Need Help with this

Need Help with this

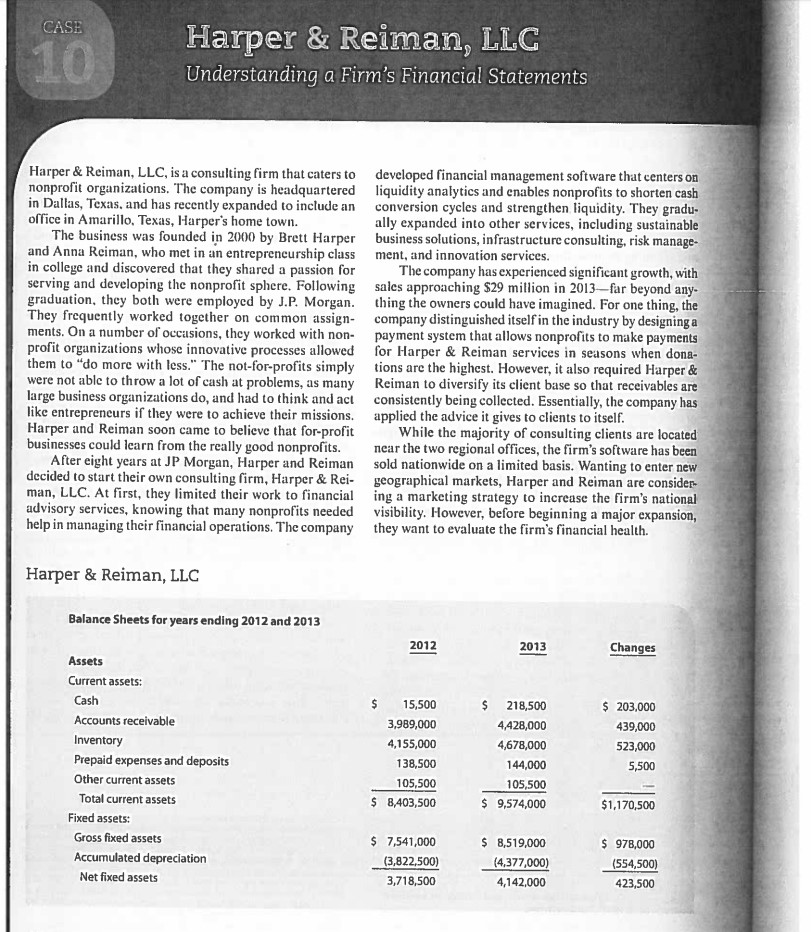

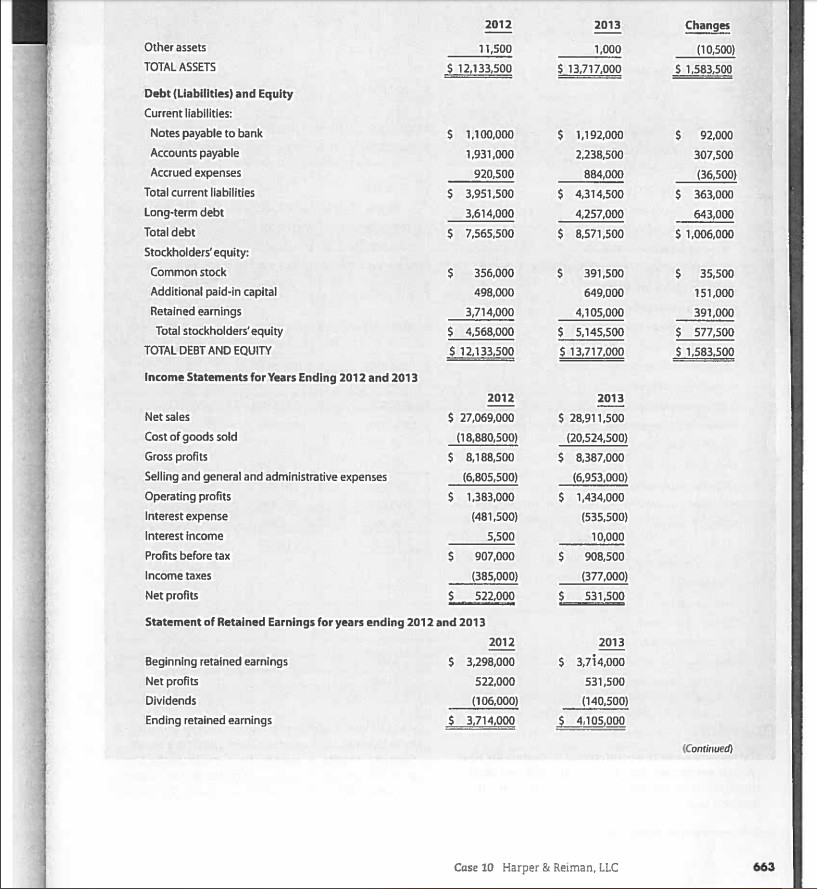

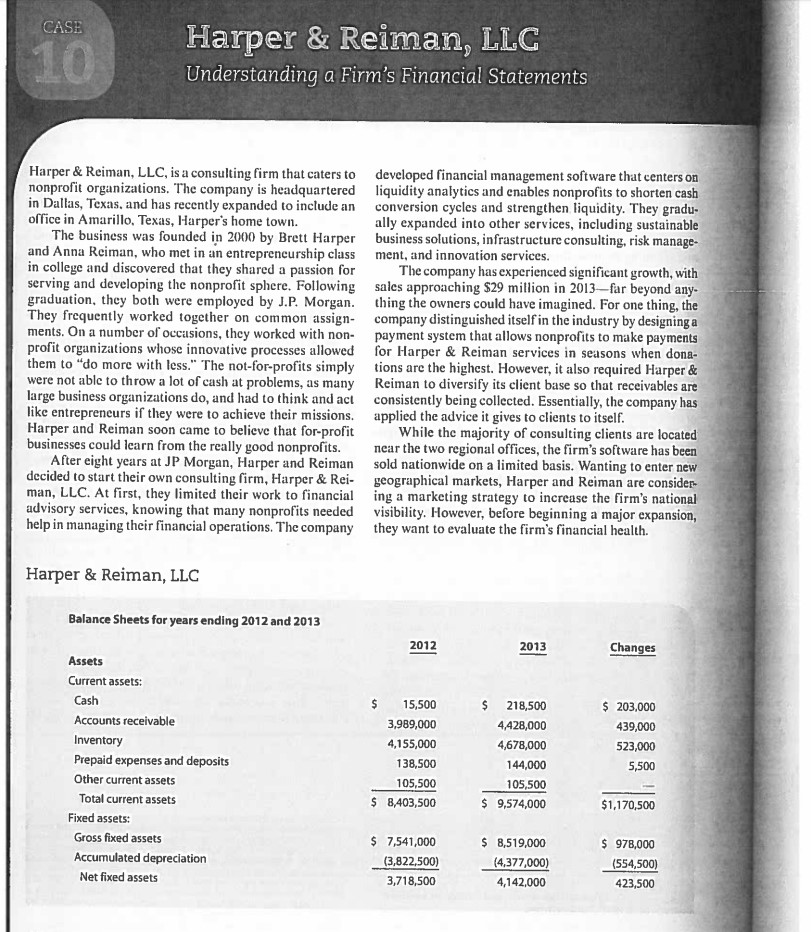

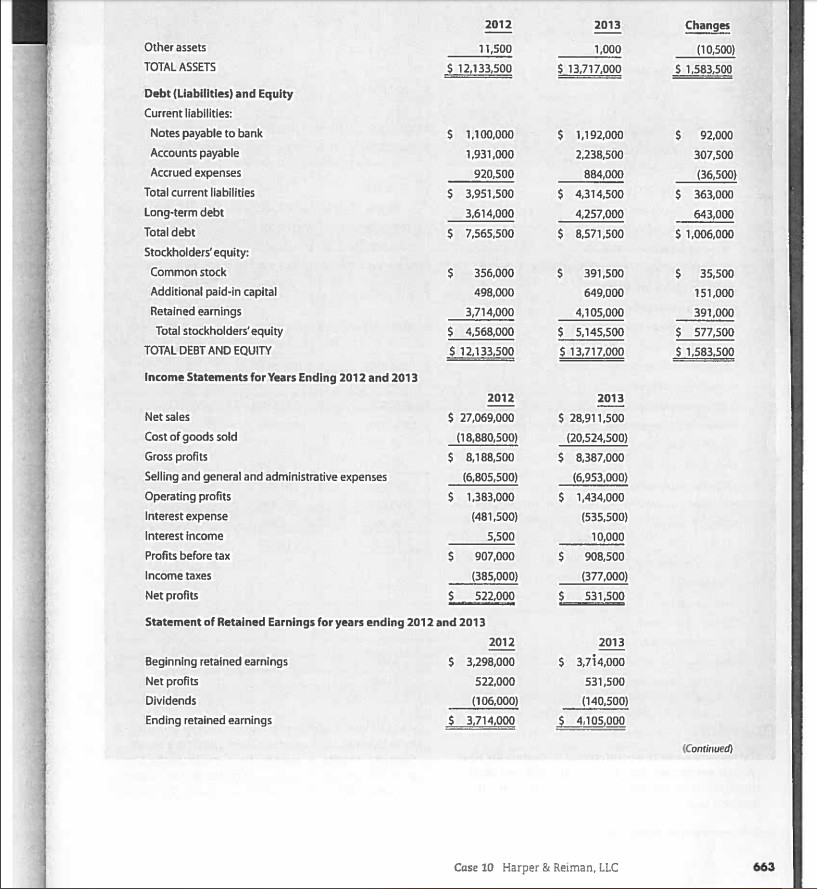

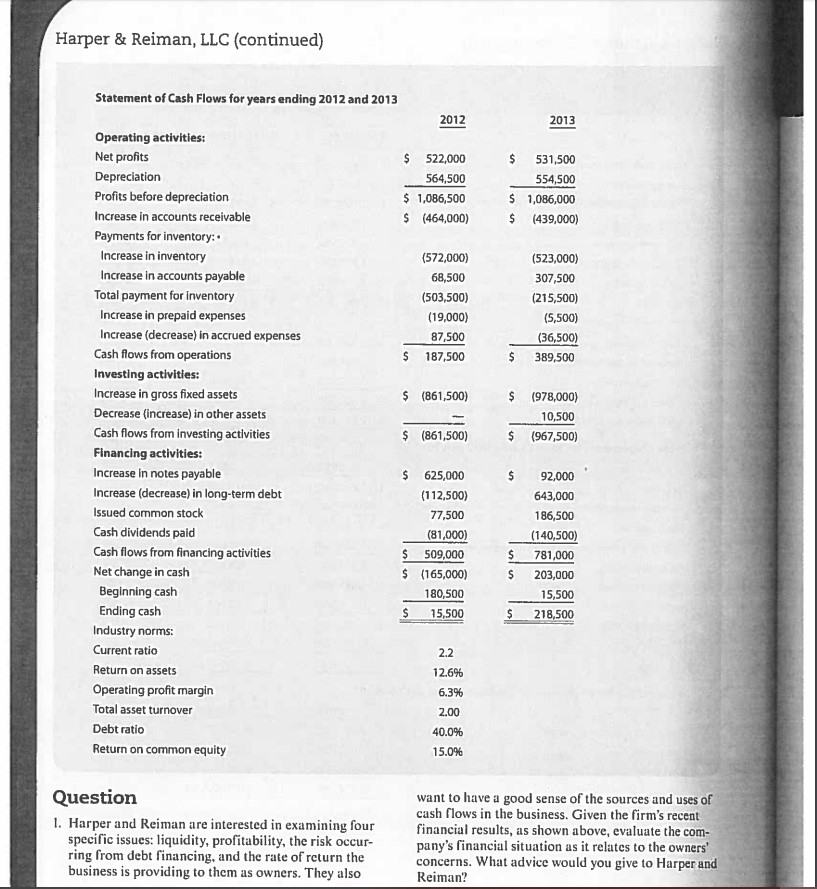

CASE Harper & Reiman, LLC Understanding a Firm's Financial Statements Harper & Reiman, LLC, is a consulting firm that caters to nonprofit organizations. The company is headquartered in Dallas, Texas, and has recently expanded to include an office in Amarillo, Texas, Harper's home town. The business was founded in 2000 by Brett Harper and Anna Reiman, who met in an entrepreneurship class in college and discovered that they shared a passion for serving and developing the nonprofit sphere. Following graduation, they both were employed by J.P. Morgan. They frequently worked together on common assign- ments. On a number of occasions, they worked with non- profit organizations whose innovative processes allowed them to "do more with less." The not-for-profits simply were not able to throw a lot of cash at problems, as many large business organizations do, and had to think and act like entrepreneurs if they were to achieve their missions. Harper and Reiman soon came to believe that for-profit businesses could learn from the really good nonprofits. After eight years at JP Morgan, Harper and Reiman decided to start their own consulting firm, Harper & Rei- man, LLC. At first, they limited their work to financial advisory services, knowing that many nonprofits needed help in managing their financial operations. The company developed financial management software that centers on liquidity analytics and enables nonprofits to shorten cash conversion cycles and strengthen liquidity. They gradu- ally expanded into other services, including sustainable business solutions, infrastructure consulting, risk manage- ment, and innovation services. The company has experienced significant growth, with sales approaching $29 million in 2013-far beyond any thing the owners could have imagined. For one thing the company distinguished itself in the industry by designing a payment system that allows nonprofits to make payments for Harper & Reiman services in seasons when dona- tions are the highest. However, it also required Harper & Reiman to diversify its client base so that receivables are consistently being collected. Essentially, the company has applied the advice it gives to clients to itself. While the majority of consulting clients are located near the two regional offices, the firm's software has been sold nationwide on a limited basis. Wanting to enter new geographical markets, Harper and Reiman are consider ing a marketing strategy to increase the firm's national visibility. However, before beginning a major expansion, they want to evaluate the firm's financial health. Harper & Reiman, LLC Balance Sheets for years ending 2012 and 2013 2012 2013 Changes Assets Current assets: Cash Accounts receivable Inventory Prepaid expenses and deposits Other current assets Total current assets Fixed assets: Gross fixed assets Accumulated depreciation Net fixed assets $ 15,500 3,989,000 4,155,000 138,500 105,500 $ 8,403,500 $ 218,500 4,428,000 4,678,000 144,000 105,500 $ 9,574,000 $ 203,000 439,000 523,000 5,500 $1,170,500 $ 7,541,000 (3,822,500) 3,718,500 $ 8,519,000 (4.377,000) 4,142.000 $ 978,000 (554,500) 423,500 2012 2013 11,500 1,000 Other assets TOTAL ASSETS Changes (10,500) $ 1,583,500 $ 12,133,500 $ 13,717,000 $ 1,192,000 2,238,500 884,000 $ 4,314,500 4,257,000 $ 8,571,500 $ 92,000 307,500 (36,500) $ 363,000 643,000 $ 1,006,000 $ 391,500 649,000 4,105,000 $ 5,145,500 $ 13,717,000 $ 35,500 151,000 391,000 $ 577,500 $ 1,583,500 Debt (Liabilities) and Equity Current liabilities: Notes payable to bank $ 1,100,000 Accounts payable 1,931,000 Accrued expenses 920,500 Total current liabilities $ 3,951,500 Long-term debt 3,614,000 Total debt $ 7,565,500 Stockholders' equity: Common stock $ 356,000 Additional paid-in capital 498,000 Retained earnings 3,714,000 Total stockholders' equity $ 4,568,000 TOTAL DEBT AND EQUITY $ 12.133,500 Income Statements for Years Ending 2012 and 2013 2012 Net sales $ 27,069,000 Cost of goods sold (18,880,500) Gross profits $ 8,188,500 Selling and general and administrative expenses (6,805,500) Operating profits $ 1,383,000 Interest expense (481,500) Interest income 5,500 Profits before tax $ 907,000 Income taxes (385,000) Net profits $ 522,000 Statement of Retained Earnings for years ending 2012 and 2013 2012 Beginning retained earnings $ 3,298,000 Net profits 522,000 Dividends (106,000) Ending retained earnings $ 3,714,000 2013 $ 28,911,500 (20,524,500) $ 8,387,000 (6,953,000) $ 1,434,000 (535,500) 10,000 $ 908,500 (377,000) $_531,500 $ 2013 3,714,000 531,500 (140,500) 4,105,000 $ (Continued) Case 10 Harper & Reiman, LLC 663 Harper & Reiman, LLC (continued) Statement of Cash Flows for years ending 2012 and 2013 2012 2013 $ $ 522,000 564,500 $ 1,086,500 $ (464,000) 531,500 554,500 1,086,000 (439,000) $ $ (572,000) 68,500 (503,500) (19,000) 87,500 187,500 (523,000) 307,500 (215,500) (5,500) (36,500) 389,500 $ $ $ (861,500) $ (978,000) 10,500 (967,500) $ (861,500) $ Operating activities: Net profits Depreciation Profits before depreciation Increase in accounts receivable Payments for inventory: Increase in inventory Increase in accounts payable Total payment for inventory Increase in prepaid expenses Increase (decrease) in accrued expenses Cash flows from operations Investing activities: Increase in gross fixed assets Decrease (increase) in other assets Cash flows from investing activities Financing activities: Increase in notes payable Increase (decrease) in long-term debt Issued common stock Cash dividends paid Cash flows from financing activities Net change in cash Beginning cash Ending cash Industry norms: Current ratio Return on assets Operating profit margin Total asset turnover Debt ratio Return on common equity $ $ 625,000 (112,500) 77,500 (81,000) 509,000 (165,000) 180,500 15,500 92,000 643,000 186,500 (140,500) 781,000 203,000 15,500 218,500 $ $ $ $ $ $ 2.2 12.6% 6.3% 2.00 40.0% 15.0% Question 1. Harper and Reiman are interested in examining four specific issues: liquidity, profitability, the risk occur- ring from debt financing, and the rate of return the business is providing to them as owners. They also want to have a good sense of the sources and uses of cash flows in the business. Given the firm's recent financial results, as shown above, evaluate the com- pany's financial situation as it relates to the owners' concerns. What advice would you give to Harper and Reiman? Please note there is a large quantity of opinions and source material on case studies and case analysis. A simple internet search will get you started if you are interested. The paragraphs which follow provide guidelines for accomplishing case study analyses Please take note of paragraph (2). This paragraph presents the format and content for case analysis submittals in this course. (1) Guidelines-1: Prepare for accomplishing the analysis a. Allow time to have a good understanding of the case. Read carefully, take notes. It may take several readings to fully grasp the issues of the case. b. First do a quick reading. Look for -principles in the case -the situation or issues; what are the strategies -timelines for decisions if any -what decisions are required c. Look over exhibits and data d. Look at the case sub-titles e. Review the case questions f. Fully understand the assignment requirements Case analyses follow this generic format. Note that not all cases require the completion of each of these steps. The steps utilized will be dictated by the particular case/company situation. The steps are: (1) a summary of the relevant situation in the case, (2) Internal analysis of the firm, including current corporate and business-level strategies, (3) external analysis, (4) SWOT analysis, (5) identification of a problem or problems, (6) proposal of 2 or more alternative courses of action that will help address the problem(s), (7) evaluation of all alternatives, (8) recommendation of best alternative and (9) implementation issues that need to be considered. (2) Requirements: Case Analysis Requirements for this Course - this addresses primarily the format and minimum content for case analysis submittals. a. Name and Title - Make sure you include a title page. Place your name and the course and section number, the date, and the title of the case on this page. b. Summary Statement of the Case - Include first a summary statement of the case. Identify the company, the principals, the situations. You may include in this some of the pertinent findings from (3), which follows. c. Address the case questions - First, write the question then write the response to that question. Repeat this process for each question to be addressed in the case. (3) Guidelines-2: Steps for accomplishing the Case Analysis. These are general statements and may not apply in every case. Depending on the company and the specific situations, some of these may not be possible. a. Investigate and Analyze the Company's History and Growth. Investigate the company's founding, critical incidents, structure, and growth. b. Identify Strengths and Weaknesses within the Company. Make a list of the value creation functions of the company. Which ones are stronger; which ones are weaker. c. Gather information on the external environment. Identify opportunities and threats. Especially note competition, bargaining power of the company, and the threat of substitute products. d. Analyze your Findings. Based on the information gathered, construct an evaluation. Compare strengths and weaknesses with opportunities and threats. Is the company in a strong competitive position and can it continue at its current pace successfully. e. Identify Corporate Level Strategy. Identify and evaluate the company's mission, goals, and corporate strategy. Analyze the company's line of business, its subsidiaries, and acquisitions. Debate the pros and cons of the company strategy. f. Identify Business Level Strategy. (If the company has a single business, the corporate and business level strategy are the same.) Identify and analyze competitive strategy, marketing strategy, costs, and general focus for each business. g. Analyze Implementations. Identify and analyze the structure and control systems that the company is using to implement its business strategies. Consider organizational change, levels of hierarchy, employee rewards, conflicts, and other issues important to the company. Page 2 of 3 h. Make recommendations. Pull together all the information gathered to address the questions of the case. Remember to be analytical and not descriptive. Allow yourself enough time to properly write the case analysis. (4) Summary of Tips and Best Practices a. Prepare properly for the case analysis - see section (1) b. Detailed reading of the case; identify the key issues, etc. C. Allow enough time to properly research and write the case analysis d. Apply the case analysis steps - see (3) e. Write the case and put the analysis into the format required - see (2) CASE Harper & Reiman, LLC Understanding a Firm's Financial Statements Harper & Reiman, LLC, is a consulting firm that caters to nonprofit organizations. The company is headquartered in Dallas, Texas, and has recently expanded to include an office in Amarillo, Texas, Harper's home town. The business was founded in 2000 by Brett Harper and Anna Reiman, who met in an entrepreneurship class in college and discovered that they shared a passion for serving and developing the nonprofit sphere. Following graduation, they both were employed by J.P. Morgan. They frequently worked together on common assign- ments. On a number of occasions, they worked with non- profit organizations whose innovative processes allowed them to "do more with less." The not-for-profits simply were not able to throw a lot of cash at problems, as many large business organizations do, and had to think and act like entrepreneurs if they were to achieve their missions. Harper and Reiman soon came to believe that for-profit businesses could learn from the really good nonprofits. After eight years at JP Morgan, Harper and Reiman decided to start their own consulting firm, Harper & Rei- man, LLC. At first, they limited their work to financial advisory services, knowing that many nonprofits needed help in managing their financial operations. The company developed financial management software that centers on liquidity analytics and enables nonprofits to shorten cash conversion cycles and strengthen liquidity. They gradu- ally expanded into other services, including sustainable business solutions, infrastructure consulting, risk manage- ment, and innovation services. The company has experienced significant growth, with sales approaching $29 million in 2013-far beyond any thing the owners could have imagined. For one thing the company distinguished itself in the industry by designing a payment system that allows nonprofits to make payments for Harper & Reiman services in seasons when dona- tions are the highest. However, it also required Harper & Reiman to diversify its client base so that receivables are consistently being collected. Essentially, the company has applied the advice it gives to clients to itself. While the majority of consulting clients are located near the two regional offices, the firm's software has been sold nationwide on a limited basis. Wanting to enter new geographical markets, Harper and Reiman are consider ing a marketing strategy to increase the firm's national visibility. However, before beginning a major expansion, they want to evaluate the firm's financial health. Harper & Reiman, LLC Balance Sheets for years ending 2012 and 2013 2012 2013 Changes Assets Current assets: Cash Accounts receivable Inventory Prepaid expenses and deposits Other current assets Total current assets Fixed assets: Gross fixed assets Accumulated depreciation Net fixed assets $ 15,500 3,989,000 4,155,000 138,500 105,500 $ 8,403,500 $ 218,500 4,428,000 4,678,000 144,000 105,500 $ 9,574,000 $ 203,000 439,000 523,000 5,500 $1,170,500 $ 7,541,000 (3,822,500) 3,718,500 $ 8,519,000 (4.377,000) 4,142.000 $ 978,000 (554,500) 423,500 2012 2013 11,500 1,000 Other assets TOTAL ASSETS Changes (10,500) $ 1,583,500 $ 12,133,500 $ 13,717,000 $ 1,192,000 2,238,500 884,000 $ 4,314,500 4,257,000 $ 8,571,500 $ 92,000 307,500 (36,500) $ 363,000 643,000 $ 1,006,000 $ 391,500 649,000 4,105,000 $ 5,145,500 $ 13,717,000 $ 35,500 151,000 391,000 $ 577,500 $ 1,583,500 Debt (Liabilities) and Equity Current liabilities: Notes payable to bank $ 1,100,000 Accounts payable 1,931,000 Accrued expenses 920,500 Total current liabilities $ 3,951,500 Long-term debt 3,614,000 Total debt $ 7,565,500 Stockholders' equity: Common stock $ 356,000 Additional paid-in capital 498,000 Retained earnings 3,714,000 Total stockholders' equity $ 4,568,000 TOTAL DEBT AND EQUITY $ 12.133,500 Income Statements for Years Ending 2012 and 2013 2012 Net sales $ 27,069,000 Cost of goods sold (18,880,500) Gross profits $ 8,188,500 Selling and general and administrative expenses (6,805,500) Operating profits $ 1,383,000 Interest expense (481,500) Interest income 5,500 Profits before tax $ 907,000 Income taxes (385,000) Net profits $ 522,000 Statement of Retained Earnings for years ending 2012 and 2013 2012 Beginning retained earnings $ 3,298,000 Net profits 522,000 Dividends (106,000) Ending retained earnings $ 3,714,000 2013 $ 28,911,500 (20,524,500) $ 8,387,000 (6,953,000) $ 1,434,000 (535,500) 10,000 $ 908,500 (377,000) $_531,500 $ 2013 3,714,000 531,500 (140,500) 4,105,000 $ (Continued) Case 10 Harper & Reiman, LLC 663 Harper & Reiman, LLC (continued) Statement of Cash Flows for years ending 2012 and 2013 2012 2013 $ $ 522,000 564,500 $ 1,086,500 $ (464,000) 531,500 554,500 1,086,000 (439,000) $ $ (572,000) 68,500 (503,500) (19,000) 87,500 187,500 (523,000) 307,500 (215,500) (5,500) (36,500) 389,500 $ $ $ (861,500) $ (978,000) 10,500 (967,500) $ (861,500) $ Operating activities: Net profits Depreciation Profits before depreciation Increase in accounts receivable Payments for inventory: Increase in inventory Increase in accounts payable Total payment for inventory Increase in prepaid expenses Increase (decrease) in accrued expenses Cash flows from operations Investing activities: Increase in gross fixed assets Decrease (increase) in other assets Cash flows from investing activities Financing activities: Increase in notes payable Increase (decrease) in long-term debt Issued common stock Cash dividends paid Cash flows from financing activities Net change in cash Beginning cash Ending cash Industry norms: Current ratio Return on assets Operating profit margin Total asset turnover Debt ratio Return on common equity $ $ 625,000 (112,500) 77,500 (81,000) 509,000 (165,000) 180,500 15,500 92,000 643,000 186,500 (140,500) 781,000 203,000 15,500 218,500 $ $ $ $ $ $ 2.2 12.6% 6.3% 2.00 40.0% 15.0% Question 1. Harper and Reiman are interested in examining four specific issues: liquidity, profitability, the risk occur- ring from debt financing, and the rate of return the business is providing to them as owners. They also want to have a good sense of the sources and uses of cash flows in the business. Given the firm's recent financial results, as shown above, evaluate the com- pany's financial situation as it relates to the owners' concerns. What advice would you give to Harper and Reiman? Please note there is a large quantity of opinions and source material on case studies and case analysis. A simple internet search will get you started if you are interested. The paragraphs which follow provide guidelines for accomplishing case study analyses Please take note of paragraph (2). This paragraph presents the format and content for case analysis submittals in this course. (1) Guidelines-1: Prepare for accomplishing the analysis a. Allow time to have a good understanding of the case. Read carefully, take notes. It may take several readings to fully grasp the issues of the case. b. First do a quick reading. Look for -principles in the case -the situation or issues; what are the strategies -timelines for decisions if any -what decisions are required c. Look over exhibits and data d. Look at the case sub-titles e. Review the case questions f. Fully understand the assignment requirements Case analyses follow this generic format. Note that not all cases require the completion of each of these steps. The steps utilized will be dictated by the particular case/company situation. The steps are: (1) a summary of the relevant situation in the case, (2) Internal analysis of the firm, including current corporate and business-level strategies, (3) external analysis, (4) SWOT analysis, (5) identification of a problem or problems, (6) proposal of 2 or more alternative courses of action that will help address the problem(s), (7) evaluation of all alternatives, (8) recommendation of best alternative and (9) implementation issues that need to be considered. (2) Requirements: Case Analysis Requirements for this Course - this addresses primarily the format and minimum content for case analysis submittals. a. Name and Title - Make sure you include a title page. Place your name and the course and section number, the date, and the title of the case on this page. b. Summary Statement of the Case - Include first a summary statement of the case. Identify the company, the principals, the situations. You may include in this some of the pertinent findings from (3), which follows. c. Address the case questions - First, write the question then write the response to that question. Repeat this process for each question to be addressed in the case. (3) Guidelines-2: Steps for accomplishing the Case Analysis. These are general statements and may not apply in every case. Depending on the company and the specific situations, some of these may not be possible. a. Investigate and Analyze the Company's History and Growth. Investigate the company's founding, critical incidents, structure, and growth. b. Identify Strengths and Weaknesses within the Company. Make a list of the value creation functions of the company. Which ones are stronger; which ones are weaker. c. Gather information on the external environment. Identify opportunities and threats. Especially note competition, bargaining power of the company, and the threat of substitute products. d. Analyze your Findings. Based on the information gathered, construct an evaluation. Compare strengths and weaknesses with opportunities and threats. Is the company in a strong competitive position and can it continue at its current pace successfully. e. Identify Corporate Level Strategy. Identify and evaluate the company's mission, goals, and corporate strategy. Analyze the company's line of business, its subsidiaries, and acquisitions. Debate the pros and cons of the company strategy. f. Identify Business Level Strategy. (If the company has a single business, the corporate and business level strategy are the same.) Identify and analyze competitive strategy, marketing strategy, costs, and general focus for each business. g. Analyze Implementations. Identify and analyze the structure and control systems that the company is using to implement its business strategies. Consider organizational change, levels of hierarchy, employee rewards, conflicts, and other issues important to the company. Page 2 of 3 h. Make recommendations. Pull together all the information gathered to address the questions of the case. Remember to be analytical and not descriptive. Allow yourself enough time to properly write the case analysis. (4) Summary of Tips and Best Practices a. Prepare properly for the case analysis - see section (1) b. Detailed reading of the case; identify the key issues, etc. C. Allow enough time to properly research and write the case analysis d. Apply the case analysis steps - see (3) e. Write the case and put the analysis into the format required - see (2)

Need Help with this

Need Help with this