need help with unadjusted, adjusted, and post-closing balance sheet please.

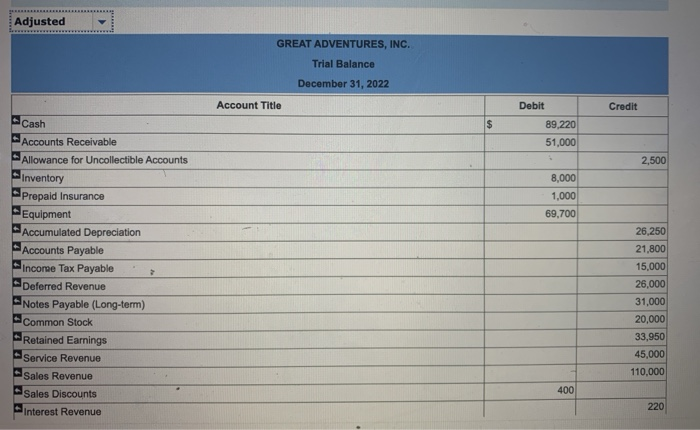

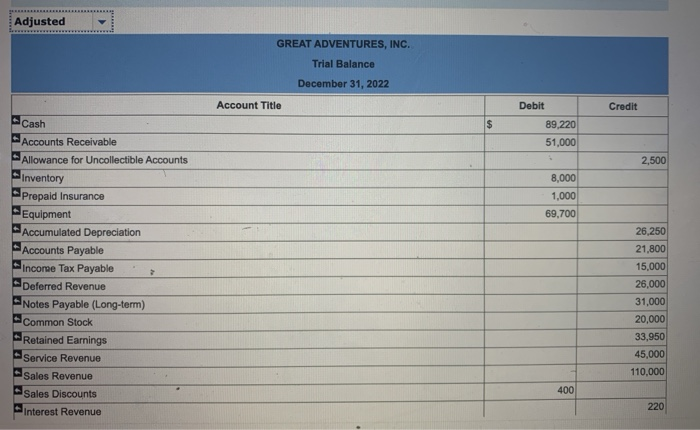

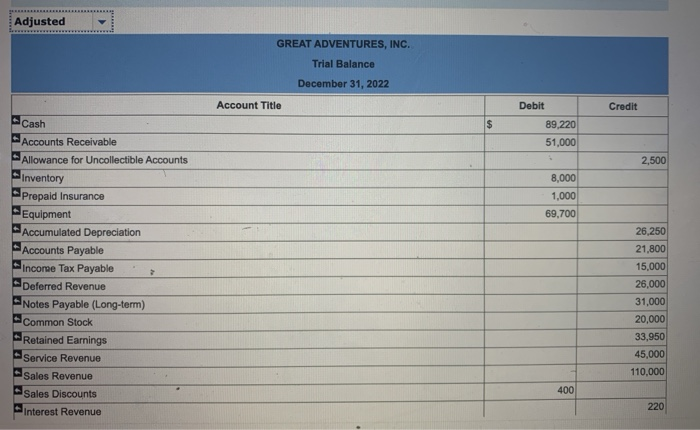

adjusted trial balance

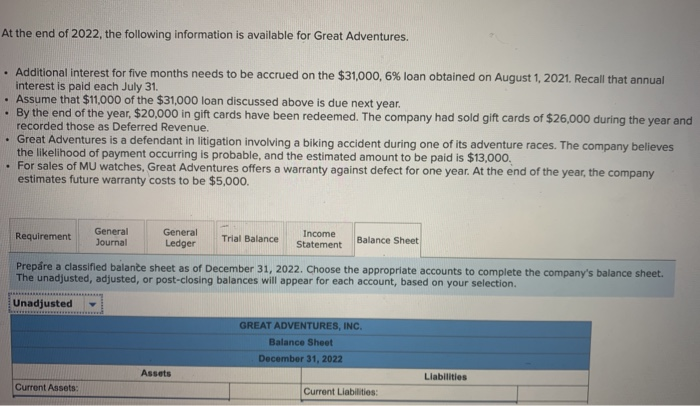

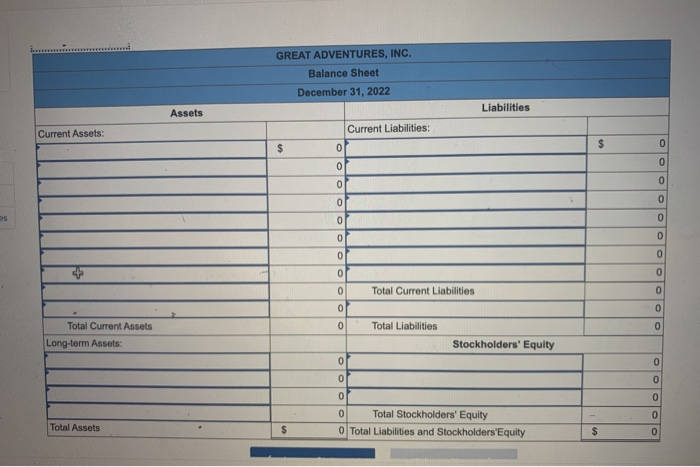

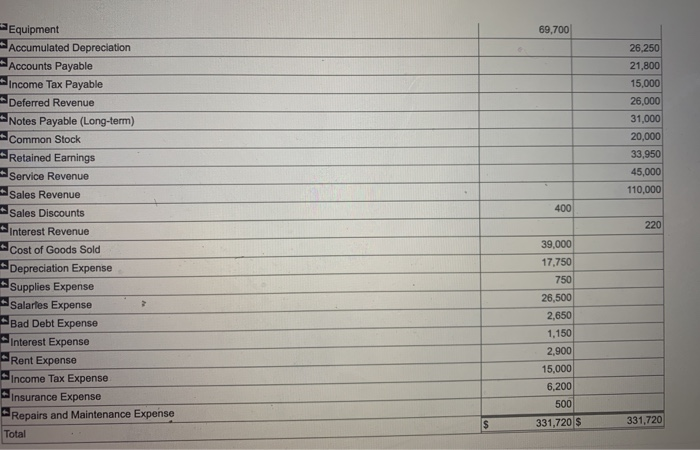

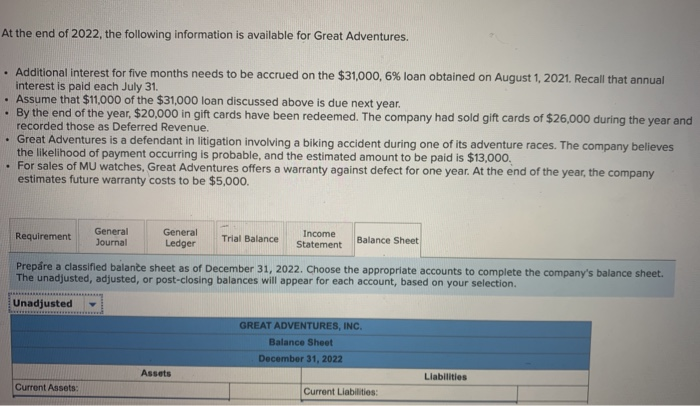

At the end of 2022, the following information is available for Great Adventures. . Additional interest for five months needs to be accrued on the $31,000, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $11,000 of the $31,000 loan discussed above is due next year. . By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $26,000 during the year and recorded those as Deferred Revenue, Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $13,000. For sales of MU watches. Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $5,000. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Prepare a classified balance sheet as of December 31, 2022. Choose the appropriate accounts to complete the company's balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Unadjusted GREAT ADVENTURES, INC. Balance Sheet December 31, 2022 Current Assets: Current Liabilities: GREAT ADVENTURES, INC. Balance Sheet December 31, 2022 Liabilities Assets Current Assets: Current Liabilities: oooos Total Current Liabilities 0 Total Liabilities Total Current Assets Long-term Assets: Stockholders' Equity 07 Total Assets 0 Total Stockholders' Equity 0 Total Liabilities and Stockholders'Equity $ Adjusted GREAT ADVENTURES, INC. Trial Balance December 31, 2022 Account Title Credit Debit 89,220 51,000 2,500 8,000 1,000 69.700 - Cash - Accounts Receivable -Allowance for Uncollectible Accounts Inventory Prepaid Insurance Equipment Accumulated Depreciation - Accounts Payable Income Tax Payable " Deferred Revenue Notes Payable (Long-term) Common Stock Retained Earnings - Service Revenue Sales Revenue - Sales Discounts Interest Revenue 26,250 21,800 15,000 26,000 31,000 20,000 33,950 45,000 110,000 400 220 69,700 26,250 21,800 15,000 26,000 31,000 20,000 33,950 45,000 110,000 400 220 -Equipment Accumulated Depreciation Accounts Payable + Income Tax Payable Deferred Revenue Notes Payable (Long-term) Common Stock Retained Earnings Service Revenue * Sales Revenue Sales Discounts Interest Revenue Cost of Goods Sold Depreciation Expense * Supplies Expense Salartes Expense Bad Debt Expense - Interest Expense Rent Expense Income Tax Expense Insurance Expense Repairs and Maintenance Expense Total 39,000 17.750 750 26,500 2,650 1,150 2,900 15,000 6,200 500 $ 331,720 S 331,720 At the end of 2022, the following information is available for Great Adventures. . Additional interest for five months needs to be accrued on the $31,000, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $11,000 of the $31,000 loan discussed above is due next year. . By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $26,000 during the year and recorded those as Deferred Revenue, Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $13,000. For sales of MU watches. Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $5,000. Requirement General Journal General Ledger Trial Balance Income Statement Balance Sheet Prepare a classified balance sheet as of December 31, 2022. Choose the appropriate accounts to complete the company's balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Unadjusted GREAT ADVENTURES, INC. Balance Sheet December 31, 2022 Current Assets: Current Liabilities: GREAT ADVENTURES, INC. Balance Sheet December 31, 2022 Liabilities Assets Current Assets: Current Liabilities: oooos Total Current Liabilities 0 Total Liabilities Total Current Assets Long-term Assets: Stockholders' Equity 07 Total Assets 0 Total Stockholders' Equity 0 Total Liabilities and Stockholders'Equity $ Adjusted GREAT ADVENTURES, INC. Trial Balance December 31, 2022 Account Title Credit Debit 89,220 51,000 2,500 8,000 1,000 69.700 - Cash - Accounts Receivable -Allowance for Uncollectible Accounts Inventory Prepaid Insurance Equipment Accumulated Depreciation - Accounts Payable Income Tax Payable " Deferred Revenue Notes Payable (Long-term) Common Stock Retained Earnings - Service Revenue Sales Revenue - Sales Discounts Interest Revenue 26,250 21,800 15,000 26,000 31,000 20,000 33,950 45,000 110,000 400 220 69,700 26,250 21,800 15,000 26,000 31,000 20,000 33,950 45,000 110,000 400 220 -Equipment Accumulated Depreciation Accounts Payable + Income Tax Payable Deferred Revenue Notes Payable (Long-term) Common Stock Retained Earnings Service Revenue * Sales Revenue Sales Discounts Interest Revenue Cost of Goods Sold Depreciation Expense * Supplies Expense Salartes Expense Bad Debt Expense - Interest Expense Rent Expense Income Tax Expense Insurance Expense Repairs and Maintenance Expense Total 39,000 17.750 750 26,500 2,650 1,150 2,900 15,000 6,200 500 $ 331,720 S 331,720