Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with these last three problems please i only have one more question that im able to post i belive until next month. Question

need help with these last three problems please

i only have one more question that im able to post i belive until next month.

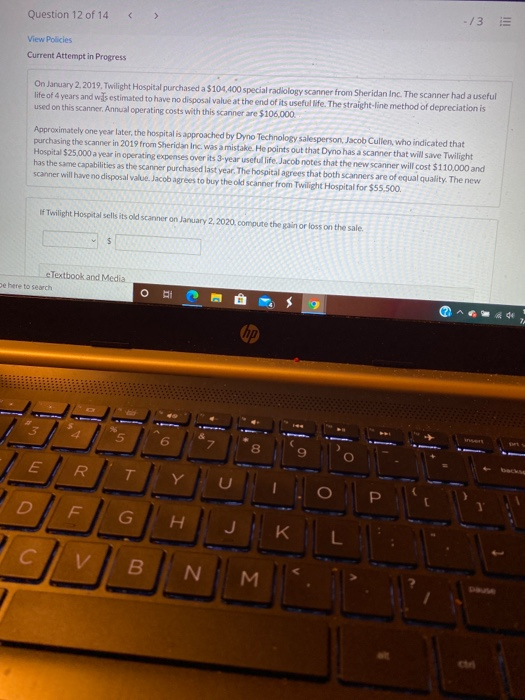

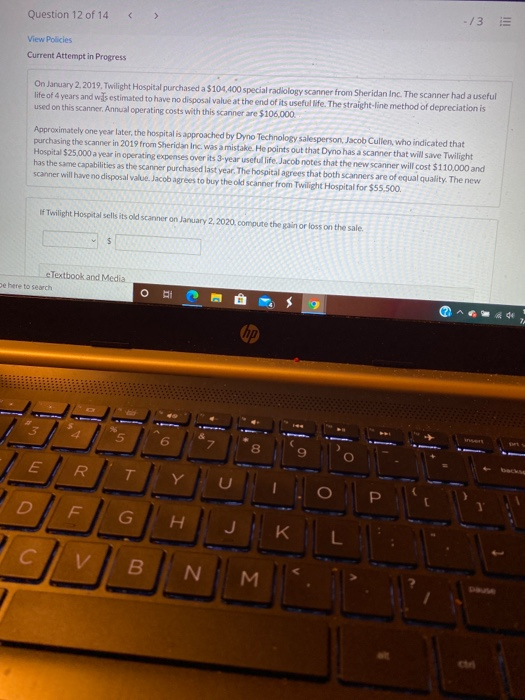

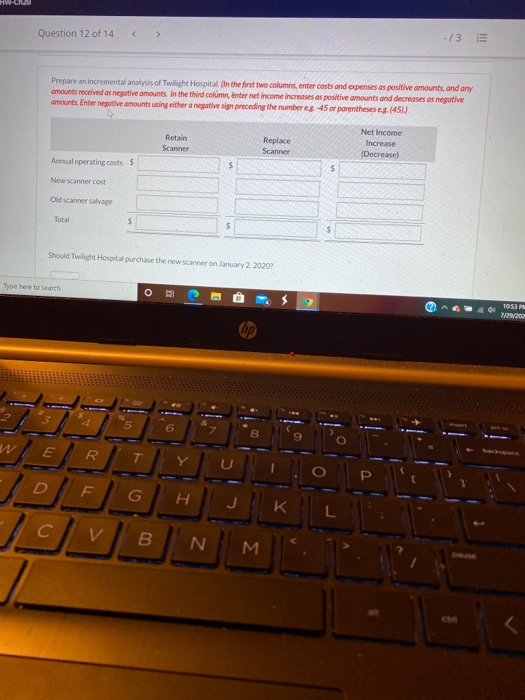

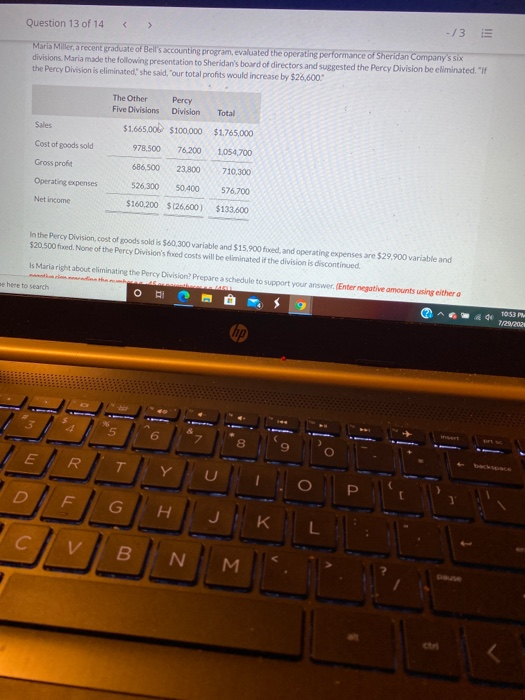

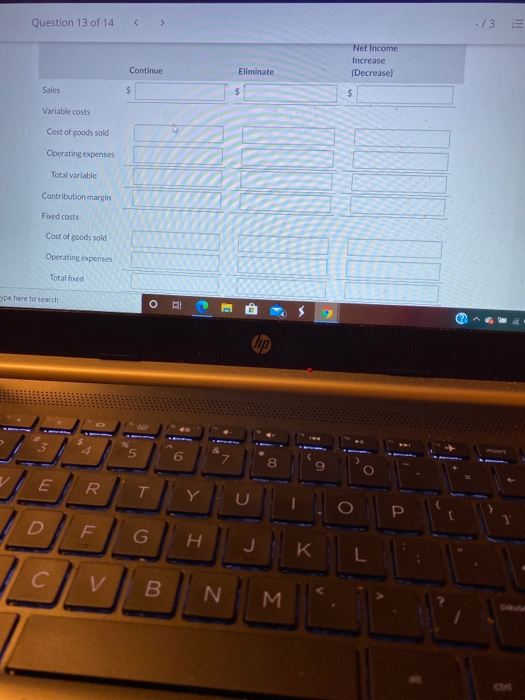

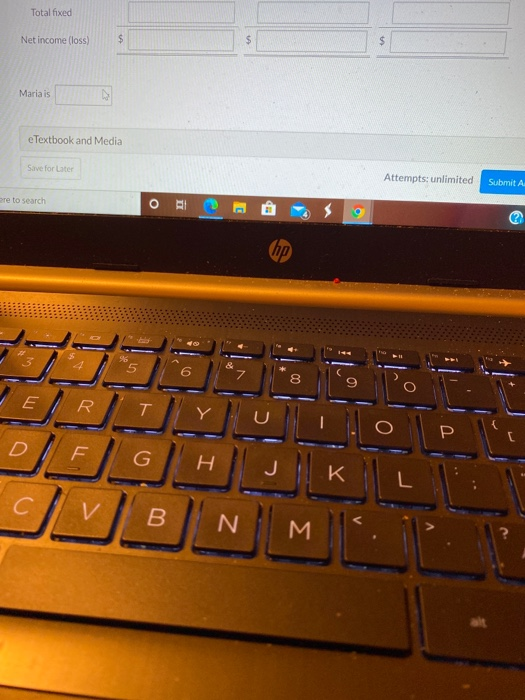

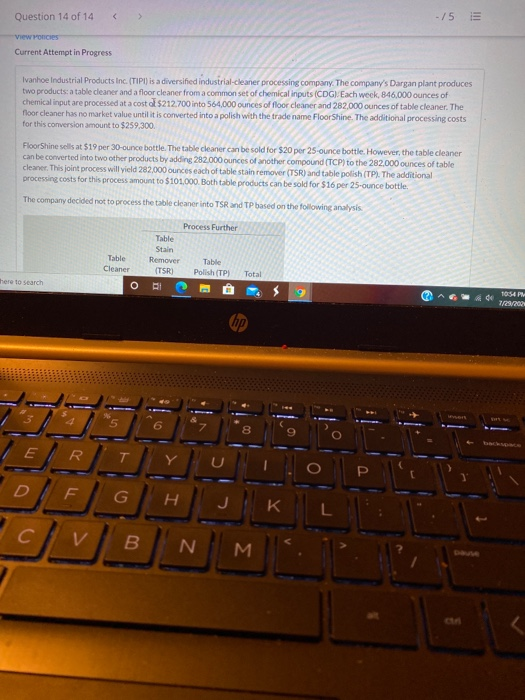

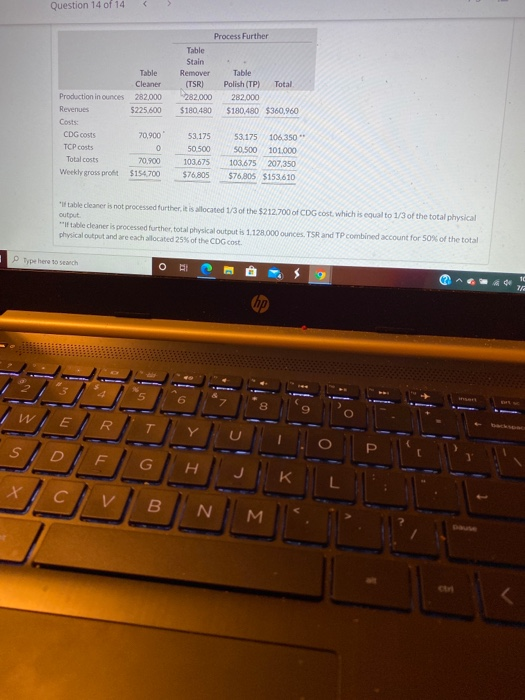

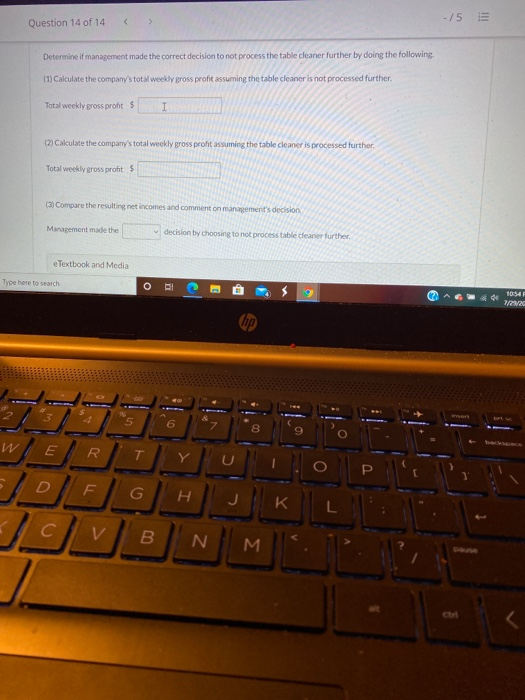

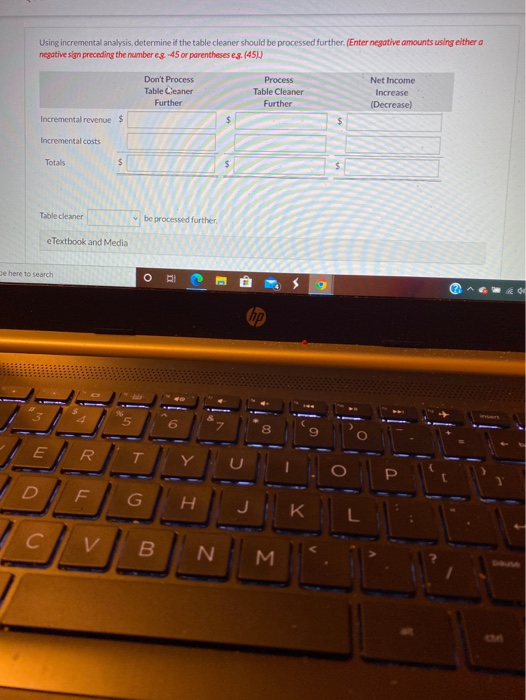

Question 12 of 14 -/3 View Policies Current Attempt in Progress On January 2, 2019. Twilight Hospital purchased a $104,400 special radiology scanner from Sheridan Inc. The scanner had a useful life of 4 years and was estimated to have no disposal value at the end of its useful life. The straight-line method of depreciation is used on this scanner Annual operating costs with this scanner are $106.000 Approximately one year later, the hospital is approached by Dyno Technology salesperson, Jacob Cullen, who indicated that purchasing the scanner in 2019 from Sheridan Inc. was a mistake. He points out that Dyno has a scanner that will save Twilight Hospital $25.000 a year in operating expenses over its 3-year useful life Jacob notes that the new Scanner will cost $110,000 and has the same capabilities as the scanner purchased last year. The hospital agrees that both scanners are of equal quality. The new scanner will have no disposal value. Jacob agrees to buy the old scanner from Twilight Hospital for $55,500. If Twilight Hospital sells its old scanner on January 2, 2020.compute the gain or loss on the sale. $ eTextbook and Media Se here to search O 6 8 E R T C P D F . J /c v B N M HWHOLU Question 12 of 14 > - /3 Prepare an incremental analysis of Twilight Hospital in the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative amounts in the third column internet income increases as positive amounts and decreases as negative amounts. Enter negative amounts using either a negative si preceding the numbers 45 or parentheses es. (450 Retain Scanner Replace Scanner Net Income Increase (Decrease) Annual operating costs $ New scanner cost Old scanner savage Total $ $ $ Should Twilight Hospital purchase the new scanner on January 2, 20202 Type here to search O 99 1053 PM 7/29/200 8 E R. T D F G . J K B N M Question 13 of 14 -13 Maria Miller, a recent graduate of Bell's accounting program, evaluated the operating performance of Sheridan Company's six divisions. Maria made the following presentation to Sheridan's board of directors and suggested the Percy Division be eliminated." the Percy Division is eliminated' she said. "our total profits would increase by $26,600 Total Sales The Other Percy Five Divisions Division $1.665.00 $100.000 978.500 76.200 $1.765.000 Cost of goods sold 1,054,700 Gross profit 686.500 23.800 710,300 Operating expenses 576.700 Net Income 526 300 50.400 $160.200 $126.600) $133.600 In the Percy Division, cost of goods sold is $60,300 variable and $15.900 foed, and operating expenses are $29.900 variable and $20.500 fod. None of the Percy Division's fred costs will be eliminated if the division is discontinued Is Maria right about eliminating the Percy Division Prepare a schedule to support your answer. (Enter negative amounts using either a O de 10:53 PM 7/21/202 hp 6 8 E R T Y OF P. G H K C V B N M Question 13 of 14 -/3 Net Income Increase (Decrease) Continue Eliminate Sales $ $ Variable costs Cost of goods sold Operating expenses Total variable Contribution margin Fixed costs Cost of goods sold Operating expenses Totalfred pe here to search RI hp 5 6 8 9 E R T Y P. D F G . K V B N M Total fixed Net income (loss $ $ Maria is e Textbook and Media Save for Later Attempts: unlimited Submit A zre to search o RE hip 5 00 U IERIT OFIL G H J K B N M. Question 14 of 14 -75 INT ViewPonces Current Attempt in Progress Ivanhoe Industrial Products Inc. (TIPI) is a diversified industrial-cleaner processing company. The company's Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG) Each week, 846,000 ounces of chemical input are processed at a cost of $212.700 into 564,000 ounces of floor cleaner and 282,000 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name Floor Shine. The additional processing costs for this conversion amount to $259,300 Floor Shine sells at $19 per 30-ounce bottle. The table cleaner can be sold for $20 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 282.000 ounces of another compound (TCP) to the 282.000 ounces of table cleaner. This joint process will yield 282,000 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $101.000. Both table products can be sold for $16 per 25-ounce bottle. The company decided not to process the table cleaner into TSR and TP based on the following analysis Process Further Table Stain Remover Table Polish (TP) Table Cleaner (TSR) Total there to search o de 10:54 PM 7/21/2002 6 8 E / R T G H j V 00 N . Question 14 of 14 Table Cleaner 282,000 $225.600 Process Further Table Stain Remover Table (TSR) Polish (TP) Total 282.000 282,000 $180.480 $180,480 $360,960 Production in ounces Revenues Costs CDG costs TCP costs Total costs Weekly gross profit 70.900" 0 70.900 $154700 53.175 50.500 103.675 $76,805 53.175 106350" 50.500 101.000 103,675 207.350 $76,805 5153.610 table cleaner is not processed further it is allocated 1/3 of the $212.700 of CDG cost, which is equal to 1/3 of the total physical output of table deaner is processed further total physical output is 1.128.000 ounces. TSR and TP combined account for 50% of the total physical output and are each allocated 25% of the CDG cost Type here to search BI 9 11 8 9 R T 0 SD F G H J Acv 00 N M -/5 INT Question 14 of 14 Determine if management made the correct decision to not process the table cleaner further by doing the following (1) Calculate the company's total weekly gross profit assuming the table cleaner is not processed further. Total weekly gross profit $ I (2) Cakulate the company's total weekly gross profit assuming the table cleaner is processed further Total weekly gross profit$ 131 Compare the resulting net incomes and comment on management's decision Management made the decision by choosing to not process table deaner further. e Textbook and Media Type here to search o 1054 8 W E R. T Y F G H 00 N . Using incremental analysis, determine if the table cleaner should be processed further. (Enter negative amounts using either a negative sign preceding the number eg -45 or parentheses es. (450) Don't Process Table Ceaner Further Process Table Cleaner Further Net Income Increase (Decrease) Incremental revenue $ Incremental costs Totals $ Table cleaner be processed further e Textbook and Media De here to search o BBB hp 8 E R T o F H . B N M Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started