Need help with these questions

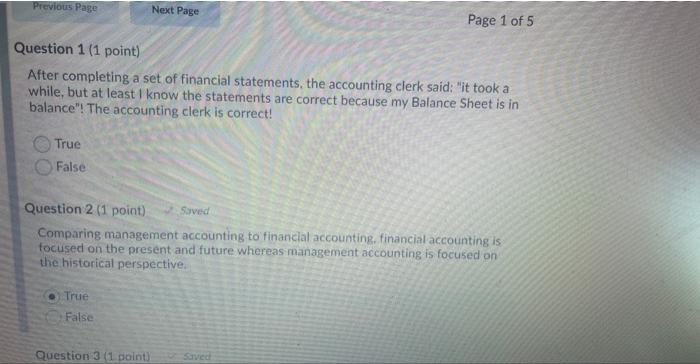

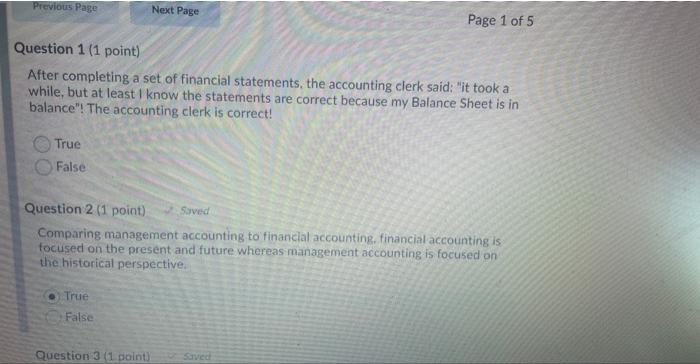

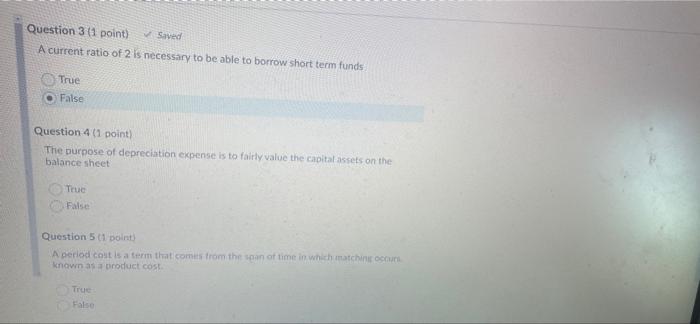

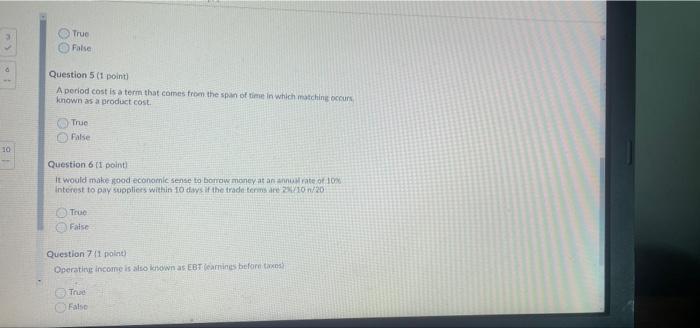

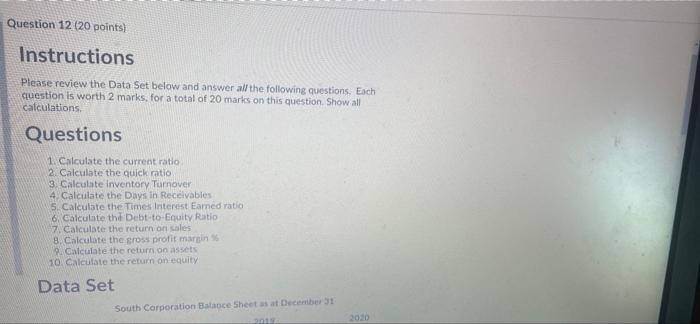

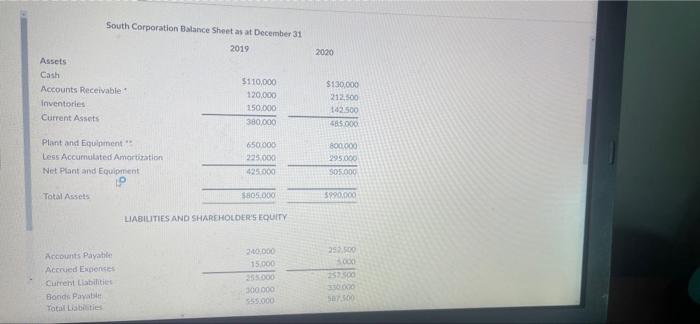

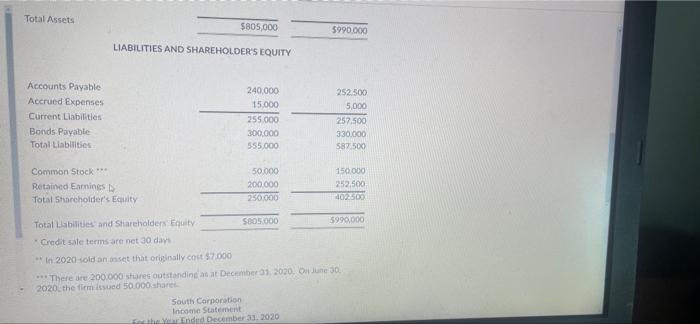

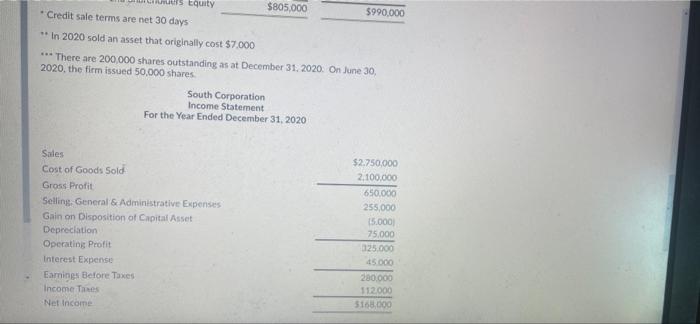

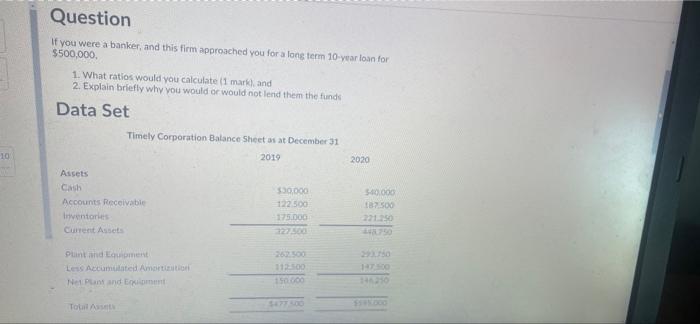

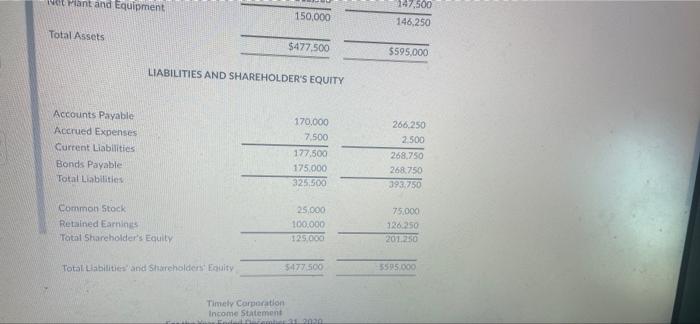

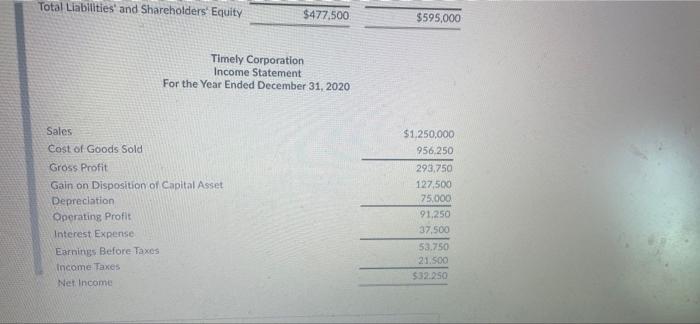

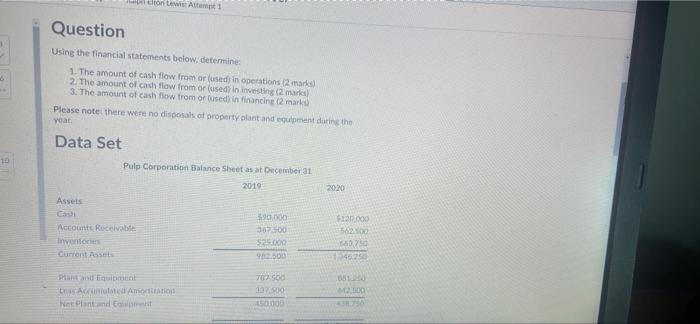

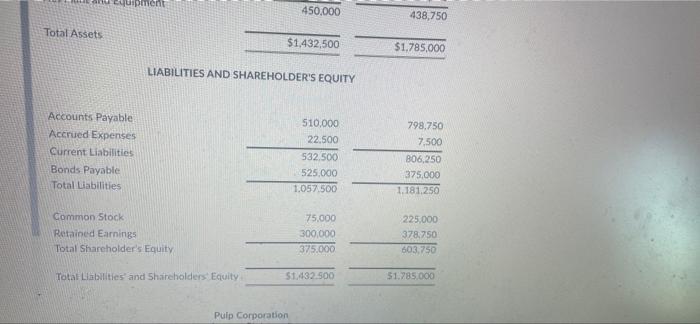

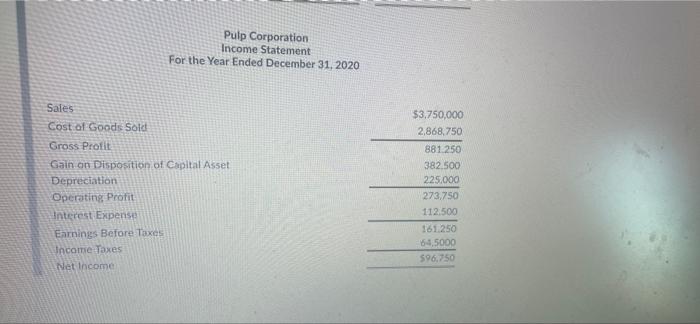

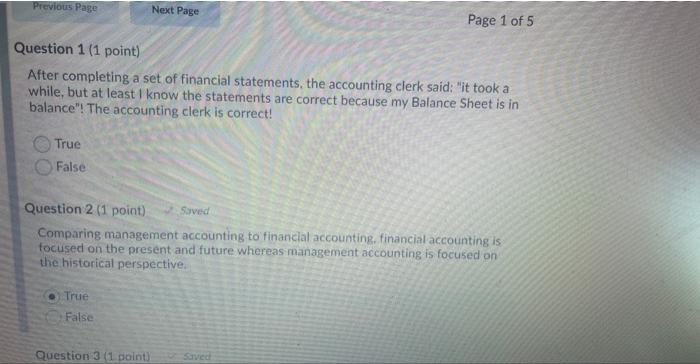

Previous Page Next Page Page 1 of 5 Question 1 (1 point) After completing a set of financial statements, the accounting clerk said: "it took a while, but at least I know the statements are correct because my Balance Sheet is in balance"! The accounting clerk is correct! True False Question 2 (1 point) saved Comparing management accounting to financial accounting, financial accounting is focused on the present and future whereas management accounting is focused on the historical perspective. True False Question 3 (1 point) Sved Question 3 (1 point) Saved A current ratio of 2 is necessary to be able to borrow short term funds True False Question 41 point) The purpose of depreciation expense is to fairly value the capital assets on the balance sheet True False Question 501 point) A period cost is a term that comes from the son of time in which machine known as a product cost True False True False o Question 5 (1 point) A period cost is a term that comes from the span of time in which matching occurs known as a product cost. True False 10 18 Question 6 (1 point) It would make mood economic sense to borrow money at an anate of 10 Interest to pay suppliers within 10 days if the trade tem 20/10/20 True False Question 711 point) Operating income is also known as EBT learnines before os Thu False Question 12 (20 points) Instructions Please review the Data Set below and answer all the following questions. Each question is worth 2 marks, for a total of 20 marks on this question. Show all calculations. Questions 1. Calculate the current ratio 2. Calculate the quick ratio 3. Calculate Inventory Turnover 4 Calculate the Days in Receivables 5. Calculate the Times Interest Earned ratio 6. Calculate the Debt-to-Equity Ratio 7. Calculate the return on sales 8. Calculate the cross profit margin 9. Calculate the return on assets 10. Calculate the return on equity Data Set South Corporation Balance Sheet us at December 31 South Corporation Balance Sheet as at December 31 2019 2020 Assets Cash Accounts Receivable Inventories Current Assets $110,000 120,000 150,000 380.000 $130,000 212,500 102500 485.000 Plant and Equipment Less Accumulated Amortization Net Plant and Equipment P Total Assets 650.000 225.000 425.000 800.000 295.000 SO1000 SBO5.000 5990.000 LIABILITIES AND SHAREHOLDER'S EQUITY 200.000 15.000 25000 300 000 5.000 25.500 5000 2500 Accounts Payable Accrued Expenses Current Liabilities Bonds Payable Total Lisbe 57.00 Total Assets $805,000 5990.000 LIABILITIES AND SHAREHOLDER'S EQUITY Accounts Payable Accrued Expenses Current Liabilities Bonds Payable Total Liabilities 240.000 15.000 255.000 300.000 555,000 252.500 5,000 257.500 330.000 587.500 Common Stock *** Retained Earnings Total Shareholder's Equity 50.000 200.000 230000 150.000 252.500 40200 Total abilities and Shareholders Equity S805.000 5990,000 Credit sale terms are net 30 days In 2020 sold on set that originally cost $7.000 *** There are 200.000 shares outstanding atat December 2020. On June 30 2020 the firm issued 50.000 share South Corporation Income Statement Ended December 31, 2020 Equity $805.000 $990,000 Credit sale terms are net 30 days ** In 2020 sold an asset that originally cost $7.000 *** There are 200.000 shares outstanding as at December 31, 2020. On June 30, 2020, the firm issued 50,000 shares South Corporation Income Statement For the Year Ended December 31, 2020 Sales Cost of Goods Sold Gross Profit Selling General & Administrative Expenses Gain on Disposition of Capital Asset Depreciation Operating Profit Interest Expense Earnings Before Taxes Income Taxes Net Income $2.750,000 2.100.000 650.000 255,000 15.000 75.000 325.000 45.000 280.000 112.000 5168,000 Question If you were a banker, and this firm approached you for a long term 10-year loan for $500,000 1. What ratios would you calculate 1 mark, and 2. Explain briefly why you would or would not lend them the funds Data Set 10 2020 Timely Corporation Balance Sheet us at December 31 2019 Assets Cash $30.000 Accounts Receivable 122.500 Inventaries 125.000 Current Asset 25 500.000 187.500 221150 2625 Punt and Equiment Lens Accumulated Amortization Nel Pant and Enim HO 12 150 Tot Wa Miant and Equipment 150,000 147,500 146,250 Total Assets $477,500 5595.000 LIABILITIES AND SHAREHOLDER'S EQUITY Accounts Payable Accrued Expenses Current Liabilities Bonds Payable Total Liabilities 170,000 7.500 177.500 175.000 325,500 266,250 2.500 268.750 268.750 393,750 Common Stock Retained Earnings Total Shareholder's Equity 25.000 100.000 125.000 75.000 126.250 20120 Total abilities and Shareholders Equity 5477.500 5525.000 Timely Corporation Income Statement Total Liabilities and Shareholders' Equity $477.500 $595,000 Timely Corporation Income Statement For the Year Ended December 31, 2020 Sales Cost of Goods Sold Gross Profit Gain on Disposition of Capital Asset Depreciation Operating Profit Interest Expense Earnings Before Taxes Income Taxes Net Income $1,250,000 956.250 293.750 127,500 75.000 91.250 37.500 53.750 21.500 $32.250 to wis Attent1 Question Using the financial statements below. determine 1. The amount of cash flow from or used in operations (2 marks) 2 The amount of cash flow from or used in investing (2 market 3. The amount of cash flow from or used in financing (2 mark Please note there were no disposals ct property blant and equipment during the Year Data Set 2020 Pulp Corporation Balance Sheetas at December 31 2019 Assets G 590.000 Accounts Receivable 107.00 Inventorien S2000 Current Asset 9.00 $12.00 502.00 0.750 14025 Pantun And Amato hat Plant and cannot 13 10 100 equipment 450.000 438,750 Total Assets $1,432,500 $1,785.000 LIABILITIES AND SHAREHOLDER'S EQUITY Accounts Payable Accrued Expenses Current Liabilities Bonds Payable Total Liabilities 510,000 22.500 532.500 525.000 1.057.500 798.750 7,500 806,250 375.000 1.181.250 Common Stock Retained Earnings Total Shareholder's Equity 75.000 300,000 375.000 225.000 378,750 603.750 Total Liabilities and Shareholders Equity 51.432.500 51.785.000 Puip Corporation Pulp Corporation Income Statement For the Year Ended December 31, 2020 Sales Cost of Goods Sold Gross Profit Gain on Disposition of Capital Asset Depreciation Operating Profit Interest Expense Earnings Before Taxes Income Taxes Net Income $3,750,000 2.868.750 881.250 382.500 225.000 273.750 112.500 161.250 64,5000 596,750