Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help You have purchased 1 million shares in a restaurant chain venture. At this zero-stage investment, your company's assets are $150,000 plus the Idea

Need help

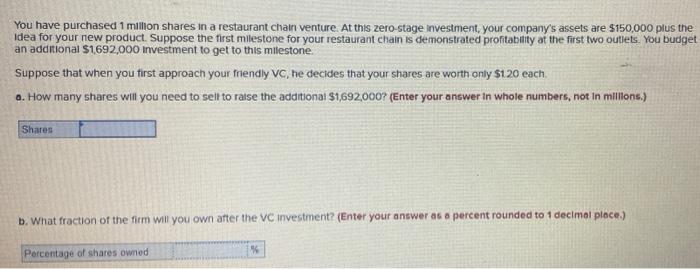

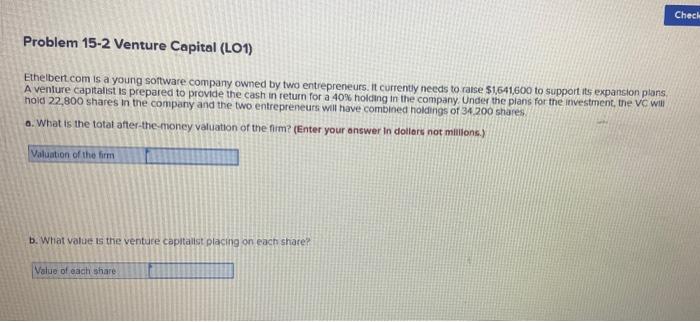

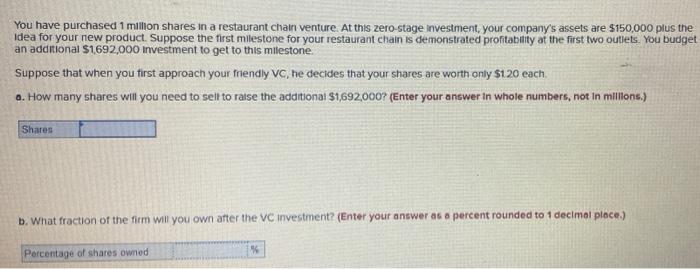

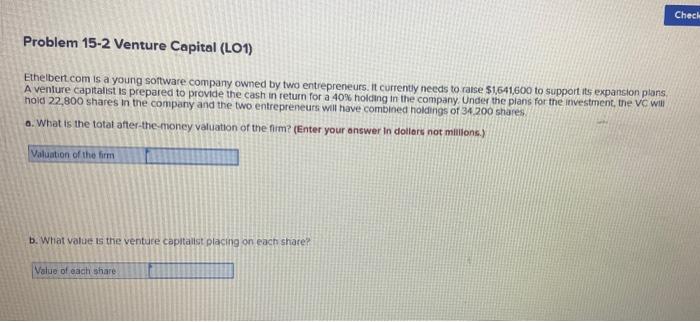

You have purchased 1 million shares in a restaurant chain venture. At this zero-stage investment, your company's assets are $150,000 plus the Idea for your new product. Suppose the first milestone for your restaurant chain is demonstrated profitability at the first two outlets. You budget an additional $1692,000 investment to get to this milestone Suppose that when you first approach your friendly VC, he decides that your shares are worth only $120 each o. How many shares will you need to sell to raise the additional S1,692,000? (Enter your answer in whole numbers, not in millons.) Shares b. What fraction of the firm will you own after the VC investment? (Enter your answer as a percent rounded to 1 decimal place) Percentage of shares owned Chech Problem 15-2 Venture Capital (L01) Ethelbert.com is a young software company owned by two entrepreneurs. It currently needs to raise 51,641,600 to support its expansion plans A venture capitalist is prepared to provide the cash in return for a 40% holding in the company. Under the plans for the investment, the VC will hold 22,800 shares in the company and the two entrepreneurs will have combined holdings of 34 200 shares a. What is the total after-the-money valuation of the film? (Enter your answer in dotteru not millons.) Valuation of the firm b. What value is the venture capitalist placing on each share? Value of each share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started