Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with work out problem!! thanks in advance Ms. Gleason, an unmarried taxpayer, had the following income items. Salary Net income from a rental

need help with work out problem!! thanks in advance

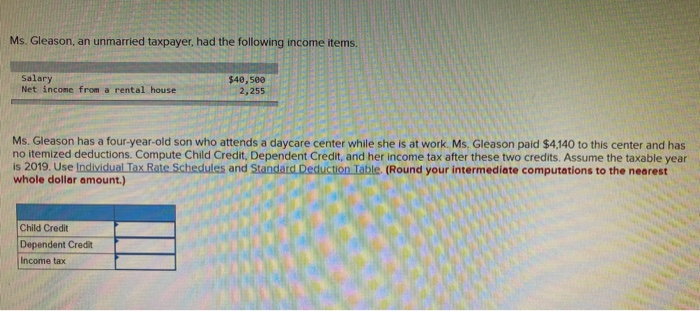

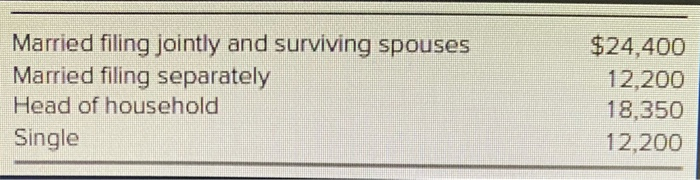

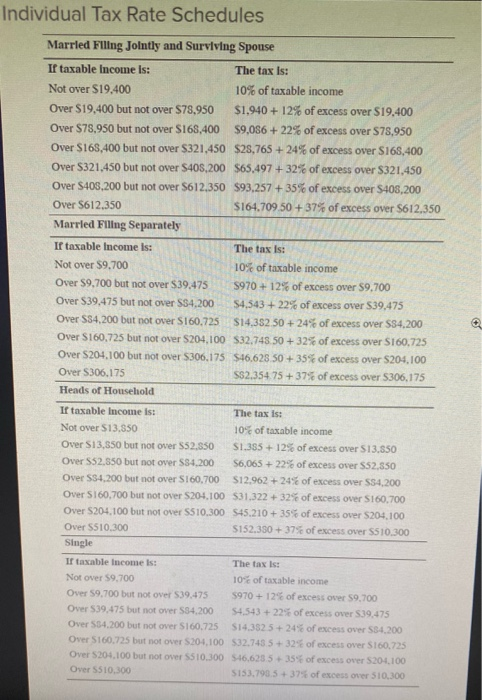

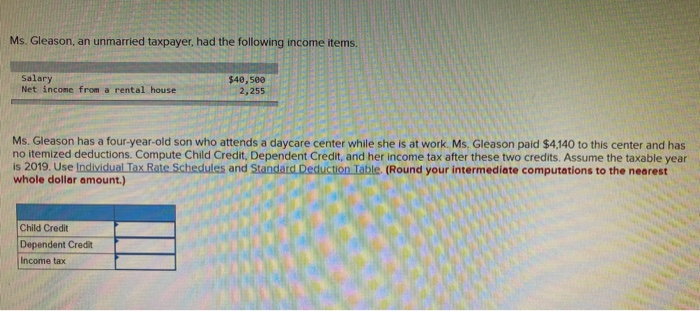

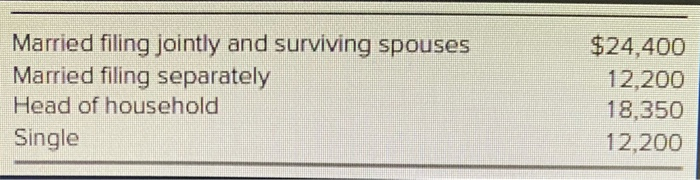

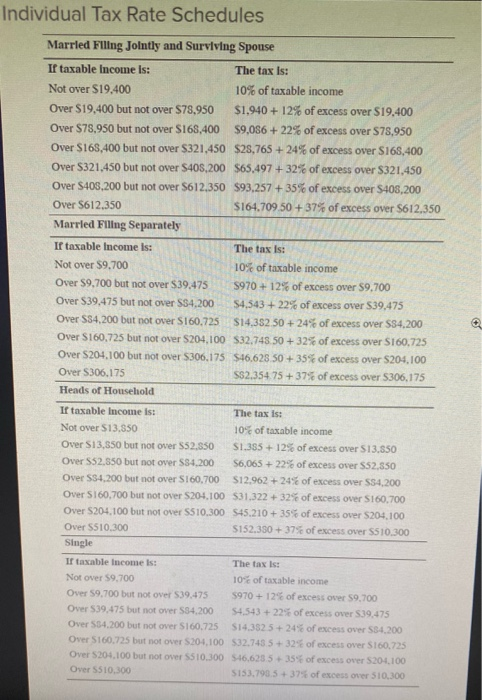

Ms. Gleason, an unmarried taxpayer, had the following income items. Salary Net income from a rental house $40,500 2,255 Ms. Gleason has a four-year-old son who attends a daycare center while she is at work. Ms. Gleason paid $4,140 to this center and has no itemized deductions. Compute Child Credit, Dependent Credit, and her income tax after these two credits. Assume the taxable year is 2019. Use Individual Tax Rate Schedules and Standard Deduction Table (Round your intermediate computations to the nearest whole dollar amount.) Child Credit Dependent Credit Income tax Married filing jointly and surviving spouses Married filing separately Head of household Single $24,400 12.200 18,350 12,200 Individual Tax Rate Schedules Married Filling Jointly and Surviving Spouse If taxable income is: The tax is: Not over $19.400 10% of taxable income Over $19,400 but not over $78,950 $1,940 + 12% of excess over $19,400 Over $78,950 but not over $168,400 $9,086 +22% of excess over $78,950 Over $168,400 but not over S321,450 $28,765 + 24% of excess over $168,400 Over 5321.450 but not over $405,200 $65,497 + 32% of excess over 321,450 Over $405,200 but not over $612.350 $93.257 +35% of excess over $408,200 Over $612.350 $164.709 50 + 37% of excess over $612,350 Married Filing Separately If taxable income is: The tax is: Not over $9.700 10% of taxable income Over $9.700 but not over $39,475 S970+ 12% of excess over $9.700 Over $39,475 but not over SS4,200 $4,543 + 22% of excess over $39,475 Over S54.200 but not over $160.725 $14,352.50 +24% of excess over $84.200 Over $160,725 but not over S204,100 $32.748 50 + 32% of excess over $160,725 Over S204,100 but not over $306,175 $46.628 50+ 35% of excess over S204,100 Over S306,175 S82.354.75 +37% of excess over $306,175 Heads of Household Ir taxable income is: The tax is: Not over $13.850 10 of taxable income Over $13,350 but not over S52.850 51.355 +12% of excess over $13.850 Over S52.550 but not over $84.200 56,065 +22% of excess over S52.550 Over $34,200 but not over $160,700 $12.962 +24% of excess over 554,200 Over $160,700 but not over S204.100 531,322 + 32% of excess over $160,700 Over S204,100 but not over S510,300 $45.210 + 35% of excess over S204,100 Over S510,300 $152.330 + 37% of excess over S510,300 Single Ir taxable income is: The tax is: Not over 59.700 10 of taxable income Over 59.700 but not over $39.475 5970 +12% of excess over 59,700 Over 539,475 but not over 534,200 54.543 +225 of excess over $39,475 Over $84.200 but not over $160.725 $14.352 5+24% of excess over 534.200 Over 5160.725 but not over S204,100 $32.743 5+ 32 of excess over $160,725 Over S204.100 but not over SS10,300 46,623.5+ 35 of excess over 5204.100 Over 5510,300 S153.793.5+ 37of excess over $10,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started