Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with these. I'm unsure how to do the 2nd one. I saw an example on how to do it then got stuck mid

need help with these. I'm unsure how to do the 2nd one. I saw an example on how to do it then got stuck mid way through

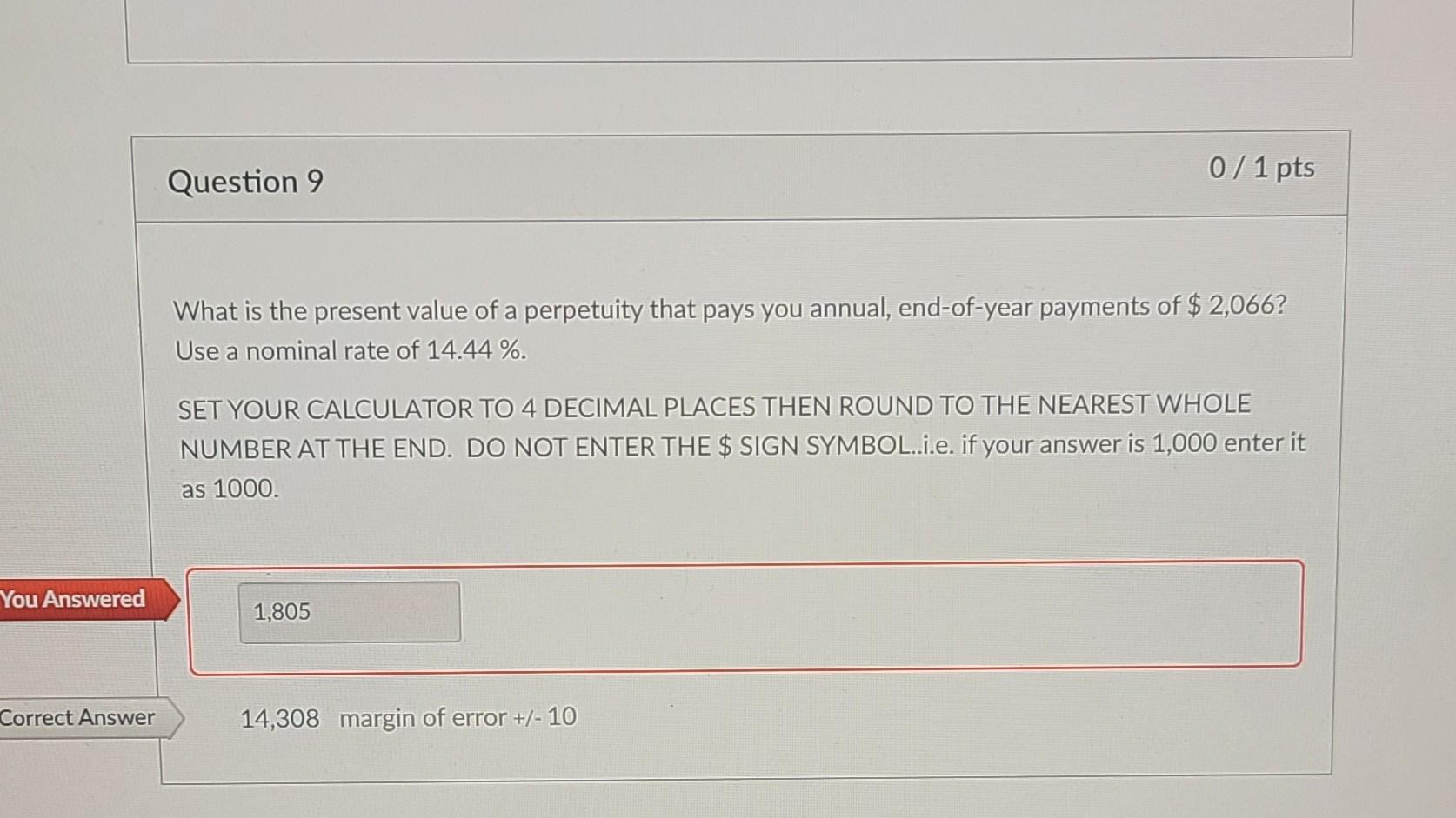

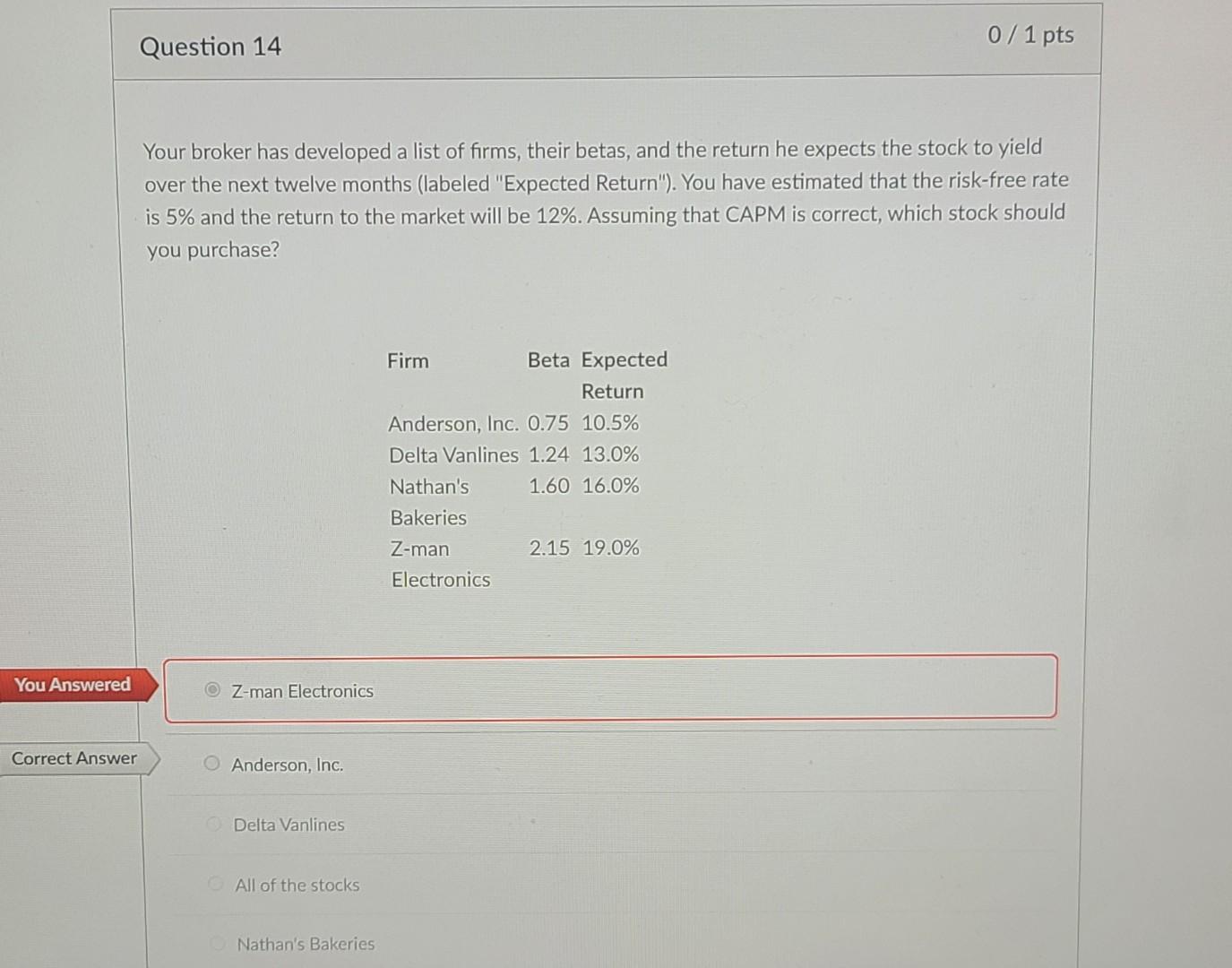

Question 9 0 / 1 pts What is the present value of a perpetuity that pays you annual, end-of-year payments of $ 2,066? Use a nominal rate of 14.44 %. SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN ROUND TO THE NEAREST WHOLE NUMBER AT THE END. DO NOT ENTER THE $ SIGN SYMBOL..i.e. if your answer is 1,000 enter it as 1000. You Answered 1,805 Correct Answer 14,308 margin of error +/- 10 Question 14 0 / 1 pts Your broker has developed a list of firms, their betas, and the return he expects the stock to yield over the next twelve months (labeled "Expected Return"). You have estimated that the risk-free rate is 5% and the return to the market will be 12%. Assuming that CAPM is correct, which stock should you purchase? Firm Beta Expected Return Anderson, Inc. 0.75 10.5% Delta Vanlines 1.24 13.0% Nathan's 1.60 16.0% Bakeries Z-man 2.15 19.0% Electronics You Answered Z-man Electronics Correct Answer O Anderson, Inc. Delta Vanlines All of the stocks Nathan's BakeriesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started