NEED HELP WITH THIS

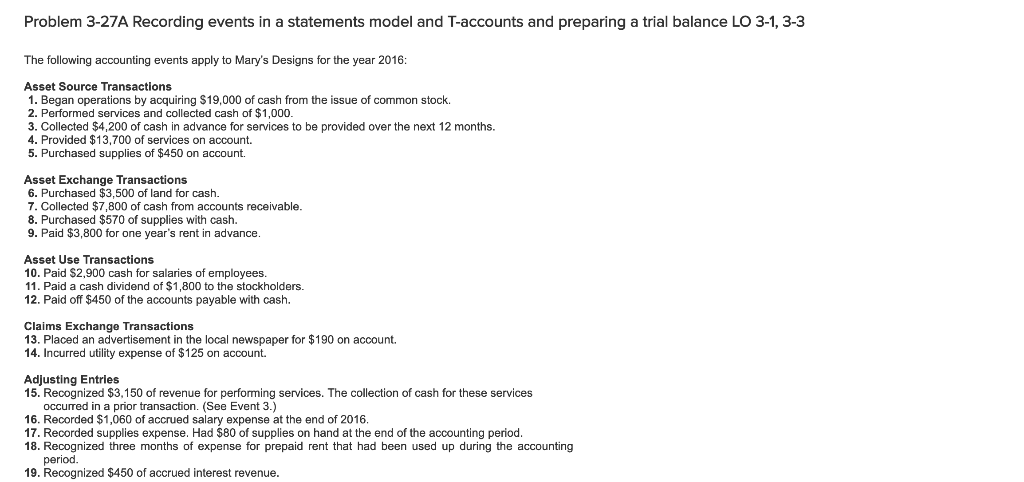

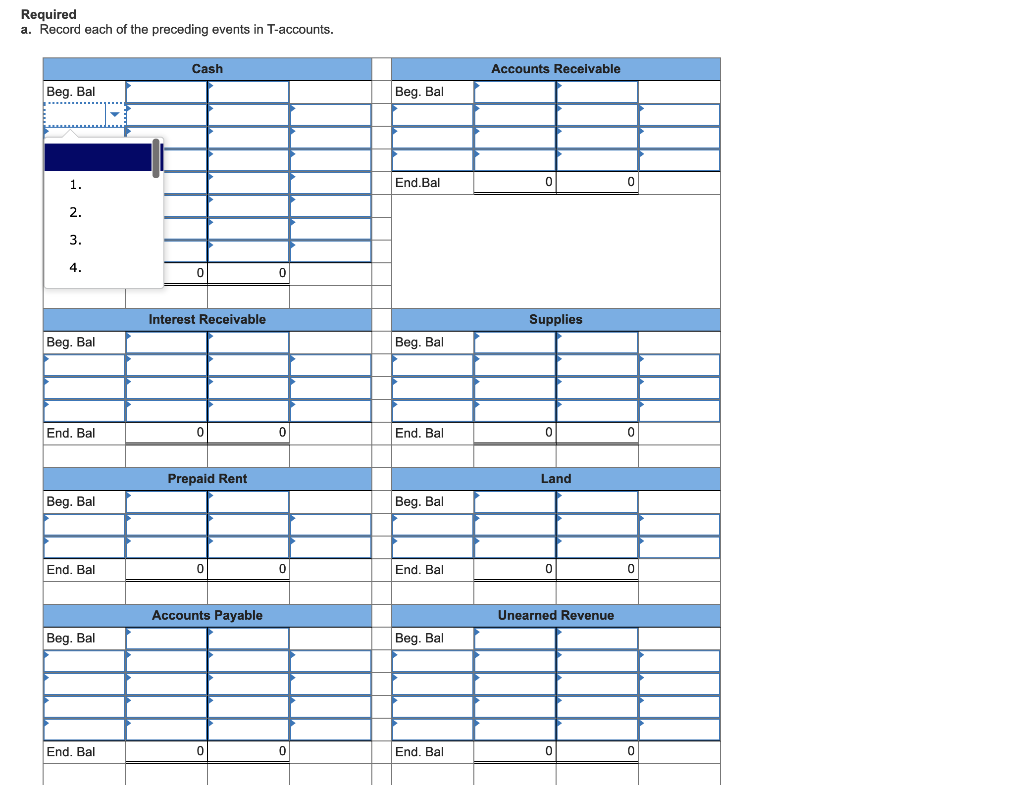

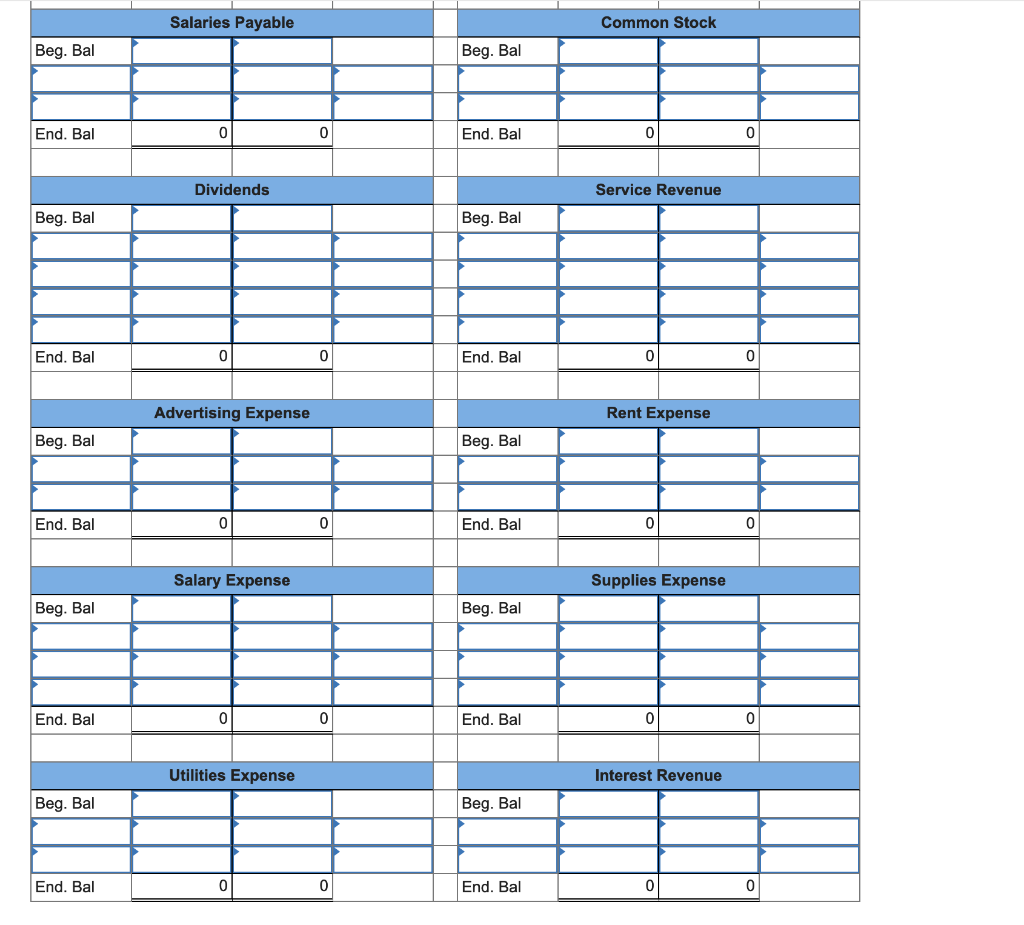

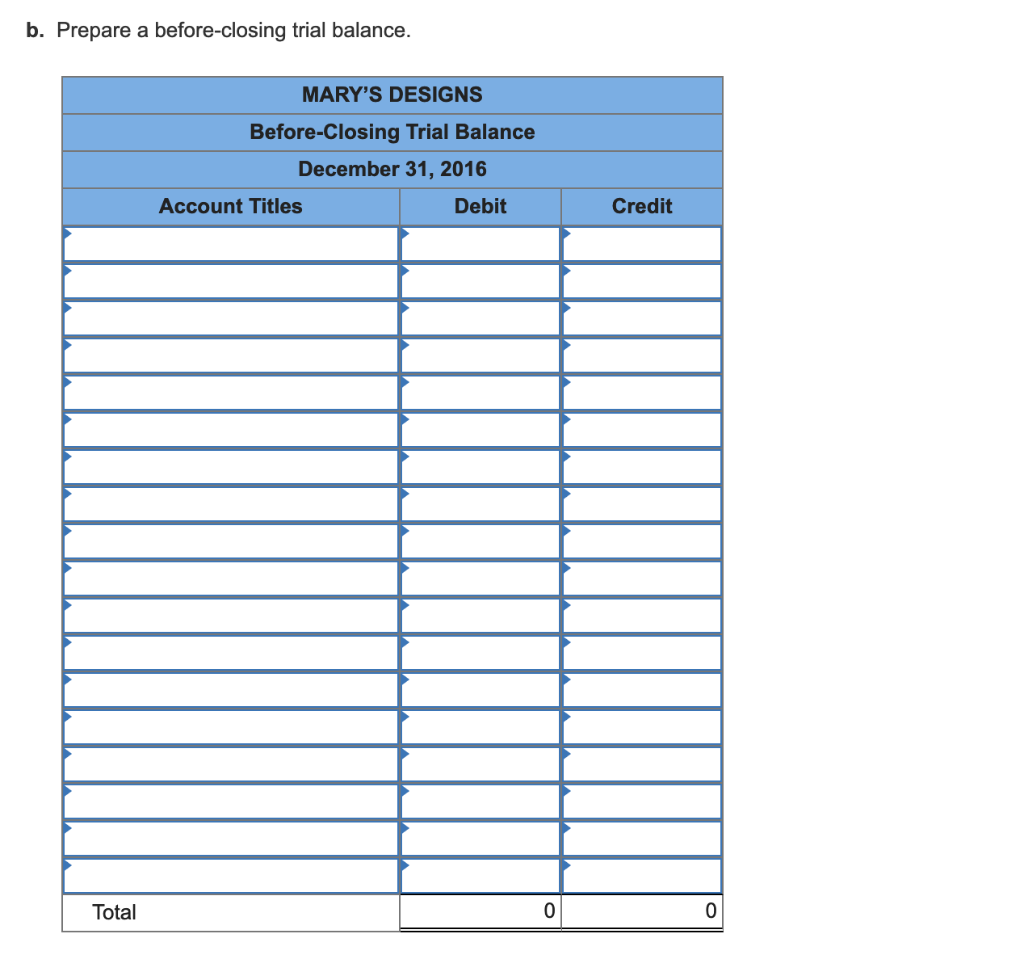

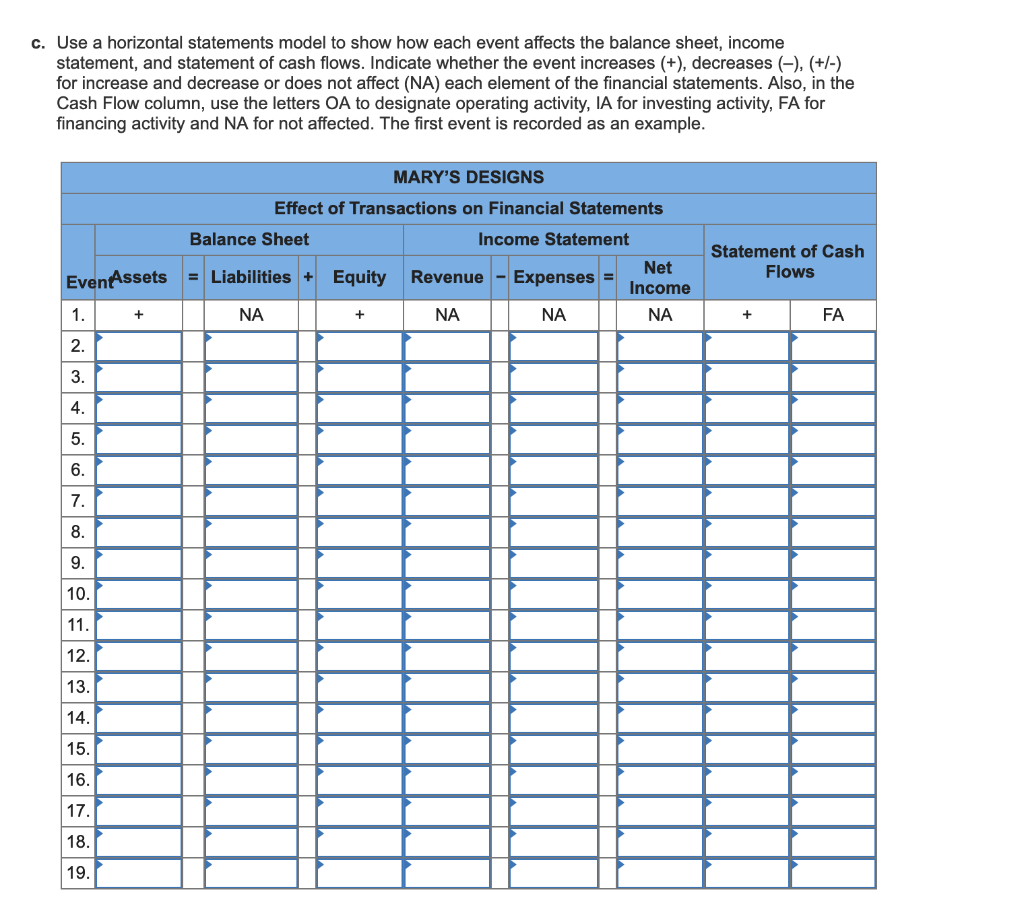

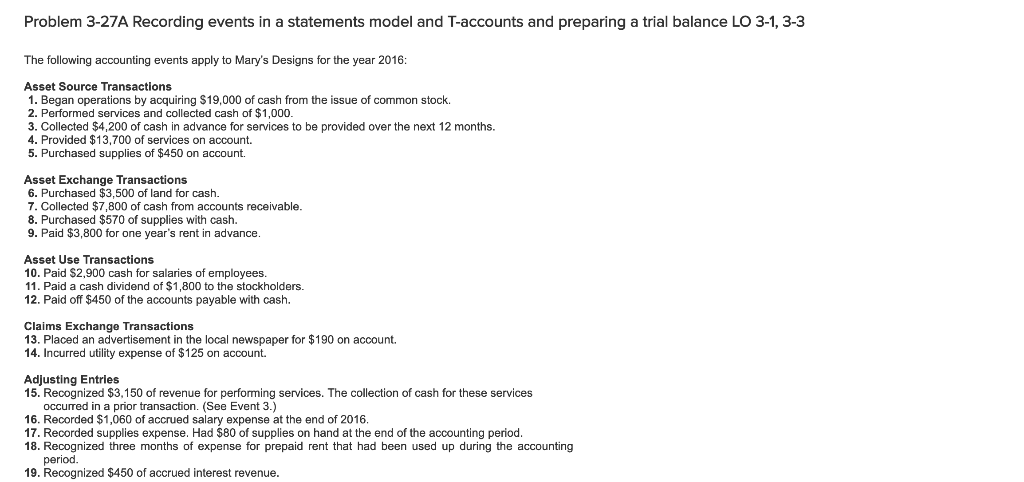

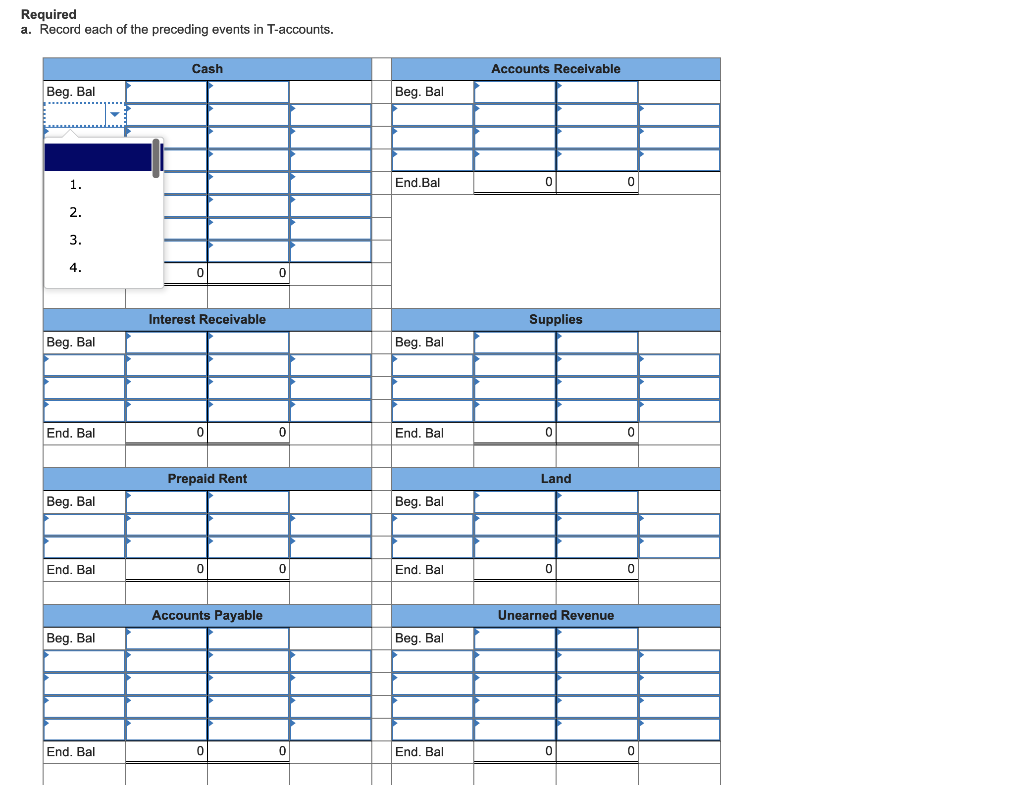

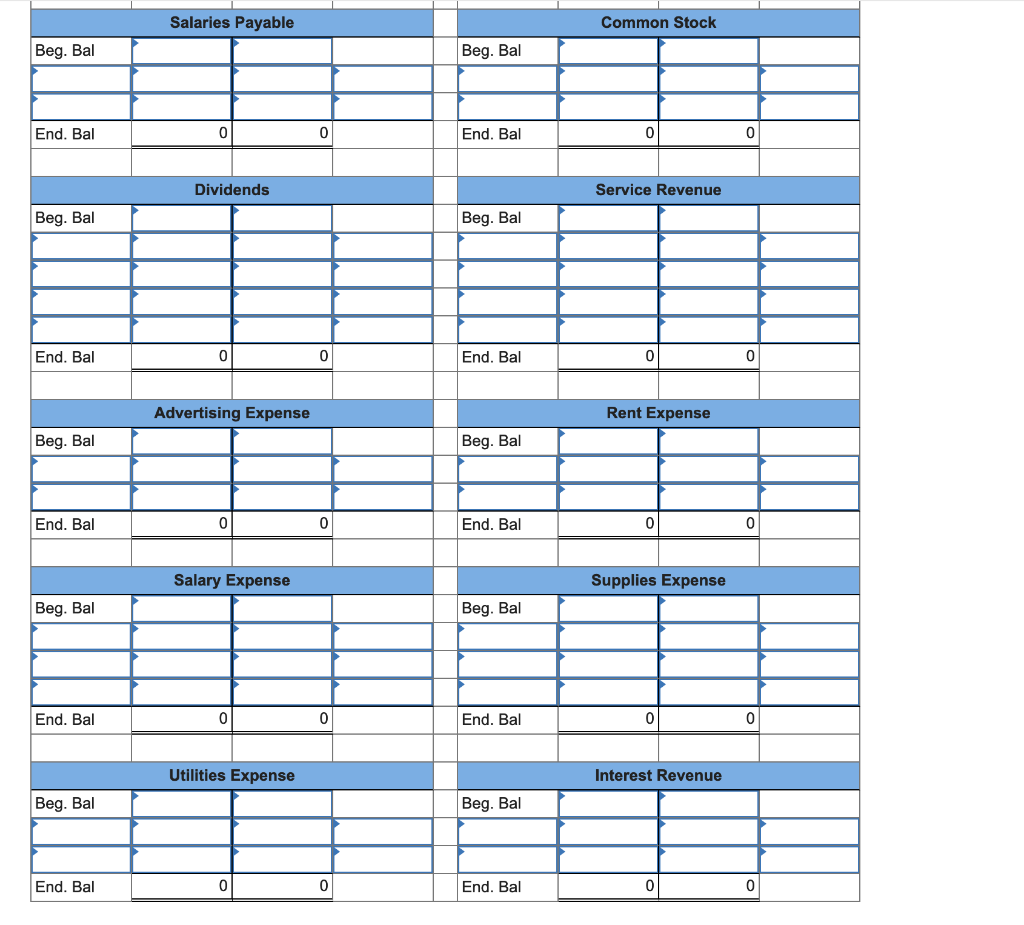

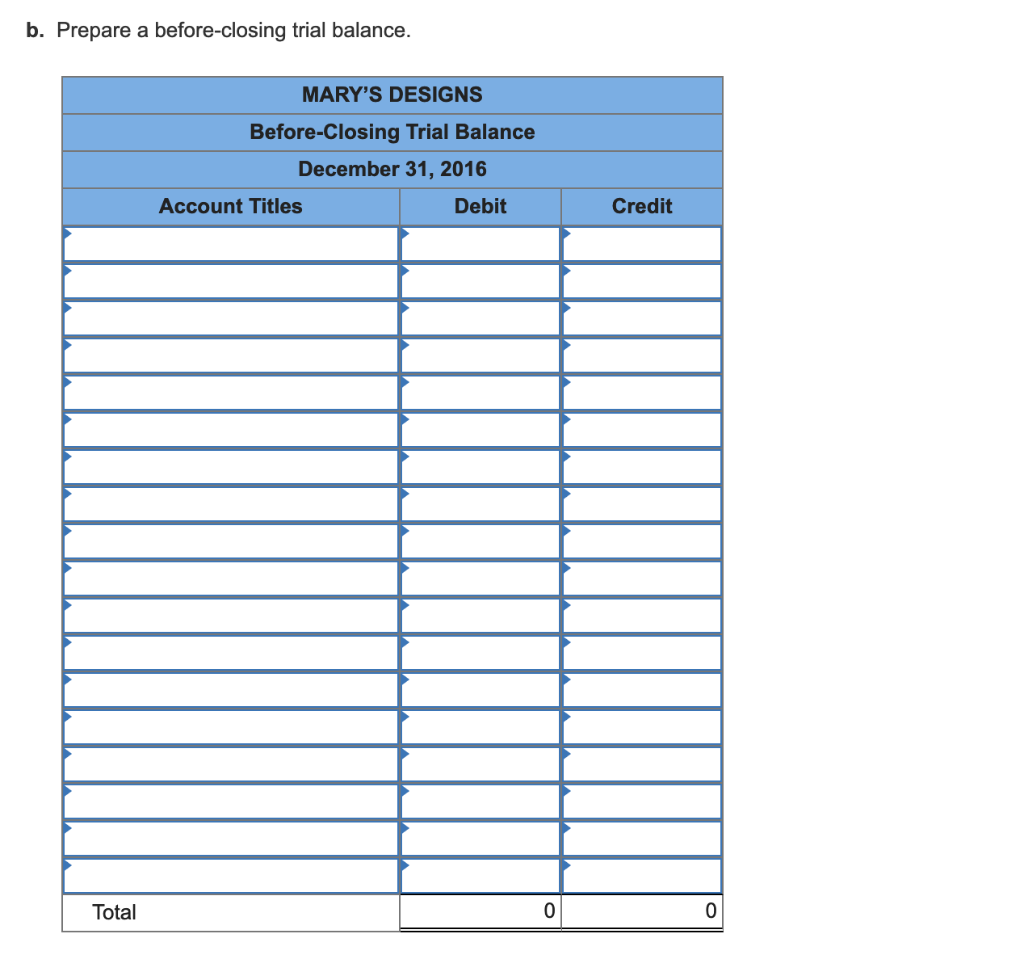

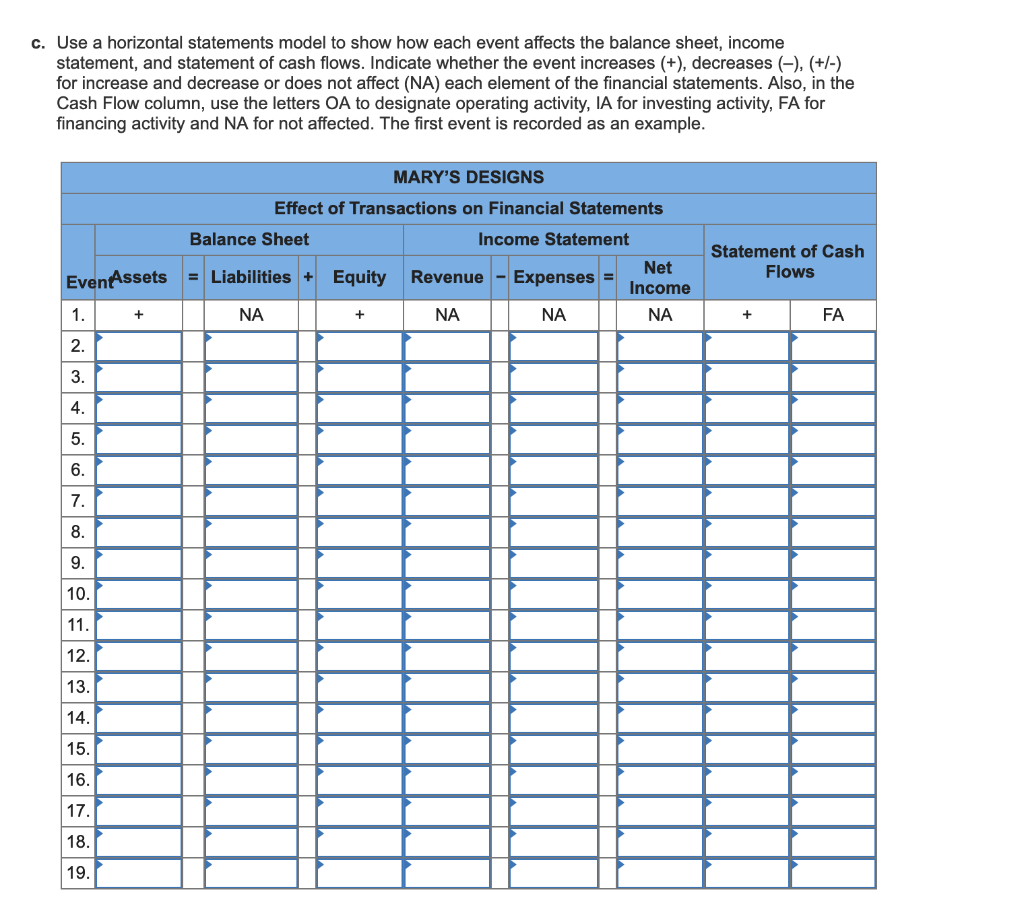

Problem 3-27A Recording events in a statements model and T-accounts and preparing a trial balance LO 3-1, 3-3 The following accounting events apply to Mary's Designs for the year 2016 Asset Source Transactions 1. Began operations by acquiring $19,000 of cash from the issue of common stock 2. Performed services and collected cash of $1,000 3. Collected $4,200 of cash in advance for services to be provided over the next 12 months. 4. Provided $13,700 of services on account. 5. Purchased supplies of $450 on account. Asset Exchange Transactions 6. Purchased $3,500 of land for cash 7. Collected $7,800 of cash from accounts receivable 8. Purchased $570 of supplies with cash. 9. Paid $3,800 for one year's rent in advance Asset Use Transactions 10. Paid $2, 11. Paid a cash dividend of $1,800 to the stockholders. 12. Paid off $450 of the accounts payable with cash. 900 cash for salaries of employees Claims Exchange Transactions 13. Placed an advertisement in the local newspaper for $190 on account. 14. Incurred utility expense of $125 on account. Adjusting Entries 15. Recognized $3,150 of revenue for performing services. The collection of cash for these services occurred in a prior transaction. (See Event 3.) 16. Recorded $1,060 of accrued salary expense at the end of 2016 17. Recorded supplies expense. Had $80 of supplies on hand at the end of the accounting period 18. Recognized three months of expense for prepaid rent that had been used up during the accounting period. 19. Recognized $450 of accrued interest revenue Required a. Record each of the preceding events in T-accounts Cash Accounts Receivable Beg. Bal Beg. Bal End.Bal 0 2 0 Interest Receivable Supplies Beg. Bal Beg. Bal End. Ba End. Bal Prepaid Rent Land Beg. Bal Beg. Bal End. Bal 0 End. Bal 0 Accounts Payable Unearned Revenu Beg. Bal Beg. Bal End. Bal End. Bal Salaries Payable Common Stock Beg. Bal Beg. Bal End. Bal End. Bal 0 Dividends Service Revenue Beg. Bal Beg. Bal End. Bal End. Bal 0 Advertising Expense Rent Expense Beg. Bal Beg. Bal End. Bal End. Bal Salary Expense Supplies Expense Beg. Bal Beg. Bal End. Bal End. Bal 0 Utilities Expense Interest Revenue Beg. Bal Beg. Bal End. Bal End. Bal b. Prepare a before-closing trial balance. MARY'S DESIGNS Before-Closing Trial Balance December 31, 2016 Account Titles Debit Credit Total 0 0 c. Use a horizontal statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. Indicate whether the event increases (+), decreases (-), (+/-) for increase and decrease or does not affect (NA) each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity and NA for not affected. The first event is recorded as an example MARY'S DESIGNS Effect of Transactions on Financial Statements Income Statement Statement of Cash Flows Balance Sheet Net pensesIncome EventAssetsLiabilities+Equity RevenueEx NA NA NA FA NA 2. 4. 7. 10 12 13 14 15 16 18 19