Answered step by step

Verified Expert Solution

Question

1 Approved Answer

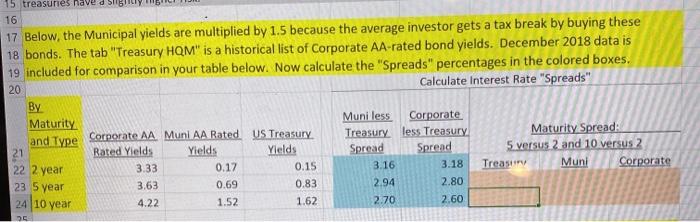

need help with the maturity spread 15 treasures naved 16 17 Below, the Municipal yields are multiplied by 1.5 because the average investor gets a

need help with the maturity spread

15 treasures naved 16 17 Below, the Municipal yields are multiplied by 1.5 because the average investor gets a tax break by buying these 18 bonds. The tab "Treasury HQM" is a historical list of Corporate AA-rated bond yields. December 2018 data is 19 included for comparison in your table below. Now calculate the "Spreads" percentages in the colored boxes. 20 Calculate Interest Rate "Spreads" By Maturity Muni less Corporate and Type Corporate AA Munl AA Rated US Treasury Treasury less Treasury Maturity Spread: 21 Rated Yields Yields Yields Spread Spread 5 versus 2 and 10 versus 2 22 2 year 3.33 0.15 3.16 3.18 Treasury Muni Corporate 23 5 year 3.63 0.69 0.83 2.94 2.80 24 10 year 4.22 1.52 1.62 2.70 2.60 0.17 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started