Answered step by step

Verified Expert Solution

Question

1 Approved Answer

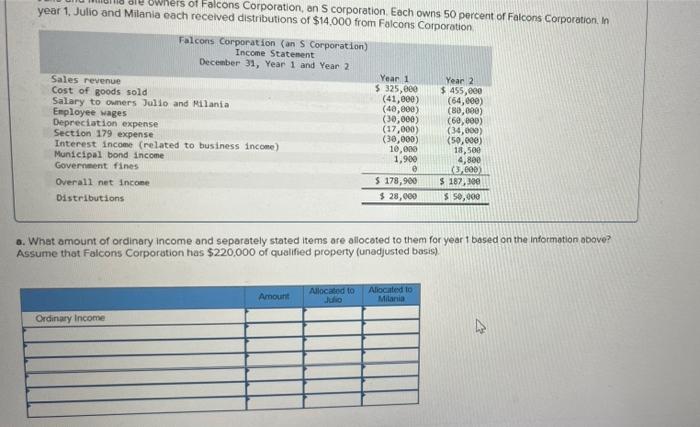

need help with this( all are one question!) Owners of Falcons Corporation, on s corporation Each owns 50 percent of Falcons Corporation. In year 1,

need help with this( all are one question!)

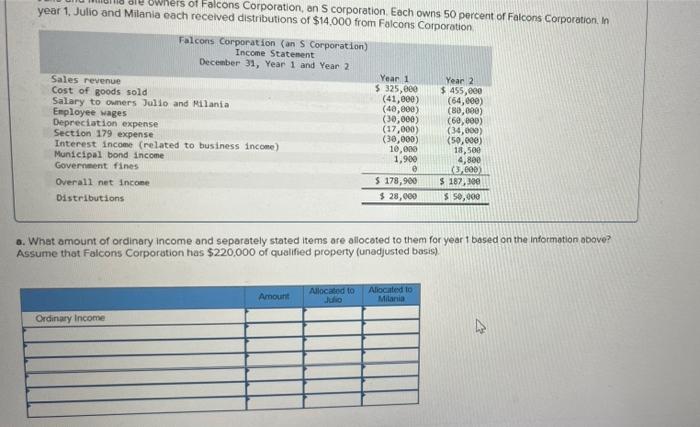

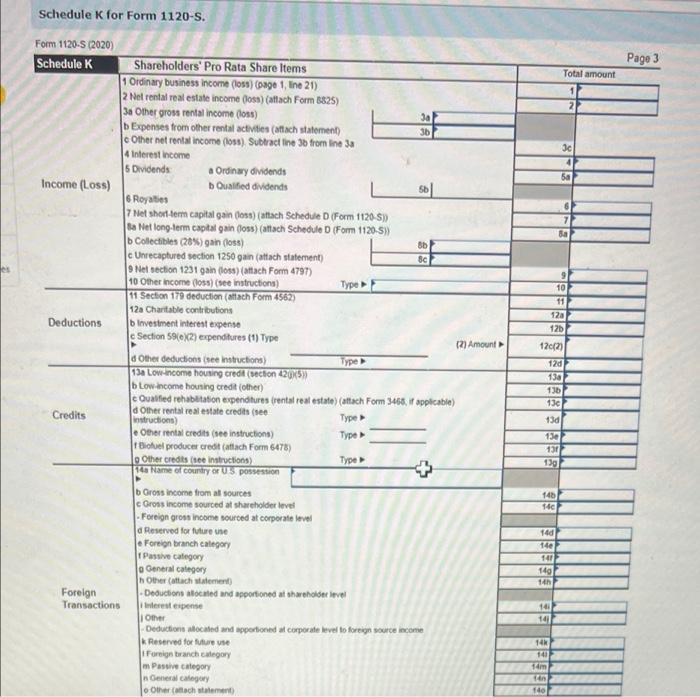

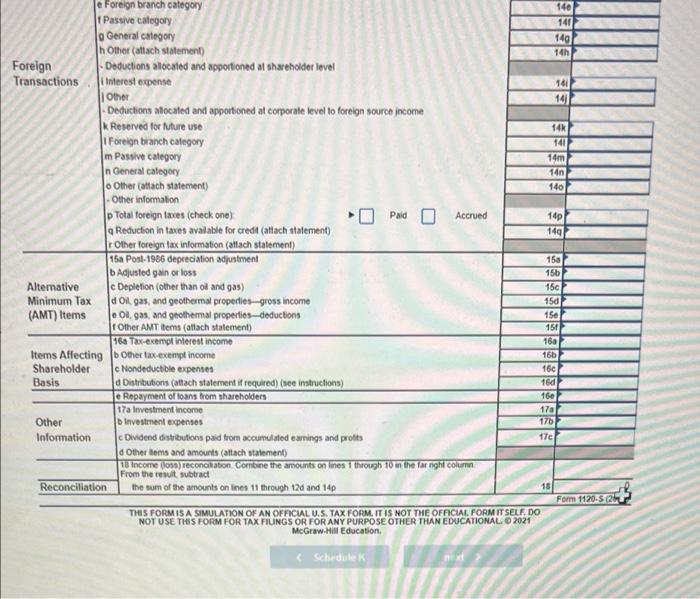

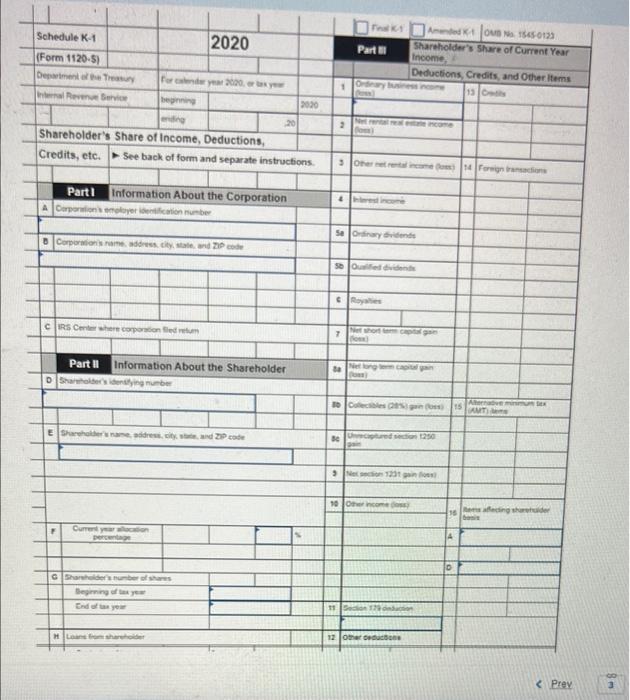

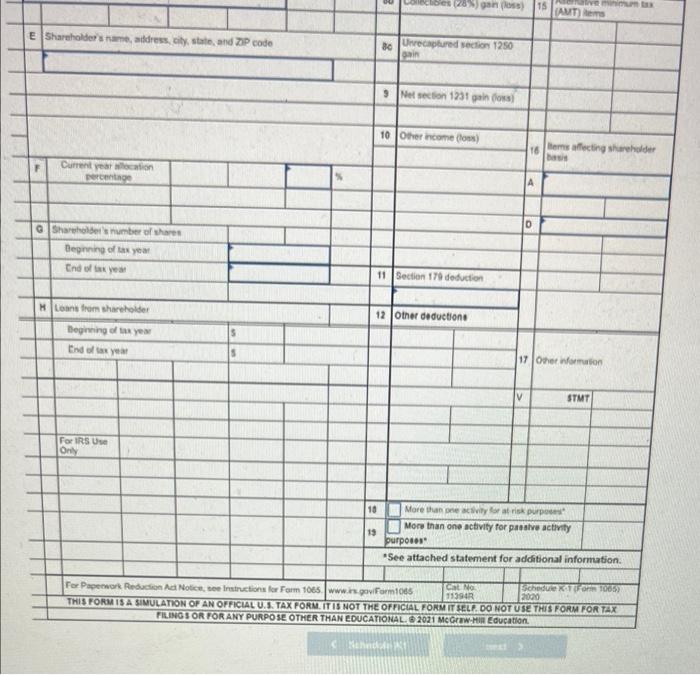

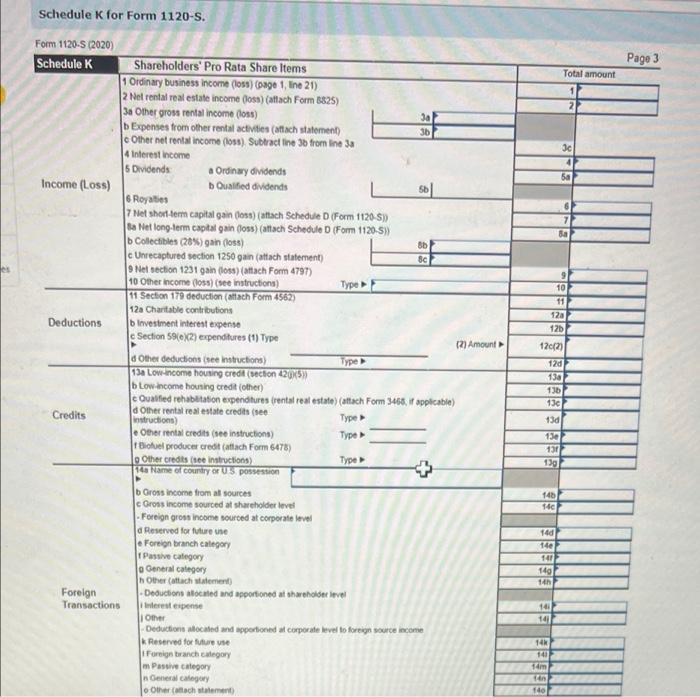

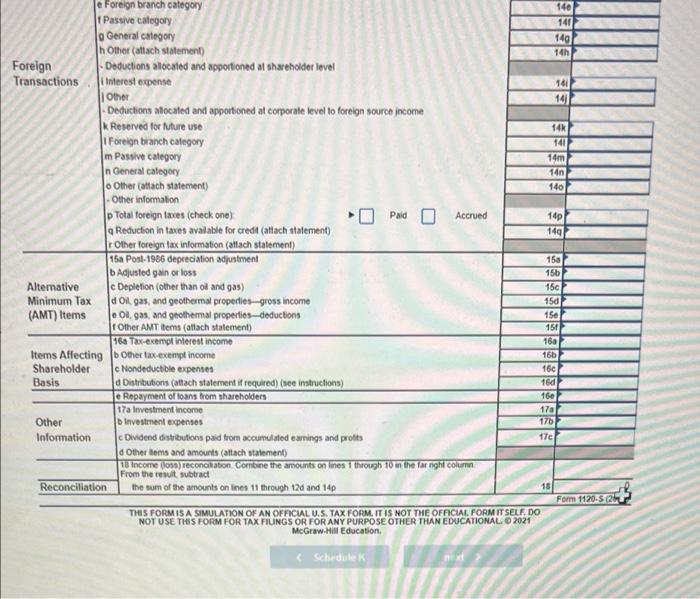

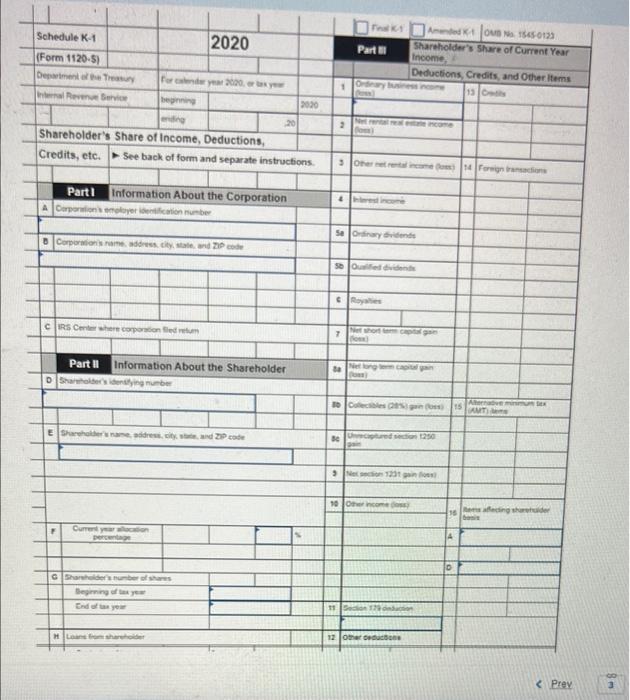

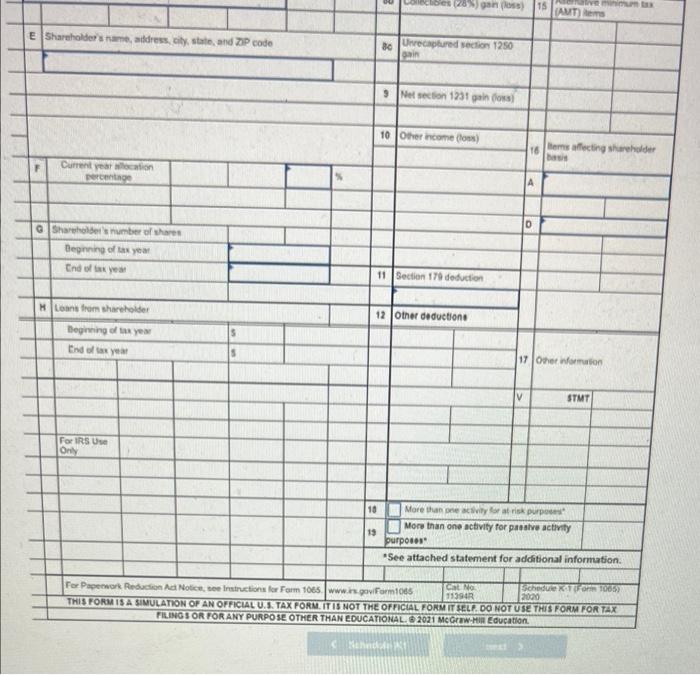

Owners of Falcons Corporation, on s corporation Each owns 50 percent of Falcons Corporation. In year 1, Julio and Milania each received distributions of $14.000 from Falcons Corporation Falcons Corporation (ans Corporation) Income Statement December 31, Year 1 and Year 2 Year 1 Sales revenue Year 2 $325,000 $ 455,000 Cost of goods sold (41,000) (64,000) Salary to Owners Julio and Milania (48,000) (80,000) Employee wages (30,000) (60,000) Depreciation expense (17,000) (34,000) Section 179 expense (30,000) (50,000) Interest income (related to business income 10,000 18,500 Municipal bond income 1,900 4,800 Government fines (3.600 $ 178,900 $ 187,100 Overall net income $ 28,000 550,000 Distributions 8. What amount of ordinary income and separately stated items are allocated to them for year 1 based on the information above? Assume that Falcons Corporation has $220,000 of qualified property (unadjusted basis) Amount Allocated to Julho Allocated to Milano Ordinary Income Page 3 Total amount Jc 50 Ba es 9 10 11 120 120 Schedule K for Form 1120-s. Form 1120-S (2020) Schedule K Shareholders' Pro Rata Share Items 1 Ordinary business income (108) (page 1. line 21) 2 Nel rental real estate income (osa) (aflach Form 6825) 3a Other gross rental income (oss) Ja Expenses from other rental activities (attach statement) 36 c Other net rental income (1088) Subtract line 3b from Ine 33 4 Interest income 5 Dividends Ordinary dividends Income (Loss) Oualified dividends 50 6 Royalties 7 Met short term capital gain (los) (attach Schedule D (Form 1120-5) sa Netlong-term capital gain (1038) (attach Schedule D (Form 1120-5) b Collectibles (20%)gain (5) Bb CUnrecaptured section 1250 gan (attach statement) Sc 9 Net section 1231 gain (08) (attach Form 4797) 10 Other income (1053) (see instructions) Type 11 Section 179 deduction (attach Form 4562) 120 Charitable contributions Deductions bInvestment interest expense Section 59(2) expenditures (1) Type (2) Amount d Other deducions see instructions) Type 138 Low.income housing credit (section 42057 bLow.income housing credit (other) Oualified rehabilitation expenditures frental real estate) (attach Form 3466, if applicable) Credits Other rentat real estate credits (see instructions) Type ener rental credits (see instructions) Type Biofuel producer credit (attach Form 6478) Other credits tee instructions) Type 14 Name of Country US POSSES b Gross income from all sources C Gross income sourced at shareholder level Foreign gross income sourced at corporate level a Reserved for future te e Foreign branch Category Passive category o General Category Other (attach statement Foreign -Deduction located and apportioned at shareholder level Transactions Interest expense Other Deduction socated and portioned of corporate level to foreign source income Reserved for future se Foreign branch Category m Passive Category General Category o Other (lach statement 12012) 120 138 130 13c 13d 13e 131 139 140 140 Te 14e 141 140 10 141 14 14K 10 um 40 e Foreign branch category 14e Passive category 141 General category 149 h Other (attach statement) 14h Foreign Deductions allocated and apportioned at shareholder level Transactions Interest expense 141 Other 141 Deductions alocated and apportioned al corporate level to foreign source income 6 k Reserved for future use 14K 1 Foreign branch category 141 m Passive category 14m In General Category Other (attach statement) 140 Other information p Total foreign taxes (check one) Paid Accrued 14p Reduction in taxes available for credit (attach statement) 149 Other foreign tax information (attach statement 15a Posl-1986 depreciation adjustment 150 b Adjusted gain or loss 150 Altemative c Depletion (other than ol and gas) 15C Minimum Tax d Oilgas, and geothermal properties-gross income 150 (AMT) Items e Olgas, and geothermal properties-deductions 15e Other AMT tems (attach statement 157 16a Tax-exempt interest income 160 Items Affecting Other tax-exempt income Shareholder c Nondeductible expenses 160 Basis a Distributions (attach statement if required) (see instructions) 160 e Repayment of loang from shareholders 160 17a Investment income 170 Other Investment expenses 176 Information Dividend distributions paid from accumulated earnings and protes 17c d Other bems and amounts (attach statement) 118 Income (055) reconciliation Combine the amounts on lines through 10 in the far right column From the result subtract Reconciliation the sum of the amounts on line 11 through 120 and 140 Form 1120.5 26 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF, DO NOT USE THIS FORM FOR TAX FIUINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. O 2021 McGraw-Hill Education. 165 s Schedule Part KOVO 15450122 Shareholder's Share of Current Year Income Deductions, Credits, and other items 1 Omary Schedule K-1 2020 (Form 1120-5) Department het Por year 2000 havice 2020 20 Shareholder's Share of income, Deductions, Credits, etc. See back of form and separate instructions 2 3 ore Fordon 7 Partl Information About the Corporation A Corporation erection number & Salonary Corporations des de 50 din RS Cheroportionem or Part II Information About the Shareholder She's doing number tatlong C 15 A AMT E Share address and Berecho 1250 123 10 other come menghider F Current A GShahborosas Bering ty Ond you 11 12 other

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started