need help with this question

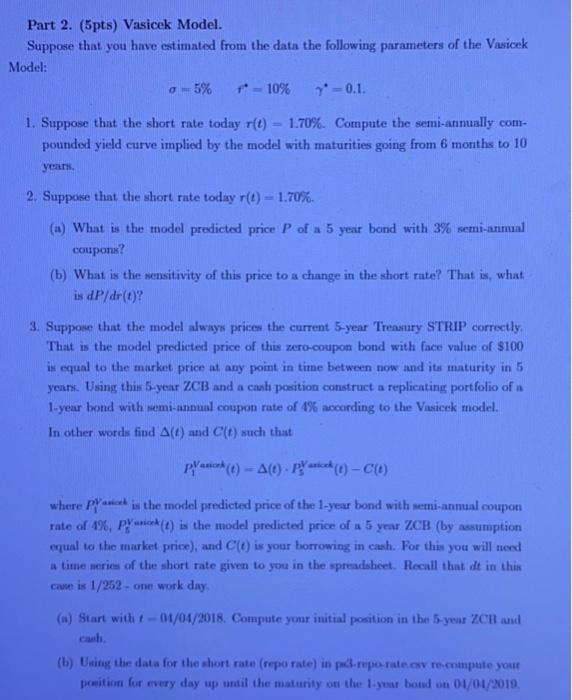

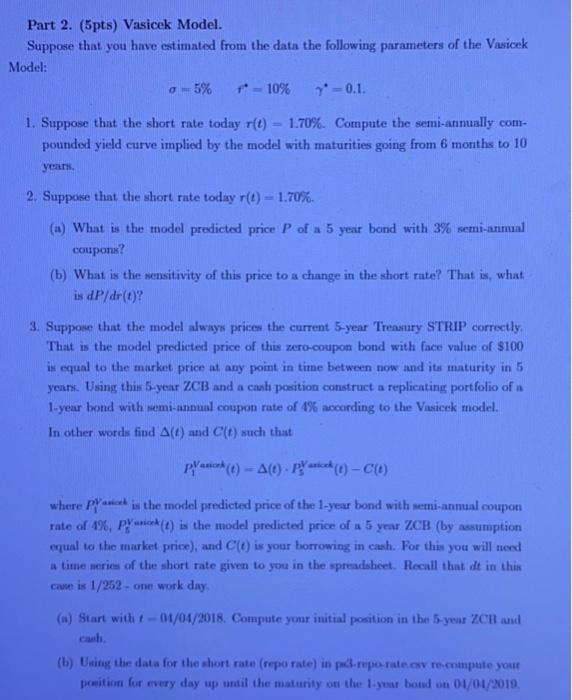

Part 2. (5pts) Vasicek Model. Suppose that you have estimated from the data the following parameters of the Vasicek Model: 0 -5% 1 - 10% 7 -0.1. 1. Suppose that the short rate today r(t) 1.70%. Compute the semi-annually com- pounded yield curve implied by the model with maturities going from 6 months to 10 year, 2. Suppose that the short rate today r(t) - 1.70%. (a) What is the model predicted price P of a 5 year bond with 3% semi-animal coupons? (b) What is the sensitivity of this price to a change in the short rate? That is what is dP/dr(t)? 3. Suppose that the model always prices the current 5-year Treasury STRIP correctly. That is the model predicted price of this zero-coupon bond with face value of $100 is equal to the market price at any point in time between now and its maturity in 5 years. Using this 5-year ZCB and a cal position construct a replicating portfolio of n 1-year bond with semi-annual coupon rate of 4% according to the Vasicek model. In other words find A(t) and (t) such that Pack (6) - A(6) - punced () -C(L) where panic is the model predicted price of the 1-year bond with semi-annual coupon rate of 4%, Pyrik (t) is the model predicted price of a 5 year ZCB (by assumption equal to the market price), and C() is your borrowing in cash. For this you will need a time series of the short rate given to you in the spreadsheet. Recall that dt in this came is 1/252-one work day. (a) Start with t-01/01/2018. Compute your initial position in the 5-yeur ZCB and cash (b) Uning the data for the short rate (repo rate) in padl-reporte.csv re.compute your pomition for every day up until the maturity on the Iyour bond on 01/01/2019. Part 2. (5pts) Vasicek Model. Suppose that you have estimated from the data the following parameters of the Vasicek Model: 0 -5% 1 - 10% 7 -0.1. 1. Suppose that the short rate today r(t) 1.70%. Compute the semi-annually com- pounded yield curve implied by the model with maturities going from 6 months to 10 year, 2. Suppose that the short rate today r(t) - 1.70%. (a) What is the model predicted price P of a 5 year bond with 3% semi-animal coupons? (b) What is the sensitivity of this price to a change in the short rate? That is what is dP/dr(t)? 3. Suppose that the model always prices the current 5-year Treasury STRIP correctly. That is the model predicted price of this zero-coupon bond with face value of $100 is equal to the market price at any point in time between now and its maturity in 5 years. Using this 5-year ZCB and a cal position construct a replicating portfolio of n 1-year bond with semi-annual coupon rate of 4% according to the Vasicek model. In other words find A(t) and (t) such that Pack (6) - A(6) - punced () -C(L) where panic is the model predicted price of the 1-year bond with semi-annual coupon rate of 4%, Pyrik (t) is the model predicted price of a 5 year ZCB (by assumption equal to the market price), and C() is your borrowing in cash. For this you will need a time series of the short rate given to you in the spreadsheet. Recall that dt in this came is 1/252-one work day. (a) Start with t-01/01/2018. Compute your initial position in the 5-yeur ZCB and cash (b) Uning the data for the short rate (repo rate) in padl-reporte.csv re.compute your pomition for every day up until the maturity on the Iyour bond on 01/01/2019

need help with this question

need help with this question