Answered step by step

Verified Expert Solution

Question

1 Approved Answer

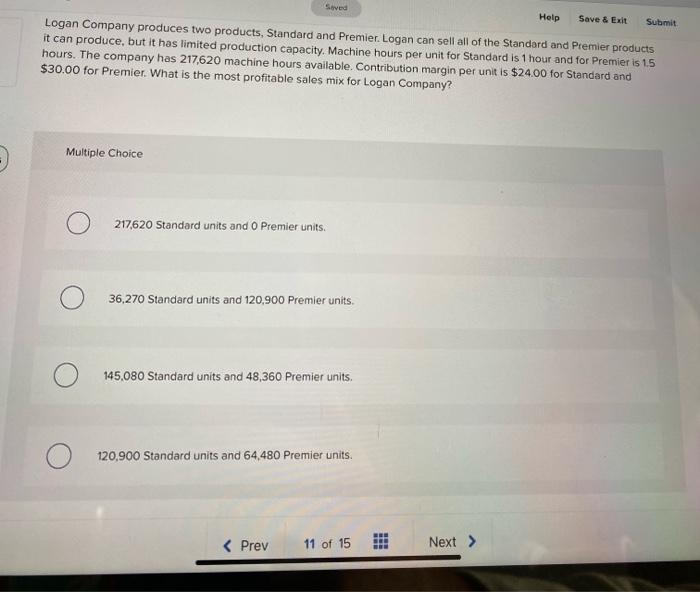

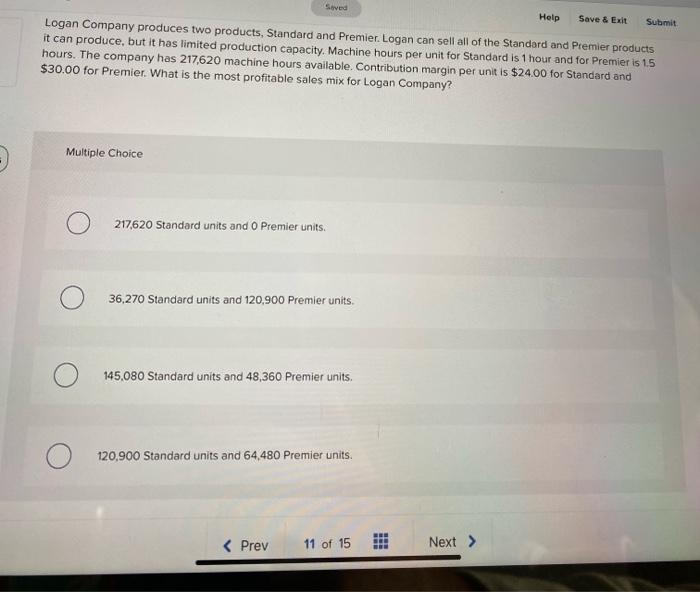

need help with this problem Help Save & Exit Submit Logan Company produces two products, Standard and Premier. Logan can sell all of the Standard

need help with this problem

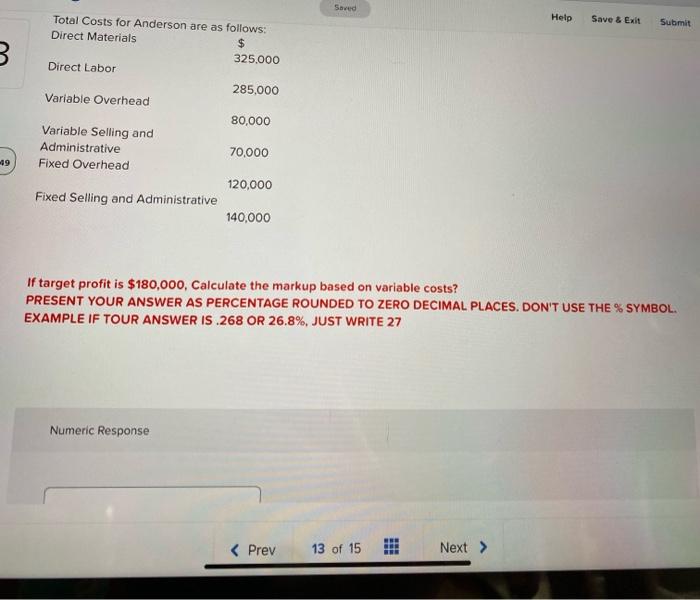

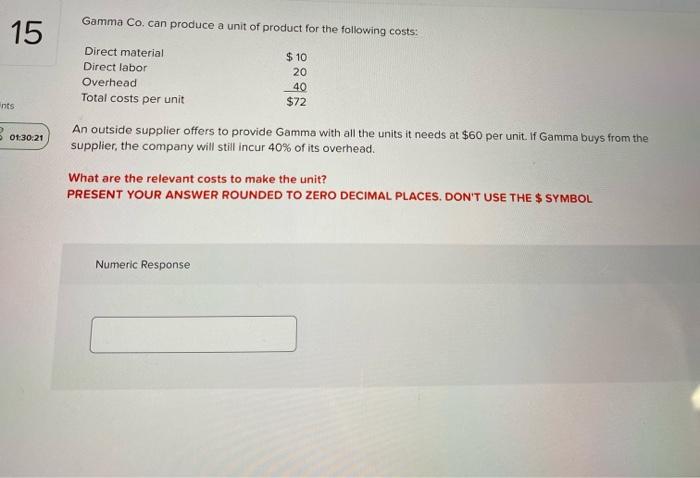

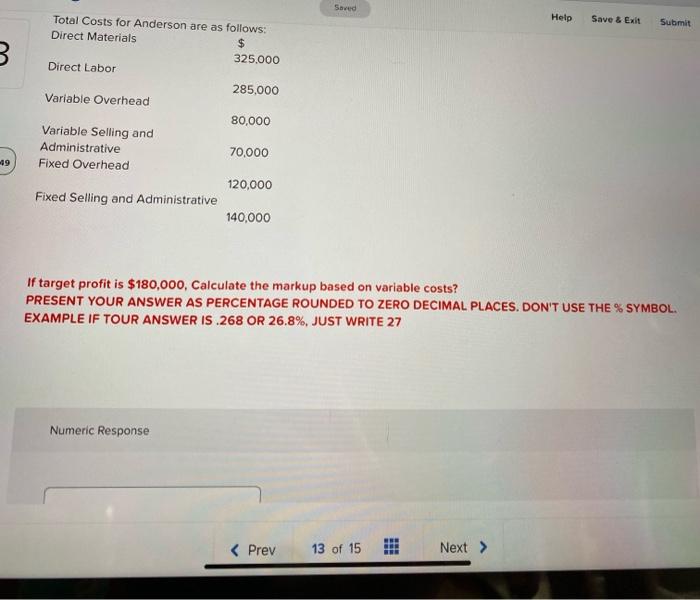

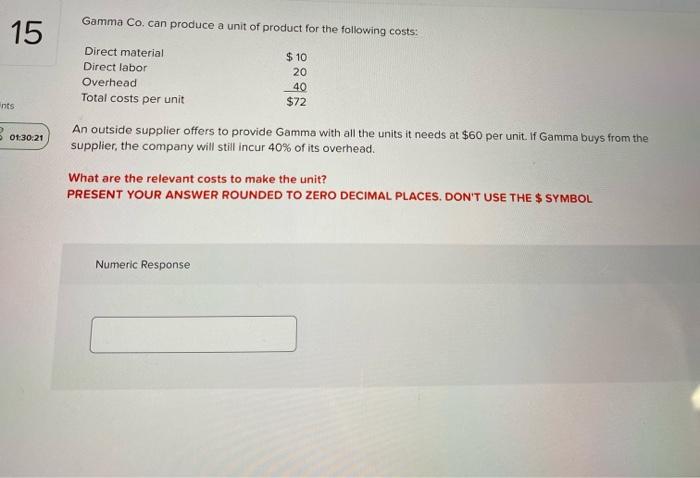

Help Save & Exit Submit Logan Company produces two products, Standard and Premier. Logan can sell all of the Standard and Premier products it can produce, but it has limited production capacity. Machine hours per unit for Standard is 1 hour and for Premier is 1.5 hours. The company has 217,620 machine hours available. Contribution margin per unit is $24.00 for Standard and $30.00 for Premier. What is the most profitable sales mix for Logan Company? Multiple Choice 217,620 Standard units and O Premier units. 36,270 Standard units and 120,900 Premier units. 145.080 Standard units and 48,360 Premier units. 120,900 Standard units and 64,480 Premier units. BU Saved Help Save & Exit Submit B. Total Costs for Anderson are as follows: Direct Materials $ 325.000 Direct Labor 285,000 Variable Overhead 80,000 Variable Selling and Administrative 70,000 Fixed Overhead 120,000 Fixed Selling and Administrative 140,000 19 If target profit is $180,000, Calculate the markup based on variable costs? PRESENT YOUR ANSWER AS PERCENTAGE ROUNDED TO ZERO DECIMAL PLACES. DON'T USE THE % SYMBOL EXAMPLE IF TOUR ANSWER IS .268 OR 26.8%, JUST WRITE 27 Numeric Response Gamma Co. can produce a unit of product for the following costs: 15 Direct material Direct labor Overhead Total costs per unit $ 10 20 40 $72 nts 01:30:21 An outside supplier offers to provide Gamma with all the units it needs at $60 per unit. If Gamma buys from the supplier, the company will still incur 40% of its overhead. What are the relevant costs to make the unit? PRESENT YOUR ANSWER ROUNDED TO ZERO DECIMAL PLACES. DON'T USE THE $ SYMBOL Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started