Answered step by step

Verified Expert Solution

Question

1 Approved Answer

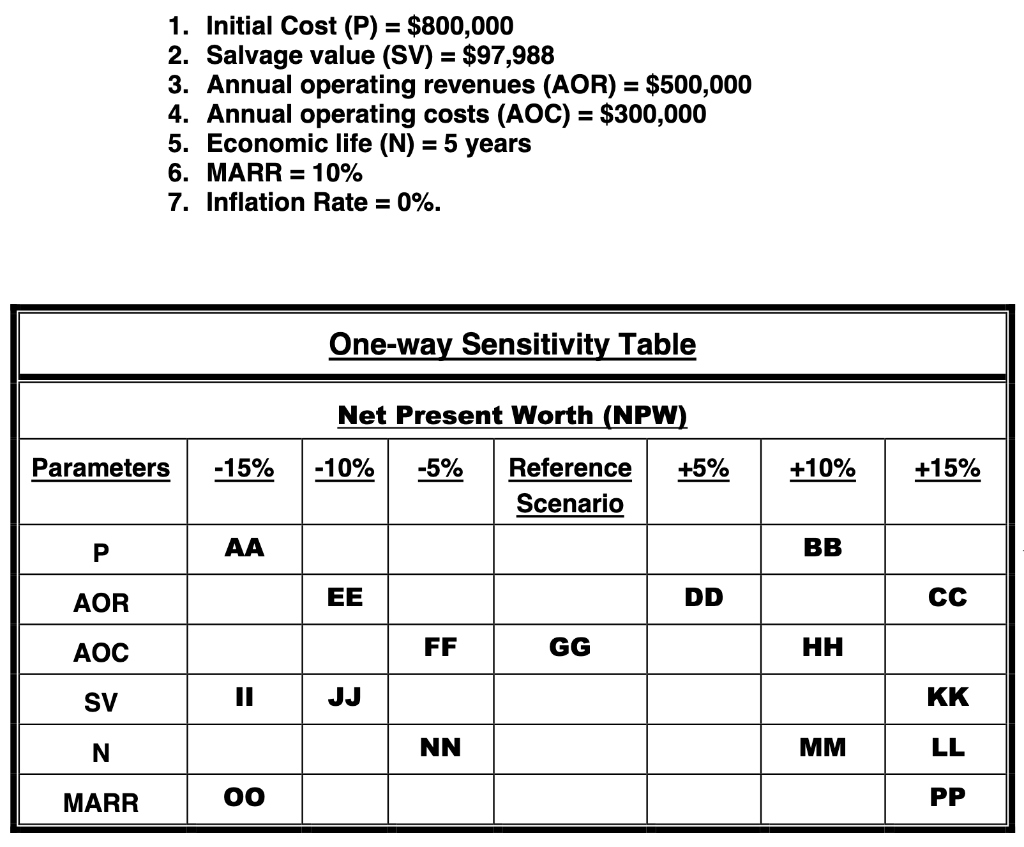

Need help with these One-way sensitivity table questions. Thank you 13.The dollar value of MM is 14.The dollar value of NN is 15.The dollar value

Need help with these One-way sensitivity table questions. Thank you

13.The dollar value of MM is

14.The dollar value of NN is

15.The dollar value of OO is

16.The dollar value of PP is

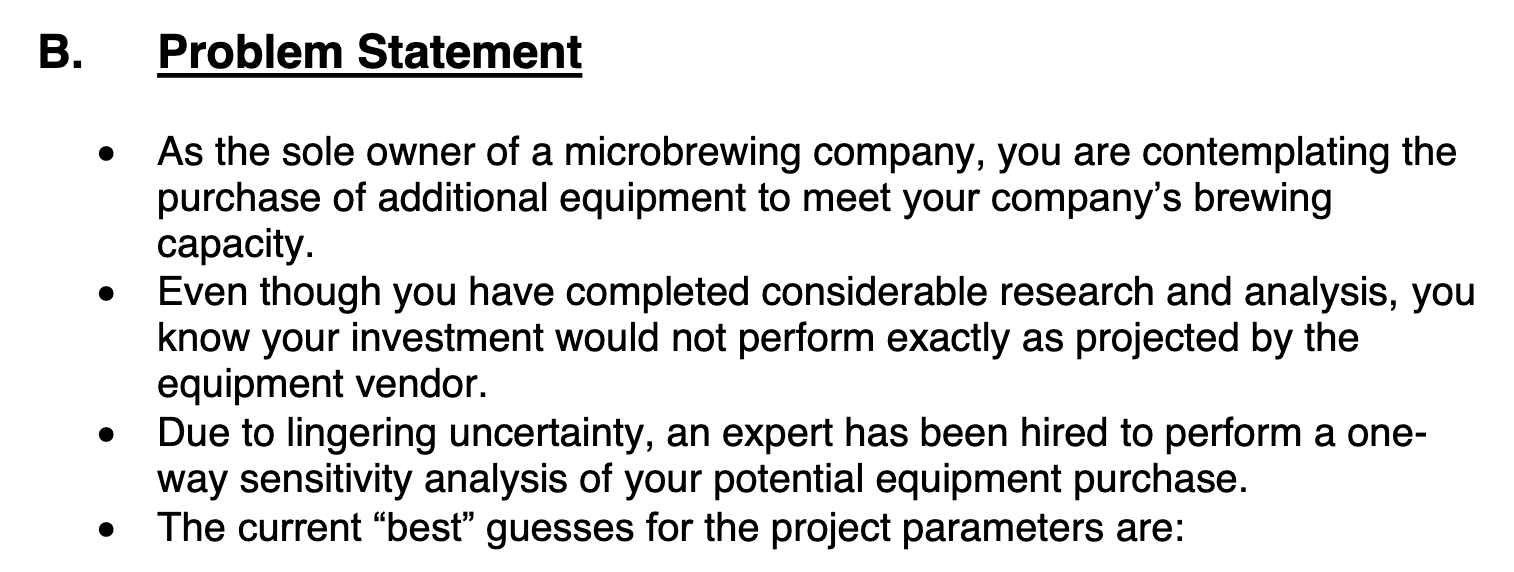

B. Problem Statement As the sole owner of a microbrewing company, you are contemplating the purchase of additional equipment to meet your company's brewing capacity Even though you have completed considerable research and analysis, you know your investment would not perform exactly as projected by the equipment vendor. Due to lingering uncertainty, an expert has been hired to perform a one- way sensitivity analysis of your potential equipment purchase. The current "best" guesses for the project parameters are: 1. Initial Cost (P) = $800,000 2. Salvage value (SV) = $97,988 3. Annual operating revenues (AOR) = $500,000 4. Annual operating costs (AOC) = $300,000 5. Economic life (N) = 5 years 6. MARR = 10% 7. Inflation Rate = 0%. One-way Sensitivity Table Net Present Worth (NPW) Parameters -15% -10% -5% +5% +10% +15% Reference Scenario P AA BB AOR EE DD CC AOC FF GG HH SV II KK N NN MM LL MARR 00 PP B. Problem Statement As the sole owner of a microbrewing company, you are contemplating the purchase of additional equipment to meet your company's brewing capacity Even though you have completed considerable research and analysis, you know your investment would not perform exactly as projected by the equipment vendor. Due to lingering uncertainty, an expert has been hired to perform a one- way sensitivity analysis of your potential equipment purchase. The current "best" guesses for the project parameters are: 1. Initial Cost (P) = $800,000 2. Salvage value (SV) = $97,988 3. Annual operating revenues (AOR) = $500,000 4. Annual operating costs (AOC) = $300,000 5. Economic life (N) = 5 years 6. MARR = 10% 7. Inflation Rate = 0%. One-way Sensitivity Table Net Present Worth (NPW) Parameters -15% -10% -5% +5% +10% +15% Reference Scenario P AA BB AOR EE DD CC AOC FF GG HH SV II KK N NN MM LL MARR 00 PPStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started