need help with these 3 problems please.

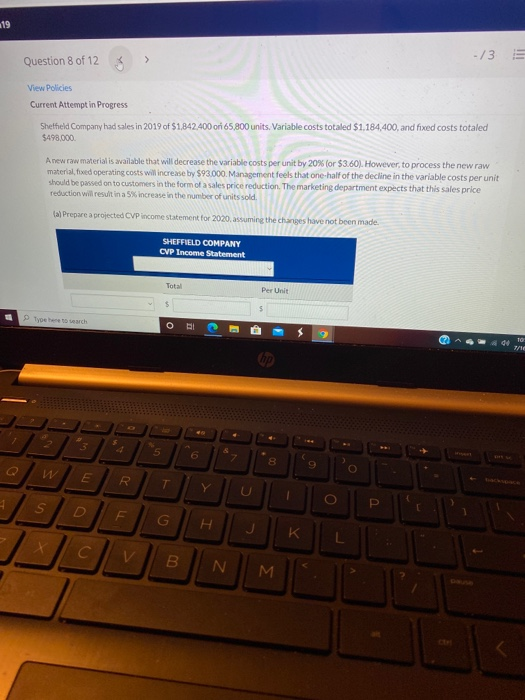

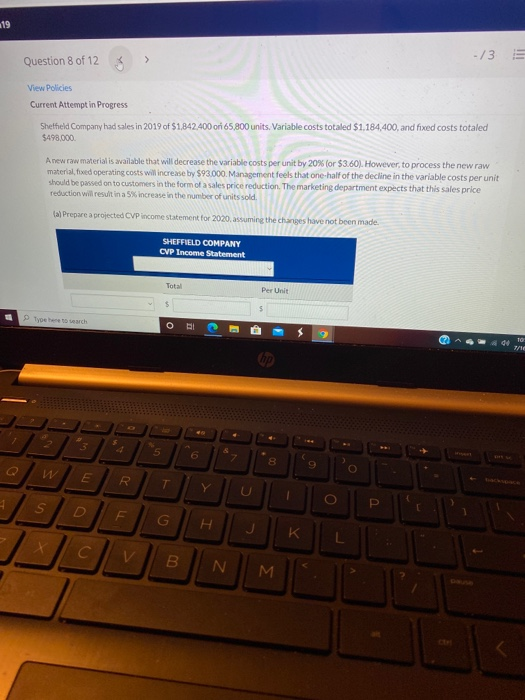

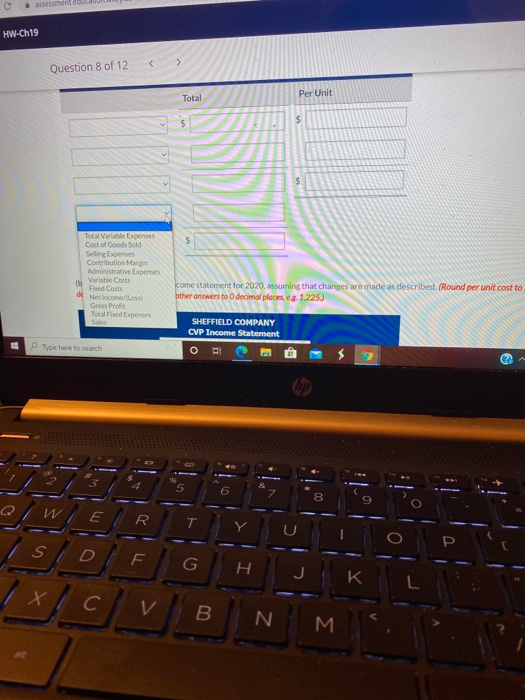

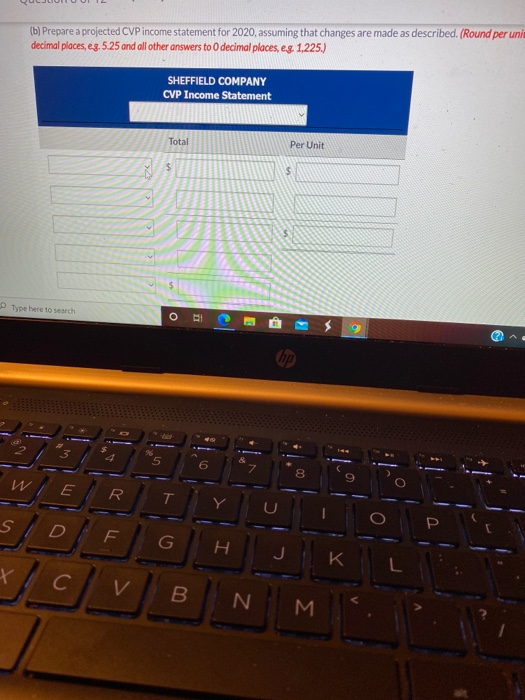

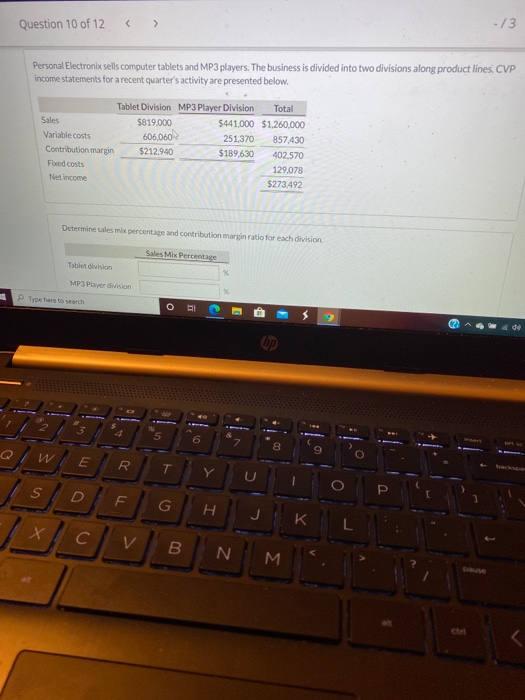

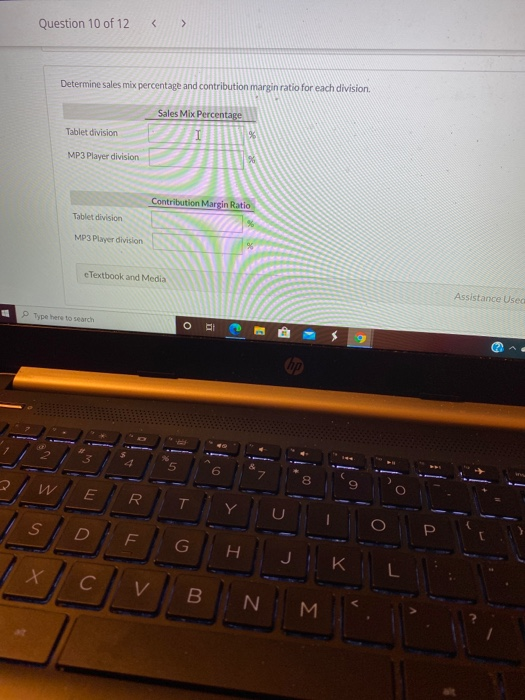

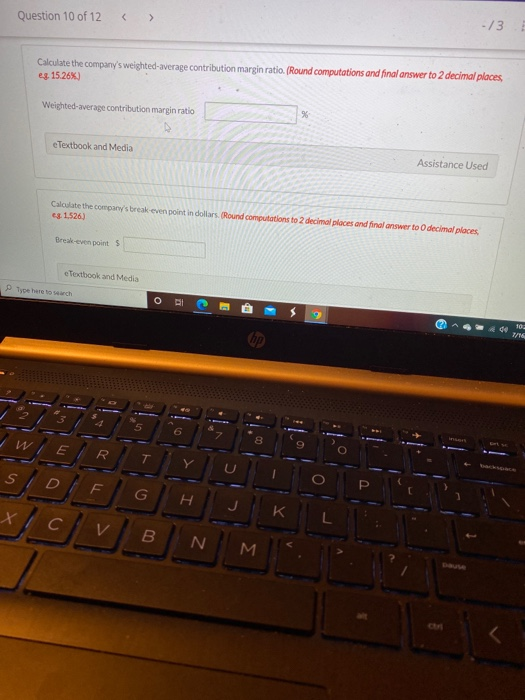

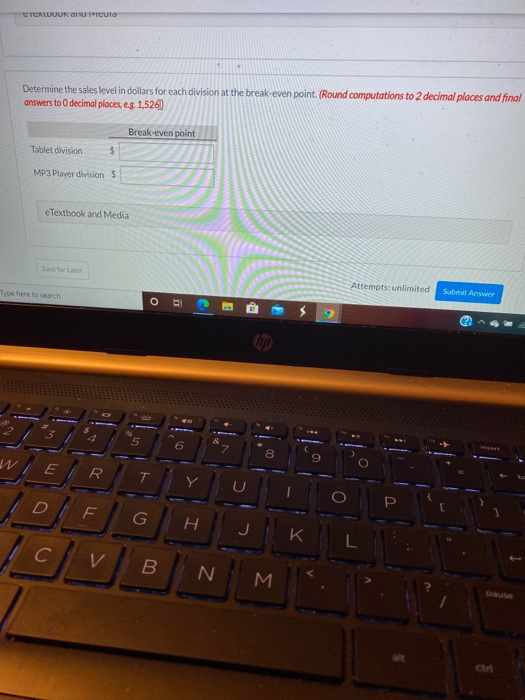

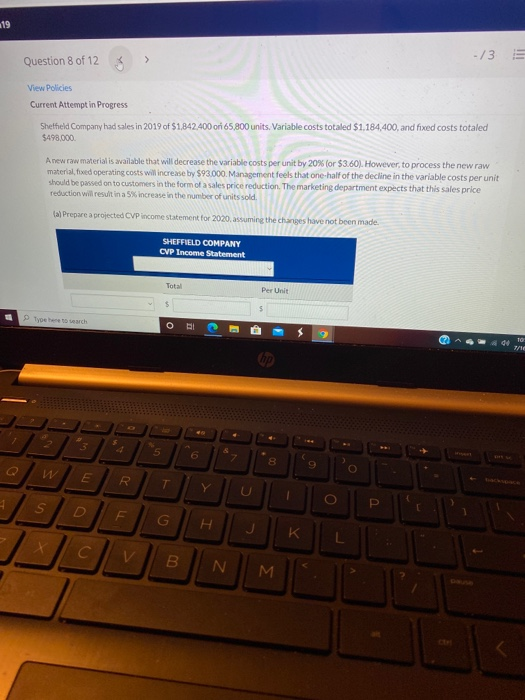

19 > -13 Question 8 of 12 View Policies Current Attempt in Progress Sheffield Company had sales in 2019 of $1,842.400 or 65,800 units. Variable costs totaled $1.184,400, and fixed costs totaled $498.000 A new raw material is available that will decrease the variable costs per unit by 20% (or $3.60). However, to process the new raw material, fixed operating costs will increase by $93.000. Management feels that one half of the decline in the variable costs per unit should be passed on to customers in the form of a sales price reduction. The marketing department expects that this sales price reduction will result in a 5% increase in the number of units sold La Prepare a projected CVP income statement for 2020, assuming the changes have not been made. SHEFFIELD COMPANY CVP Income Statement Total Per Unit you to O TO / 3 5 6 7 8 9 E R . U D G H K x V B N. M assessment HW-Ch19 Question 8 of 12 Total Per Unit $ $ Total Variable Expenses Cost of Goods Sold Selling Expenses Contribution Margin Administrative Expenses 16 Variable costs Fixed Costs de como Gross Prot Tots Fed Expenses kome statement for 2020, assuming that changes are made as described. (Round per unit cost to other answers to decimal places, eg. 1.225) Sale SHEFFIELD COMPANY CVP Income Statement Type here to search O 9 6 8 9 WE R T SD F H L /*/cv B N M. (b) Prepare a projected CVP income statement for 2020, assuming that changes are made as described. (Round per uniu decimal places, eg. 5.25 and all other answers to decimal places, eg. 1,225) SHEFFIELD COMPANY CVP Income Statement Total Per Unit $ $ Type here to search o 021 5 B 9 E R. T s o F G H. J X B . M Question 10 of 12 -13 Personal Electronix sells computer tablets and MP3 players. The business is divided into two divisions along product lines, CVP income statements for a recent quarter's activity are presented below. Sales Variable costs Contribution margin Fixed costs Net income Tablet Division MP3 Player Division Total $819.000 $441,000 $1,260,000 606,060 251,370 857430 $212,940 $189,630 402.570 129,078 $273.492 Determine sales mix percentage and contribution margin ratio for each division Sales Mix Percentate Tablet division MP3 Player division Type here to search O E 9 7 8 alwe R. T S P G H K. V B N . Question 10 of 12 Determine sales mix percentage and contribution margin ratio for each division. Sales Mix Percentage Tablet division I % MP3 Player division Contribution Margin Ratio Tablet division MP3 Player division e Textbook and Media Assistance Used Type here to se O 9 (hp 5 6 7 8 E R C S o U D G H J K V B M Question 10 of 12 -/3 Calculate the company's weighted average contribution margin ratio. (Round computations and final answer to 2 decimal places, ex 15.26%) Weighted average contribution margin ratio eTextbook and Media Assistance Used Calculate the company's break even point in dollars. (Round computations to 2 decimal places and final answer to decimal places 3.1.526) Break-even points Tedbook and Media Type here to wach O 10 /NE 6 I wl 8 9 R Y s D O F G H J K V 00 N . CICLUDUNG TUA Determine the sales level in dollars for each division at the break-even point. (Round computations to 2 decimal places and final answers to decimal places, eg. 1,526 Break-even point Tablet division $ MP3 Player division $ e Textbook and Media Svetor Later Attempts: unlimited Type here to search Submit Answer O II E hp 5 8 9 W E R T C o P lo G H J K C V B N M Cri