Need help with this assignment. Please write the answer in the table. Thanks very much.

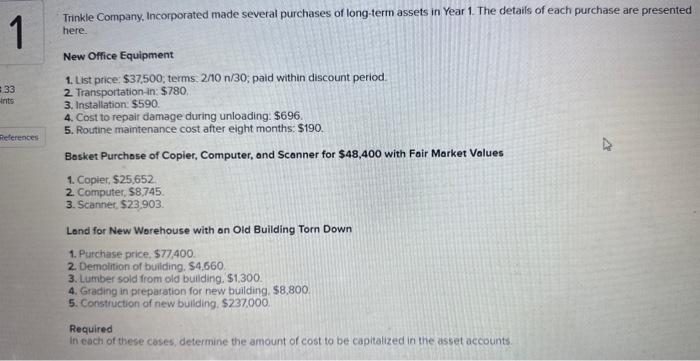

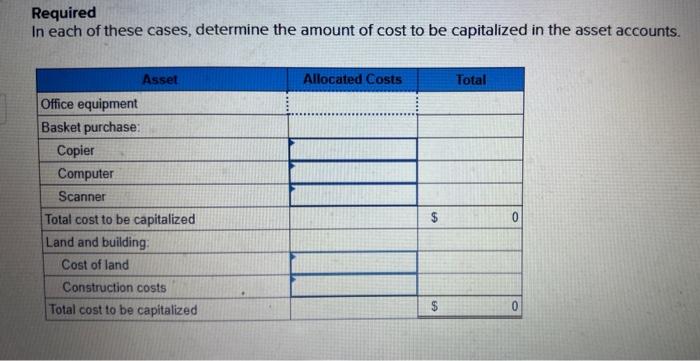

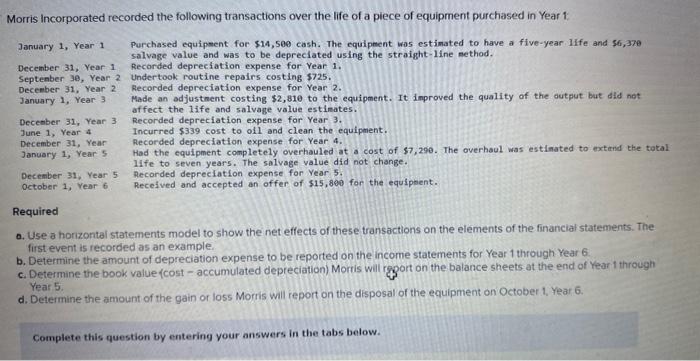

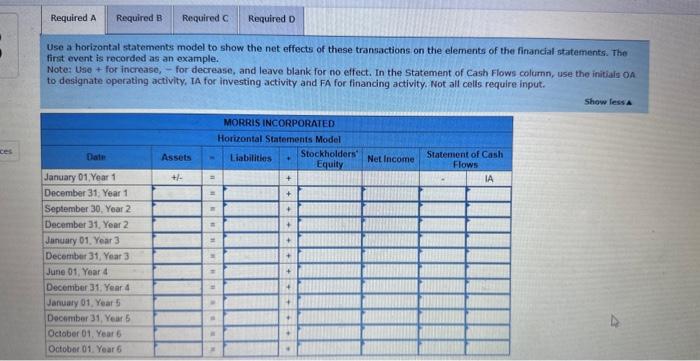

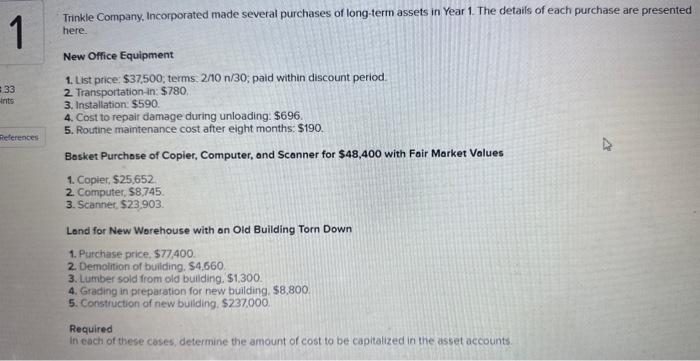

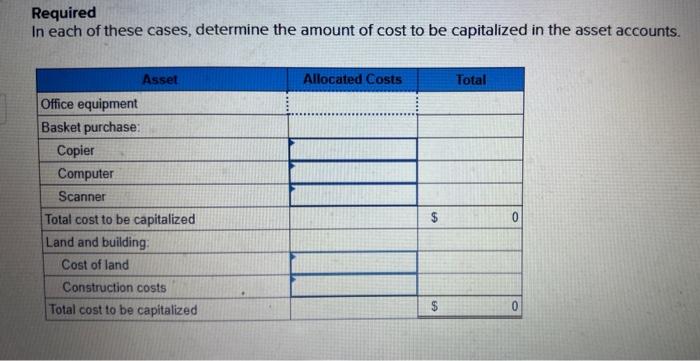

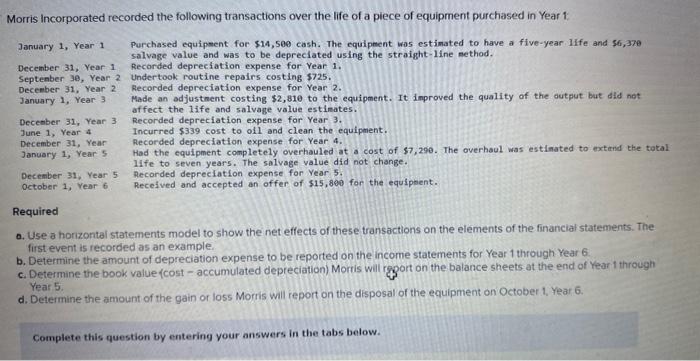

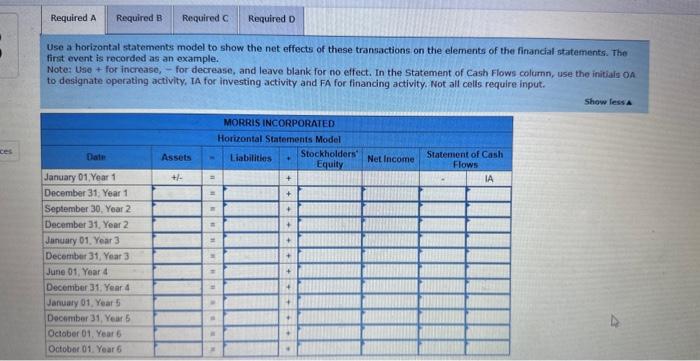

Trinkle Company, Incorporated made several purchases of long-term assets in Year 1 . The details of each purchase are presented here. New Office Equipment 1. List price: $37,500, terms, 2/10n/30; paid within discount period. 2. Transportation-in: $780 3. Installation: $590. 4. Cost to repair damage during unloading: $696. 5. Routine maintenance cost after eight months: $190. Bosket Purchose of Copier, Computer, and Scanner for $48,400 with Fair Market Values 1. Copier, $25,652 2. Computer, 58745 3. Scanner, 523,903 Lond for New Worehouse with an Old Building Torn Down 1. Purchase price, $77,400. 2. Demolition of building, $4,660 3. Lumber sold from old building. $1,300. 4. Grading in preparation for new building, $8,800. 5. Construction of new buliding. $237,000. Required In each of these cases, determine the amount of cost to be capitalized in the asset accounts. Required In each of these cases, determine the amount of cost to be capitalized in the asset accounts. Morris Incorporated recorded the following transactions over the life of a piece of equipment purchased in Year 1 : January 1, Year 1 Purchased equipment for $14,500 cash. The equipment wos estimated to have a five-year 1ife and \$6,37e salvage value and was to be depreclated using the straight-1ine nethod. December 31, Year 1 Recorded depreciation expense for Year 1 . Septenber 3e, Year 2 Undertook routine repalrs costing $725. December 31, Year 2 Recorded depreciation expense for Year 2. January 1, Year 3 Made an adjustment costing $2,810 to the equipment. It improved the quality af the autput but did not 31, Year 3 Recorded depreciation expense for Year 3. . Year 4 Incurred $339 cost to oll and clean the equipment. Recorded depreciation expense for Year 4. January 1, Year 5 . Had the equipment completely overhauled at a cost of 57,290 . The overhaul was estinated to extend the tatal December. 31, Year 5 . Recorded depreciation expense for Year 5 . October 1, Year 6 . Received and accepted an offer of $15,800 for the equipsent. Required a. Use a horizontal statements model to show the net effects of these transactions on the elements of the financial statements. The first event is recorded as an example. b. Determine the amount of depreciation expense to be reported on the income statements for Year 1 through Year 6 . c. Determine the book value \{cost - accumulated depreciation) Mortis will report on the balance sheets at the end of Year 1 through Yeai 5. d. Determine the amount of the gain or loss Morris will report on the disposal of the equipment on October 1, Year 6. Use a horizontal statements model to show the net effects of these transactions on the elements of the financial statements. The first event is recorded as an example. Note: Use + for increase, - for decrease, and leave blank for no effect. In the statement of Cash Flows column, use the initiais on to designate operating activity, IA for investing activity and FA for financing activity. Not all cells require input. Trinkle Company, Incorporated made several purchases of long-term assets in Year 1 . The details of each purchase are presented here. New Office Equipment 1. List price: $37,500, terms, 2/10n/30; paid within discount period. 2. Transportation-in: $780 3. Installation: $590. 4. Cost to repair damage during unloading: $696. 5. Routine maintenance cost after eight months: $190. Bosket Purchose of Copier, Computer, and Scanner for $48,400 with Fair Market Values 1. Copier, $25,652 2. Computer, 58745 3. Scanner, 523,903 Lond for New Worehouse with an Old Building Torn Down 1. Purchase price, $77,400. 2. Demolition of building, $4,660 3. Lumber sold from old building. $1,300. 4. Grading in preparation for new building, $8,800. 5. Construction of new buliding. $237,000. Required In each of these cases, determine the amount of cost to be capitalized in the asset accounts. Required In each of these cases, determine the amount of cost to be capitalized in the asset accounts. Morris Incorporated recorded the following transactions over the life of a piece of equipment purchased in Year 1 : January 1, Year 1 Purchased equipment for $14,500 cash. The equipment wos estimated to have a five-year 1ife and \$6,37e salvage value and was to be depreclated using the straight-1ine nethod. December 31, Year 1 Recorded depreciation expense for Year 1 . Septenber 3e, Year 2 Undertook routine repalrs costing $725. December 31, Year 2 Recorded depreciation expense for Year 2. January 1, Year 3 Made an adjustment costing $2,810 to the equipment. It improved the quality af the autput but did not 31, Year 3 Recorded depreciation expense for Year 3. . Year 4 Incurred $339 cost to oll and clean the equipment. Recorded depreciation expense for Year 4. January 1, Year 5 . Had the equipment completely overhauled at a cost of 57,290 . The overhaul was estinated to extend the tatal December. 31, Year 5 . Recorded depreciation expense for Year 5 . October 1, Year 6 . Received and accepted an offer of $15,800 for the equipsent. Required a. Use a horizontal statements model to show the net effects of these transactions on the elements of the financial statements. The first event is recorded as an example. b. Determine the amount of depreciation expense to be reported on the income statements for Year 1 through Year 6 . c. Determine the book value \{cost - accumulated depreciation) Mortis will report on the balance sheets at the end of Year 1 through Yeai 5. d. Determine the amount of the gain or loss Morris will report on the disposal of the equipment on October 1, Year 6. Use a horizontal statements model to show the net effects of these transactions on the elements of the financial statements. The first event is recorded as an example. Note: Use + for increase, - for decrease, and leave blank for no effect. In the statement of Cash Flows column, use the initiais on to designate operating activity, IA for investing activity and FA for financing activity. Not all cells require input