need help with this assignment

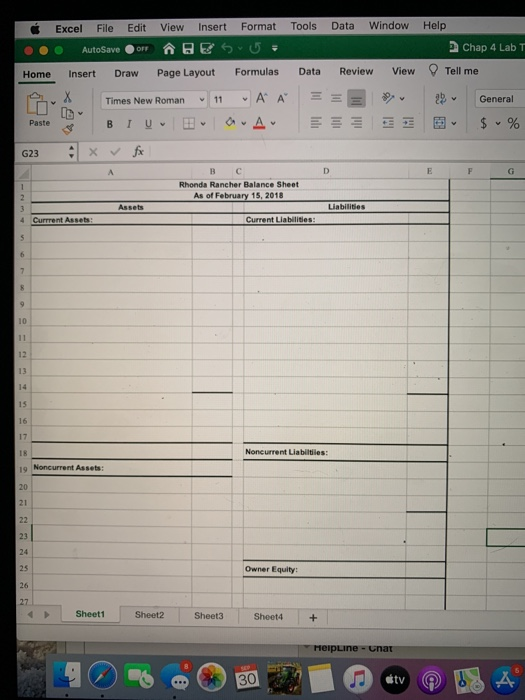

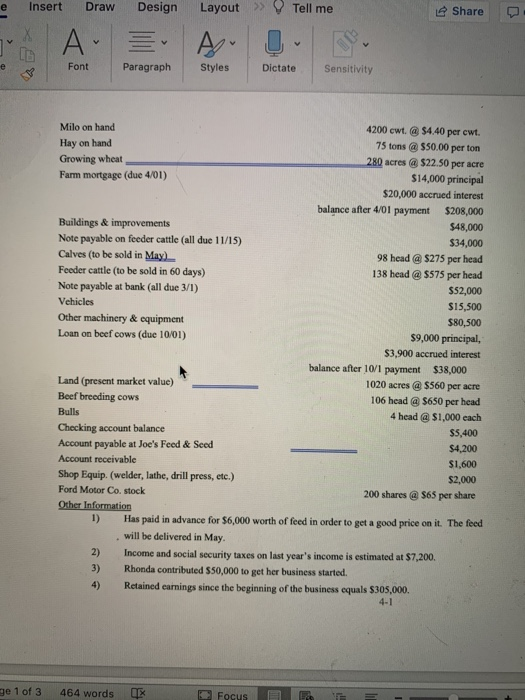

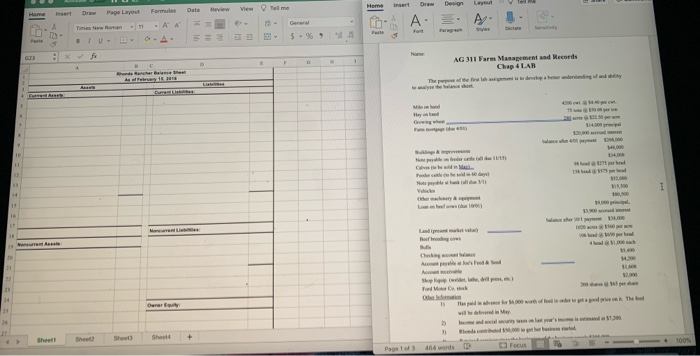

Home Tume insert Design Formulas Vie Data Home Page Layout ser AA General . 9 il Puste fo 0 AG 311 Farm Management and Records Chap 4 LAR 5140 14 ho 4. 34 15 1 will be Sheet Sheet Sheet Sheet + 100 Pato 464 words Excel File Edit View Insert Format Tools Data Window Help AutoSave OFF Chap 4 Lab T Home Insert Draw Page Layout Formulas Data Review View Tell me X 11 Times New Roman = 2 General v ' a. Au Paste BIU IM $ % G23 X fx D E F G 1 2 Rhonda Rancher Balance Sheet As of February 15, 2018 Assets Liabilities Current Assets Current Liabilities: 5 3 9 10 11 12 13 14 15 16 17 Noncurrent Liabilties: 19 Noncurrent Assets 20 21 22 23 24 25 Owner Equity 26 27 Sheet1 Sheet2 Sheet3 Sheet4 + HelpLine-Unat ... 30 tv A e Insert Draw Design Layout>> Tell me Share A. [D e Font Paragraph Styles Dictate Sensitivity Milo on hand 4200 cwt @ $4.40 per cwt. Hay on hand 75 tons @ $50.00 per ton Growing wheat 280 acres @ $22.50 per acre Farm mortgage (due 4/01) $14,000 principal $20,000 accrued interest balance after 4/01 payment $208,000 Buildings & improvements $48,000 Note payable on feeder cattle (all due 11/15) $34,000 Calves (to be sold in May) 98 head @ $275 per head Feeder cattle (to be sold in 60 days) 138 head @ $575 per head Note payable at bank (all due 3/1) $52,000 Vehicles $15,500 Other machinery & equipment $80,500 Loan on beef cows (due 10/01) $9,000 principal, $3,900 accrued interest balance after 10/1 payment $38,000 Land (present market value) 1020 acres @ $560 per acre Beef breeding cows 106 head @ $650 per head Bulls 4 head @ $1,000 each Checking account balance $5,400 Account payable at Joe's Feed & Seed $4,200 Account receivable $1,600 Shop Equip. (welder, lathe, drill press, etc.) $2,000 Ford Motor Co. stock 200 shares @ $65 per share Other Information 1) Has paid in advance for $6,000 worth of feed in order to get a good price on it. The feed will be delivered in May. 2) Income and social security taxes on last year's income is estimated at $7,200. 3) Rhonda contributed $50,000 to get her business started. 4) Retained earnings since the beginning of the business equals $305,000. 4-1 ge 1 of 3 464 words LE Focus Home Tume insert Design Formulas Vie Data Home Page Layout ser AA General . 9 il Puste fo 0 AG 311 Farm Management and Records Chap 4 LAR 5140 14 ho 4. 34 15 1 will be Sheet Sheet Sheet Sheet + 100 Pato 464 words Excel File Edit View Insert Format Tools Data Window Help AutoSave OFF Chap 4 Lab T Home Insert Draw Page Layout Formulas Data Review View Tell me X 11 Times New Roman = 2 General v ' a. Au Paste BIU IM $ % G23 X fx D E F G 1 2 Rhonda Rancher Balance Sheet As of February 15, 2018 Assets Liabilities Current Assets Current Liabilities: 5 3 9 10 11 12 13 14 15 16 17 Noncurrent Liabilties: 19 Noncurrent Assets 20 21 22 23 24 25 Owner Equity 26 27 Sheet1 Sheet2 Sheet3 Sheet4 + HelpLine-Unat ... 30 tv A e Insert Draw Design Layout>> Tell me Share A. [D e Font Paragraph Styles Dictate Sensitivity Milo on hand 4200 cwt @ $4.40 per cwt. Hay on hand 75 tons @ $50.00 per ton Growing wheat 280 acres @ $22.50 per acre Farm mortgage (due 4/01) $14,000 principal $20,000 accrued interest balance after 4/01 payment $208,000 Buildings & improvements $48,000 Note payable on feeder cattle (all due 11/15) $34,000 Calves (to be sold in May) 98 head @ $275 per head Feeder cattle (to be sold in 60 days) 138 head @ $575 per head Note payable at bank (all due 3/1) $52,000 Vehicles $15,500 Other machinery & equipment $80,500 Loan on beef cows (due 10/01) $9,000 principal, $3,900 accrued interest balance after 10/1 payment $38,000 Land (present market value) 1020 acres @ $560 per acre Beef breeding cows 106 head @ $650 per head Bulls 4 head @ $1,000 each Checking account balance $5,400 Account payable at Joe's Feed & Seed $4,200 Account receivable $1,600 Shop Equip. (welder, lathe, drill press, etc.) $2,000 Ford Motor Co. stock 200 shares @ $65 per share Other Information 1) Has paid in advance for $6,000 worth of feed in order to get a good price on it. The feed will be delivered in May. 2) Income and social security taxes on last year's income is estimated at $7,200. 3) Rhonda contributed $50,000 to get her business started. 4) Retained earnings since the beginning of the business equals $305,000. 4-1 ge 1 of 3 464 words LE Focus

need help with this assignment

need help with this assignment