Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with this Dorothy's Design is a relatively new landscaping business. Last year (2022) has been very profitable, so Dorothy is planning to purchase

need help with this

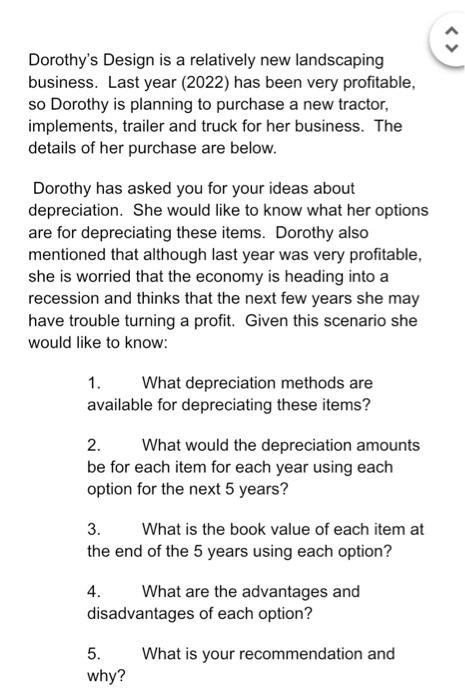

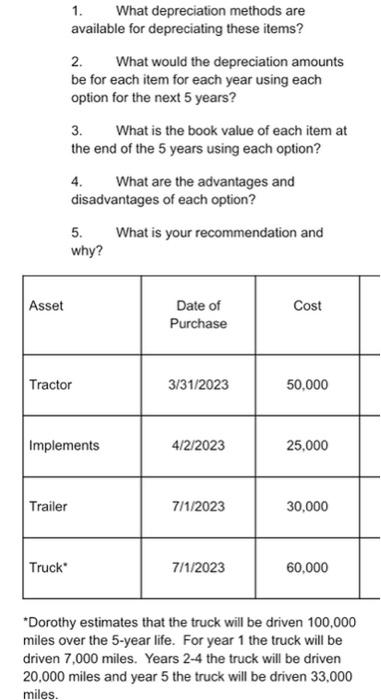

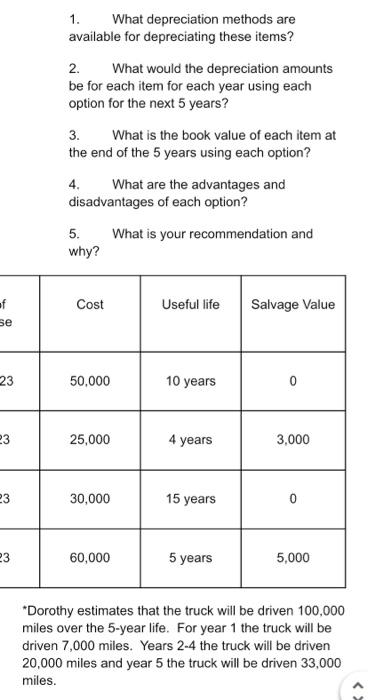

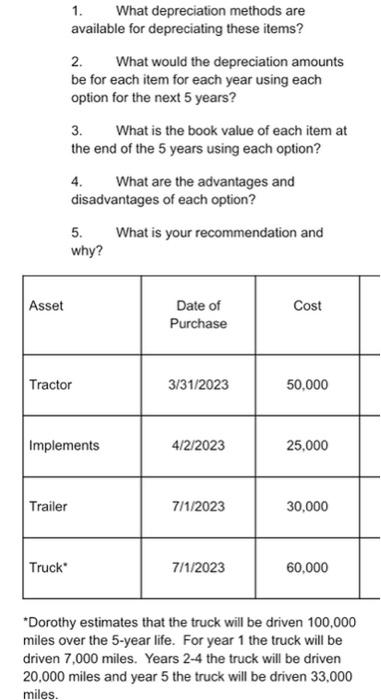

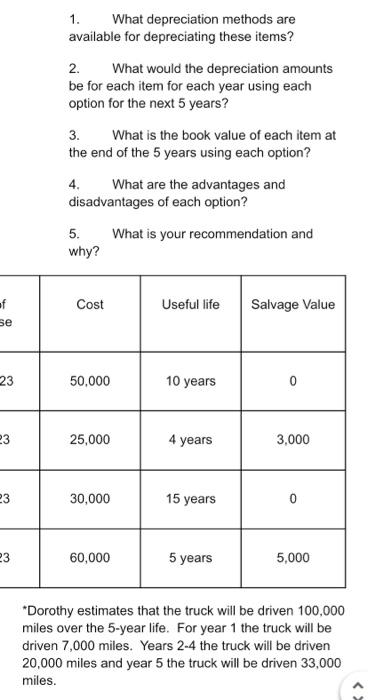

Dorothy's Design is a relatively new landscaping business. Last year (2022) has been very profitable, so Dorothy is planning to purchase a new tractor, implements, trailer and truck for her business. The details of her purchase are below. Dorothy has asked you for your ideas about depreciation. She would like to know what her options are for depreciating these items. Dorothy also mentioned that although last year was very profitable, she is worried that the economy is heading into a recession and thinks that the next few years she may have trouble turning a profit. Given this scenario she would like to know: 1. What depreciation methods are available for depreciating these items? 2. What would the depreciation amounts be for each item for each year using each option for the next 5 years? 3. What is the book value of each item at the end of the 5 years using each option? 4. What are the advantages and disadvantages of each option? 5. What is your recommendation and why? 1. What depreciation methods are available for depreciating these items? 2. What would the depreciation amounts be for each item for each year using each option for the next 5 years? 3. What is the book value of each item at the end of the 5 years using each option? 4. What are the advantages and disadvantages of each option? 5. What is your recommendation and why? "Dorothy estimates that the truck will be driven 100,000 miles over the 5-year life. For year 1 the truck will be driven 7,000 miles. Years 2-4 the truck will be driven 20,000 miles and year 5 the truck will be driven 33,000 miles. 1. What depreciation methods are available for depreciating these items? 2. What would the depreciation amounts be for each item for each year using each option for the next 5 years? 3. What is the book value of each item at the end of the 5 years using each option? 4. What are the advantages and disadvantages of each option? 5. What is your recommendation and why? "Dorothy estimates that the truck will be driven 100,000 miles over the 5 -year life. For year 1 the truck will be driven 7,000 miles. Years 2-4 the truck will be driven 20,000 miles and year 5 the truck will be driven 33,000 miles

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started