Question

Need help with the journal the employer's payroll tax expense for January 31. Journalize the employer's payroll tax expense for February 28. Journalize the employer's

Need help with the journal the employer's payroll tax expense for January 31.

Need help with the journal the employer's payroll tax expense for January 31.

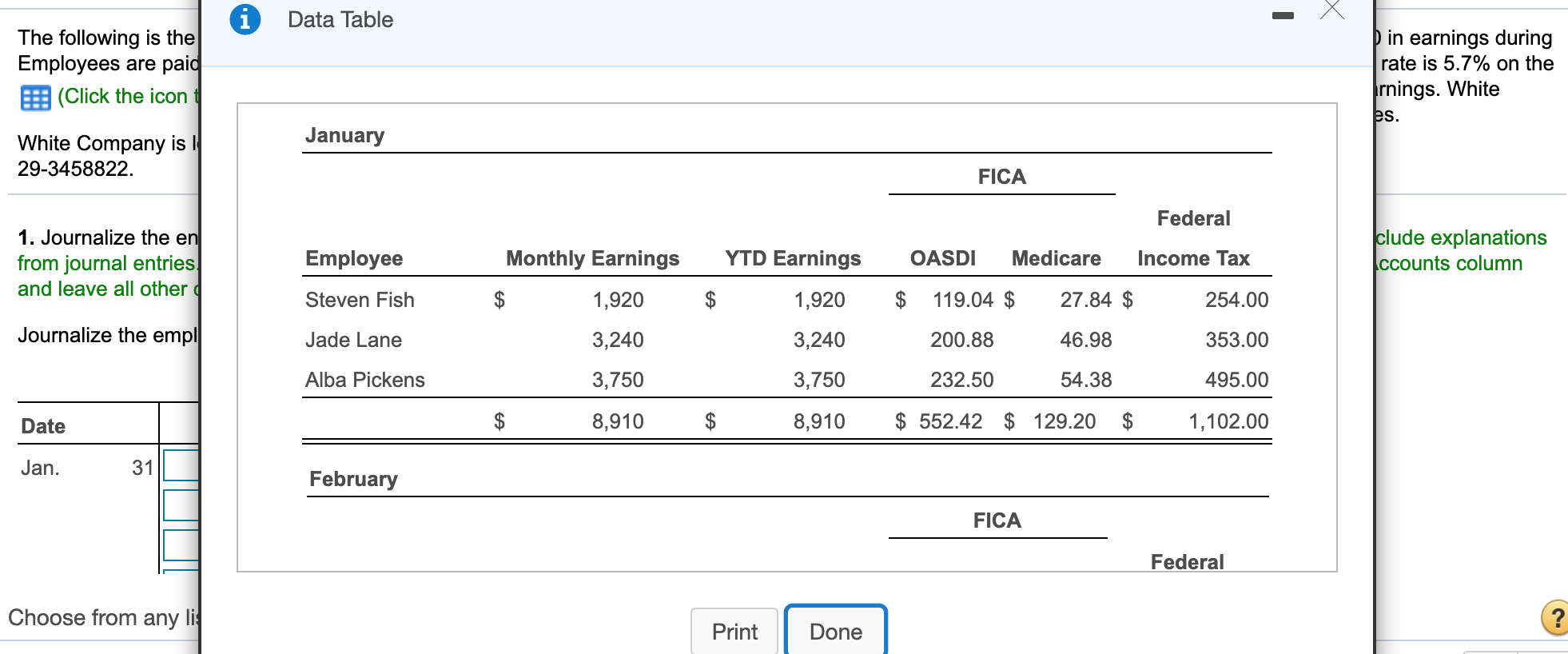

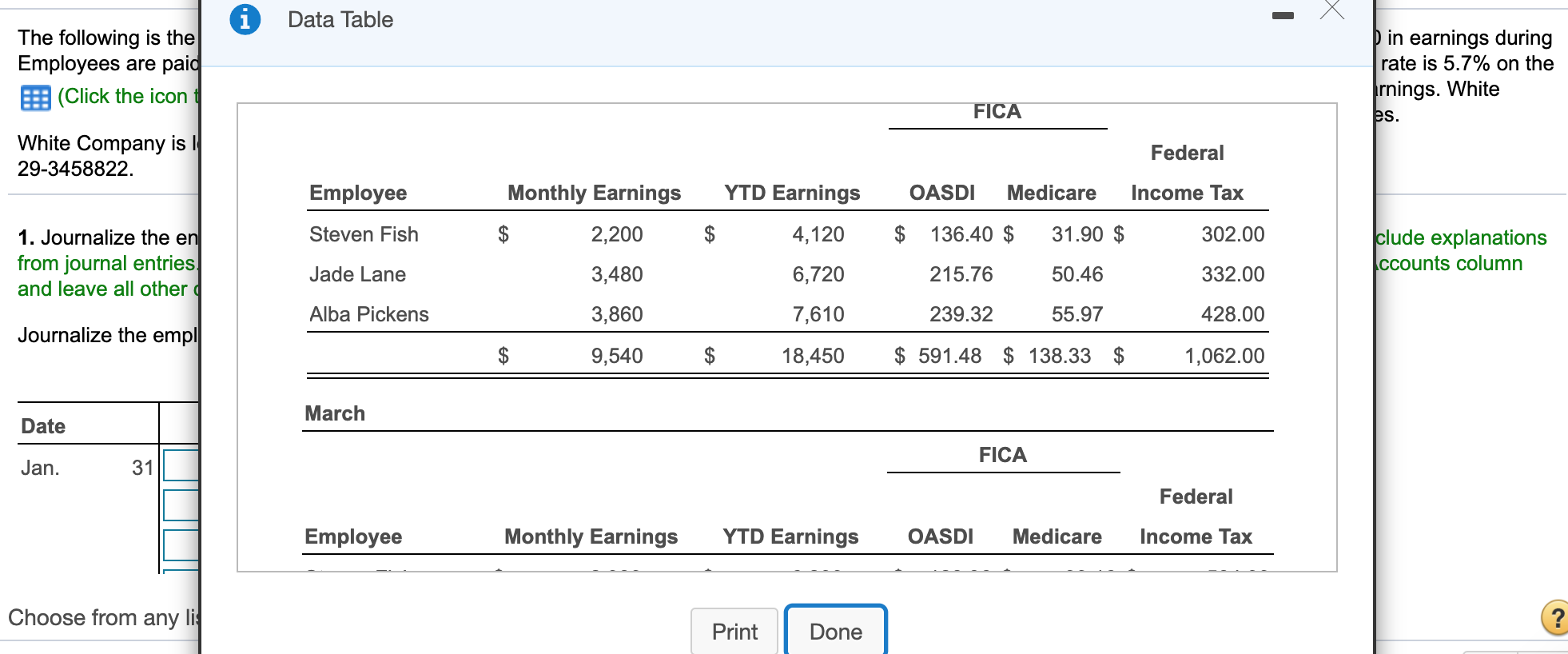

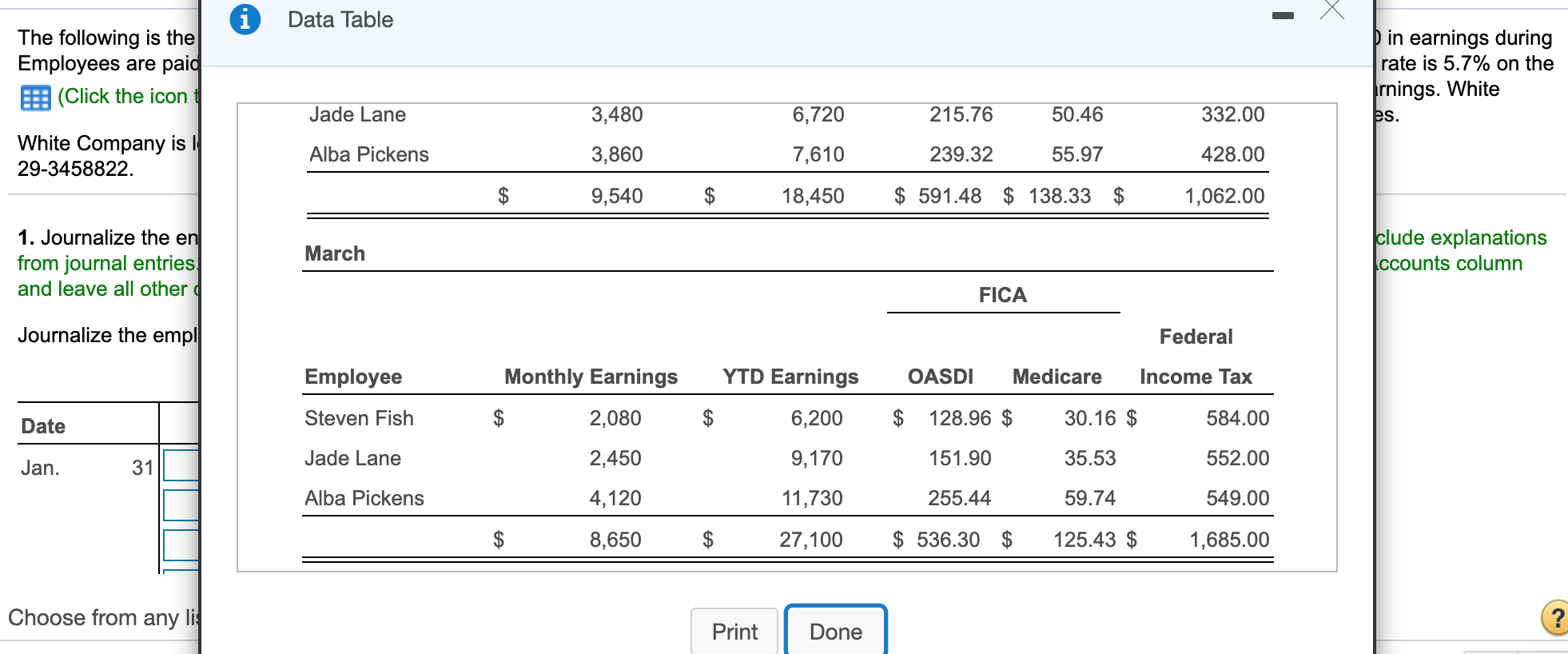

Journalize the employer's payroll tax expense for February 28.

Journalize the employer's payroll tax expense for March 31.

Journalize the payment of the January tax liability (excluding FUTA and SUTA payments) in the general journal.

Journalize the payment of the February tax liability (excluding FUTA and SUTA payments) in the general journal.

Journalize the payment of the March tax liability (excluding FUTA and SUTA payments) in the general journal.

Journalize the payment of the first quarter state unemployment tax liability.

Journalize the payment of the first quarter federal unemployment tax liability that may be required.

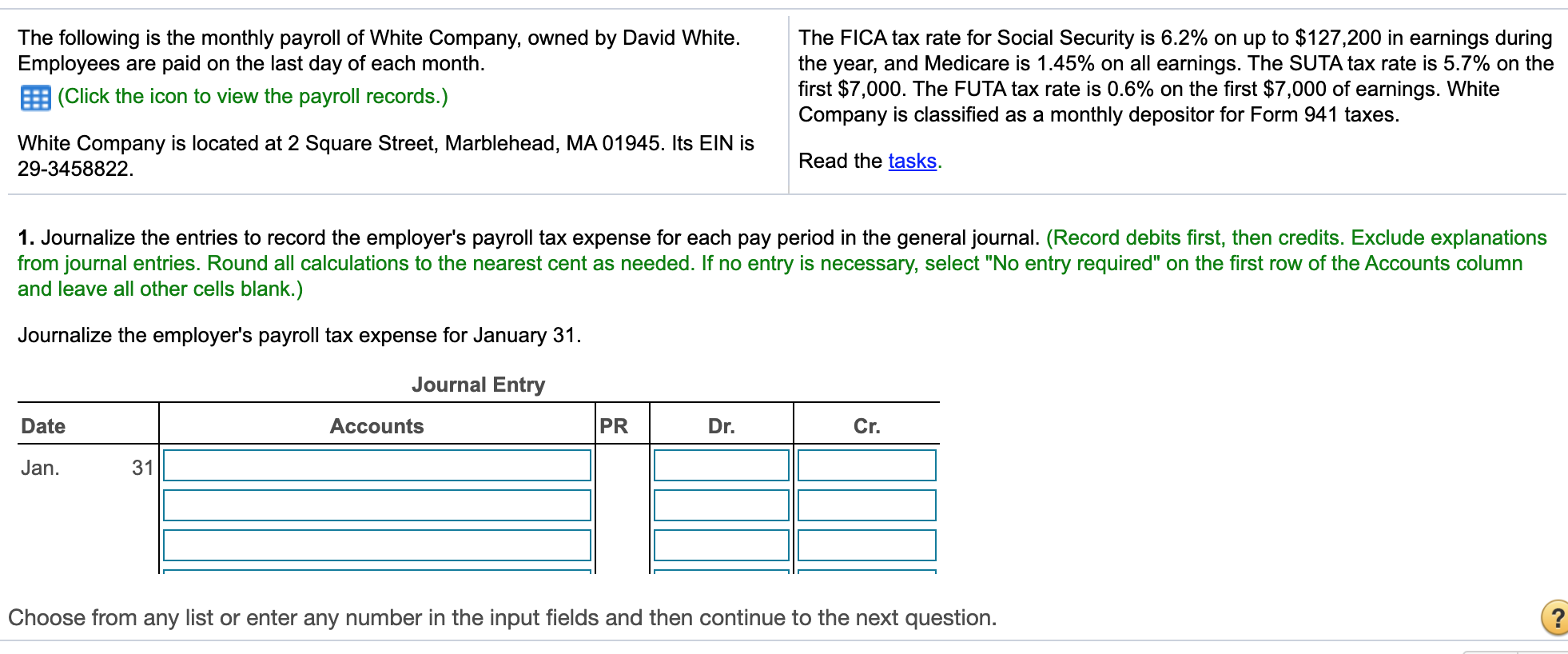

The following is the monthly payroll of White Company, owned by David White. Employees are paid on the last day of each month. (Click the icon to view the payroll records.) The FICA tax rate for Social Security is 6.2% on up to $127,200 in earnings during the year, and Medicare is 1.45% on all earnings. The SUTA tax rate is 5.7% on the first $7,000. The FUTA tax rate is 0.6% on the first $7,000 of earnings. White Company is classified as a monthly depositor for Form 941 taxes. White Company is located at 2 Square Street, Marblehead, MA 01945. Its EIN is 29-3458822. Read the tasks. 1. Journalize the entries to record the employer's payroll tax expense for each pay period in the general journal. (Record debits first, then credits. Exclude explanations from journal entries. Round all calculations to the nearest cent as needed. If no entry is necessary, select "No entry required" on the first row of the Accounts column and leave all other cells blank.) Journalize the employer's payroll tax expense for January 31. Journal Entry Date Accounts PR Dr. Cr. Jan. 31 Choose from any list or enter any number in the input fields and then continue to the next question. ? Data Table The following is the Employees are paid (Click the icon in earnings during rate is 5.7% on the Irnings. White es. January White Company is | 29-3458822. FICA Federal 1. Journalize the en from journal entries and leave all other Employee Monthly Earnings YTD Earnings OASDI Medicare Income Tax clude explanations ccounts column Steven Fish $ 1,920 $ 1,920 $ 119.04 $ 27.84 $ 254.00 Journalize the empl| Jade Lane 3,240 3,240 200.88 46.98 353.00 Alba Pickens 3,750 3,750 232.50 54.38 495.00 FA Date 8,910 8,910 $ 552.42 $ 129.20 $ 1,102.00 Jan. 31 February FICA Federal Choose from any li ? Print Done Data Table The following is the Employees are paid (Click the icon in earnings during rate is 5.7% on the Irnings. White es. FICA White Company is | 29-3458822. Federal Monthly Earnings YTD Earnings OASDI Medicare Income Tax Employee Steven Fish $ 2,200 4,120 $ 136.40 $ 31.90 $ 302.00 1. Journalize the en from journal entries and leave all other clude explanations ccounts column Jade Lane 3,480 6,720 215.76 50.46 332.00 Alba Pickens 3,860 7,610 239.32 55.97 428.00 Journalize the empl|| $ 9,540 $ 18,450 $ 591.48 $ 138.33 $ 1,062.00 March Date FICA Jan. 31 Federal Employee Monthly Earnings YTD Earnings OASDI Medicare Income Tax Choose from any li ? Print Done Data Table The following is the Employees are paid (Click the icon in earnings during rate is 5.7% on the Irnings. White es. Jade Lane 3,480 6,720 215.76 50.46 332.00 White Company is | 29-3458822. Alba Pickens 3,860 7,610 239.32 55.97 428.00 9,540 18,450 $ 591.48 $ 138.33 $ 1,062.00 March 1. Journalize the en from journal entries and leave all other clude explanations ccounts column FICA Journalize the empl|| Federal Employee Monthly Earnings YTD Earnings OASDI Medicare Income Tax Date Steven Fish 2,080 $ 6,200 $ 128.96 $ 30.16 $ 584.00 Jade Lane 31 2,450 Jan. 9,170 151.90 35.53 552.00 Alba Pickens 4,120 11,730 255.44 59.74 549.00 $ 8,650 $ 27,100 $ 536.30 $ 125.43 $ 1,685.00 Choose from any li ? Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started