Answered step by step

Verified Expert Solution

Question

1 Approved Answer

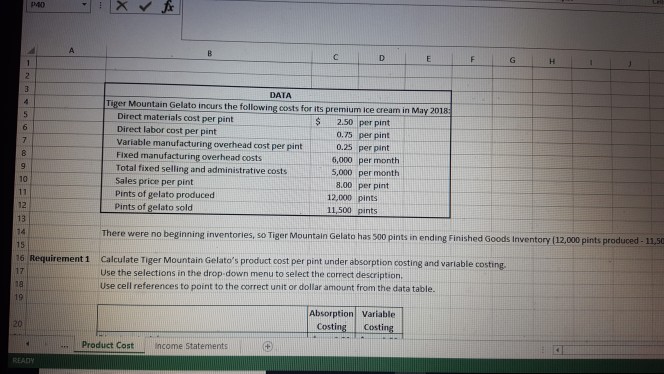

need help wiyh requirement 2 p40 DATA Tiger Mountain Gelato incurs the following costs for its premium ice cream in May 2018 Direct materials cost

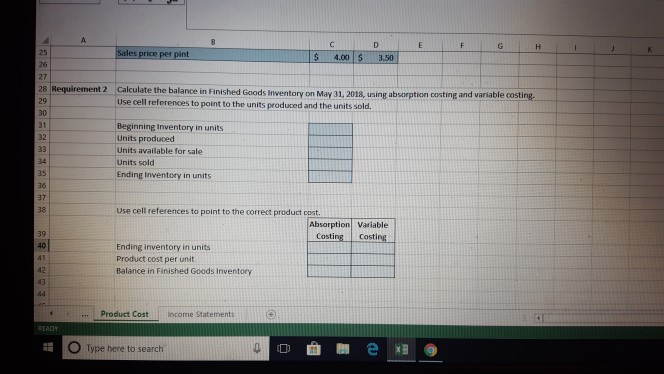

need help wiyh requirement 2

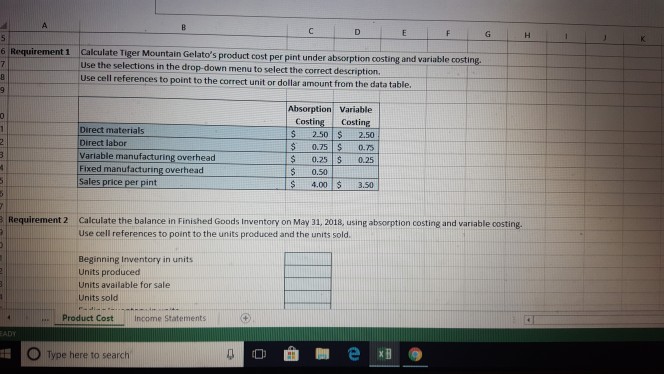

p40 DATA Tiger Mountain Gelato incurs the following costs for its premium ice cream in May 2018 Direct materials cost per pint Direct labor cost per pint Variable manufacturing overhead cost per pint Fixed manufacturing overhead oosts Total fixed selling and administrative costs Sales price per pint Pints of gelato produced Pints of gelato sold $2.50 per pint 0.75 per pint 0.25 per pint 6,000 per month 5,000 per month 8.00 per pint 12,000 pints 11,500 pints 10 12 There were no beginning inventories, so Tiger Mountaln Gelato has 500 pints in ending Finished Goods Inventory (12,000 pints produced - 11,50 14 16 Requirement 1 Calculate Tiger Mountain Gelato's product cost per pint under absorption costing and variable cost Iculate Tiger Mountain Gelato's product cost per pint under absorption costing and variable costing. Use the selections in the drop-down menu to select the correct description Use cell references to point to the correct unit or dollar amount from the data table. Absorption Variable ting Cost Product Cost income Statements READYStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started