Need help with these questions.

Below are trial balances and financial statements. Need help with further

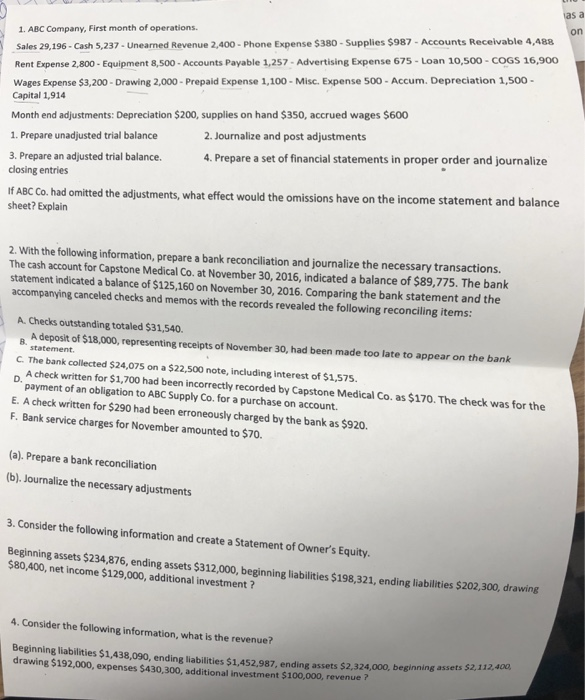

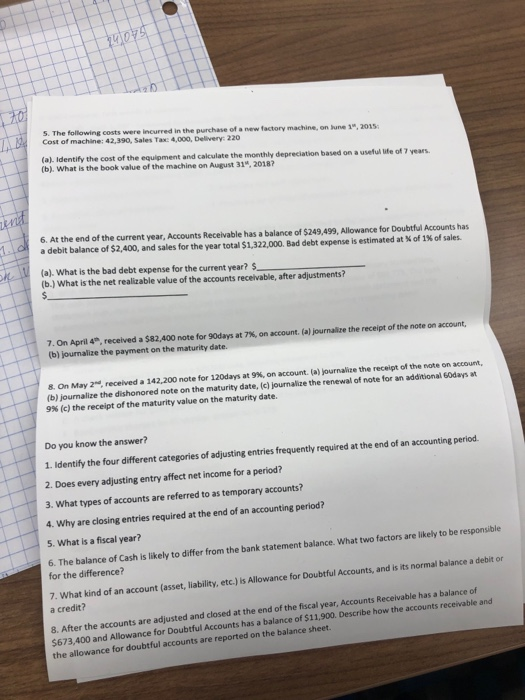

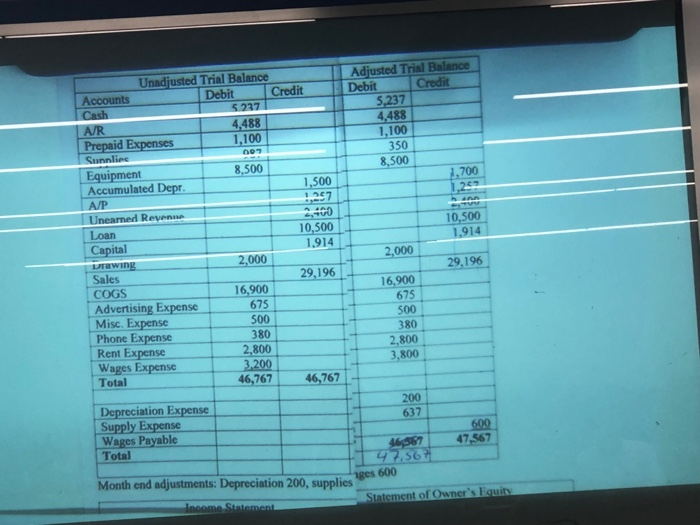

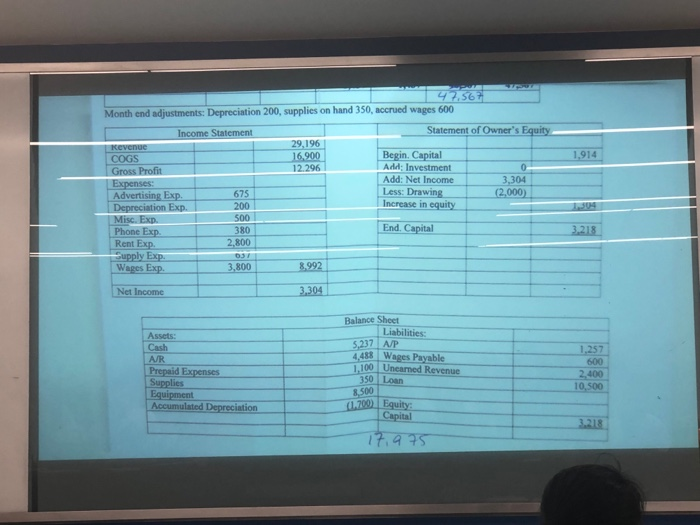

as a 1. ABC Company, First month of operations sales 29,196-Cash 5,237-Unearned Revenue 2,400 - Phone Expense $380-Supplies $987-Accounts Receivable 4,488 Rent Expense 2,800 - Equipment 8,500 - Accounts Payable 1,257-Advertising Expense 675-Loan 10,500-COGS 16,900 Wages Expense $3,200-Drawing 2,000-Prepaid Expense 1,100- Misc. Expense 500-Accum. Depreciation 1,500- Capital 1,914 Month end adjustments: Depreciation $200, supplies on hand $350, accrued wages $600 1. Prepare unadjusted trial balance 3. Prepare an adjusted trial balance closing entries 2. Journalize and post adjustments 4. Prepare a set of financial statements in proper order and journalize ABC Co. had omitted the adjustments, what effect would the omissions have on the income statement and balance sheet? Explain 2. With the following information, prepare a bank reconciliation and journalize the necessary transactions. The cash account for Capstone Medical Co. at November 30, 2016, indicated a balance of $89,775. The bank statement indicated a balance of $125,160 on November 30, 2016. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: A. Checks outstanding totaled $31,540 B. A deposit of $18,000, representing receipts of November 30, had been made too late to appear on the bank statement. C. The bank collected $24,075 on a $22,500 note, including interest of A check written for $1,700 had been incorrectly recorded by Capstone D. Medical Co. as $170. The check was for the payment of an obligation to ABC Supply Co. for a purchase on account. E. A check written for $290 had been erroneously charged by the bank as $920. F. Bank service charges for November amounted to $70 (a). Prepare a bank reconciliation b). Journalize the necessary adjustments 3. Consider the following information and create a Statement of Owner's Equity. Begining ssts$5234 876, ending assets 312,000 beginning liabities $198,321, ending liblities $202,30o, drawing $80,400, net income $129,000, additional investment? 4. Consider the following information, what is the revenue? Beginning liabilities $1,438,09o, ending liabilities $1,452,987, ending assets $2,324,000, beginning assets $2,112 drawing $192,000, expenses $430,300, additional investment $100,000, revenue i g assets $2,112,400 5. The following costs were incurred in the purchase of a new factory machine, on June 1", 2015 Cost of machine: 42,390, Sales Tax: 4,000, Delivery: 220 (a). Identify the cost of the equipment and calculate the monthly depreciation based on a useful life of 7 years. (b) What is the book value of the machine on August 31, 2018? 6. At the end of the current year, Accounts Receivable has a balance of $249,499, Allowance for Doubtful Accounts has a debit balance of $2.400, and sales for the year total $1,322,000. Bad debt expense is estimated at % of 1% of sales. (a). What is the bad debt expense for the current year?s (b.) What is the net realizable value of the accounts receivable, after adjustments? 7. On April 4, received a $82,400 note for 90days at 7%, on account. (a) journale the receipt of the note on account, (b) journalize the payment on the maturity date. 8, O, May 2.. received a 142,200 note for 120days at 9%, on account. (a) journalize the receipt of the note on account. (b) journalize the dishonored note on the maturity date, (c) journalize the renewal of note for an additional 60days at 9% (c) the receipt of the maturity value on the maturity date. Do you know the answer? 1. dentify the four different categories of adjusting entries frequently required at the end of an accounting period. 2. Does every adjusting entry affect net income for a period? 3. What types of accounts are referred to as temporary accounts? 4. Why are closing entries required at the end of an accounting period? 5. What is a fiscal year? 6. The balance of Cash is likely to differ from the bank statement balance. What two factors are likely to be responsible for the difference? 7. What kind of an account (asset, liability, etc.) is Allowance for Doubtful Accounts, and is its normal balance a debit or a credit? 8. After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $673,400 and Allowance for Doubtful Accounts has a balance of $11,900. Describe how the accounts receivable and the allowance for doubtful accounts are reported on the balance sheet. Unadjusted Trial Balance Adjusted Trial Balance Debit Credit Debit Credit 5,237 4.488 1,100 350 8,500 4,488 1,100 Prepaid Expenses Equipment 8,500 Accumulated Depr 1,500 10,500 1,914 Loan 10,500 1914 2,000 2,000 urawing 29,196 29,196 16,900 COGS Advertising Expense Misc. Expense Phone Expense Rent Expense Wages Expense3,200 Total 16,900 675 500 380 675 500 380 2,800 3,800 2,800 767 767 200 637 Depreciation Ex Supply Expense Wages Payable Total 47,567 Month end adjustments: Depreciation 200, supplies ges 600 Month end adjustments: Depreciation 200, supplies on hand 350, accrued wages 600 Statement of Owner's Equity 29,196 COGS Begin. Capital 1,914 12.296 Add: Investment Add: Net Income Less: Drawing Increase 3,304 (2,000) 675 200 500 380 2,800 Advertising Exp in equity End. Capital Phone Exp. Rent Supply Exp 3,800 8,992 Net Income Balance Sheet Liabilities: Assets: Cash A/R 5,237 A/P 4,488 Wages Payable 1,100 Unearmed Revenue 600 400 10,500 Supplies Equipment Accumulated Depreciation 350 Loan 8,500