Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need it in the next 20-30 mins 1. The journal entry to record the September 1 transiction will have the following effect on Trader Joe's

need it in the next 20-30 mins

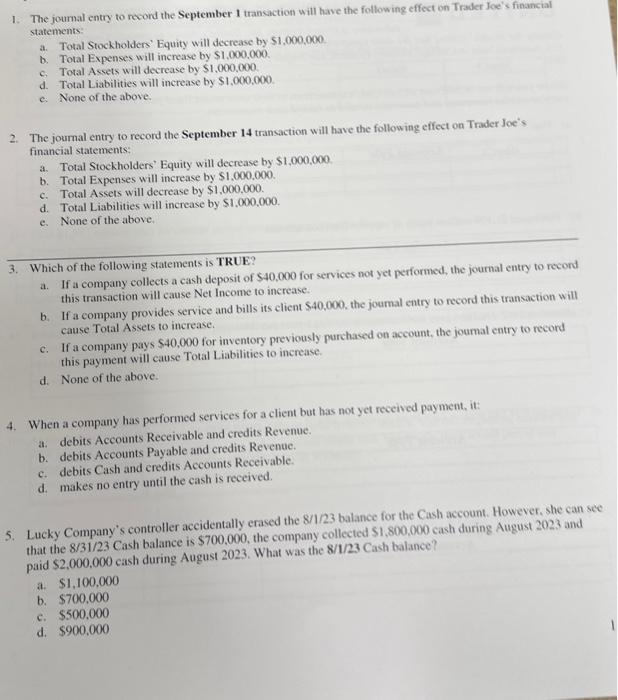

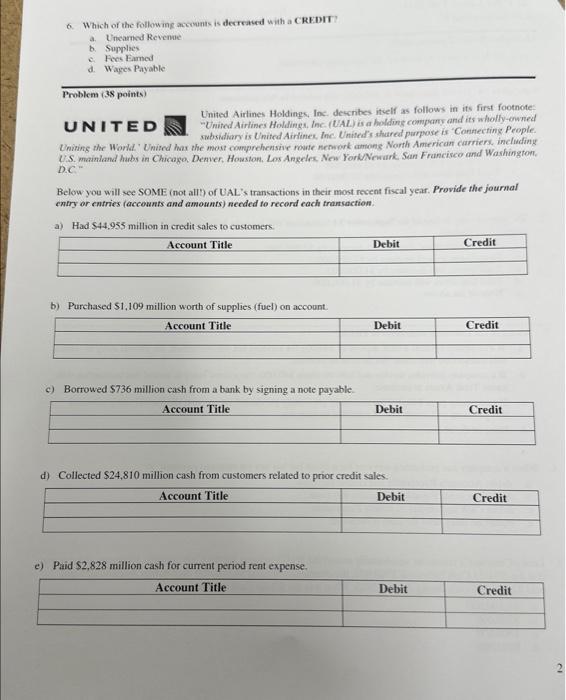

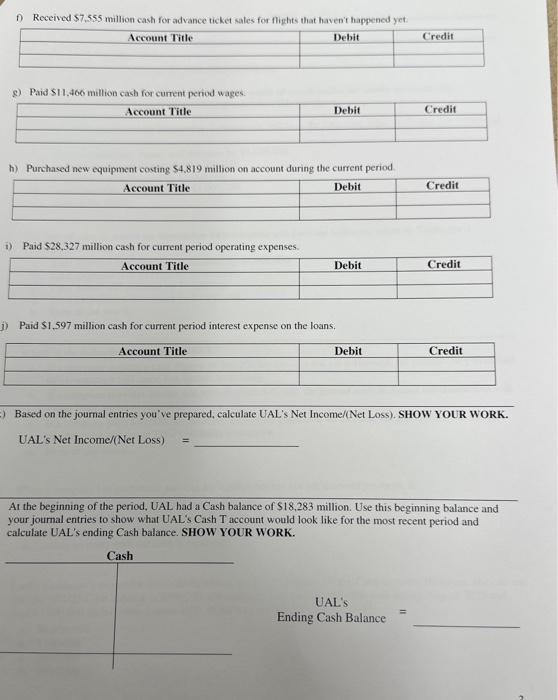

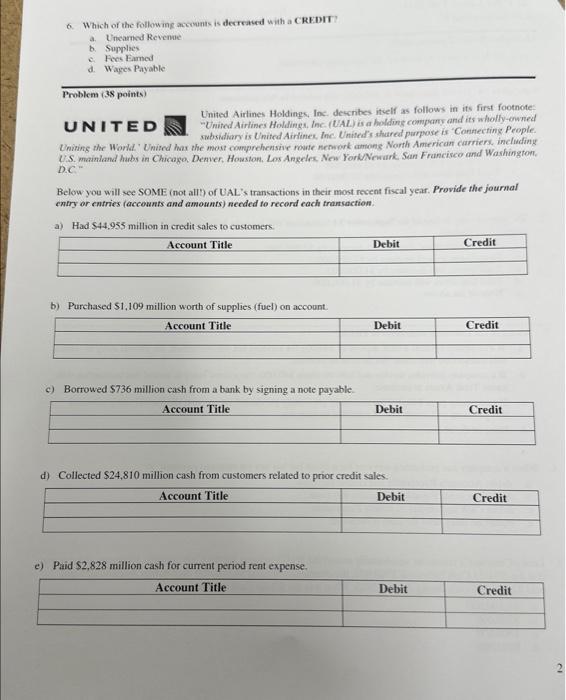

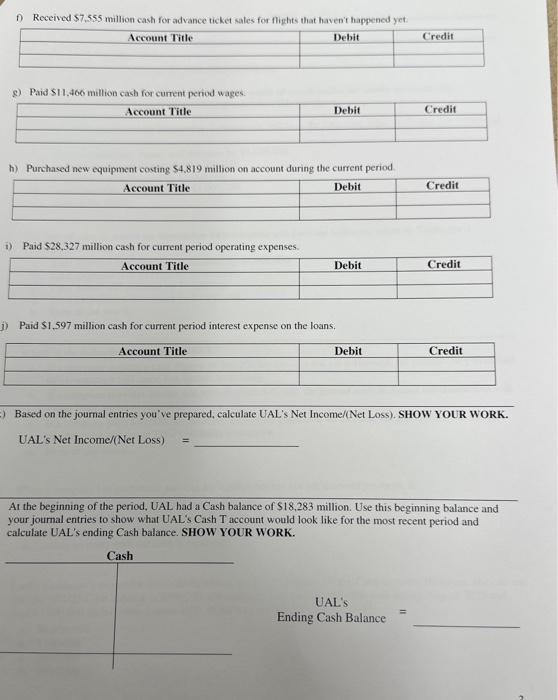

1. The journal entry to record the September 1 transiction will have the following effect on Trader Joe's financial statements a. Total Stockholders' Equity will decrease by $1,000,000 b. Total Expenses will increave by $1,000,000. c. Total Assets will decrease by $1,000,000. d. Total Liabilities will increase by $1,000,000. c. None of the above. 2. The journal entry to record the September 14 transaction will have the following effect on Trader Joe's financial statements: a. Total Stockholders' Equity will decrease by $1,000,000 b. Total Expenses will increase by $1,000,000. c. Total Assets will decrease by $1,000,000. d. Total Liabilities will increase by $1,000,000. e. None of the above. 3. Which of the following statements is TRUE? a. If a company collects a cash deposit of $40,000 for services not yet performed, the journal entry to record this transaction will cause Net Income to increase. b. If a company provides service and bills its client $40,000, the joumal entry to record this transaction will cause Total Assets to increase. c. If a company pays $40,000 for inventory previously purchased on account, the joumal entry to record this payment will cause Total Liabilities to inerease. d. None of the above. 4. When a company has performed services for a client but has not yet received payment, it: a. debits Accounts Receivable and credits Revenue. b. debits Accounts Payable and credits Revenue. c. debits Cash and eredits Accounts Receivable. d. makes no entry until the eash is received. 5. Lucky Company's controller accidentally erased the 8/1/23 balance for the Cush account. However, she can see that the 8/31/23 Cash balance is $700,000, the company collected $1,800,000 cash during August 2023 and paid $2,000,000 cash during August 2023 . What was the 8/1/23 Cash balance? a. $1,100,000 b. $700,000 c. $500,000 d. $900,000 6. Which of the following accosants is decreaued with a CREDIT? a. Unearned Revenue b. Supplies c. Foes Eamed d. Wayes Payable Problem (38 points) swbsidiary is United Airlines, Inc. United's shutred parpose is 'Conterting People. U.S. mainland habs in Chicago. Denver. Howston. Los Angeles. New YorlWNenurk. San Francisco and Washington. D.C. Below you will see SOME (not all) of UAL's transactions in their most recent fiscal year. Provide the journal entry or entries (accounts and amounts) necded to record each trantsaction. a) Had $44,955 million in credit sales to customers. b) Purchased $1,109 million worth of supplies (fuel) on account. c) Borrowed $736 million cash from a bank by signing a note payable. d) Collected $24,810 million cash from customers related to prior credit sales. e) Paid $2,828 million cash for current period rent expense. f) Received $7,555 million cash for advance ticket sales for flights that haven't happened yet. g) Paid $11,460 million cash for current period wages. h) Purchased new equipment eosting $4,819 million on account during the current period i) Paid $28,327 million cash for current period operating expenses. j) Paid $1,597 million cash for current period interest expense on the loans. Based on the journal entries you've prepared, calculate UAL's Net Income/(Net Loss). SHOW YOUR WORK. UAL's Net Income/(Net Loss) = At the beginning of the period, UAL had a Cash balance of $18,283 million. Use this beginning balance and your joumal entries to show what UAL's Cash T account would look like for the most recent period and calculate UAL's ending Cash balance. SHOW YOUR WORK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started