Answered step by step

Verified Expert Solution

Question

1 Approved Answer

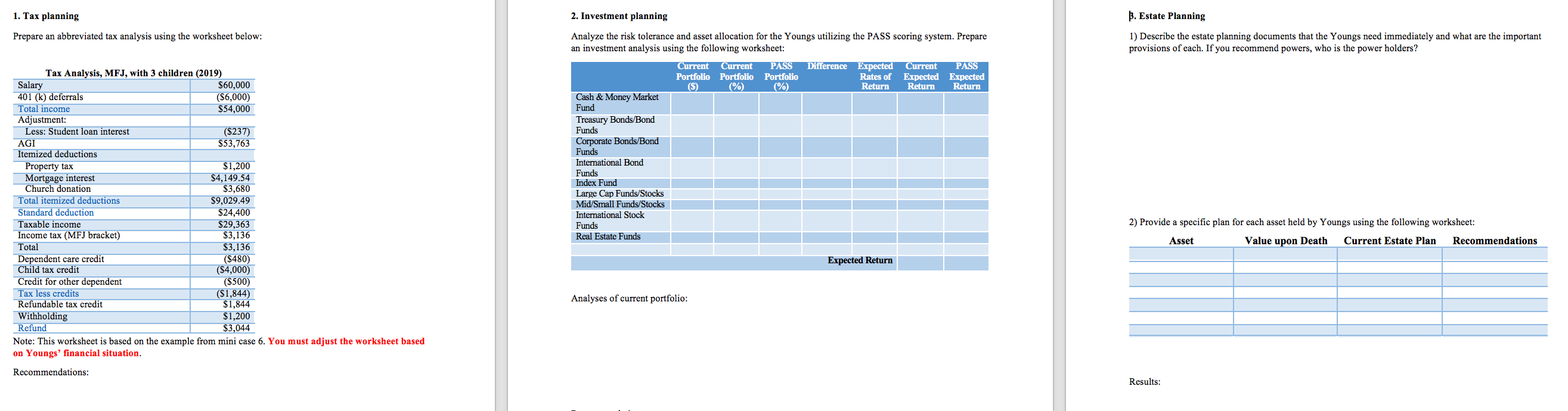

Need help with these Calculations 1. Tax planning 2. Investment planning B. Estate Planning Prepare an abbreviated tax analysis using the worksheet below: 1) Describe

Need help with these Calculations

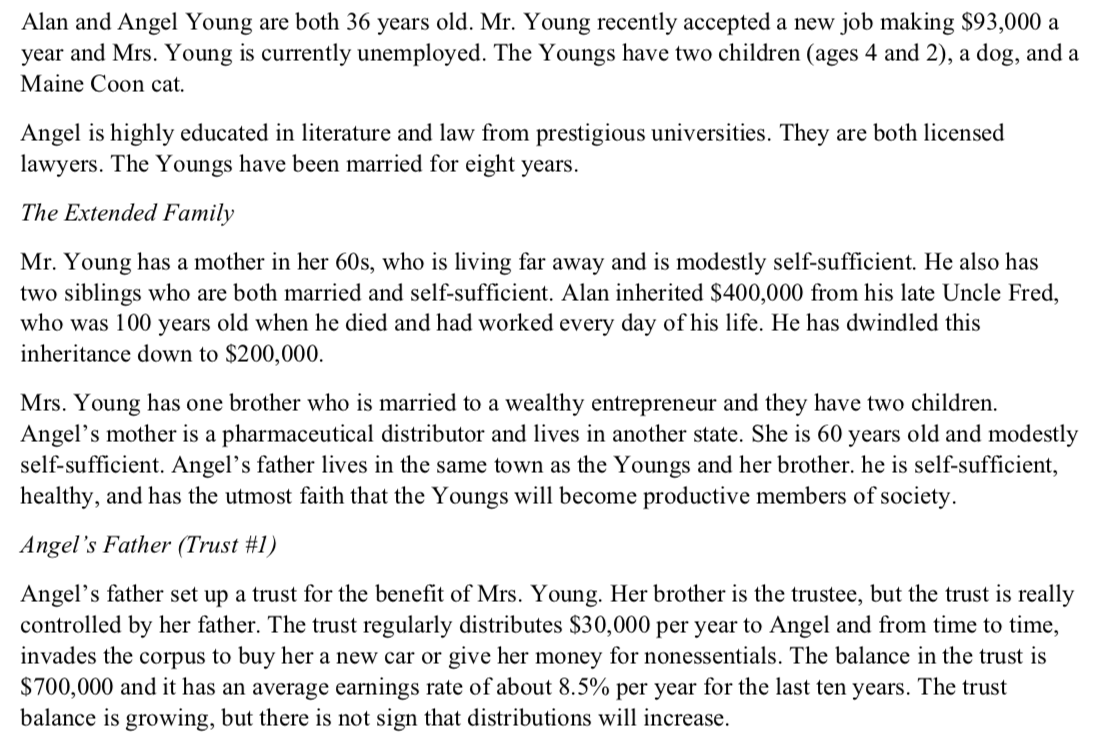

1. Tax planning 2. Investment planning B. Estate Planning Prepare an abbreviated tax analysis using the worksheet below: 1) Describe the estate planning documents that the Youngs need immediately and what are the important provisions of each. If you recommend powers, who is the power holders? Tax Analysis, MFJ, with 3 children (2019) Salary $60,000 401 (k) deferrals ($6,000) Total income $54,000 Adjustment: Less: Student loan interest ($237) AGI $53,763 Itemized deductions Property tax $1,200 Mortgage interest $4,149.54 Church donation $3,680 Total itemized deductions $9,029.49 Standard deduction $24,400 Taxable income $29,363 Income tax (MFJ bracket) $3,136 Total $3,136 Dependent care credit (S480) Child tax credit ($4,000) Credit for other dependent (S500) Tax less credits ($1,844) Refundable tax credit $1,844 Withholding $1,200 Refund $3,044 Note: This worksheet is based on the example from mini case 6. You must adjust the worksheet based on Youngs' financial situation. Analyze the risk tolerance and asset allocation for the Youngs utilizing the PASS scoring system. Prepare an investment analysis using the following worksheet: Current Current PASS Difference Expected Current PASS Portfolio Portfolio Portfolio Rates of Expected Expected ($) (%) (%) Return Return Return Cash & Money Market Fund Treasury Bonds/Bond Funds Corporate Bonds/Bond Funds International Bond Funds Index Fund Large Cap Funds/Stocks Mid/Small Funds/Stocks International Stock Funds Real Estate Funds 2) Provide a specific plan for each asset held by Youngs using the following worksheet: Asset Value upon Death Current Estate Plan Recommendations Expected Return Analyses of current portfolio: Recommendations: Results: Alan and Angel Young are both 36 years old. Mr. Young recently accepted a new job making $93,000 a year and Mrs. Young is currently unemployed. The Youngs have two children (ages 4 and 2), a dog, and a Maine Coon cat. Angel is highly educated in literature and law from prestigious universities. They are both licensed lawyers. The Youngs have been married for eight years. The Extended Family Mr. Young has a mother in her 60s, who is living far away and is modestly self-sufficient. He also has two siblings who are both married and self-sufficient. Alan inherited $400,000 from his late Uncle Fred, who was 100 years old when he died and had worked every day of his life. He has dwindled this inheritance down to $200,000. Mrs. Young has one brother who is married to a wealthy entrepreneur and they have two children. Angel's mother is a pharmaceutical distributor and lives in another state. She is 60 years old and modestly self-sufficient. Angel's father lives in the same town as the Youngs and her brother. he is self-sufficient, healthy, and has the utmost faith that the Youngs will become productive members of society. Angel's Father (Trust #1) Angel's father set up a trust for the benefit of Mrs. Young. Her brother is the trustee, but the trust is really controlled by her father. The trust regularly distributes $30,000 per year to Angel and from time to time, invades the corpus to buy her a new car or give her money for nonessentials. The balance in the trust is $700,000 and it has an average earnings rate of about 8.5% per year for the last ten years. The trust balance is growing, but there is not sign that distributions will increase. 1. Tax planning 2. Investment planning B. Estate Planning Prepare an abbreviated tax analysis using the worksheet below: 1) Describe the estate planning documents that the Youngs need immediately and what are the important provisions of each. If you recommend powers, who is the power holders? Tax Analysis, MFJ, with 3 children (2019) Salary $60,000 401 (k) deferrals ($6,000) Total income $54,000 Adjustment: Less: Student loan interest ($237) AGI $53,763 Itemized deductions Property tax $1,200 Mortgage interest $4,149.54 Church donation $3,680 Total itemized deductions $9,029.49 Standard deduction $24,400 Taxable income $29,363 Income tax (MFJ bracket) $3,136 Total $3,136 Dependent care credit (S480) Child tax credit ($4,000) Credit for other dependent (S500) Tax less credits ($1,844) Refundable tax credit $1,844 Withholding $1,200 Refund $3,044 Note: This worksheet is based on the example from mini case 6. You must adjust the worksheet based on Youngs' financial situation. Analyze the risk tolerance and asset allocation for the Youngs utilizing the PASS scoring system. Prepare an investment analysis using the following worksheet: Current Current PASS Difference Expected Current PASS Portfolio Portfolio Portfolio Rates of Expected Expected ($) (%) (%) Return Return Return Cash & Money Market Fund Treasury Bonds/Bond Funds Corporate Bonds/Bond Funds International Bond Funds Index Fund Large Cap Funds/Stocks Mid/Small Funds/Stocks International Stock Funds Real Estate Funds 2) Provide a specific plan for each asset held by Youngs using the following worksheet: Asset Value upon Death Current Estate Plan Recommendations Expected Return Analyses of current portfolio: Recommendations: Results: Alan and Angel Young are both 36 years old. Mr. Young recently accepted a new job making $93,000 a year and Mrs. Young is currently unemployed. The Youngs have two children (ages 4 and 2), a dog, and a Maine Coon cat. Angel is highly educated in literature and law from prestigious universities. They are both licensed lawyers. The Youngs have been married for eight years. The Extended Family Mr. Young has a mother in her 60s, who is living far away and is modestly self-sufficient. He also has two siblings who are both married and self-sufficient. Alan inherited $400,000 from his late Uncle Fred, who was 100 years old when he died and had worked every day of his life. He has dwindled this inheritance down to $200,000. Mrs. Young has one brother who is married to a wealthy entrepreneur and they have two children. Angel's mother is a pharmaceutical distributor and lives in another state. She is 60 years old and modestly self-sufficient. Angel's father lives in the same town as the Youngs and her brother. he is self-sufficient, healthy, and has the utmost faith that the Youngs will become productive members of society. Angel's Father (Trust #1) Angel's father set up a trust for the benefit of Mrs. Young. Her brother is the trustee, but the trust is really controlled by her father. The trust regularly distributes $30,000 per year to Angel and from time to time, invades the corpus to buy her a new car or give her money for nonessentials. The balance in the trust is $700,000 and it has an average earnings rate of about 8.5% per year for the last ten years. The trust balance is growing, but there is not sign that distributions will increaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started