Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with these thank you Question 29 (2.5 points) The tax treatments of assets affects the term structure of interest rates True False Question

Need help with these thank you

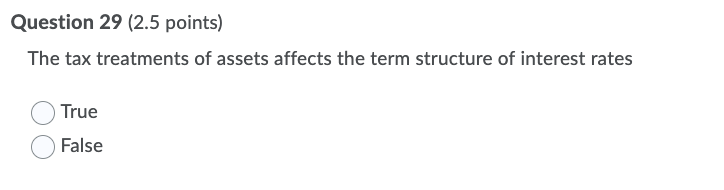

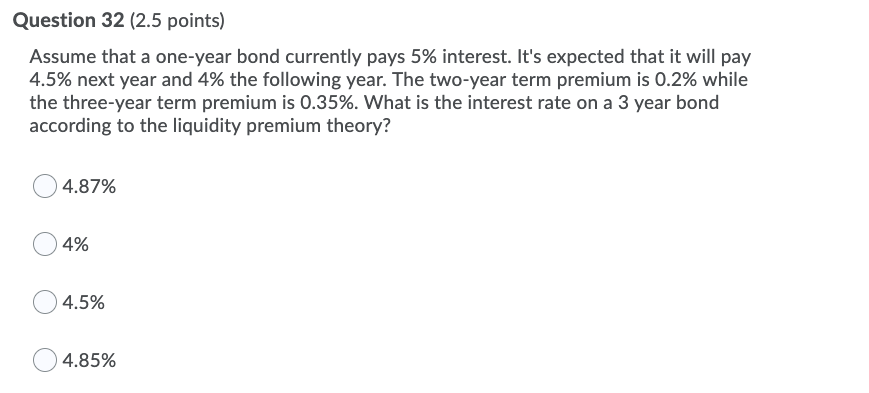

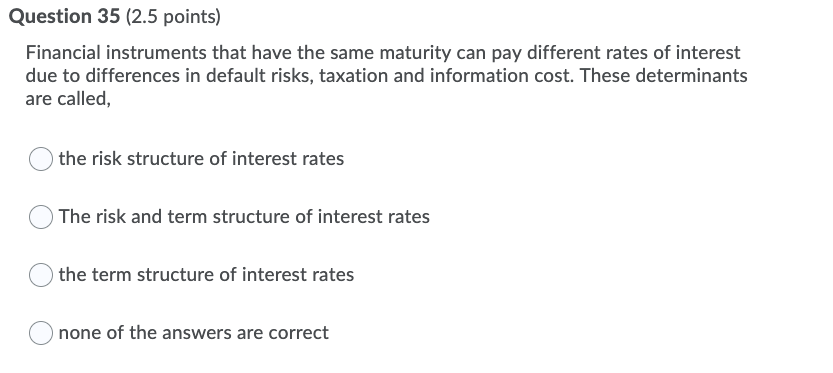

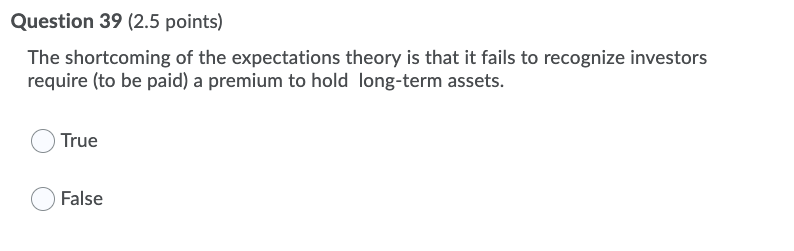

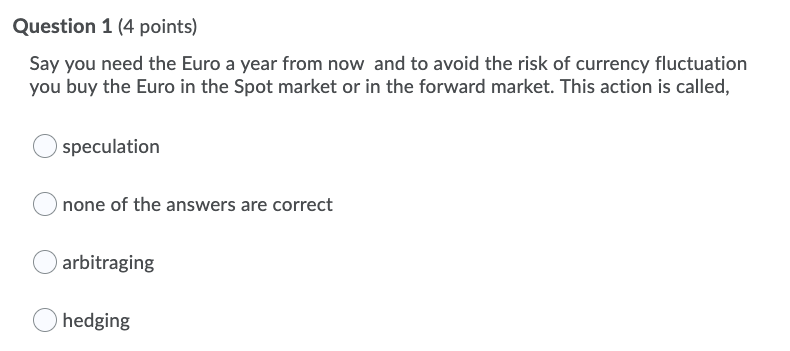

Question 29 (2.5 points) The tax treatments of assets affects the term structure of interest rates True False Question 32 (2.5 points) Assume that a one-year bond currently pays 5% interest. It's expected that it will pay 4.5% next year and 4% the following year. The two-year term premium is 0.2% while the three-year term premium is 0.35%. What is the interest rate on a 3 year bond according to the liquidity premium theory? 4.87% 04% 4.5% 04.85% Question 35 (2.5 points) Financial instruments that have the same maturity can pay different rates of interest due to differences in default risks, taxation and information cost. These determinants are called, the risk structure of interest rates The risk and term structure of interest rates the term structure of interest rates Onone of the answers are correct Question 39 (2.5 points) The shortcoming of the expectations theory is that it fails to recognize investors require (to be paid) a premium to hold long-term assets. True False Question 1 (4 points) Say you need the Euro a year from now and to avoid the risk of currency fluctuation you buy the Euro in the Spot market or in the forward market. This action is called, speculation Onone of the answers are correct arbitraging hedgingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started