need help with these problems below

need help with these

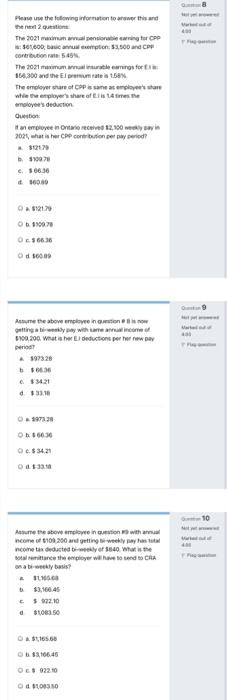

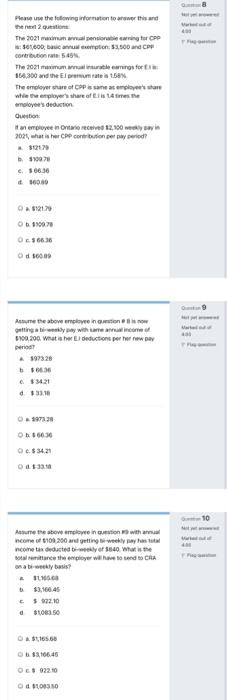

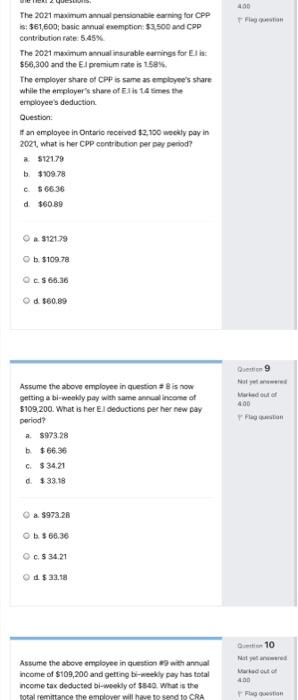

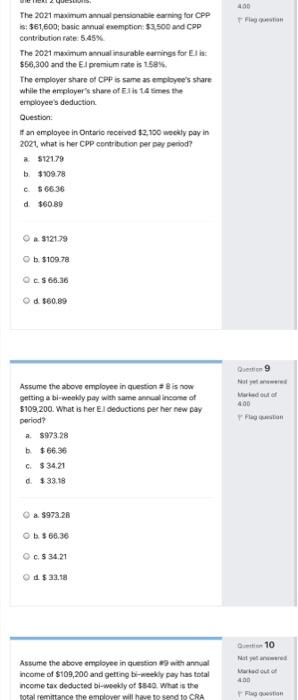

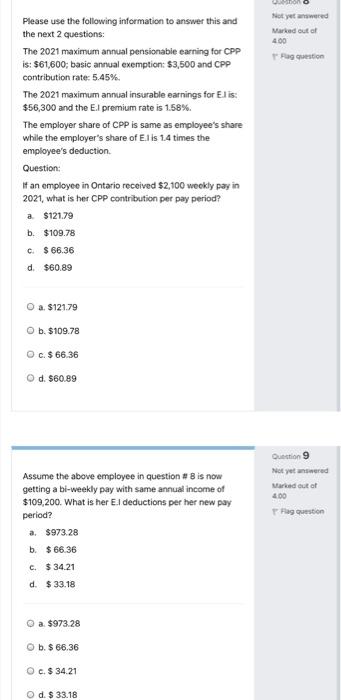

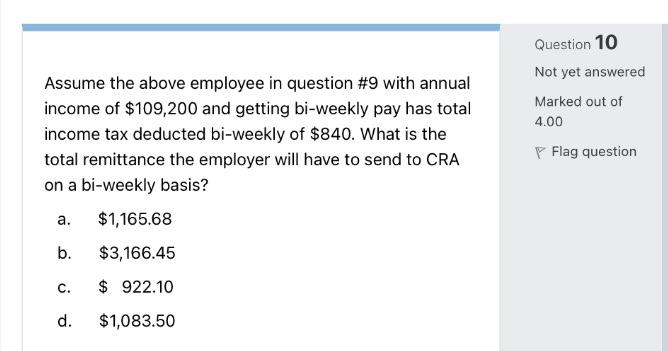

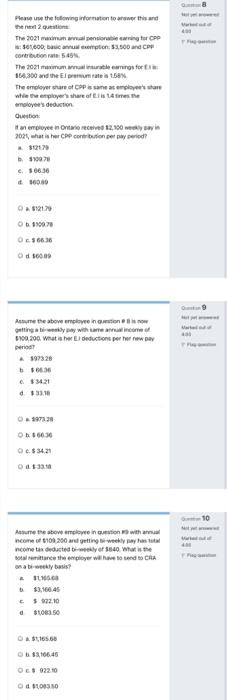

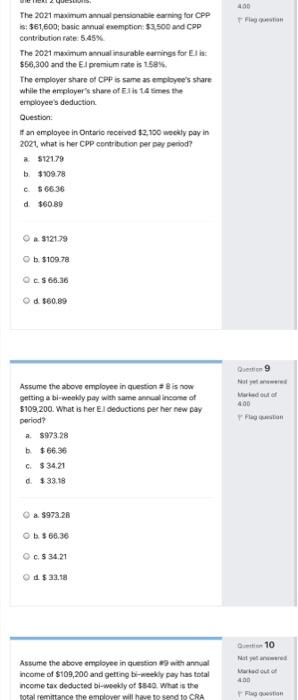

Penseuse the following information to this and the next question The 2021 met CPP 50,000 baton: 53.500 and CPH continue The 2021.gs for 164,300 and the rest The role of CPP same as employees are wher'share of its reste angloyee's deduction it an employee Ontario recev 12.100 lysay 701, what is her CPP contribution per a period 6.366.30 10:00 1212 O 366.36 od 160.09 Asume the above mention to Getting with me 109.200. What a herdeduction per terrew Day 6. $21.21 d30 97130 On 86630 0.85420 10 Asume testove emowo incin with ncome of 100 200 and getting weekly pays to ncome taste of 40 What the way basis? 22.10 O 1165.60 OES 02210 Od 2003.10 400 The 2021 maximum annual pensionale caring for CPP 18: $61,600; basic annual exemption: $3,500 and CPP contribution rate: 5.45% The 2021 maximum annual insurable earnings for Eli $56,300 and the El premium rate is 158%. The employer share of CPP is same as employee's share while the employer's share of Elis 14 times the employee's deduction Question an employee in Ontario received $2,100 wekly pay in 2021, what is her CPP contribution par pay period a 5121.79 b. $109.78 C. 566.36 d. $60.89 a $121.79 Ob $109.78 O.CS 66.36 Od $60.89 Queen 9 Mutal 400 Assume the above employee in question is now getting a bi-weekly pay with same anal income of 5109.200. What is her Eldeductions per her new pay period? a $973.28 b$66.36 Fan C$34.21 d. $33.18 a $973.28 Ob $ 66.36 c. $ 34,21 Od $33.18 Assume the above employee in question with annual income of $109,200 and getting bi-weekly pay has total ncome tax deducted bi-weekly of 40 What is the total remittance the employer will have to seed to CRA De 10 Net w out of 400 Not yet answered Marked out of 400 Pages Please use the following information to answer this and the next 2 questions: The 2021 maximum annual pensionable earning for CPP is: $61,600; basic annual exemption: $3,500 and CPP contribution rate: 5.45% The 2021 maximum annual insurable earnings for Elis: $56,300 and the E.I premium rate is 1.58%. The employer share of CPP is same as employee's share while the employer's share of El is 1.4 times the employee's deduction Question: If an employee in Ontario received $2,100 weekly pay in 2021, what is her CPP contribution per pay period? a $121.79 b. $109.78 c. $ 66.36 d. $60.89 O a $121.79 O b. $109.78 Oc. $ 66.36 O d. $60.89 Assume the above employee in question #8 is now getting a bi-weekly pay with same annual income of $109,200. What is her Eldeductions per her new pay period? a. $973.28 b. $ 66,36 Question 9 Not yetened Marked out of 4.00 Tagestion C. $34.21 d. $33.18 a $973.28 O b. $ 66.36 O c. $ 34.21 od. $ 33.18 Question 10 Not yet answered Marked out of 4.00 Assume the above employee in question #9 with annual income of $109,200 and getting bi-weekly pay has total income tax deducted bi-weekly of $840. What is the total remittance the employer will have to send to CRA on a bi-weekly basis? $1,165.68 Flag question a. b. $3,166.45 c. $ 922.10 d. $1,083.50 Penseuse the following information to this and the next question The 2021 met CPP 50,000 baton: 53.500 and CPH continue The 2021.gs for 164,300 and the rest The role of CPP same as employees are wher'share of its reste angloyee's deduction it an employee Ontario recev 12.100 lysay 701, what is her CPP contribution per a period 6.366.30 10:00 1212 O 366.36 od 160.09 Asume the above mention to Getting with me 109.200. What a herdeduction per terrew Day 6. $21.21 d30 97130 On 86630 0.85420 10 Asume testove emowo incin with ncome of 100 200 and getting weekly pays to ncome taste of 40 What the way basis? 22.10 O 1165.60 OES 02210 Od 2003.10 400 The 2021 maximum annual pensionale caring for CPP 18: $61,600; basic annual exemption: $3,500 and CPP contribution rate: 5.45% The 2021 maximum annual insurable earnings for Eli $56,300 and the El premium rate is 158%. The employer share of CPP is same as employee's share while the employer's share of Elis 14 times the employee's deduction Question an employee in Ontario received $2,100 wekly pay in 2021, what is her CPP contribution par pay period a 5121.79 b. $109.78 C. 566.36 d. $60.89 a $121.79 Ob $109.78 O.CS 66.36 Od $60.89 Queen 9 Mutal 400 Assume the above employee in question is now getting a bi-weekly pay with same anal income of 5109.200. What is her Eldeductions per her new pay period? a $973.28 b$66.36 Fan C$34.21 d. $33.18 a $973.28 Ob $ 66.36 c. $ 34,21 Od $33.18 Assume the above employee in question with annual income of $109,200 and getting bi-weekly pay has total ncome tax deducted bi-weekly of 40 What is the total remittance the employer will have to seed to CRA De 10 Net w out of 400 Not yet answered Marked out of 400 Pages Please use the following information to answer this and the next 2 questions: The 2021 maximum annual pensionable earning for CPP is: $61,600; basic annual exemption: $3,500 and CPP contribution rate: 5.45% The 2021 maximum annual insurable earnings for Elis: $56,300 and the E.I premium rate is 1.58%. The employer share of CPP is same as employee's share while the employer's share of El is 1.4 times the employee's deduction Question: If an employee in Ontario received $2,100 weekly pay in 2021, what is her CPP contribution per pay period? a $121.79 b. $109.78 c. $ 66.36 d. $60.89 O a $121.79 O b. $109.78 Oc. $ 66.36 O d. $60.89 Assume the above employee in question #8 is now getting a bi-weekly pay with same annual income of $109,200. What is her Eldeductions per her new pay period? a. $973.28 b. $ 66,36 Question 9 Not yetened Marked out of 4.00 Tagestion C. $34.21 d. $33.18 a $973.28 O b. $ 66.36 O c. $ 34.21 od. $ 33.18 Question 10 Not yet answered Marked out of 4.00 Assume the above employee in question #9 with annual income of $109,200 and getting bi-weekly pay has total income tax deducted bi-weekly of $840. What is the total remittance the employer will have to send to CRA on a bi-weekly basis? $1,165.68 Flag question a. b. $3,166.45 c. $ 922.10 d. $1,083.50