Need help with the partially correct problem!

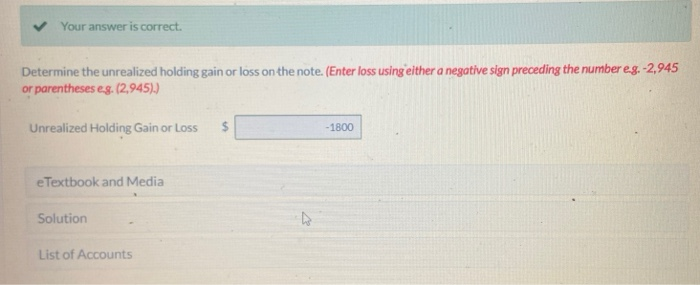

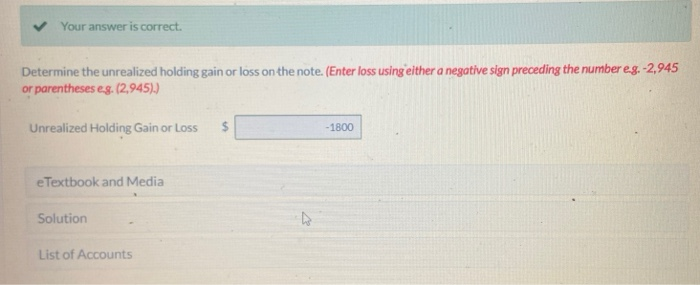

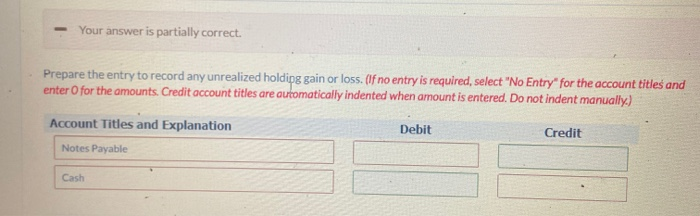

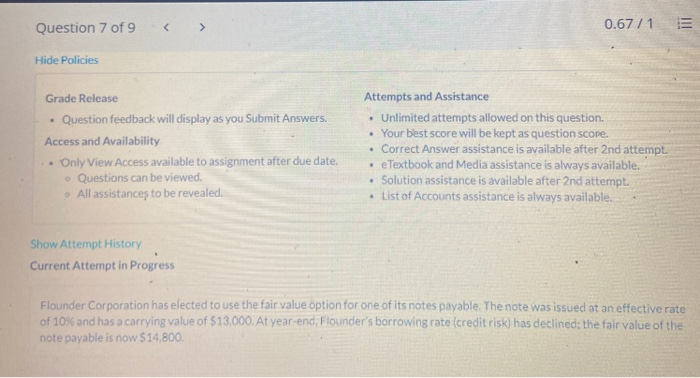

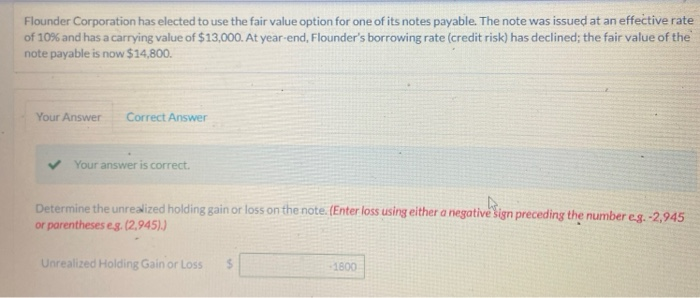

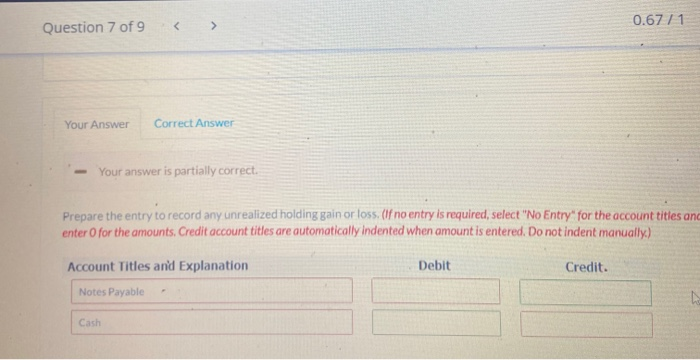

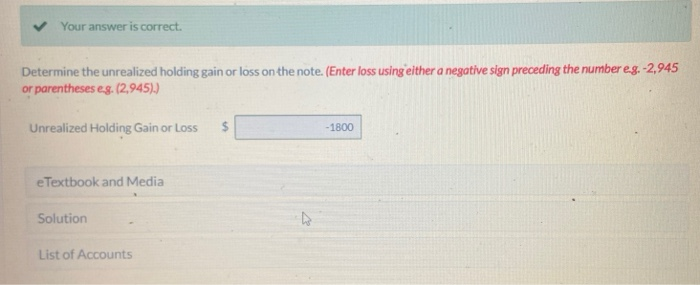

Your answer is correct. Determine the unrealized holding gain or loss on the note. (Enter loss using either a negative sign preceding the number e.g.-2,945 or parentheses eg. (2,945).) Unrealized Holding Gain or Loss $ - 1800 e Textbook and Media Solution List of Accounts Your answer is partially correct. Prepare the entry to record any unrealized holdipg gain or loss. (If no entry is required, select "No Entry" for the account titles and enter for the amounts Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Notes Payable Cash Question 7 of 9 0.67 / 1 III Hide Policies . Grade Release Question feedback will display as you Submit Answers Access and Availability Only View Access available to assignment after due date. Questions can be viewed. All assistances to be revealed. Attempts and Assistance Unlimited attempts allowed on this question. Your best score will be kept as question score. Correct Answer assistance is available after 2nd attempt. e Textbook and Media assistance is always available. Solution assistance is available after 2nd attempt. List of Accounts assistance is always available. . Show Attempt History Current Attempt in Progress Flounder Corporation has elected to use the fair value option for one of its notes payable. The note was issued at an effective rate of 10% and has a carrying value of $13,000. At year-end, Flounder's borrowing rate (credit risk) has declined; the fair value of the note payable is now $14,800. Flounder Corporation has elected to use the fair value option for one of its notes payable. The note was issued at an effective rate of 10% and has a carrying value of $13,000. At year-end, Flounder's borrowing rate (credit risk) has declined; the fair value of the note payable is now $14,800. Your Answer Correct Answer Your answer is correct. Determine the unrealized holding gain or loss on the note. (Enter loss using either a negative sign preceding the number eg.-2,945 or parentheses es. (2.945).) Unrealized Holding Gain or loss S 1800 0.67 / 1 Question 7 of 9 Your Answer Correct Answer - Your answer is partially correct. Prepare the entry to record any unrealized holding gain or loss. (If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit. Notes Payable Cash