Answered step by step

Verified Expert Solution

Question

1 Approved Answer

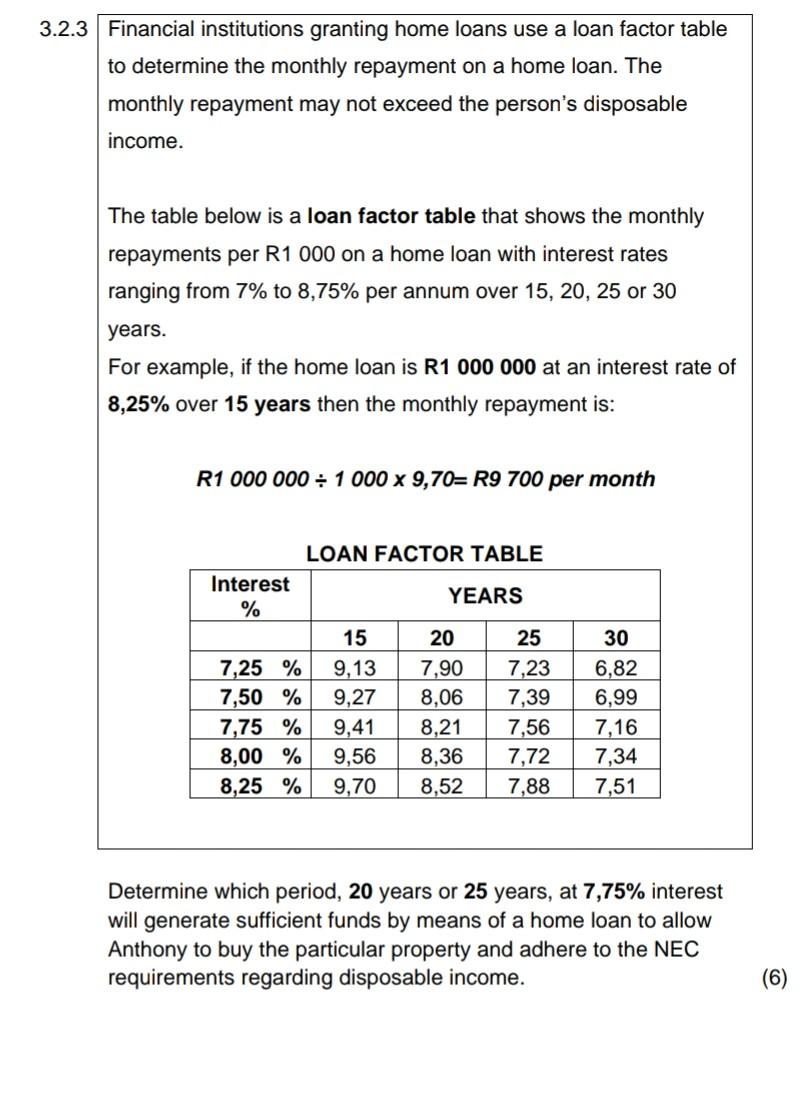

need help,thanks Financial institutions granting home loans use a loan factor table to determine the monthly repayment on a home loan. The monthly repayment may

need help,thanks

Financial institutions granting home loans use a loan factor table to determine the monthly repayment on a home loan. The monthly repayment may not exceed the person's disposable income. The table below is a loan factor table that shows the monthly repayments per R1000 on a home loan with interest rates ranging from 7% to 8,75% per annum over 15,20,25 or 30 years. For example, if the home loan is R1000000 at an interest rate of 8,25% over 15 years then the monthly repayment is: R100000010009,70=R9700 per month Determine which period, 20 years or 25 years, at 7,75% interest will generate sufficient funds by means of a home loan to allow Anthony to buy the particular property and adhere to the NEC requirements regarding disposable income. 2.4 Anthony is fortunate enough to be granted a home loan for the full remaining amount of the selling price and on 31st July 2022 he makes the first payment on the loan. Using his budget for March 2022, briefly discuss the change in his disposable income on 31st July 2022 if the cost of Municipal Services remains the same. Financial institutions granting home loans use a loan factor table to determine the monthly repayment on a home loan. The monthly repayment may not exceed the person's disposable income. The table below is a loan factor table that shows the monthly repayments per R1000 on a home loan with interest rates ranging from 7% to 8,75% per annum over 15,20,25 or 30 years. For example, if the home loan is R1000000 at an interest rate of 8,25% over 15 years then the monthly repayment is: R100000010009,70=R9700 per month Determine which period, 20 years or 25 years, at 7,75% interest will generate sufficient funds by means of a home loan to allow Anthony to buy the particular property and adhere to the NEC requirements regarding disposable income. 2.4 Anthony is fortunate enough to be granted a home loan for the full remaining amount of the selling price and on 31st July 2022 he makes the first payment on the loan. Using his budget for March 2022, briefly discuss the change in his disposable income on 31st July 2022 if the cost of Municipal Services remains the sameStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started