Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help wot need help with 2,3,4,6,9,10. Thank you in advance 2. Interest of $500 has accrued on a note payable to the bank. The

need help wot

need help with 2,3,4,6,9,10. Thank you in advance

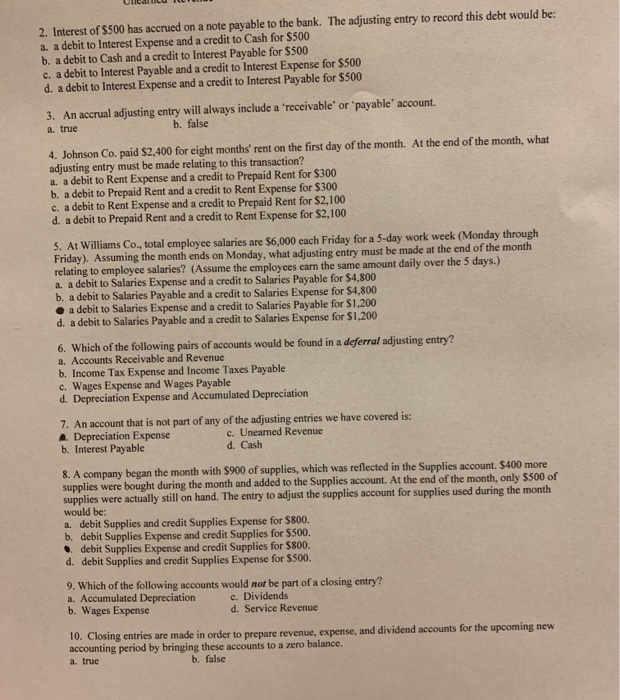

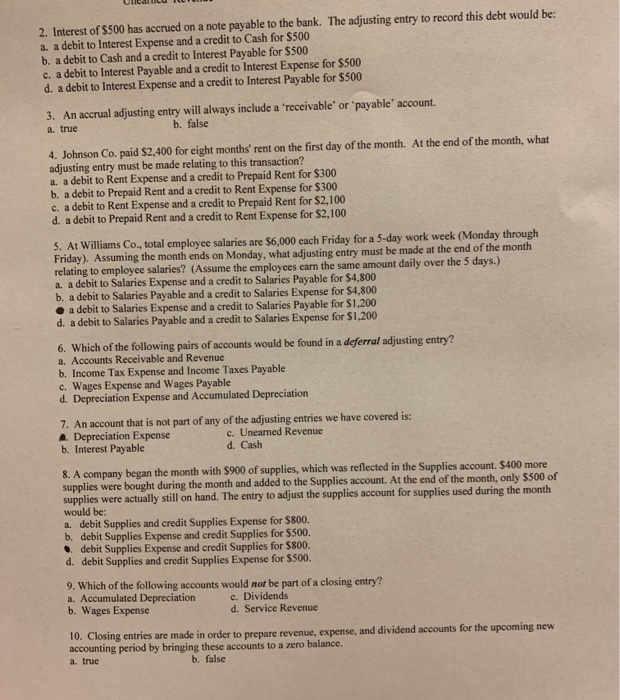

2. Interest of $500 has accrued on a note payable to the bank. The adjusting entry to record this debt would be: a. a debit to Interest Expense and a credit to Cash for $500 b. a debit to Cash and a credit to Interest Payable for $500 c. a debit to Interest Payable and a credit to Interest Expense for $500 d. a debit to Interest Expense and a credit to Interest Payable for $500 3. An accrual adjusting entry will always include a 'receivable' or 'payable' account. a true b. false 4. Johnson Co. paid $2,400 for eight months' rent on the first day of the month. At the end of the month, what adjusting entry must be made relating to this transaction? a. a debit to Rent Expense and a credit to Prepaid Rent for $300 b. a debit to Prepaid Rent and a credit to Rent Expense for $300 c. a debit to Rent Expense and a credit to Prepaid Rent for $2,100 d. a debit to Prepaid Rent and a credit to Rent Expense for $2,100 5. At Williams Co., total employee salaries are $6,000 each Friday for a 5-day work week (Monday through Friday). Assuming the month ends on Monday, what adjusting entry must be made at the end of the month relating to employee salaries? (Assume the employees earn the same amount daily over the 5 days.) a. a debit to Salaries Expense and a credit to Salaries Payable for $4,800 b. a debit to Salaries Payable and a credit to Salaries Expense for $4,800 a debit to Salaries Expense and a credit to Salaries Payable for $1.200 d. a debit to Salaries Payable and a credit to Salaries Expense for $1,200 6. Which of the following pairs of accounts would be found in a deferral adjusting entry? a. Accounts Receivable and Revenue b. Income Tax Expense and Income Taxes Payable c. Wages Expense and Wages Payable d. Depreciation Expense and Accumulated Depreciation 7. An account that is not part of any of the adjusting entries we have covered is: A. Depreciation Expense c. Unearned Revenue b. Interest Payable d. Cash 8. A company began the month with $900 of supplies, which was reflected in the Supplies account. $400 more supplies were bought during the month and added to the Supplies account. At the end of the month, only $500 of supplies were actually still on hand. The entry to adjust the supplies account for supplies used during the month would be: a. debit Supplies and credit Supplies Expense for $800. b. debit Supplies Expense and credit Supplies for $500. .. debit Supplies Expense and credit Supplies for $800. d. debit Supplies and credit Supplies Expense for $500. 9. Which of the following accounts would not be part of a closing entry? a. Accumulated Depreciation c. Dividends b. Wages Expense d. Service Revenue 10. Closing entries are made in order to prepare revenue, expense, and dividend accounts for the upcoming new accounting period by bringing these accounts to a zero balance. b. false a true Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started