Question

Need help writing a Memo with the Following information given below how would I write this Given the two project options, we can only afford

Need help writing a Memo with the Following information given below how would I write this

Given the two project options, we can only afford to undertake one of the investments. I look to you to provide an evaluation and recommendation as to which project we should proceed with. In addition, I would also like you to present any issues or concerns you see from your analysis of the projected cash budget and our current cash conversion cycle. Are there any recommended changes you would suggest to maximize the effectiveness of our working capital?

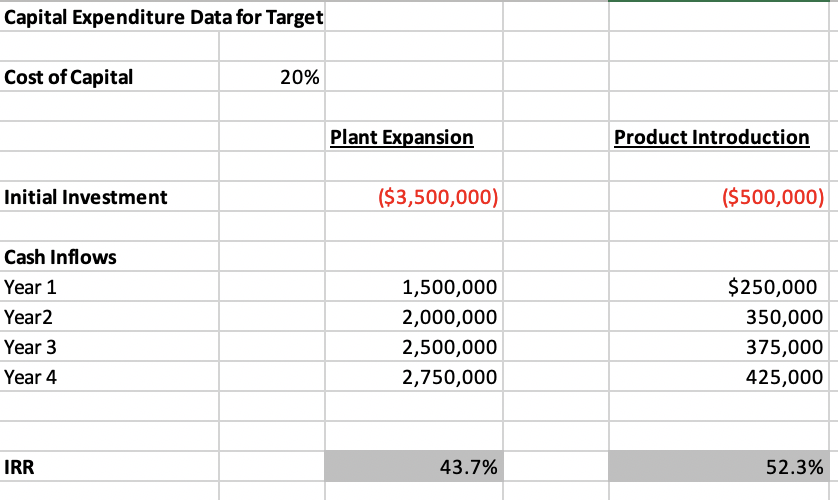

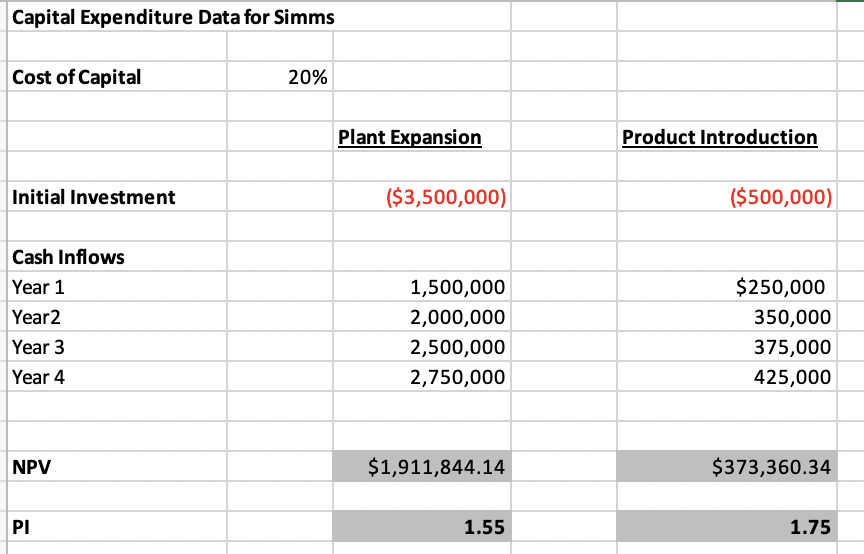

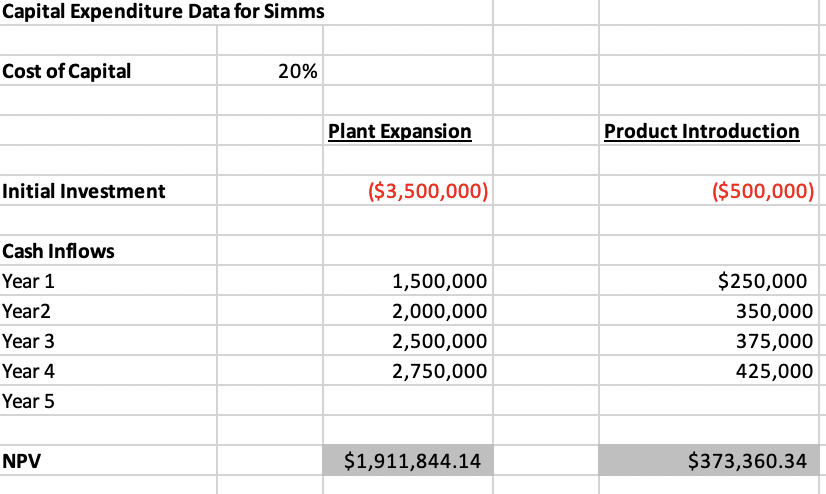

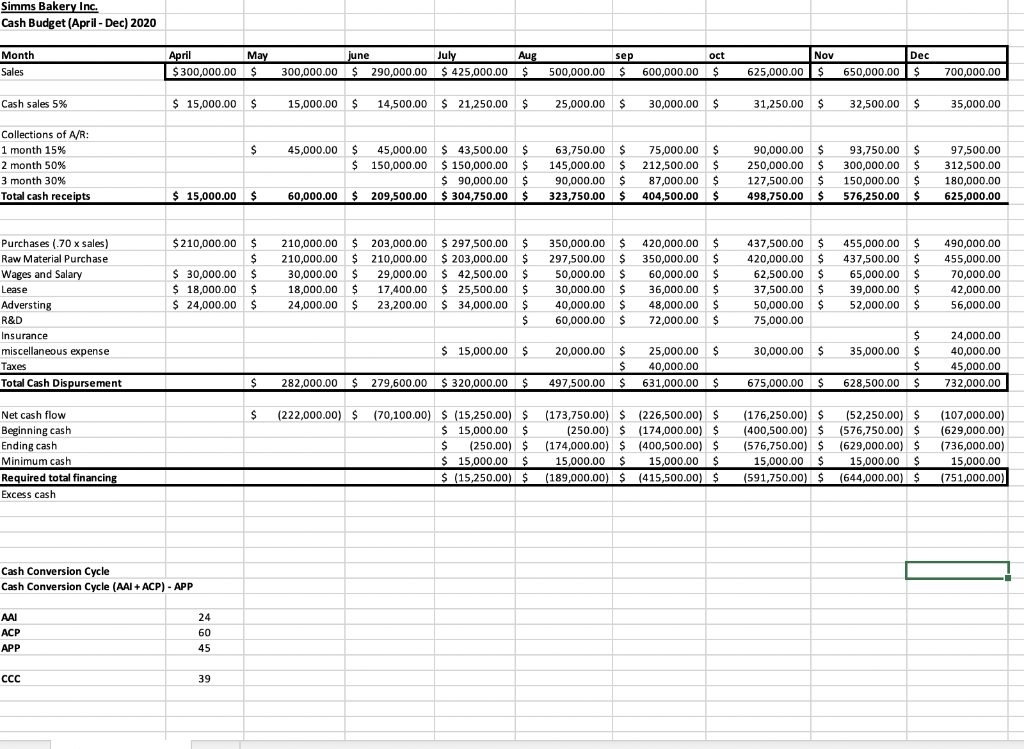

Capital Expenditure Data for Target Cost of Capital 20% Plant Expansion Product Introduction Initial Investment ($3,500,000) ($500,000) Cash Inflows Year 1 Year2 Year 3 Year 4 1,500,000 2,000,000 2,500,000 2,750,000 $250,000 350,000 375,000 425,000 IRR 43.7% 52.3% Capital Expenditure Data for Simms Cost of Capital 20% Plant Expansion Product Introduction Initial Investment ($3,500,000) ($500,000) Cash Inflows Year 1 Year2 Year 3 Year 4 1,500,000 2,000,000 2,500,000 2,750,000 $250,000 350,000 375,000 425,000 NPV $1,911,844.14 $373,360.34 1.55 1.75 Capital Expenditure Data for Simms Cost of Capital 20% Plant Expansion Product Introduction Initial Investment ($3,500,000) ($500,000) Cash Inflows Year 1 Year2 Year 3 Year 4 Year 5 1,500,000 2,000,000 2,500,000 2,750,000 $250,000 350,000 375,000 425,000 NPV $1,911,844.14 $373,360.34 Simms Bakery Inc. Cash Budget (April - Dec) 2020 Month Sales April $ 300,000.00 May $ June $ 290,000.00 July $ 425,000.00 Aug $ Sep $ Oct $ Nov $ Dec $ 300,000.00 500,000.00 600,000.00 625,000.00 650,000.00 700,000.00 Cash sales 5% $ 15,000.00 $ 15,000.00 $ 14,500.00 $ 21,250.00 $ 25,000.00 $ 30,000.00 $ 31,250.00 $ 32,500.00 $ 35,000.00 $ 45,000.00 Collections of A/R: 1 month 15% 2 month 50% 3 month 30% Total cash receipts $ $ 45,000.00 150,000.00 $ 43,500.00 $ 150,000.00 $ 90,000.00 $ 304,750.00 $ $ $ $ 63,750.00 145,000.00 90,000.00 323,750.00 $ $ $ $ 75,000.00 212,500.00 87,000.00 404,500.00 $ $ $ $ 90,000.00 250,000.00 127,500.00 498,750.00 $ $ $ $ 93,750.00 300,000.00 150,000.00 576,250.00 $ $ $ $ 97,500.00 312,500.00 180,000.00 625,000.00 $ 15,000.00 $ 60,000.00 $ 209,500.00 $ 30,000.00 $ 18,000.00 $ 24,000.00 $ $ $ $ 210,000.00 210,000.00 30,000.00 18,000.00 24,000.00 $ $ $ $ $ 203,000.00 210,000.00 29,000.00 17,400.00 23,200.00 $ 297,500.00 $ 203,000.00 $ 42,500.00 $ 25,500.00 $ 34,000.00 $ $ $ $ $ $ 297,500.00 50,000.00 30,000.00 40,000.00 60,000.00 $ $ $ $ $ Purchases (.70 x sales) Raw Material Purchase Wages and Salary Lease Adversting R&D Insurance miscellaneous expense Taxes Total Cash Dispursement 350,000.00 60,000.00 36,000.00 48,000.00 72,000.00 $ $ $ $ $ 437,500.00 420,000.00 62,500.00 37,500.00 50,000.00 75,000.00 $ $ $ $ $ 455,000.00 437,500.00 65,000.00 39,000.00 52,000.00 $ $ $ $ $ 490,000.00 455,000.00 70,000.00 42,000.00 56,000.00 $ 15,000.00 $ 20,000.00 $ 30,000.00 $ 35,000.00 $ $ $ 25,000.00 40,000.00 631,000.00 $ $ $ $ 24,000.00 40,000.00 45,000.00 732,000.00 $ 282,000.00 $ 279,600.00 $ 320,000.00 $ 497,500.00 $ 675,000.00 $ 628,500.00 $ (222,000.00) $ Net cash flow Beginning cash Ending cash Minimum cash Required total financing Excess cash (70,100.00) $ (15,250.00) $ $ 15,000.00 $ $ (250.00) $ $ 15,000.00 $ $ (15,250.00) $ (173,750.00) $ (226,500.00) $ (250.00) $ (174,000.00) $ (174,000.00) $ (400,500.00) $ 15,000.00 $ 15,000.00 $ (189,000.00) $ (415,500.00) $ (176,250.00) $ (52,250.00) $ (400,500.00) $ (576,750.00) $ (576,750.00) $ (629,000.00) $ 15,000.00 $ 15,000.00 $ (591,750.00) $_(644,000.00) $ (107,000.00) (629,000.00) (736,000.00) 15,000.00 (751,000.00), Cash Conversion Cycle Cash Conversion Cycle (AAI + ACP) - APP AAI ACP APP 60 45 CCC 39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started