need help with this question.

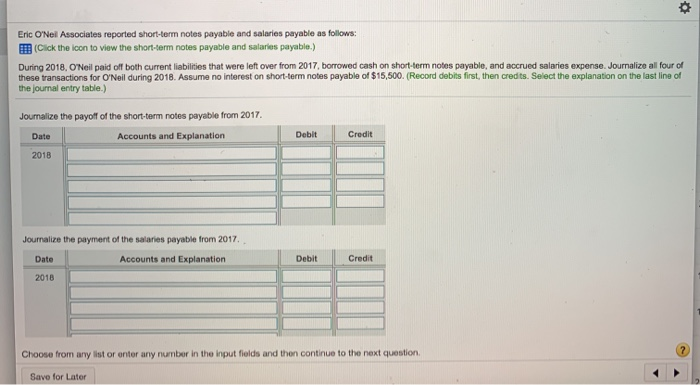

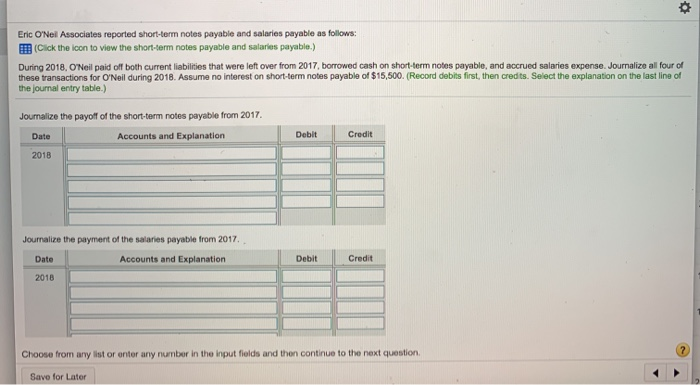

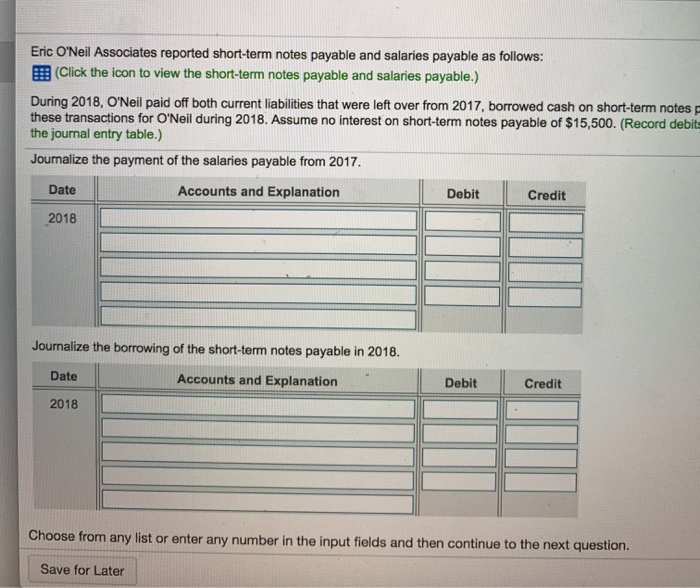

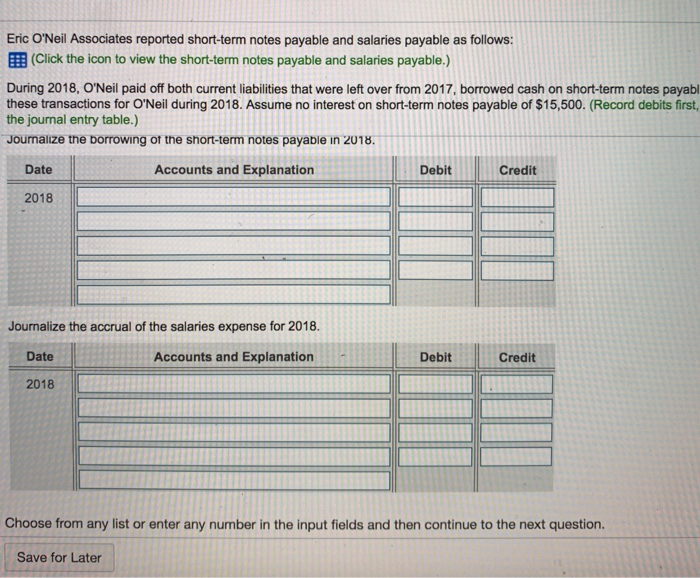

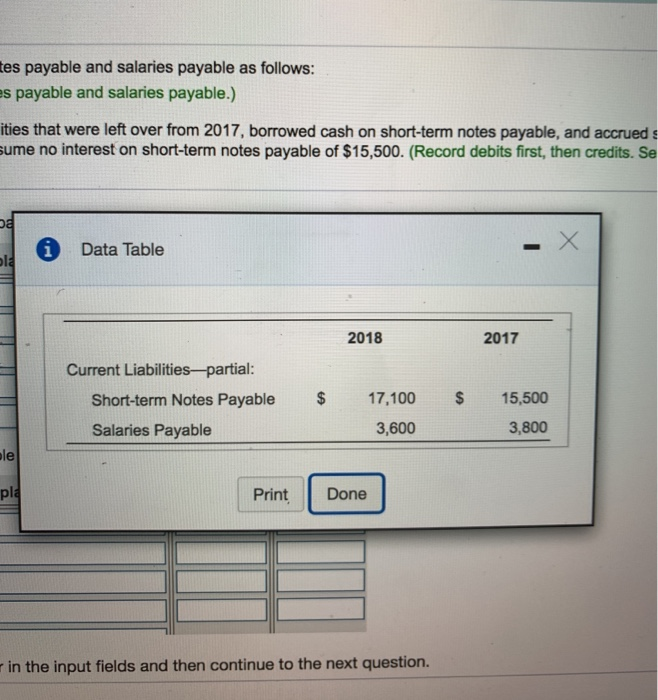

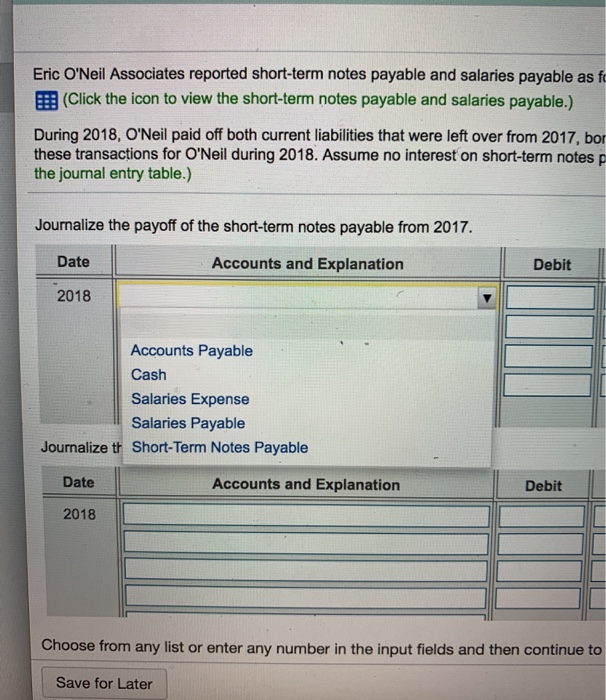

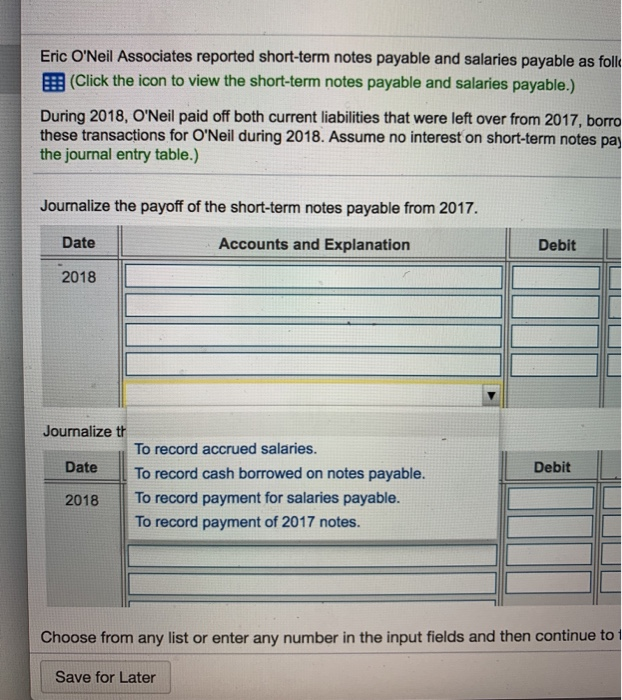

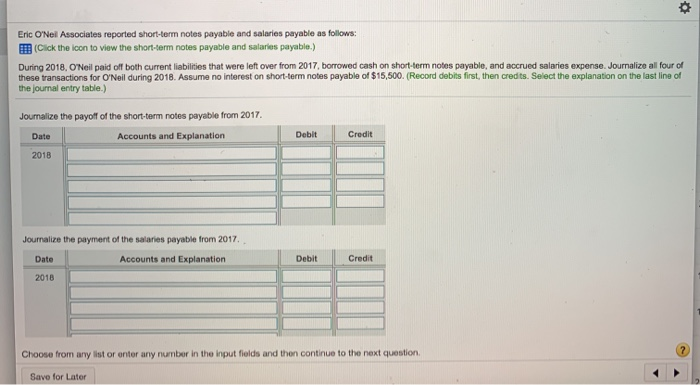

Eric O'Nel Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2018, O'Neil paid off both current liabilities that were left over from 2017, borrowed cash on short-term notes payable, and accrued salaries expense. Journalize all four of these transactions for O'Neil during 2018. Assume no interest on short-term notes payable of $15,500. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journalize the payoff of the short-term notes payable from 2017 Date Accounts and Explanation Debit Credit 2018 Journalize the payment of the salaries payable from 2017. Date Accounts and Explanation 2018 Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Eric O'Neil Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2018, O'Neil paid off both current liabilities that were left over from 2017, borrowed cash on short-term notes these transactions for O'Neil during 2018. Assume no interest on short-term notes payable of $15,500. (Record debit the journal entry table.) Journalize the payment of the salaries payable from 2017. Date Accounts and Explanation Debit Credit 2018 Journalize the borrowing of the short-term notes payable in 2018. Date Accounts and Explanation Debit Credit 2018 Choose from any list or enter any number in the input fields and then continue to the next question. Save for Later Eric O'Neil Associates reported short-term notes payable and salaries payable as follows: (Click the icon to view the short-term notes payable and salaries payable.) During 2018, O'Neil paid off both current liabilities that were left over from 2017, borrowed cash on short-term notes payabl these transactions for O'Neil during 2018. Assume no interest on short-term notes payable of $15,500. (Record debits first, the journal entry table.) Journalize the borrowing of the short-term notes payable in 2018. Date Accounts and Explanation Debit Credit 2018 Journalize the accrual of the salaries expense for 2018. Date Accounts and Explanation Debit Credit 2018 Choose from any list or enter any number in the input fields and then continue to the next question. Save for Later tes payable and salaries payable as follows: s payable and salaries payable.) ities that were left over from 2017, borrowed cash on short-term notes payable, and accrued jume no interest on short-term notes payable of $15,500. (Record debits first, then credits. Se i Data Table 2018 2017 Current Liabilitiespartial: Short-term Notes Payable Salaries Payable $ 17,100 3,600 15,500 3,800 pla Print Done - in the input fields and then continue to the next question. Eric O'Neil Associates reported short-term notes payable and salaries payable as fi .: (Click the icon to view the short-term notes payable and salaries payable.) During 2018, O'Neil paid off both current liabilities that were left over from 2017, bor these transactions for O'Neil during 2018. Assume no interest on short-term notes p the journal entry table.) Journalize the payoff of the short-term notes payable from 2017. Date Accounts and Explanation Debit 2018 Accounts Payable Cash Salaries Expense Salaries Payable Journalize th Short-Term Notes Payable Date Accounts and Explanation Debit 2018 Choose from any list or enter any number in the input fields and then continue to Save for Later Eric O'Neil Associates reported short-term notes payable and salaries payable as folle BE: (Click the icon to view the short-term notes payable and salaries payable.) During 2018, O'Neil paid off both current liabilities that were left over from 2017, borro these transactions for O'Neil during 2018. Assume no interest on short-term notes paj the journal entry table.) Journalize the payoff of the short-term notes payable from 2017. Date Accounts and Explanation Debit 2018 Journalize tt Date Debit To record accrued salaries. To record cash borrowed on notes payable. To record payment for salaries payable. To record payment of 2017 notes 2018 Choose from any list or enter any number in the input fields and then continue to Save for Later