Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with the missing values. Jeff has 8000 and would like to purchase a 10,000 bond In doing so, Jeff takes out a 10

Need help with the missing values.

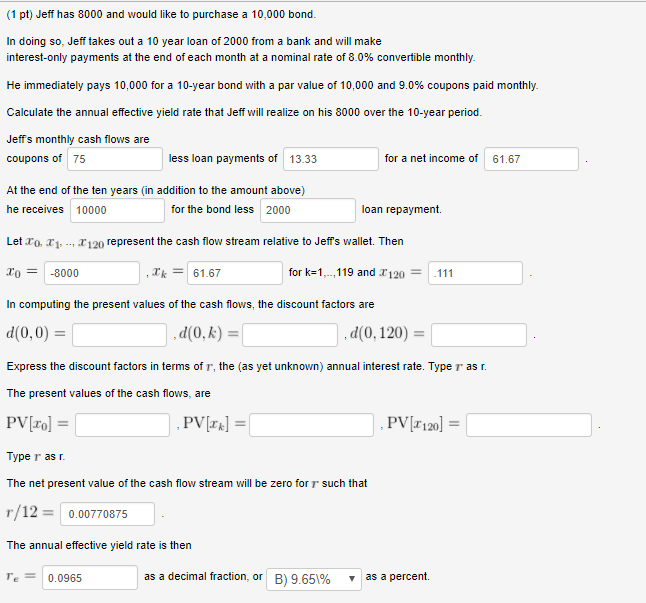

Jeff has 8000 and would like to purchase a 10,000 bond In doing so, Jeff takes out a 10 year loan of 2000 from a bank and will make interest-only payments at the end of each month at a nominal rate of 8.0% convertible monthly. He immediately pays 10,000 for a 10-year bond with a par value of 10,000 and 9.0% coupons paid monthly. Calculate the annual effective yield rate that Jeff will realize on his 8000 over the 10-year period. Jeff's monthly cash flows are coupons of 75 less loan payments of 13.33 fir a net income of 61.67 At the end of the ten years (in addition to the amount above) At the end of the ten years (in addition to the amount above))he receives 10000 for the bond less 2000 loan repayment. Let x_0, x_1, x_120 represent the cash flow stream relative to Jeff's wallet. Then x_0 = -8000 x_k = 61.67 for k = 1, .., 119 and x_120 = 111 In computing the present values of the cash flows, the discount factors are d(0, 0) = d(0, k) = d(0, 120) = Express the discount factors in terms of r, the (as yet unknown) annual interest rate. Type r as r. The present values of the cash flows, are PV[x_0] = PV[x_k] = PV[x_120] = Type r as r The net present value of the cash flow stream will be zero for r such that r/12 = 0.00770875 The annual effective yield rate is then r_epsilon = 0.0965 as a decimal fraction, or B) 9.65\% as a percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started