Answered step by step

Verified Expert Solution

Question

1 Approved Answer

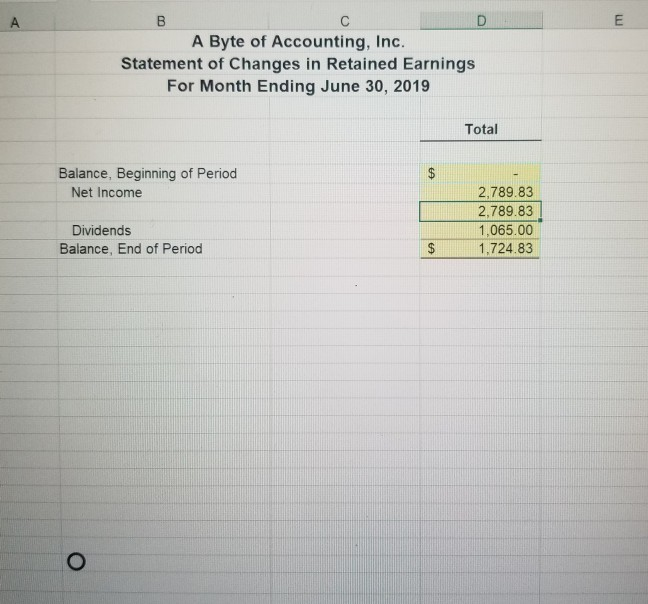

Need help with these if anyone can... A Byte of Accounting, Inc. Statement of Changes in Retained Earnings For Month Ending June 30, 2019 Total

Need help with these if anyone can...

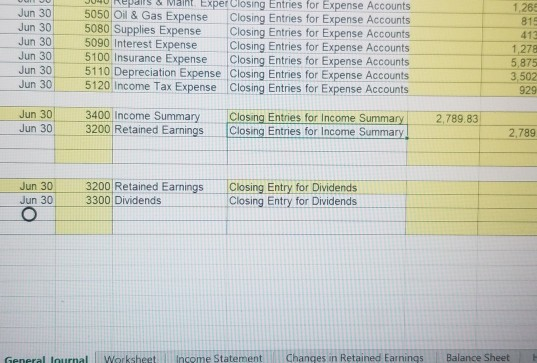

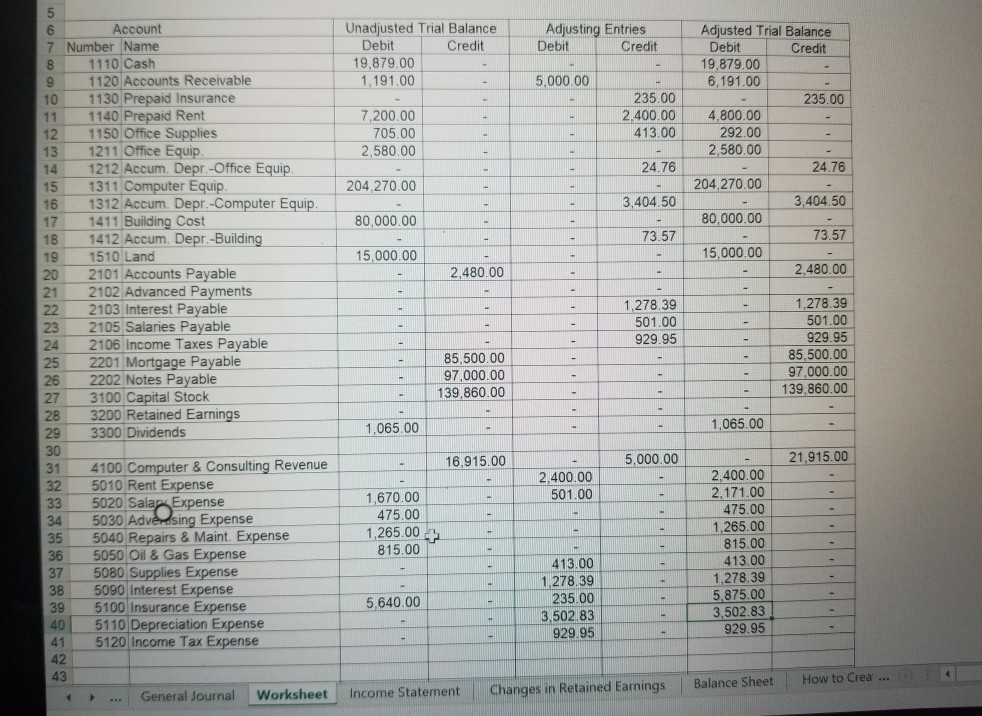

A Byte of Accounting, Inc. Statement of Changes in Retained Earnings For Month Ending June 30, 2019 Total Balance, Beginning of Period 2,789.83 Net Income 2.789.83 1,065.00 1.724.83 Dividends Balance, End of Period nukepirs Closing & Malht Exper Entries for Expense Accounts 1.265 815 41 1 278 5,875 3.502 929 Jun 30 5050 Oil & Gas Expense Closing Entries for Expense Accounts un 30 5080 Supplies Expense Closing Entries for Expense Accounts Jun 30 5090 Interest ExpenseClosing Entries for Expense Acco Jun 30 5100 Insurance Expense Closing Entries for Expense Accounts Jun 305110 Depreciation Expense Closing Entries for Expense Accounts 5120 Income Tax Expense Closing Entries for Expense Accounts Jun 30 3400 Income SummaryClosing Entries for Income Summary 3200 Retained Earnings Closing Entries for Income Summary Jun 30 2,789.83 2,789 un 30 Jun 30 3200 Retained Earnings Closing Entry for Dividends 3300 Dividends Closing Entry for Dividends General lournal Worksheet Income Statement Changes in Retained Earnings Balance Sheet Unadjusted Trial Balance Adjusting Entries Adjusted Trial Balance Credit 6 7 Number Name 8 1110 Cash 9 1120 Accounts Receivable 10 1130 Prepaid Insurance Account Debit Credit Credit Debit 19,879.00 5,000.00 235.00 235.00 2 400.004,800.00 292.00 2,580.00 7,200.00 705.00 2,580.00 en 413.00 12 1150 Office Supplies 13 1211 Office Equip 14 1212 Accum. Depr-Office Equip 15 1311 Computer Equip 16 1312 Accum. Depr.-Computer Equip 17 1411 Building Cost 18 1412 Accum. Depr.-Building 19 1510 Land 20 2101 Accounts Payable 21 2102 Advanced Payments 22 2103 Interest Payable 23 2105 Salaries Payable 24 2106 Income Taxes Payable 25 2201 Mortgage Payable 26 2202 Notes Payable 27 3100 Capital Stock 28 3200 Retained Earnings 29 3300 Dividends 30 31 4100 Computer& Consulting Revenue 32 5010 Rent Expense 33 5020 Sala 34 5030 Adv 35 5040 Repairs & Maint. Expense 36 5050 Oil & Gas Expense 37 5080 Supplies Expense 38 5090 Interest Expense 39 5100 Insurance Expense 40 5110 Depreciation Expense 41 5120 Income Tax Expense 204,270.00 204,270.00 80,000.00 15,000.00 3,404.50 3,404.50 15,000.00 2,480.00 2,480.00 1,278.39 501.00 1,278.39 929.95 85,500.00 97,000.00 139,860.00 929.95 85,500.00 97,000.00 139.860.00 1,065.00 1,065.00 21,915.00 5,000.00 16,915.00 2,400.00 2,171.00 475.00 1,265.00 815.00 413.00 1.278.39 5,875.00 3,502.83 929.95 2.400.00 501.00 1,670.00 Expense 475.00 1,265.0 815.00 413.00 1.278.39 235.00 3,502.83 929,95 5,640.00 | Changes in Retained Earnings | Balance Sheet How to Crea General Journal Worksheet Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started