Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NEED HELP WITH THIS QUICKLY! Will greatly appreciate Data for Barry Computer Co. and its Industry averages follow. The firm's debt is priced at par,

NEED HELP WITH THIS QUICKLY! Will greatly appreciate

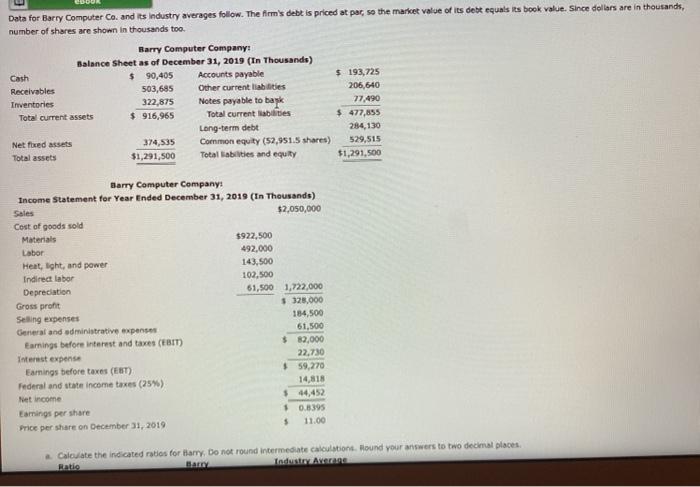

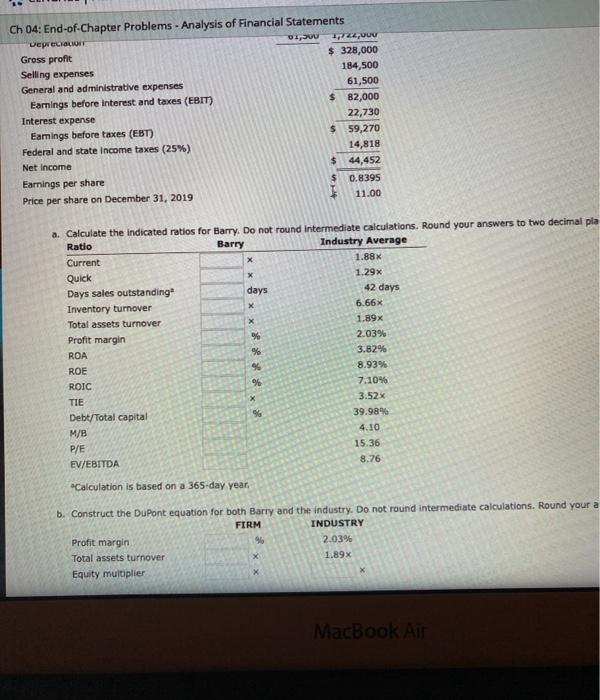

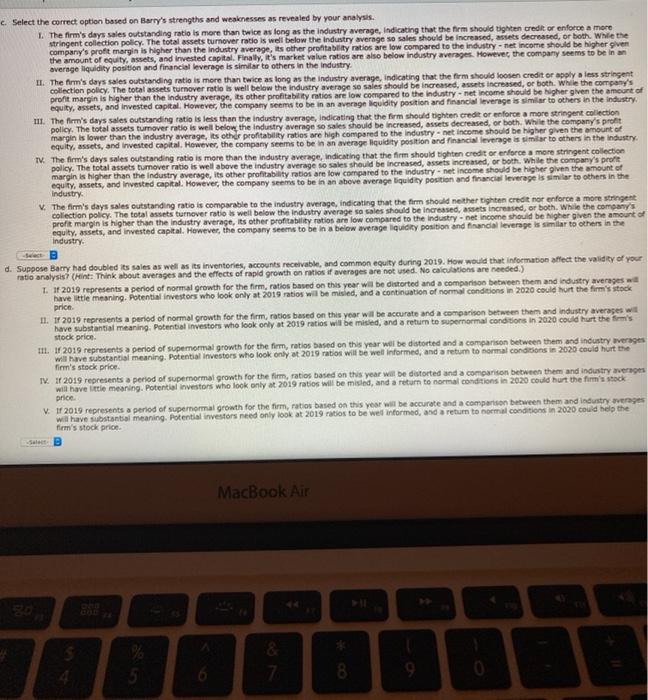

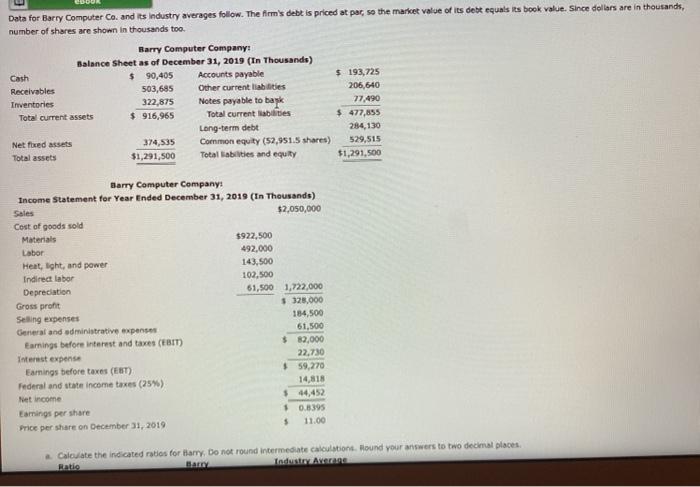

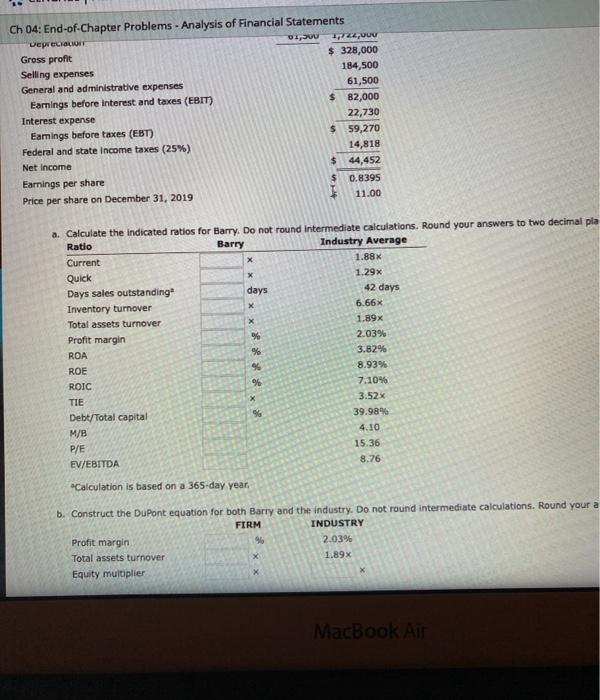

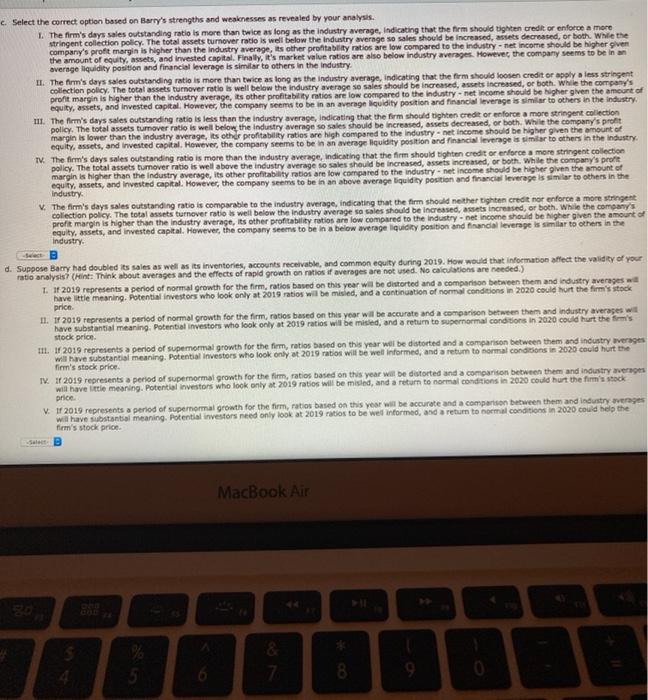

Data for Barry Computer Co. and its Industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands number of shares are shown in thousands too. Barry Computer Company: Balance Sheet as of December 31, 2019 (In Thousands) Cash $ 90,405 Accounts payable Receivables 503,685 Other current liabilities Inventories 322,875 Notes payable to bask Total current assets $ 916,965 Total current abilities Long-term debt Net fixed assets 374,535 Common equity (52,951.5 shares) Total assets $1,291,500 Total liabilities and equity $ 193,725 206,640 77.490 $ 477,855 284,130 529,515 $1,291,500 Barry Computer Company: Income Statement for Year Ended December 31, 2019 (In Thousands) Sales $2,050,000 Cost of goods sold Materials $922,500 Labor 492,000 Heat, light, and power 143,500 Indirect labor 102,500 Depreciation 61,500 1,722,000 Gross profit $325.000 Selling expenses 184,500 General and administrative expenses 61,500 Earnings before interest and taxes (EBIT) $ 82,000 Interest expense 22,730 Earnings before taxes (ET) $ 59,270 Federal and state income taxes (25%) 14,818 Net income 44,452 Earnings per share $ 0.8.395 Price per share on December 31, 2019 $ 11.00 Calculate the indicated ratios for Harry. Do not round Intermediate calculations. Hound your answers to two decimal places Ratio Bany Tad Area Ch 04: End-of-Chapter Problems - Analysis of Financial Statements DeprecIGLIONI 01, 1,744,00 Gross profit $ 328,000 Selling expenses 184,500 General and administrative expenses 61,500 Earnings before interest and taxes (EBIT) $ 82,000 Interest expense 22,730 Eamnings before taxes (EBT) 59,270 Federal and state income taxes (25%) 14,818 Net Income 44,452 Earnings per share 0.8395 Price per share on December 31, 2019 11.00 a. Calculate the indicated ratios for Barry. Do not round intermediate calculations. Round your answers to two decimal pla Ratio Barry Industry Average Current X 1.88x Quick x 1.29% Days sales outstanding days 42 days Inventory turnover X 6.66 Total assets turnover 1.89x Profit margin 3% 2.03% ROA % 3.82% ROE $ 8.93% ROIC 7.10% TIE 3.52x Debt/Total capital 39.989 M/B 4.10 P/E 15.36 EV/EBITDA 8.76 96 Calculation is based on a 365-day year, b. Construct the DuPont equation for both Barry and the industry. Do not round intermediate calculations. Round your a FIRM INDUSTRY Profit margin 96 2.03% Total assets turnover 1.89x Equity multiplier MacBook Air c. Select the correct option based on Barry's strengths and weaknesses as revealed by your analysis. 1. The firm's days sales outstanding ratio is more than twice as long as the industry average, indicating that the firm should tighten credit or enforce a more stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets decreased, or both. We the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry - net income should be higher given the amount of equity assets, and invested capital. Finally, it's market value ratios are also below Industry averages. However the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. II. The firm's days sales outstanding ratio is more than twice as long as the industry average, indicating that the firm should loosen credit or apply a less stringent collection policy. The total assets turnover ratio is well below the industry average se sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry III. The firm's days sales outstanding ratio is less than the industry average, indicating that the firm should tighten creditorenforce a more stringent collection policy. The total assets tumover ratio is well below the industry average so sales should be increased, assets decreased, or both. While the company's profit margin is lower than the industry average, its other profitability ratios are high compared to the industry - net income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an average liquidity position and financial leverage is similar to others in the industry. TV. The firm's days sales outstanding ratio is more than the industry average, indicating that the firm should tighten creditorenforce a more stringent collection policy. The total assets turnover ratio is well above the industry average so sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry.net Income should be higher given the amount of equity, assets, and invested capital. However, the company seems to be in an above average liquidity position and financial leverage is similar to others in the industry V. The firm's days sales outstanding Patio is comparable to the industry average, indicating that the firm should neither tighton creditorenforce a more stringent collection policy. The total assets turnover ratio is well below the industry average so sales should be increased, assets increased, or both. While the company's profit margin is higher than the industry average, its other profitability ratios are low compared to the industry - net income should be Nigher given the amount of equity, assets, and invested capital. However, the company seems to be in a below average liquidity position and financial leverage is similar to others in the industry Set B d. Suppose Barry had doubled its sales as well as its inventories, accounts receivable, and common equity during 2019. How would that information affect the validity of your ratio analysis (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) I. 1 2019 represents a period of normal growth for the firm, ratios based on this year will be distorted and comparison between them and industry averages wit have little meaning, Potential investors who look only at 2019 ratios will be misled, and a continuation of normal conditions in 2020 could hurt the firm's stock price 11. I 2019 represents a period of normal growth for the firm, ratios based on this year will be accurate and a comparison between them and Industry averages wit have substantial meaning. Potential investors who look only at 2019 ratios will be missed, and a return to supernormal conditions in 2020 could hurt the firm's stock price m. 18 2019 represents a period of superormal growth for the firm, ratios based on this year will be distorted and comparison between them and industry averages will have substantial meaning. Potential investors who look only at 2019 ratios will be well informed, and a retum to normal conditions in 2020 could hurt the firm's stock price IV. 18 2019 represents a period of supernormal growth for the firm, ratios based on this year will be distorted and a comparison between them and industry averages will have little meaning. Potential investors who look only at 2019 ratios will be misled, and a return to normal conditions in 2020 could hurt the firm's stock price V. If 2019 represents a period of supernormal growth for the firm, ratios based on this year will be accurate and a comparison between them and industry averages will have substantial meaning. Potential investors need only look at 2019ration to be wel informed, and a return to normal conditions in 2020 could help the firm's stock price MacBook Air E 5 7. 0 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started