problem 4-7 Your answer is partially correct. Try again. Price Company purchased 90% of the outstanding common stock of Score Company on January 1, 2011, for $450,450. At that time, Score Company had stockholders' equity consisting of common stock, $202,200; other contributed capital, $162,200; and retained earnings, $91,300. On December 31, 2015, trial balances for Price Company and Score Company were as follows: Cash Accounts Receivable Note Receivable Inventory Investment in Score Company Plant and Equipment Land Dividends Declared Cost of Goods Sold Other Expenses Total Debits Price Score $107,300 $79,300 162,800 95,200 74,600 -- 303,900 158,600 450,450 -0- 927,600 428,200 161,100 70,900 69,800 50,300 818,400 245,800 248,200 121,900 $3,324,150 $1,250,200 Accounts Payable Notes Payable Common Stock Other Contributed Capital Retained Earnings, 1/1 Sales Dividend and Interest Income Total Credits $129,800 $45,100 294,400 117,600 499,500 202,200 264,200 162,200 683,400 208,800 1,400,120 514,300 52,730 -0- $3,324,150 $1,250,200 Price Company's note receivable is receivable from Score Company. Interest of $7,460 was paid by Score to Price during 2015. Any difference between book value and the value implied by the purchase price relates to goodwill. Prepare a consolidated statements workpaper on December 31, 2015. (List items that increase retained earnings first.) Price Company and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2015 Price Score Eliminating Entries Company Company Dr. Cr. Noncontrolling Interest Consolidated Balance Income Statement sales 1400120 514300 1914420 Dividend and Interest Income 52730 52730 Total Revenues 1452850 514300 1914420 Cost of Goods Sold 818400 245800 1064200 Tother Expenses 248200 121900 7460 362640 - Total Cost and Expense 1066600 367700 1426840 Net Income 386250 146600 1 487580 DERDELEO) DRUE HOELECHLE OHIO a Noncontrolling Interest 14660 14660 TV Net Income to Retained Earnings 386250 146600 7460 14660 472920 Retained Earnings Statement Retained Earnings 1/1 683400 208800 L 208800 683400 Net Income 386250 146600 7460 14660 472920 Dividends Declared 69800 50300 45270T 5030 69800 Retained Earnings 12/31 999850 305100 208800 9630 1086520 Balance Sheet Cash 79300 186600 Accounts Receivable 162800 95200 258000 Note Receivable 74600 Inventory 303900 158600 462500 Investment in Subsidiary Difference between Implied and Book Value 927600 428200 1355800 Plant and Equipment Land TGoodwill 161100 70900 232000 X 40320 Total GOOHHHHd PUHHINNHAT 2187750 832200 00000UUU TO00000000 2535220 Accounts Payable 129800 T 832200 2535220 TNotes Payable 294400 117600 74600 T 337400 Common Stock T 499500 T 202200 202200 T 499500 Tother Contributed Capital 264200 1622001 162200 T 264200 Retained Earnings 999850 T 305100 1086520 Noncontrolling Interest 1/1 Noncontrolling Interest 12/31 18775 832200 2535220