Need help with these problems

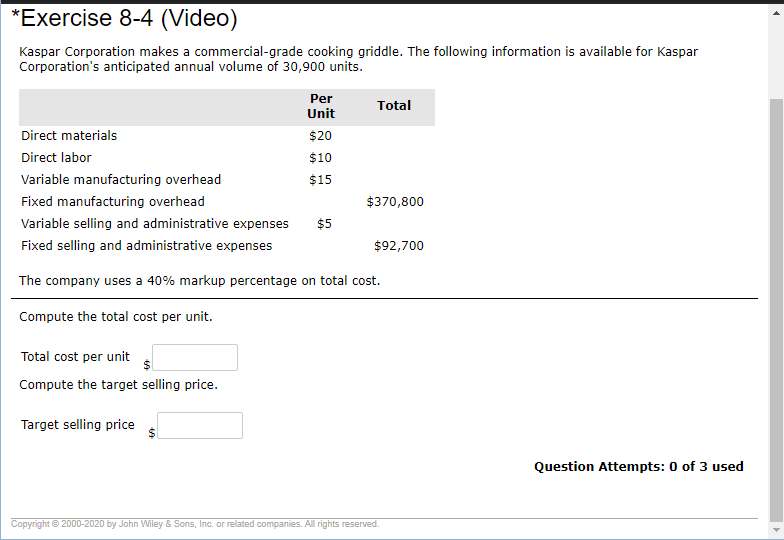

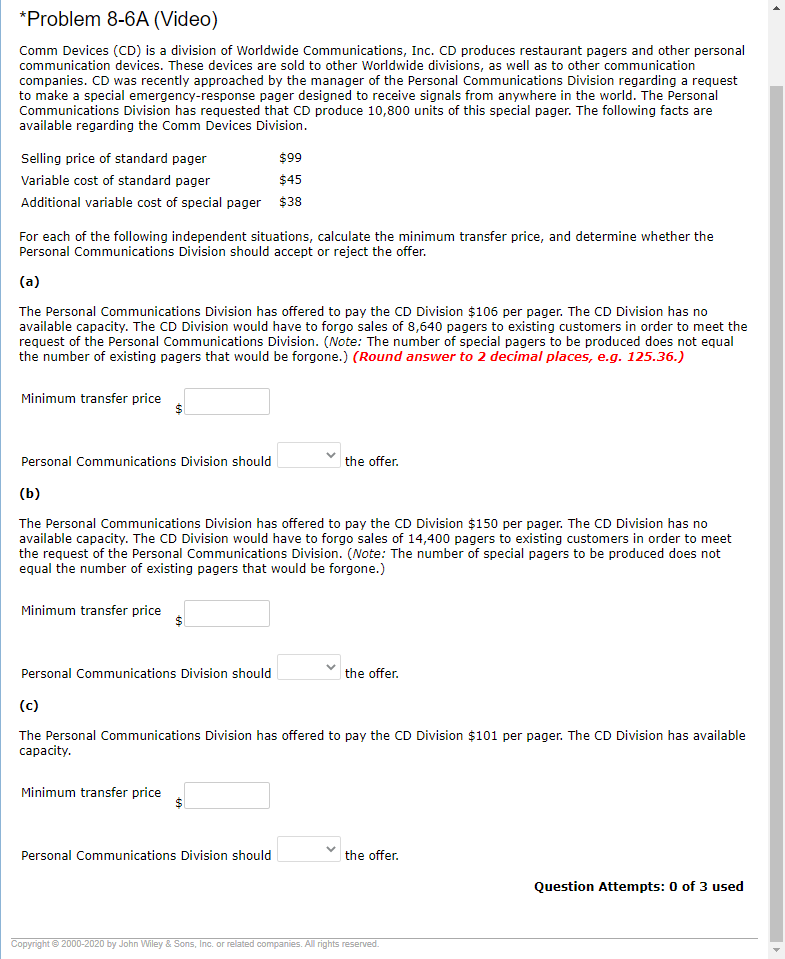

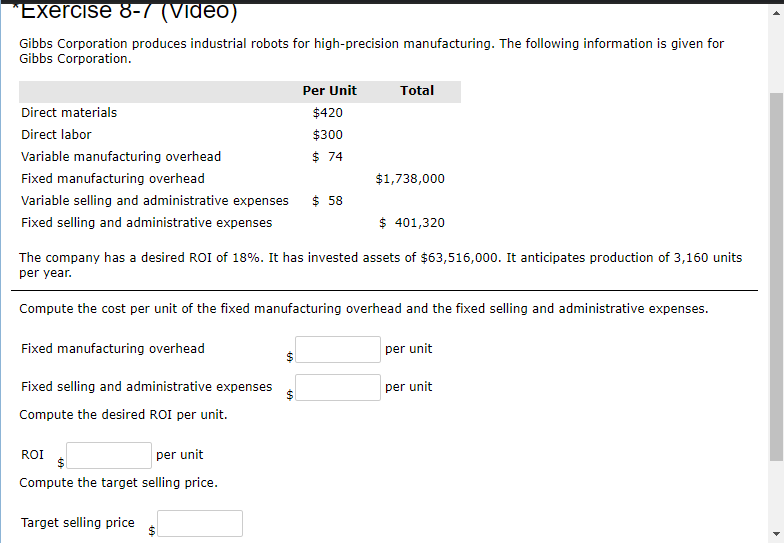

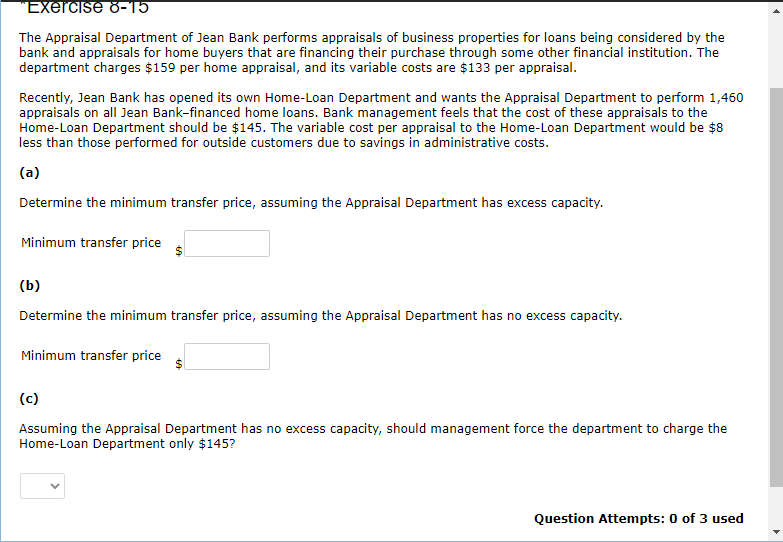

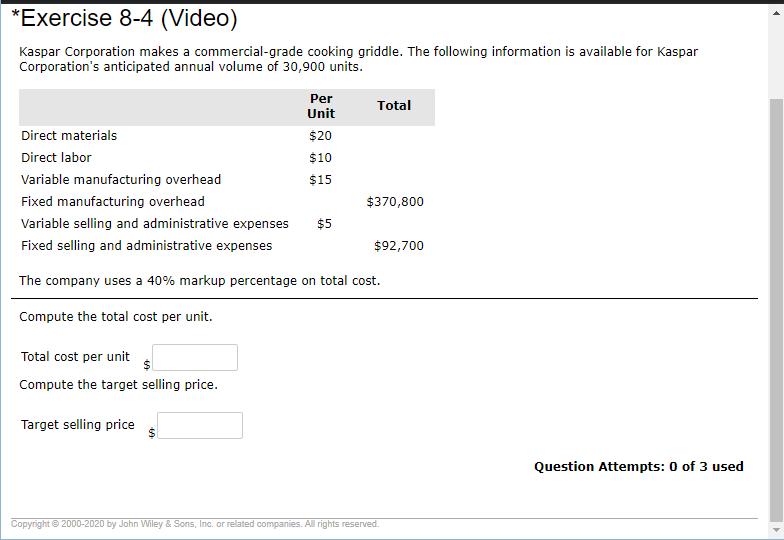

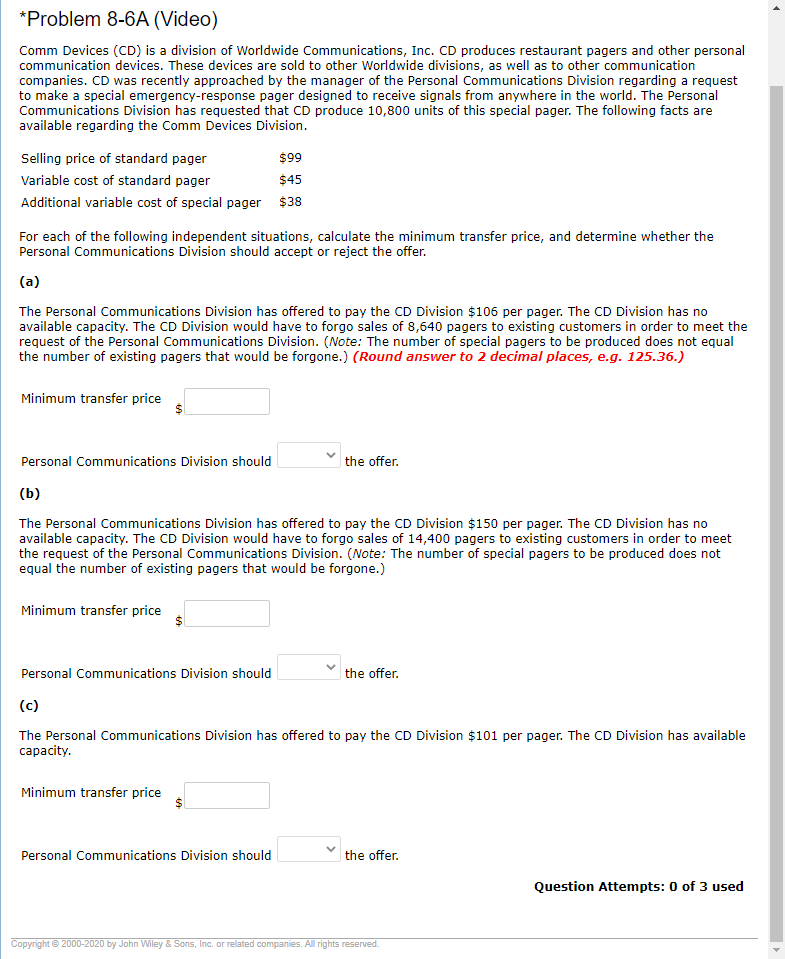

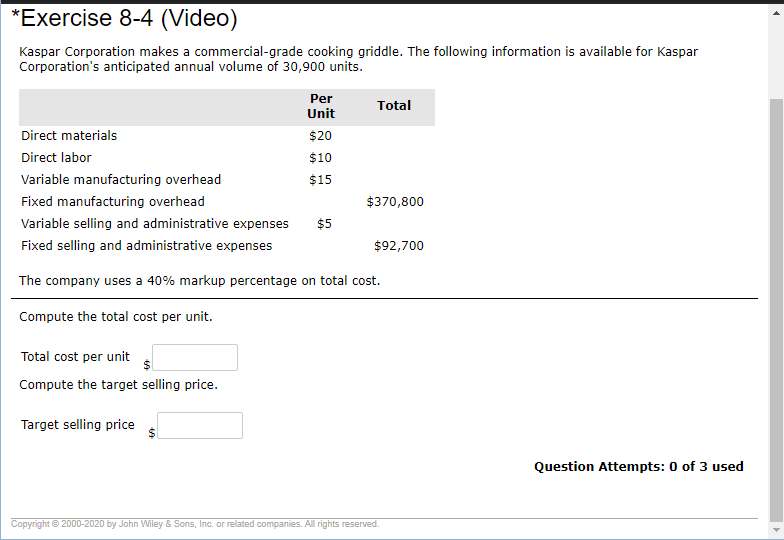

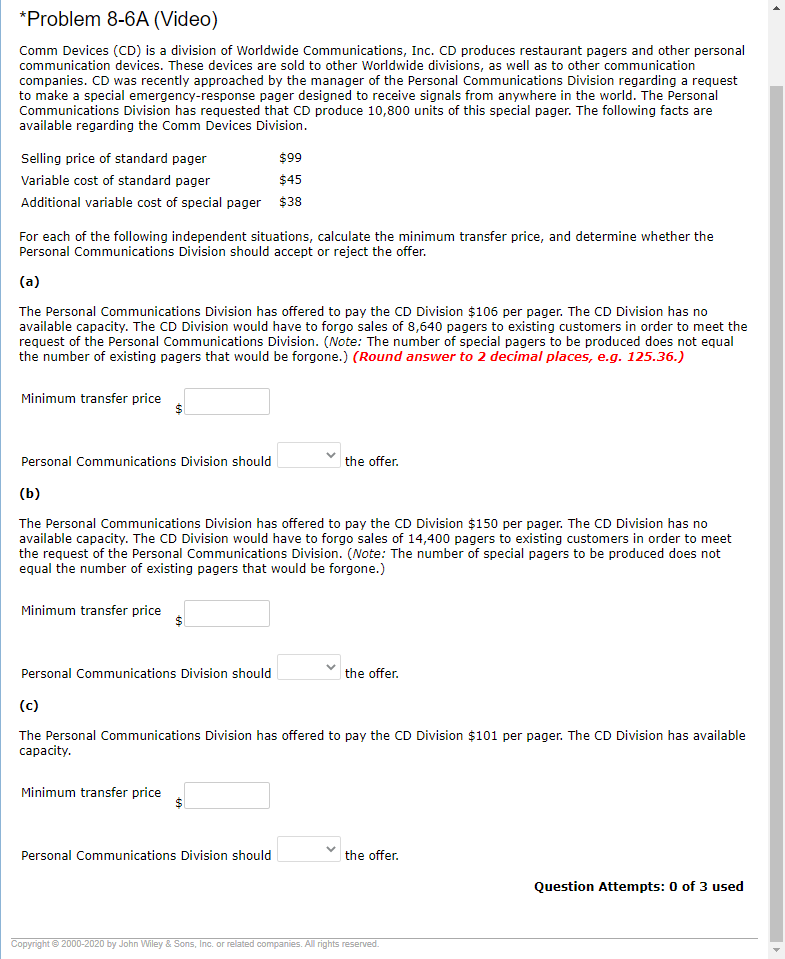

Exercise 8-7 (Video) Gibbs Corporation produces industrial robots for high-precision manufacturing. The following information is given for Gibbs Corporation. Per Unit Total Direct materials $420 Direct labor $300 Variable manufacturing overhead $ 74 Fixed manufacturing overhead $1,738,000 Variable selling and administrative expenses $ 58 Fixed selling and administrative expenses $ 401,320 The company has a desired ROI of 18%. It has invested assets of $63,516,000. It anticipates production of 3,160 units per year. Compute the cost per unit of the fixed manufacturing overhead and the fixed selling and administrative expenses. Fixed manufacturing overhead per unit Fixed selling and administrative expenses $ per unit Compute the desired ROI per unit. ROI per unit Compute the target selling price. Target selling priceThe Appraisal Department of Jean Bank performs appraisals of business properties for leans being considered bv the bank and appraisals for home buvers that are nancing their purchase through some other nancial institution. The department charges $159 per home appraisal, and its variable costs are $133 per appraisal. Recently, Jean Bank has opened its own HomeLoan Department and I.vants the Appraisal Department to perform 1,460 appraisals on all Jean Banknanced home loans. Bank management feels that the cost of these appraisals to the HomeLoan Department should be $145. The variable cost per appraisal to the HomeLoan Department would be $8 less than those performed for outside customers due to savings in administrative costs. {a} Determine the minimum transfer price, assuming the Appraisal Department has excess capacity. Minimum transfer price $ {b} Determine the minimum transfer price, assuming the Appraisal Department has no excess capacity. Minimum transfer price $ {It} Assuming the Appraisal Department has no excess capacity, should management force the department to charge the Home-Loan Department onl'l:r $145? Question Attempts: D of 3 used Exercise 8-4 (Video) Kaspar Corporation makes a commercial-grade cooking griddle. The following information is available for Kaspar Corporation's anticipated annual volume of 30,900 units. Per Unit Total Direct materials $20 Direct labor $10 Variable manufacturing overhead $15 Fixed manufacturing overhead $370,800 Variable selling and administrative expenses $5 Fixed selling and administrative expenses $92,700 The company uses a 40% markup percentage on total cost. Compute the total cost per unit. Total cost per unit $ Compute the target selling price. Target selling price $1 Question Attempts: 0 of 3 used Copyright @ 2000-2020 by John Wiley & Sons, Inc. or related companies. All rights reserved.*Problem 8-615. (Video) Comm Devices {CD} is a division of Worldwide Communications, Inc. CD produces restaurant pagers and other personal communication devices. These devices are sold to other Worldwide divisions, as well as to other communication companies. CD was recently approached by the manager of the Personal Communications Division regarding a request to make a special emergencyresponse pager designed to receive signals from anywhere in the world. The Personal Communications Division has requested that CD produce 10,800 units of this special pager. The following facts are available regarding the Comm Devices Division. Selling price of standard pager $99 1variable cost of standard pager $45 Additional variable cost of special pager $38 For each of the following independent situations, calculate the minimum transfer price, and determine whether the Personal Communications Division should accept or reject the offer. (a) The Personal Communications Division has offered to pay the CD Division $106 per pager. The CD Division has no available capacity. The CD Division would have to forgo sales of 8,640 pagers to existing customers in order to meet the request of the Personal Communications Division. (Note: The number of special pagers to be produced does not equal the number of existing pagers that would be forgone.) {Round answer to: 2 decimal places, e.g'. 125.35.} Minimum transfer price . . . . . V Personal Communlcatlons DIvISIon should the offer. (h) The Personal Communications Division has offered to pay the CD Division $150 per pager. The CD Division has no available capacity. The CD Division would have to forgo sales of 14,400 pagers to existing customers in order to meet the request of the Personal Communications Division. (Note: The number of special pagers to be produced does not equal the number of existing pagers that would be forgone.) Minimum transfer price . . . . . V Personal Communlcatlons DIvISIon should the offer. (It) The Personal Communications Division has offered to pay the CD Division $101 per pager. The CD Division has available capacity. Minimum transfer price Personal Communlcatlons DIvISIon should the offer. Question Attempts: D of 3 used Copyrigt1 2000-2020 oy John Wiley 3: Ems. he. or 'EaTEEI con~ :a'l es. .4. rights 'EEEr'lI'Ed