Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need it ASAP please! (a) Suppose Bitcoin is trading at $30,000. The binomial model for the future Bitcoin price over the next two years is

Need it ASAP please!

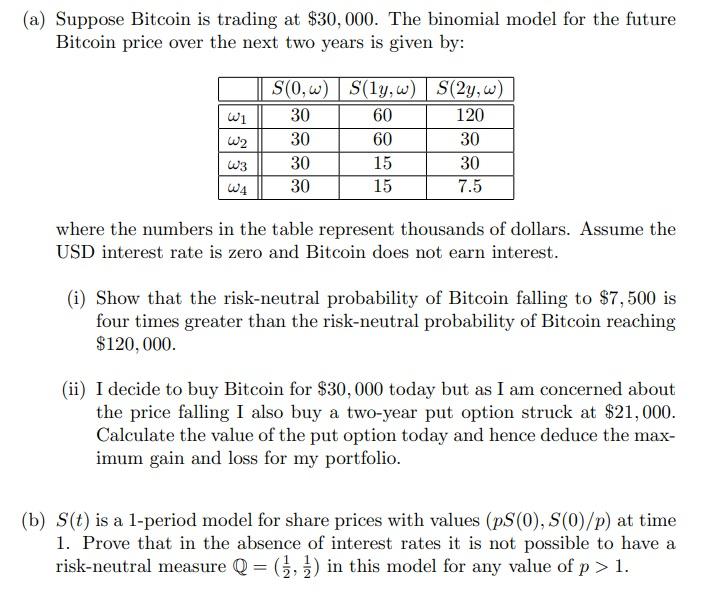

(a) Suppose Bitcoin is trading at $30,000. The binomial model for the future Bitcoin price over the next two years is given by: W1 W2 W3 W4 S(0,w) S(ly,w) S(24,w) 30 60 120 30 60 30 30 15 30 30 15 7.5 where the numbers in the table represent thousands of dollars. Assume the USD interest rate is zero and Bitcoin does not earn interest. (i) Show that the risk-neutral probability of Bitcoin falling to $7,500 is four times greater than the risk-neutral probability of Bitcoin reaching $120,000 (ii) I decide to buy Bitcoin for $30,000 today but as I am concerned about the price falling I also buy a two-year put option struck at $21,000. Calculate the value of the put option today and hence deduce the max- imum gain and loss for my portfolio. (b) S(t) is a 1-period model for share prices with values (pS(O), S(0)/p) at time 1. Prove that in the absence of interest rates it is not possible to have a risk-neutral measure Q = (1, 3) in this model for any value of p > 1. (a) Suppose Bitcoin is trading at $30,000. The binomial model for the future Bitcoin price over the next two years is given by: W1 W2 W3 W4 S(0,w) S(ly,w) S(24,w) 30 60 120 30 60 30 30 15 30 30 15 7.5 where the numbers in the table represent thousands of dollars. Assume the USD interest rate is zero and Bitcoin does not earn interest. (i) Show that the risk-neutral probability of Bitcoin falling to $7,500 is four times greater than the risk-neutral probability of Bitcoin reaching $120,000 (ii) I decide to buy Bitcoin for $30,000 today but as I am concerned about the price falling I also buy a two-year put option struck at $21,000. Calculate the value of the put option today and hence deduce the max- imum gain and loss for my portfolio. (b) S(t) is a 1-period model for share prices with values (pS(O), S(0)/p) at time 1. Prove that in the absence of interest rates it is not possible to have a risk-neutral measure Q = (1, 3) in this model for any value of p > 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started